-

3Q17 Business Results Presentation

Greetings and Summary

Good afternoon. I am Peter Kwon, Head of IR Department at KB Financial Group. We would like to now begin Q3 2017 Earnings Presentation. Thank you very much for joining us this afternoon.

For today's earnings release, we have our CFO, Jae Keun Lee, and the group's executive team with us. We will begin with Q3 2017 Earnings Results, which will be presented by our CFO, followed by a Q&A session. With that, let me invite our CFO for Q3 2017 Earnings Presentation.

Good afternoon. I am CFO, Jae Keun Lee, of KB Financial Group. Thank you for joining KBFG’s Q3 2017 earnings presentation. Before I present on the earnings results, allow me to walk through several key issues.

Firstly, we have completed the process of making KB Insurance and KB Capital 100% wholly owned subsidiaries through small-scale share swap during the third quarter. As a result, we have laid the foundation for further enhancement of group-level profitability and we expect stability of group's profit to further improve. In the meantime, following the August housing market stabilization plan, the government announced on October 24 comprehensive plan on household debt. The new regulation expand support for the financially vulnerable class and introduced stringent financial regulations for owners of multiple houses so as to induce soft landing of the household debt issue and incurred stable growth of the domestic economy in the mid to long run.

And turning to KBFG, underpinned by the stable governance structure, we have nominated the incumbent CEO as the next CEO candidate. In November, during the extraordinary shareholders meeting, if the reelection is confirmed, we expect our key business strategies and the implementations will accelerate, supported by business stability.

(2p) 3Q17 Highlights

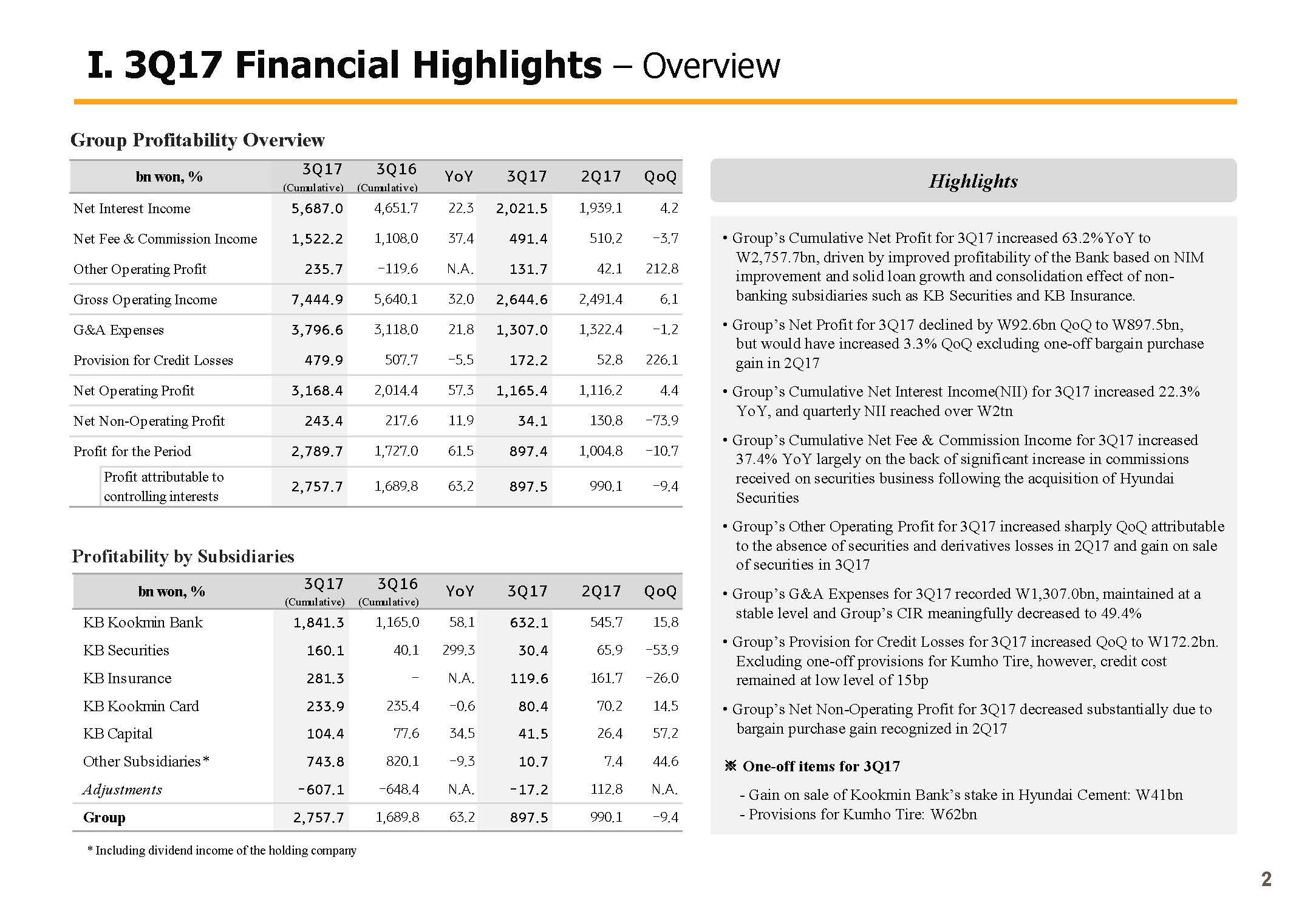

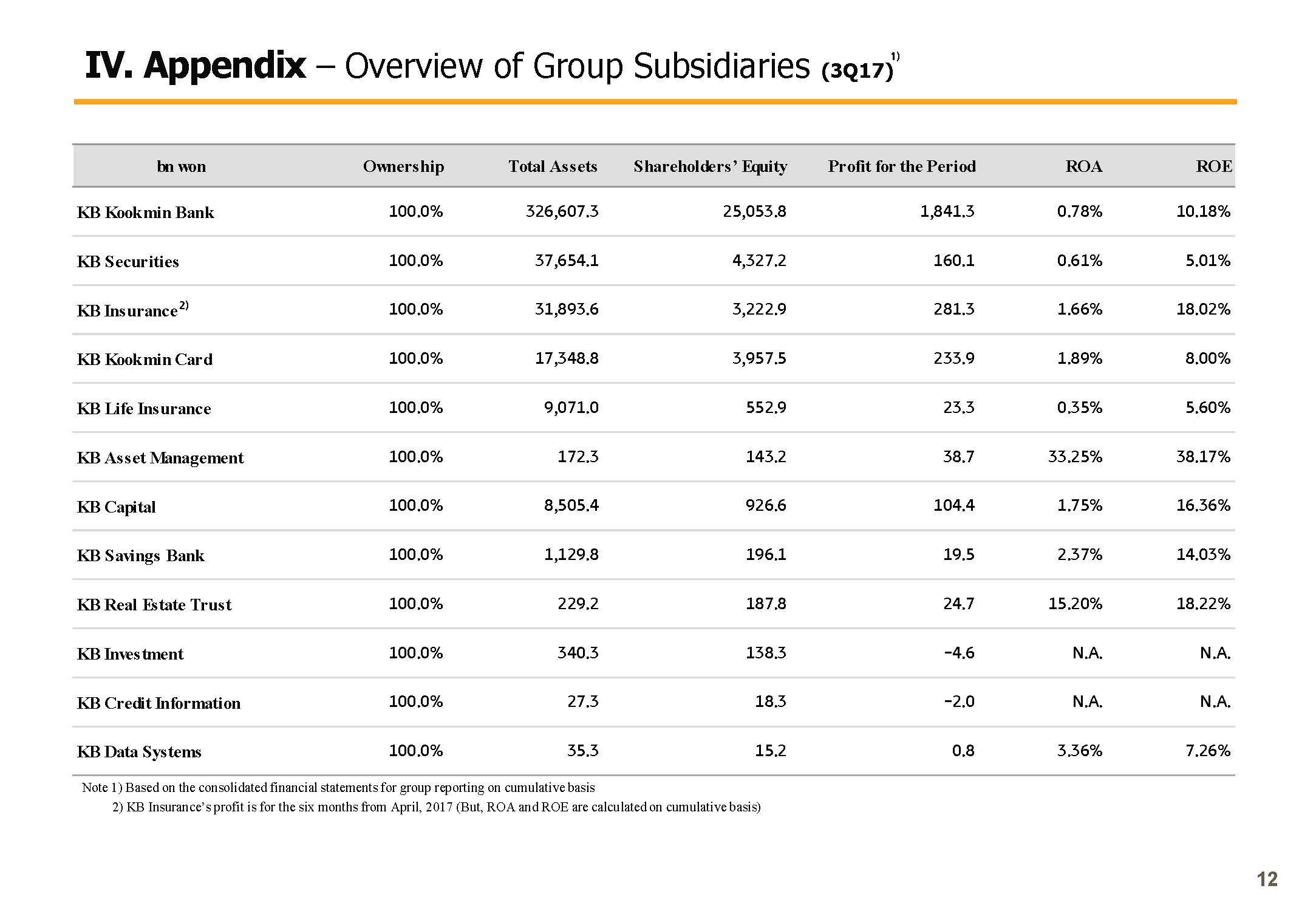

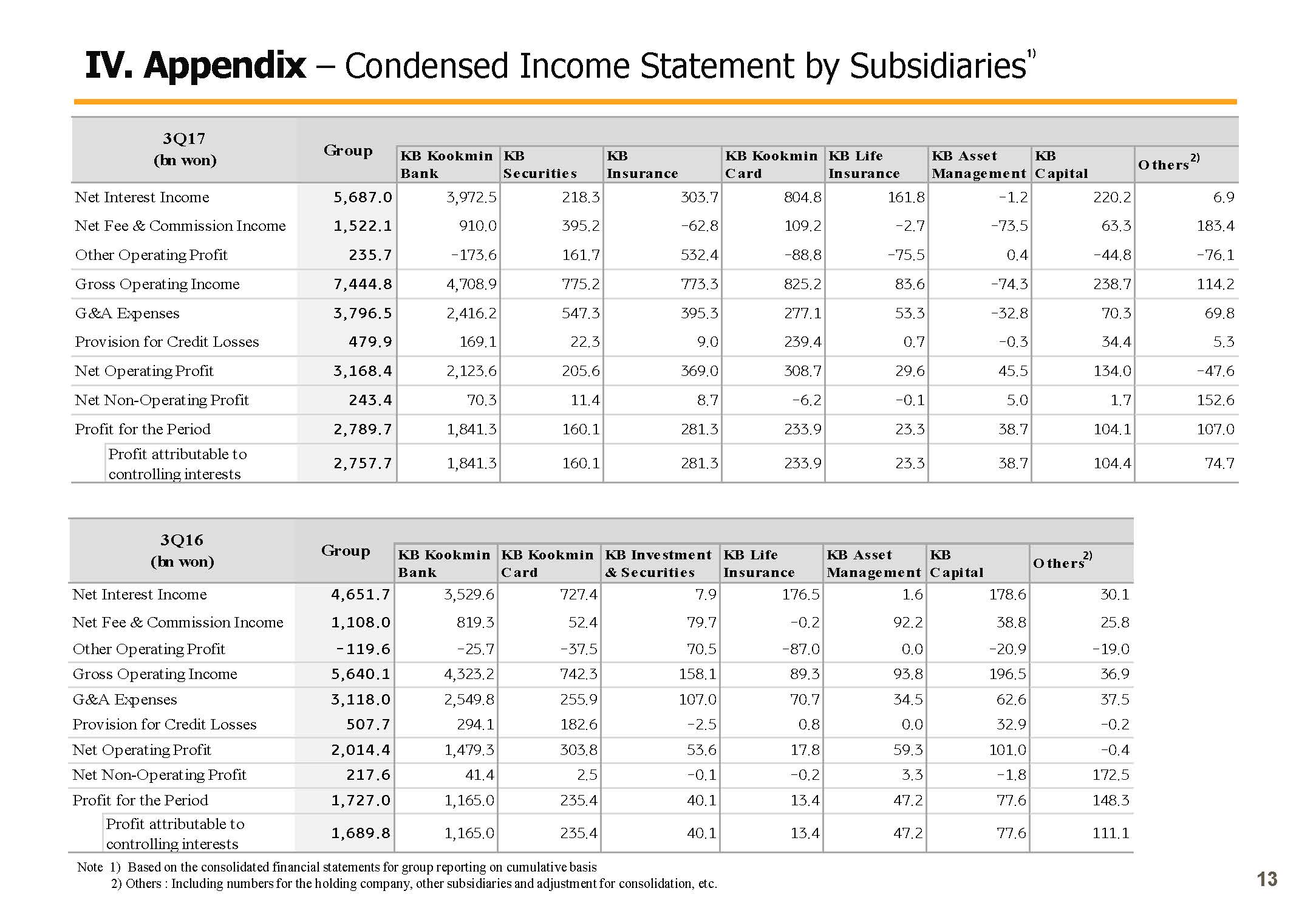

Now let me move on to Q3 2017 earnings results. Q3 2017 KBFG's cumulative net profit was KRW 2,757.7 billion. This is KRW 1,067.9 billion increase year-over-year driven by salient improvement in bank profitability, together with sizable non-bank profit increases on the back of the Hyundai Securities acquisition and turning KB Insurance and KB Capital as wholly-owned subsidiaries. Q3 net profit declined slightly Q-on-Q on the impact of KB Insurance's schemes from bargain purchase reflected in the second quarter. But excluding the one-off factor, recurring level of profit actually increased, supported by improvements in the fundamentals.

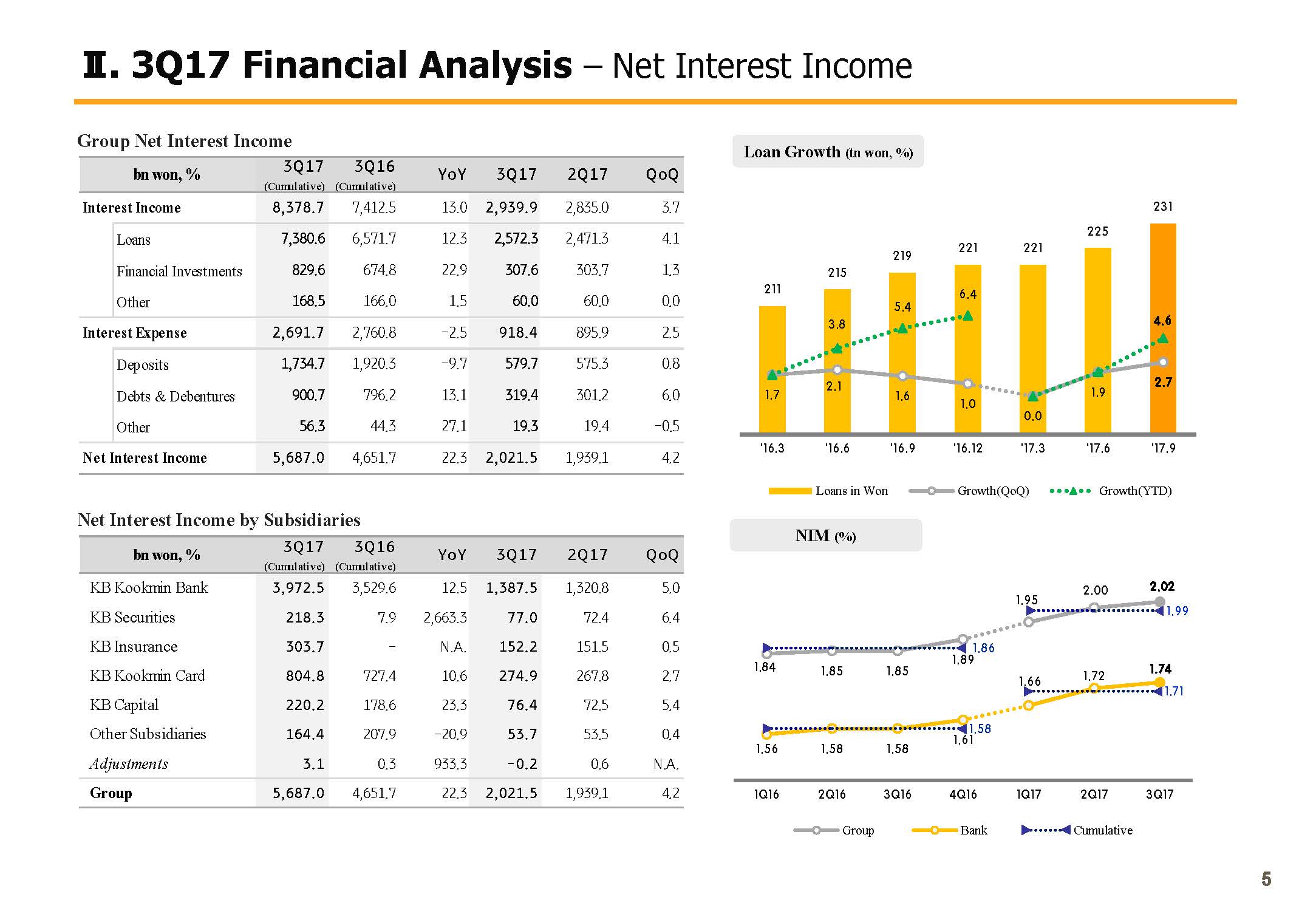

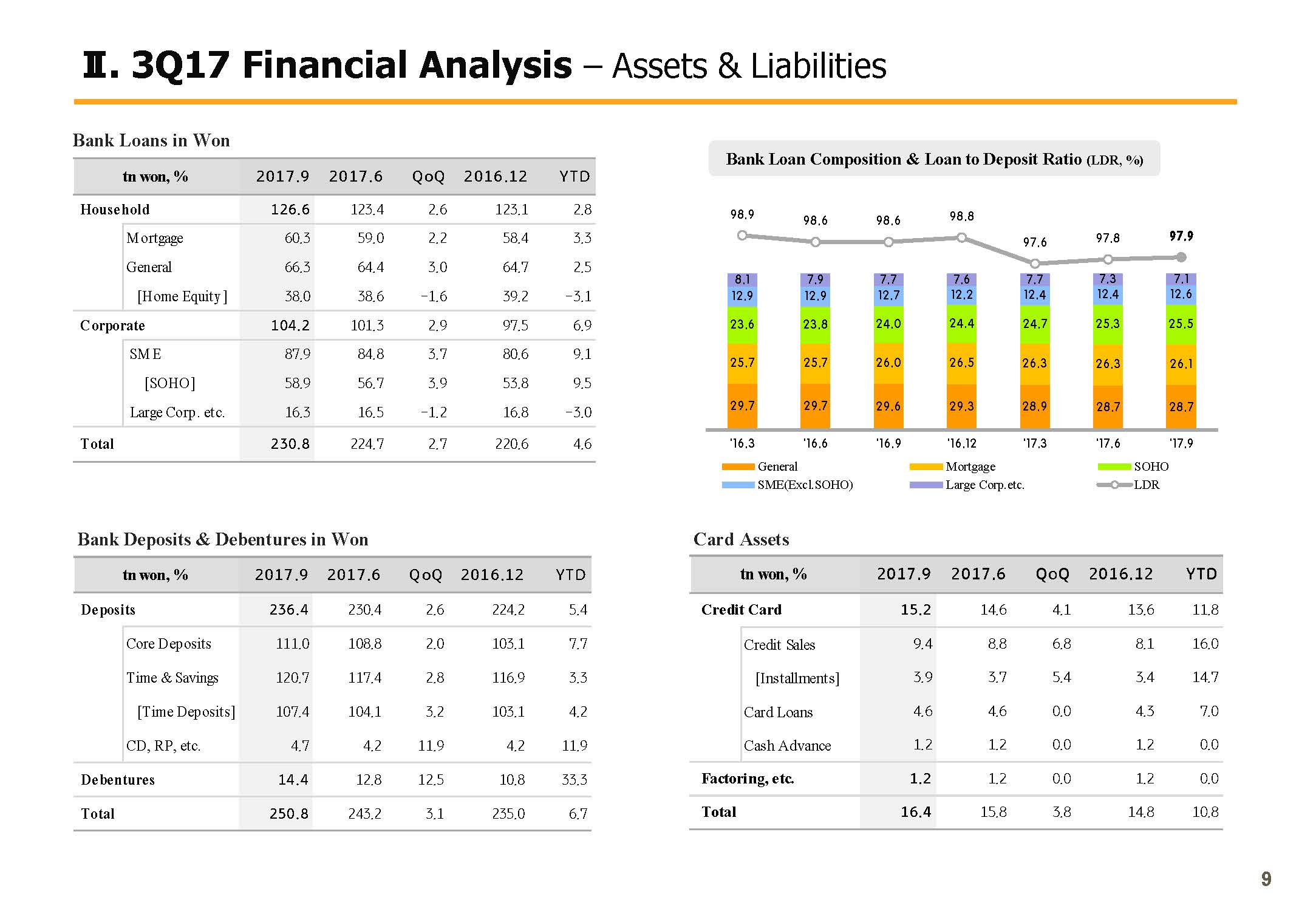

Moving on to each line item, Q3 cumulative net interest income was KRW 5,687 billion, improving 22.3% year-over-year, with a quarterly figure coming in at KRW 2,021.5 billion, up 4.2% Q-on-Q. This was driven by robust increase in the bank's loans and bonds, with sustained NIM improvement trends from the group and the bank.

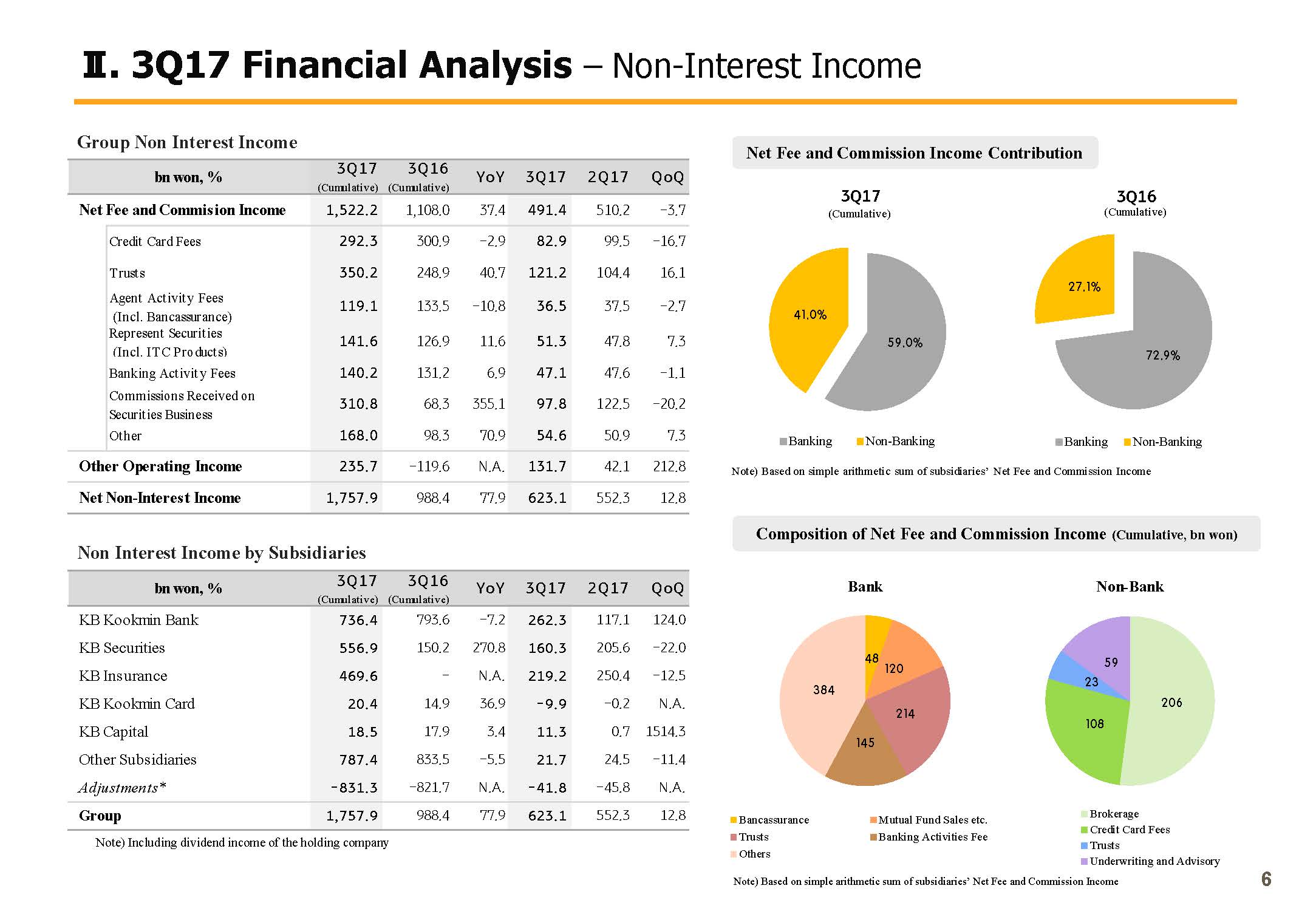

3Q cumulative net fees and commissions income was KRW 1,522.2 billion, up 37.4% year-over-year, driven by sizable increase in commissions received following the acquisition of Hyundai Securities and the launch of the integrated KB Securities, as well as higher sales of bank's trust products, including ELS'.

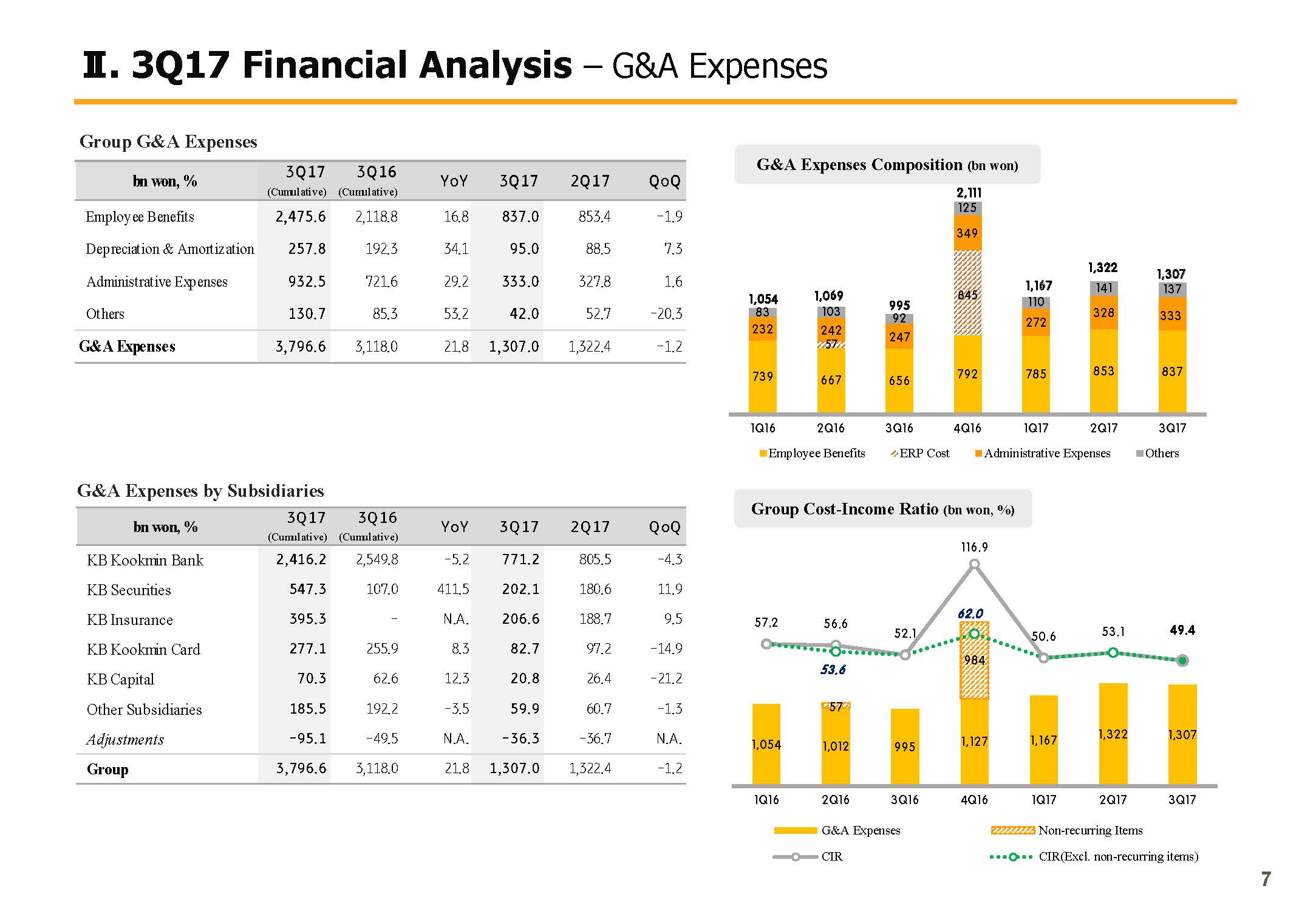

Q3 cumulative other operating profit displayed significant year-over-year rise with the inclusion of underwriting profit from KB Insurance. On a quarterly basis, there was also around KRW 90 billion increase attributable to the absence of loses related to interest rates and FX rate rises. Q3 cumulative G&A expense was KRW 3,796.6 billion, a rise year-over-year, which is due to the inclusion of non-bank subsidiaries, if this factor is crossed out G&A expense actually dropped marginally. 3Q quarterly G&A was KRW 1,307 billion, a slight decline Q-on-Q, and as such G&A expense is managed at around the recurring level.

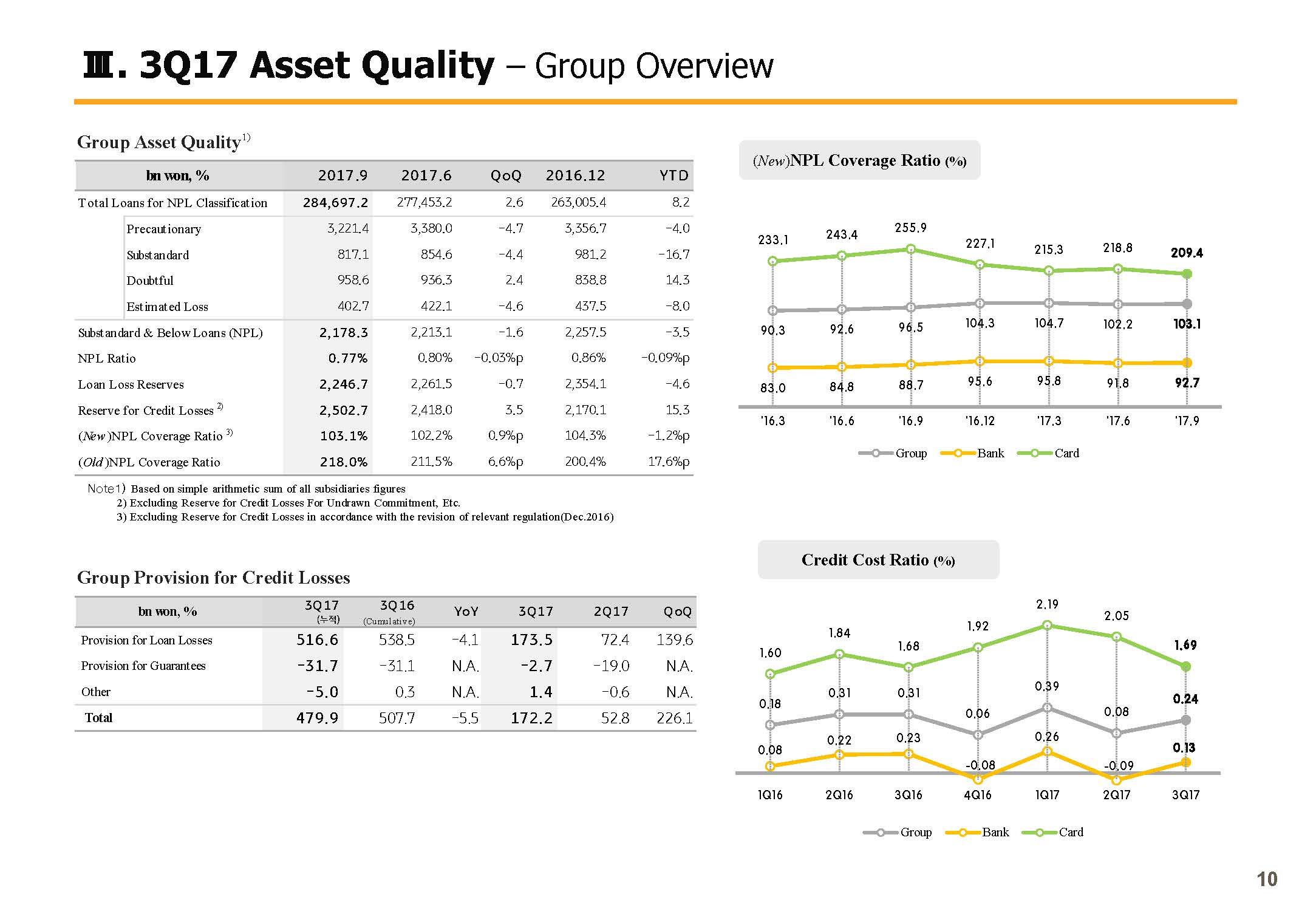

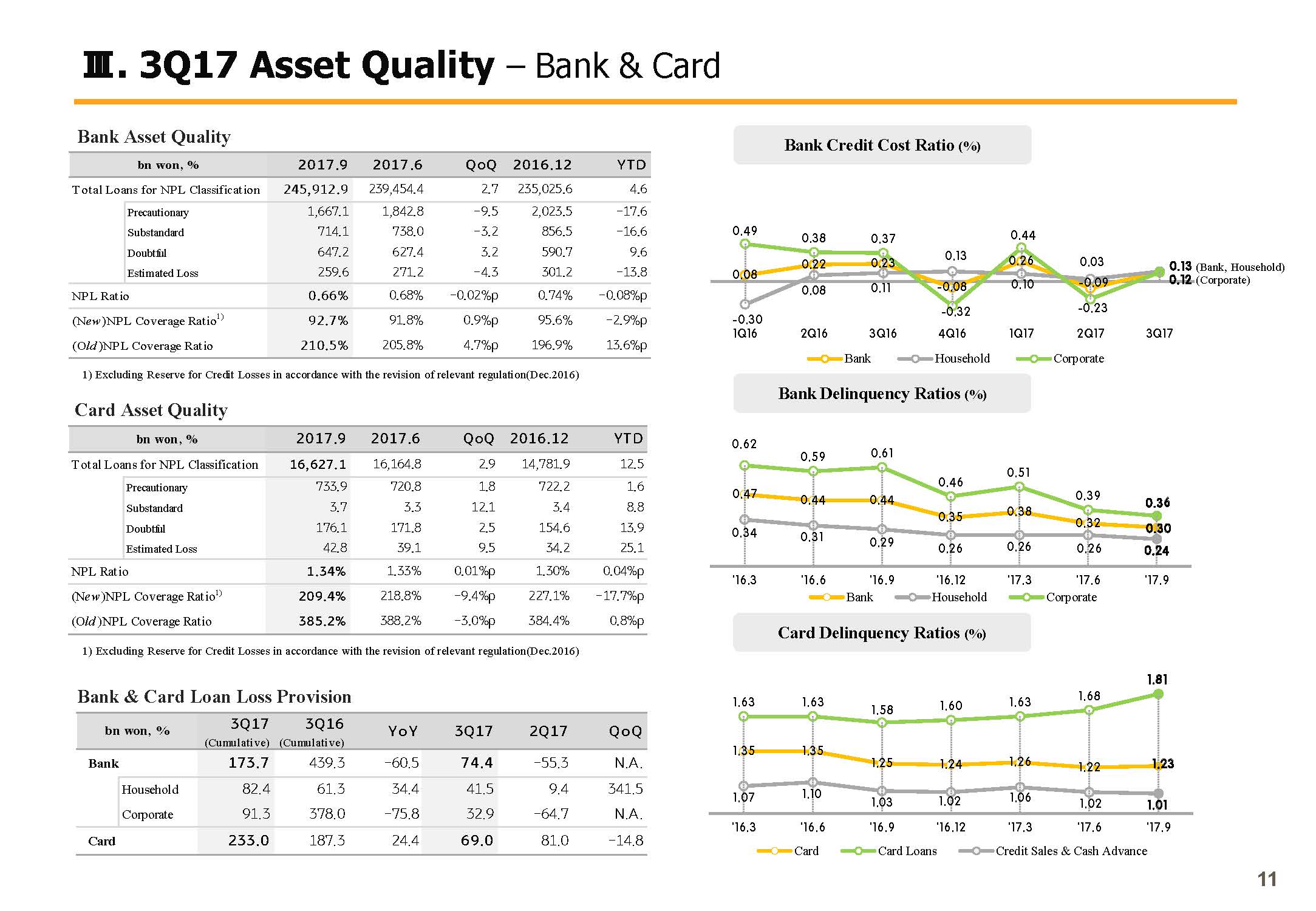

Q3 cumulative PCL was KRW 479.9 billion, and is continuously improving. On a quarterly basis, there was an increase of KRW 62 billion provisioning following Kumho Tire's voluntary restructuring agreement. Carving out this one-off factor, Q3 PCL provisioning was KRW 110 billion level with credit cost at 15 basis points, still being kept at a low level.

Q3 nonoperating profit showed Q-on-Q decline with the dissipation of gains from bargain purchase impact in relation to KB Insurance in the previous quarter.

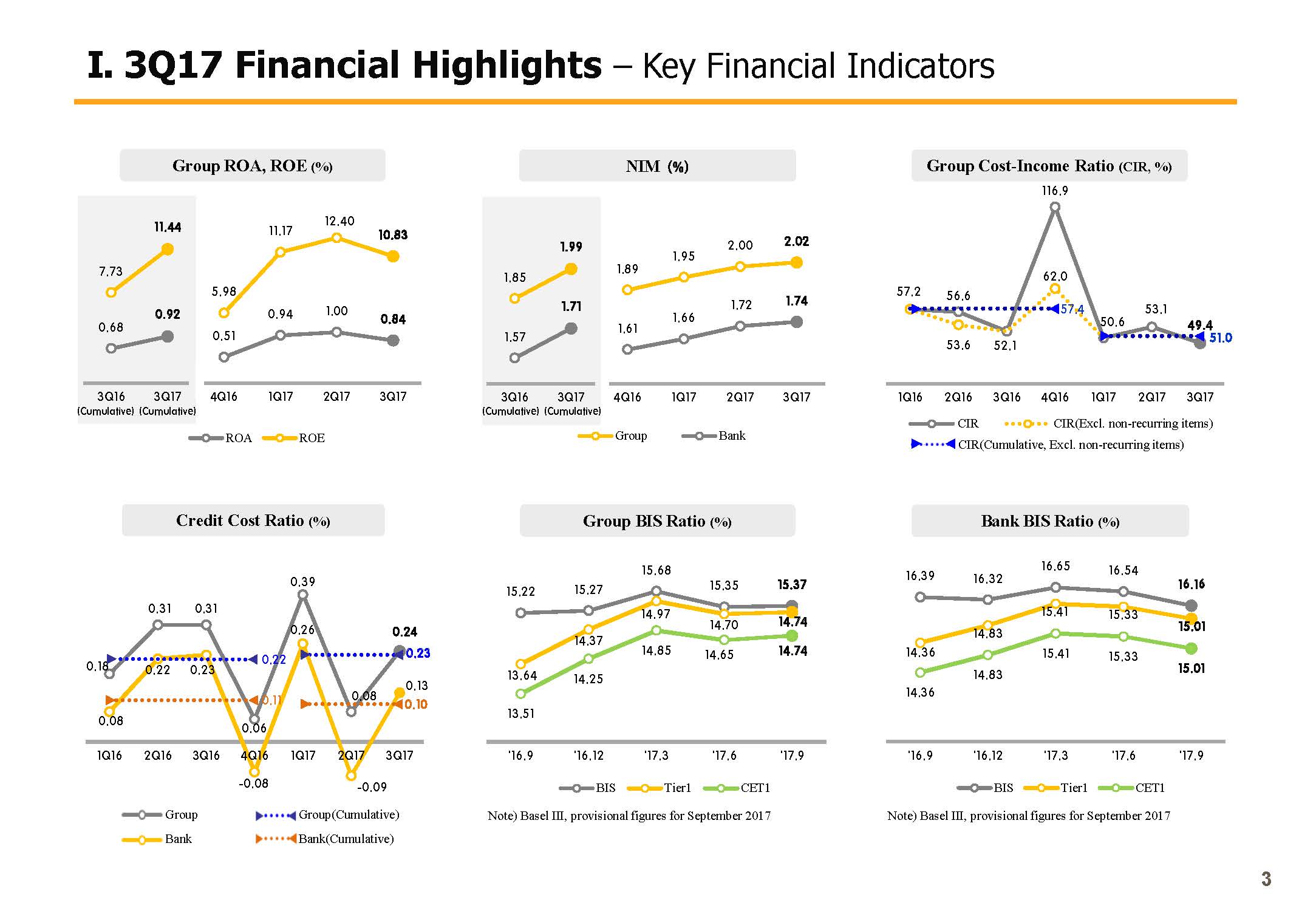

(3p) Financial Highlights

Next on Page 3 is on financial statement. 2017 Q3 cumulative group ROE posted 0.92%, ROE 11.44%, a great improvement Y-o-Y. Q3 ROA and ROE seems to have slightly decreased Q-o-Q, but taking into consideration, Q1 BCC-related disposition gains, Q2 gains from bargain purchase and other one-off factors, the quarterly improvement trend is continuing. Q3 NIM posted 2.02% for the group and 1.17% for the bank, a 2 bp additional improvement Q-o-Q. The margin improved mainly because of the lower funding cost on the back of low-cost core deposit growth efforts and spread improvement, thanks to the highly profitable assets focused growth and efforts for pricing sophistication.

Looking at the cost income ratio on the top right, Q3 CIR posted 49.4%, and improved Q-o-Q. We will try to manage it at around 50% going forward through top line improvement and group-wide cost controls.

Next is the group's credit cost ratio. Q3 credit cost ratio compared to total loans posted 0.24% for the group and 0.13% for the bank. As aforementioned, it rose slightly Q-o-Q due to one-off provisioning related to Kumho Tire, but it's still being managed stably.

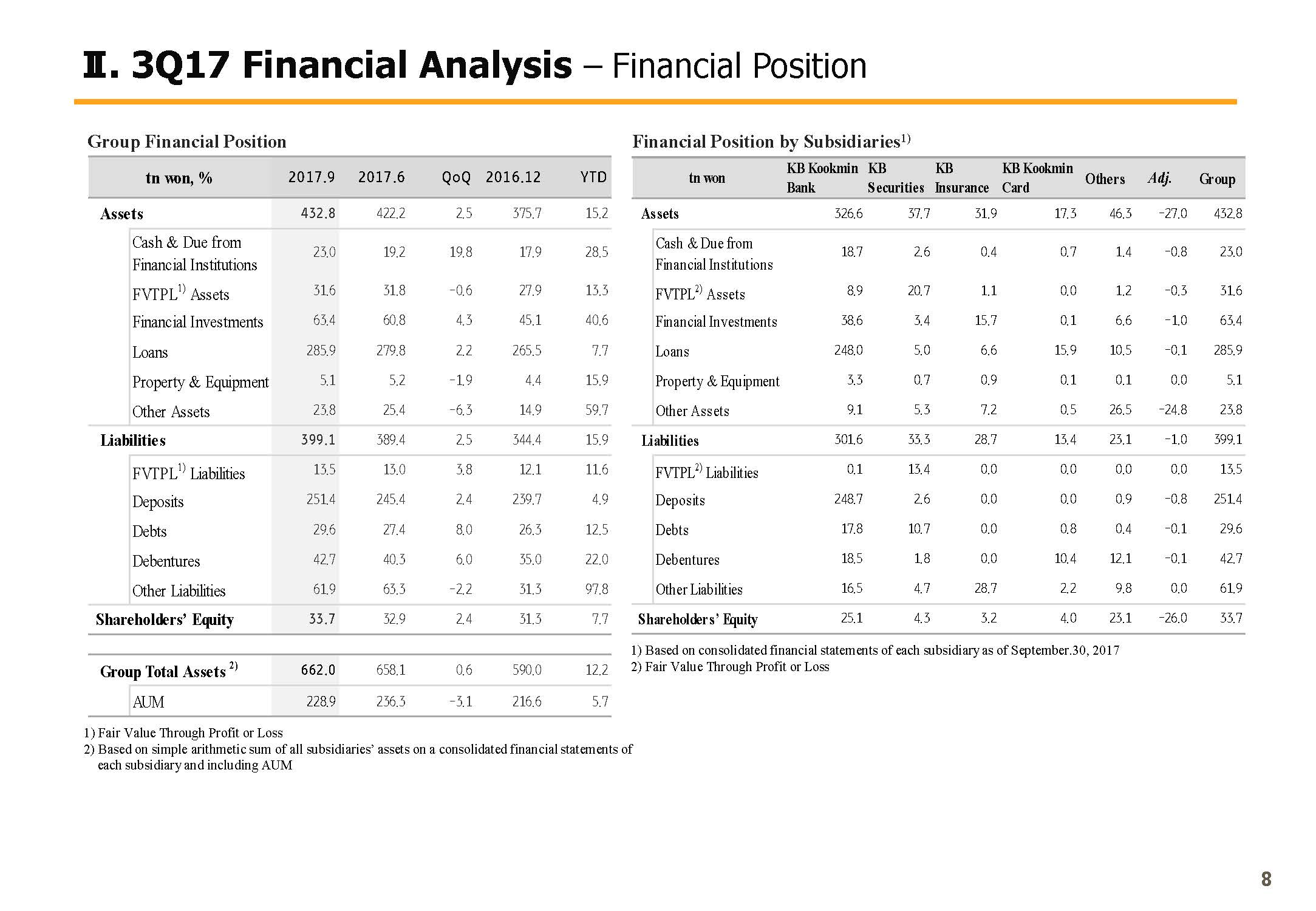

September end group BIS ratio, CET1 ratio posted 15.37% and 14.74%, respectively. Bank BIS ratio and CET1 ratio recorded 16.16% and 15.01% respectively, still maintaining the highest level of capital adequacy in the financial industry.

(4p) Key Takeaways

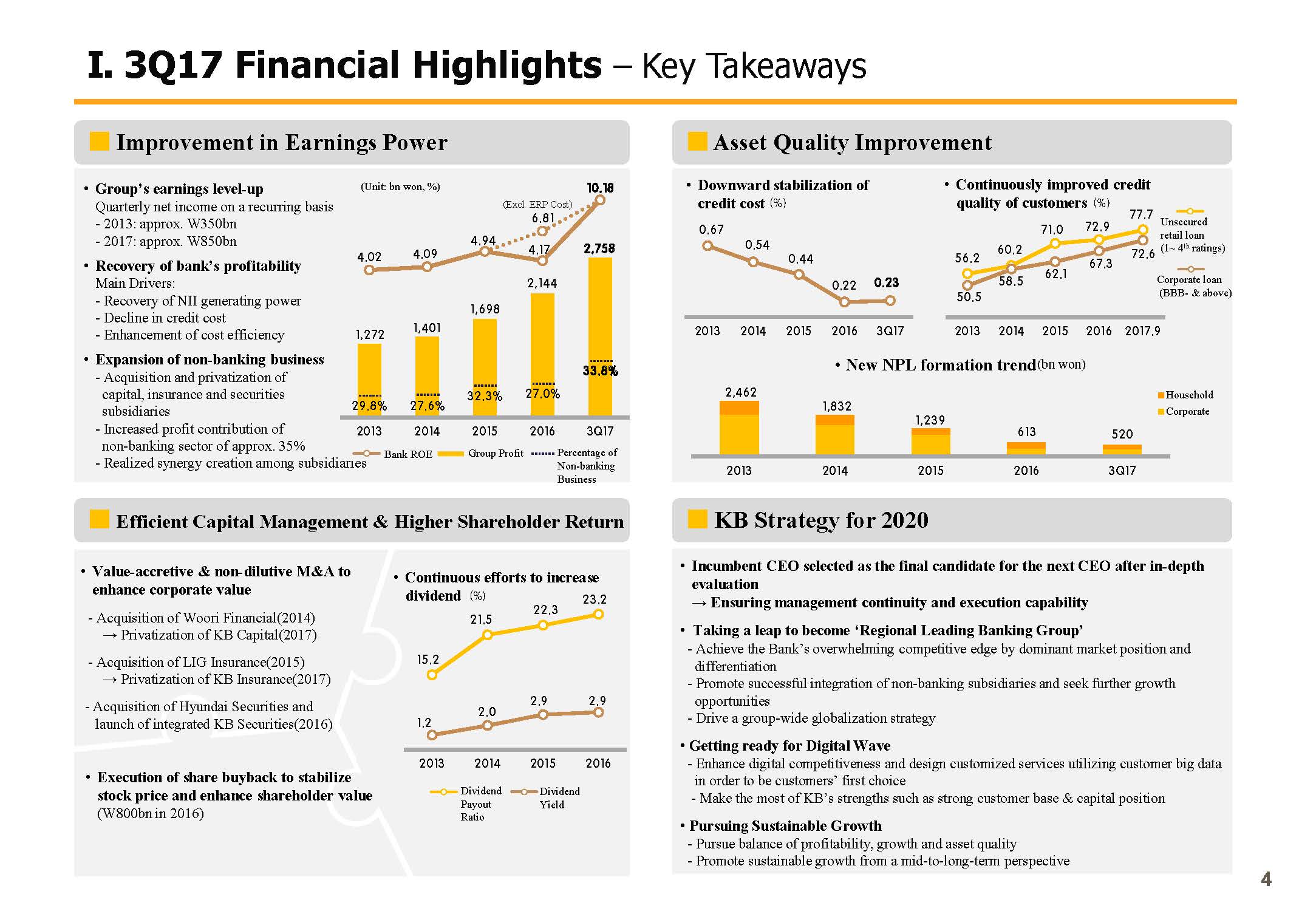

From Page 4, I will cover the key financial highlights during the past 3 years and the strategic direction the group aims to pursue for the next 3 years.

First, on the top-left side, 2013 group net income was only KRW 1,272 billion, and net income on a recurring basis was only at KRW 350 billion level. However, in 2017, Q3 cumulative net income posted KRW 2,757.7 billion, growing the quarterly net income significantly to a KRW 850 billion level. As you can see on the right-hand graph, this was due to the bank ROE improving greatly from 4.02% in 2013 to 10.18% in 2017 due to improvement in interest income and cost cutting measures, and also, supported by the nonbanking sector profit growing through nonbanking subsidiaries M&As.

On the upper-right hand side you can see that the group's asset quality during the past 5 years has been improving in many aspects. First, group's credit cost posted 67 bp in 2013 and 54 bp in 2014, with asset quality deterioration in sectors such as real estate, PS that are sensitive to economic cycles. However, with asset cleaning of NPLs and deleveraging of risk assets, it quickly improved to 20 bp level in 2017 Q3.

The credit quality of our consumers also improved greatly. The percentage of high credit quality customers, which was around 50% in 2013, rose to a 70% level in 2017 Q3. Also, you can see on the bottom graph that the bank's new NPL formation exceeding KRW 3 trillion, on a yearly basis decreased to less than KRW 100 billion from 2016. Apart from this fundamental improvement, we have been utilizing our capital in many ways to improve corporate and shareholder value. Starting from Woori Financial in 2014, LIG Insurance in 2015 and Hyundai Securities in 2016, corporate value was greatly improved through acquiring nonbanking subsidiaries at reasonable prices. A KRW 800 billion level of share buyback was also executed to boost stock prices and enhance shareholder value.

In addition, as a part of our group's policies to bolster shareholder return, dividend payout ratio recorded 15% in 2013 was expanded to a 23% level as of 2016. I will cover the group strategic direction for the next 3 years as seen on the bottom right side.

First, with the vision of Asia's regional leading banking group as our goal, the bank will achieve overwhelming competitiveness and strive for management stability of newly integrated subsidiaries, including securities and insurance, and implement a global strengthening strategy for the the group. Second is to thoroughly prepare for the digital wave. We will strengthen the digital competitiveness to become the customer's first choice in the fast-changing financial environment and have a customer customized service using customer big data to this end, our greatest strength of strong customer base and strong capital position will be actively utilized.

Lastly, we will not be complacent with our recent performance and pursue a balance of profitability, growth and asset quality and pursue sustainable growth from a midterm perspective that can look forward to the next 5 to 10 years and not focus on short-term results.

Please refer to the following pages for details regarding this quarter's performance. With this, I will conclude KBFG 2017 Q3 business results presentation. Thank you very much for listening.