-

2017 Business Results Presentation

Greetings and Summary

Greetings. I'm Peter Kwon, the Head the IR Department at KB Financial Group. We will now begin the 2017 Business Results Presentation. Thank you all for participating in our earnings call.

Joining us in today's earnings conference, we have with us KBFG's CFO, Kim Ki Hwan, and executives from our group. The conference will consist of 2017 business results presentation by our CFO, Kim Ki Hwan, followed by a Q&A session. I'd like to invite our CFO, Kim Ki Hwan, to give the 2017 business results presentation.

Greetings. I am KBFG's CFO, Kim Ki Hwan. Thank you all for participating in the 2017 KBFG business results presentation. Before we start the presentation, let me brief you on the major highlights of KBFG's 2017 performance.

In 2017, starting with the U.S. tightening policy and U.S. interest rate hike, there was a widespread interest rate hike trend, including the BOK, raising the base interest rate for the first time in 6 years in Korea. In addition with the global economic recovery and expectations regarding corporate performance improvement, the stock market in and out of Korea reached record heights and the favorable sales environment for the financial sector was fostered. On the other hand, in order to present household loan deterioration and to promote the virtuous cycle of the domestic economy, the government introduced regulations, including housing market stabilization policy, loan review advancement policies and inclusive and productive financial policies. Under this background, KBFG was able to recover its original profitability as a result of KB bank's NIM improvement and efforts to improve cost efficiency.

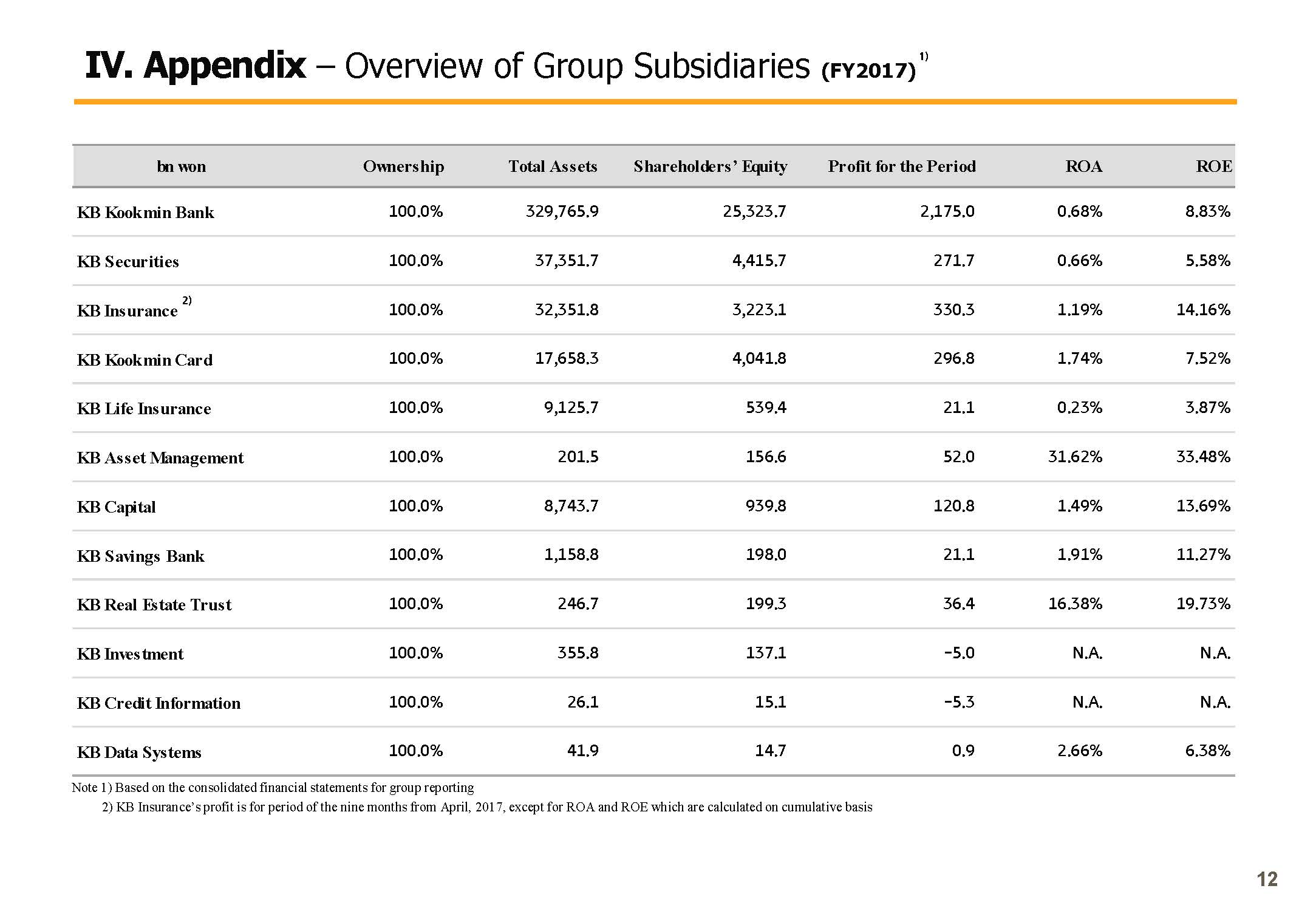

After launching the integrated KB Securities in order to expand the securities business, KB Insurance and KB Capital became 100% completely owned subsidiaries, and KBFG was able to have a meaningful year in 2017, going one step toward our vision of regional leading banking group.

For your reference, the KBFG BOD meeting held today resolved to have the 2017 dividend payout ratio to be 23.2% at the same level to the previous year. The DPS is KRW 1,920, a 54% increase Y-o-Y, backed by the performance improvement compared to last year. Going forward, KBFG will do our best to improve shareholder value.

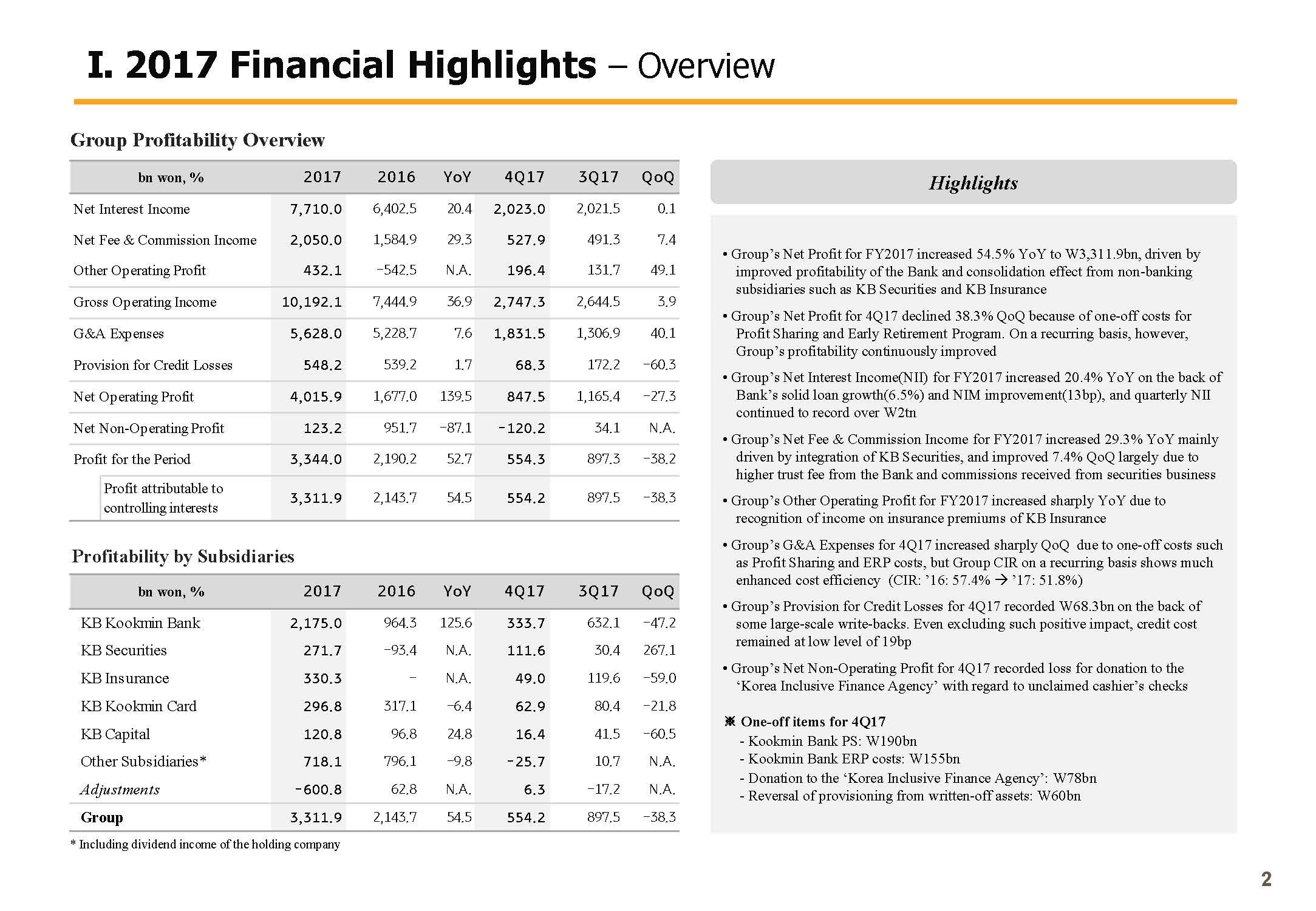

(2p) 2017 Highlights

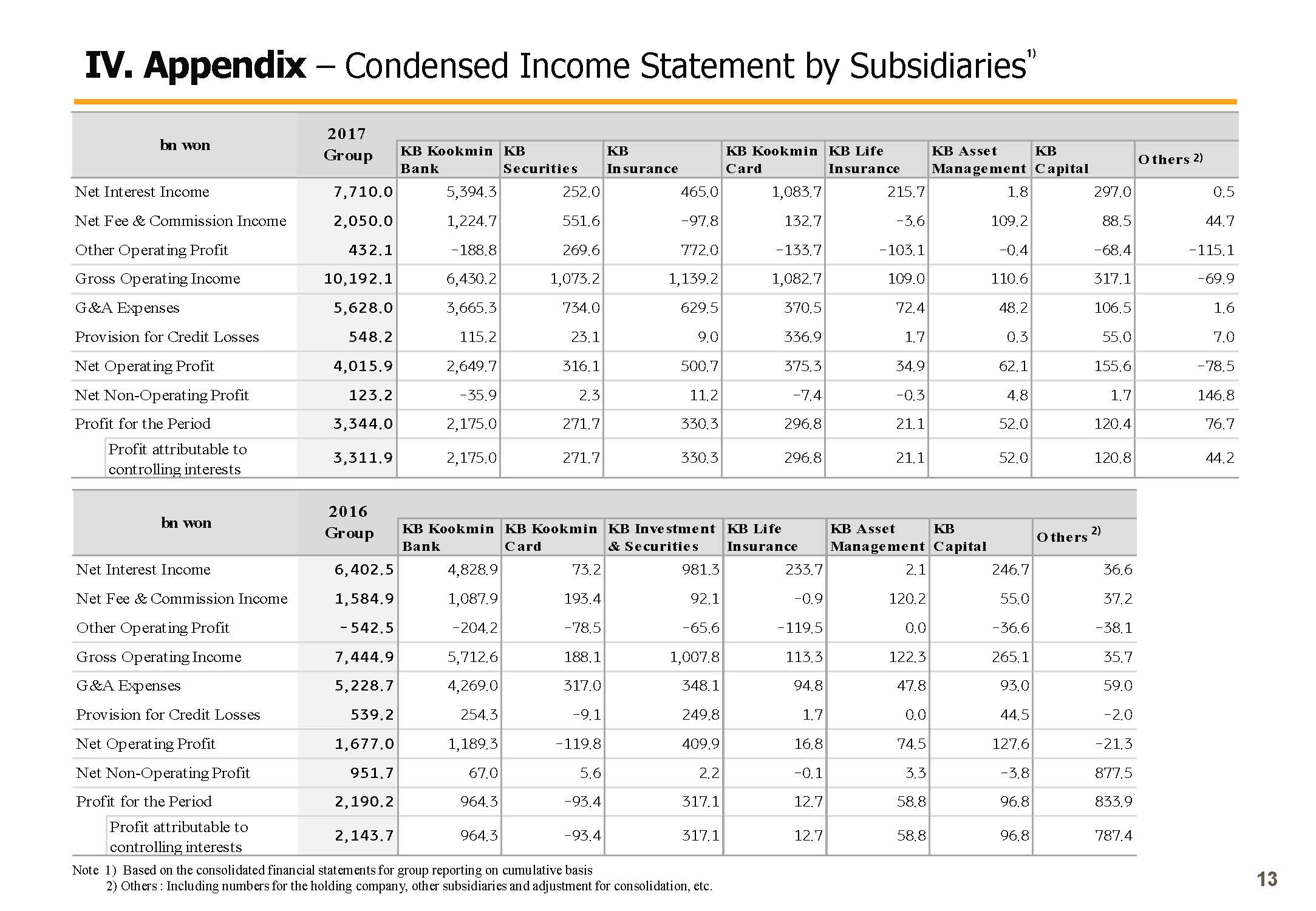

Let me now elaborate on the 2017 business results. KBFG 2017 net profit posted KRW 3,319.9 billion. This was a KRW 1,168.2 billion increase Y-o-Y. With robust improvement of the bank profitability, the nonbanking subsidiaries profits also sharply grew with the launching of KB Securities and through KB Insurance and KB Capital becoming completely owned subsidiaries.

Q4 net profit posted KRW 554.2 billion, and may look like there was a 38.3% decrease Q-o-Q. But apart from the one-off factors in this quarter, the overall profitability is showing continuous improvement.

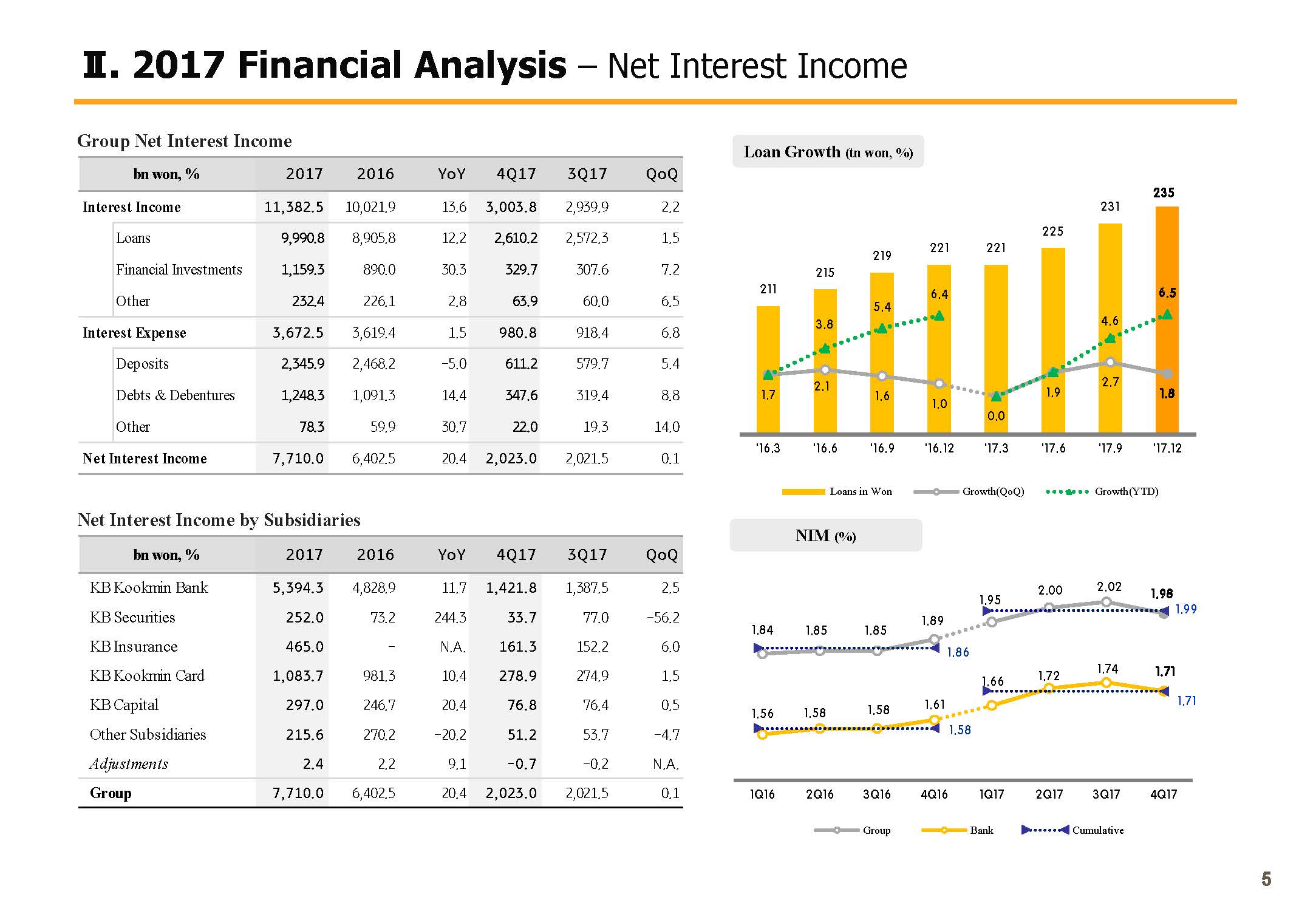

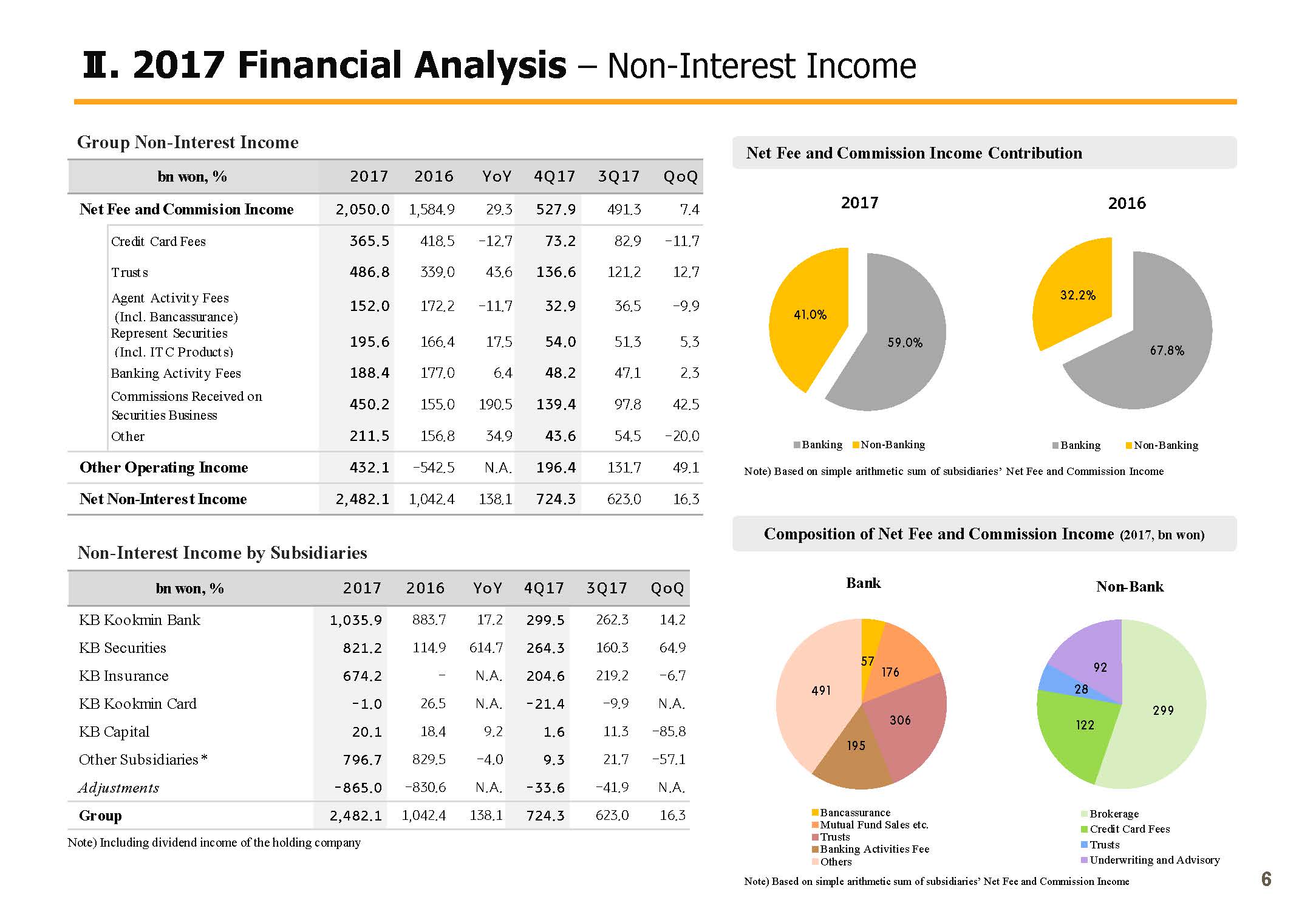

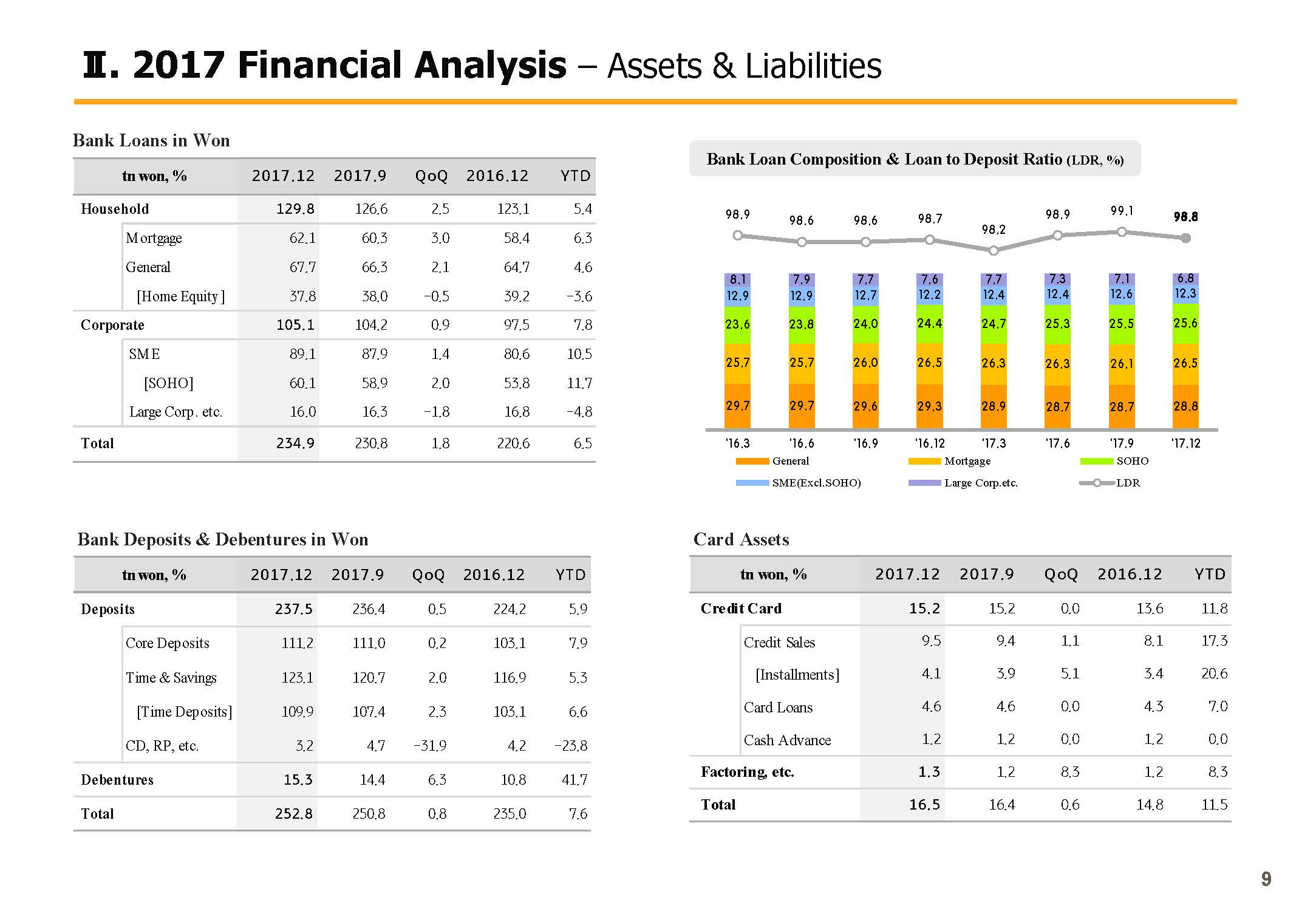

Let's look into the details of the earnings. 2017 net interest income posted KRW 7,710 billion a 20.4% improvement Y-o-Y. This was a result of the bank loans in won continuing robust growth, loan portfolio diversification and the bank NIM improving by 13 bps, a sizable improvement with efforts to expand core low-cost deposits. 2017 net fee and commission income posted KRW 2,050 billion and KRW 527.9 billion in Q4 and rose 29.3% Y-o-Y and 7.4% Q-o-Q.

The reason why fee and commissions income showed such solid results was because of the great increase of the securities fee and commissions income and with the launching of the integrated KB Securities and also because of the bank trust fee, which increased with the positive results of the stock market in and out of Korea. The other operating profit in 2017 posted KRW 432.1 billion, with KB Insurance being consolidated from Q2 of the previous year and sharply improved Y-o-Y with KB Insurance, insurance premium recognition. In Q4, with the decline of the won/dollar exchange rate, bank recognized FX translation gains. And with securities and ETF management related gains increasing for KB Securities, other operating profit grew 49.1% Q-o-Q.

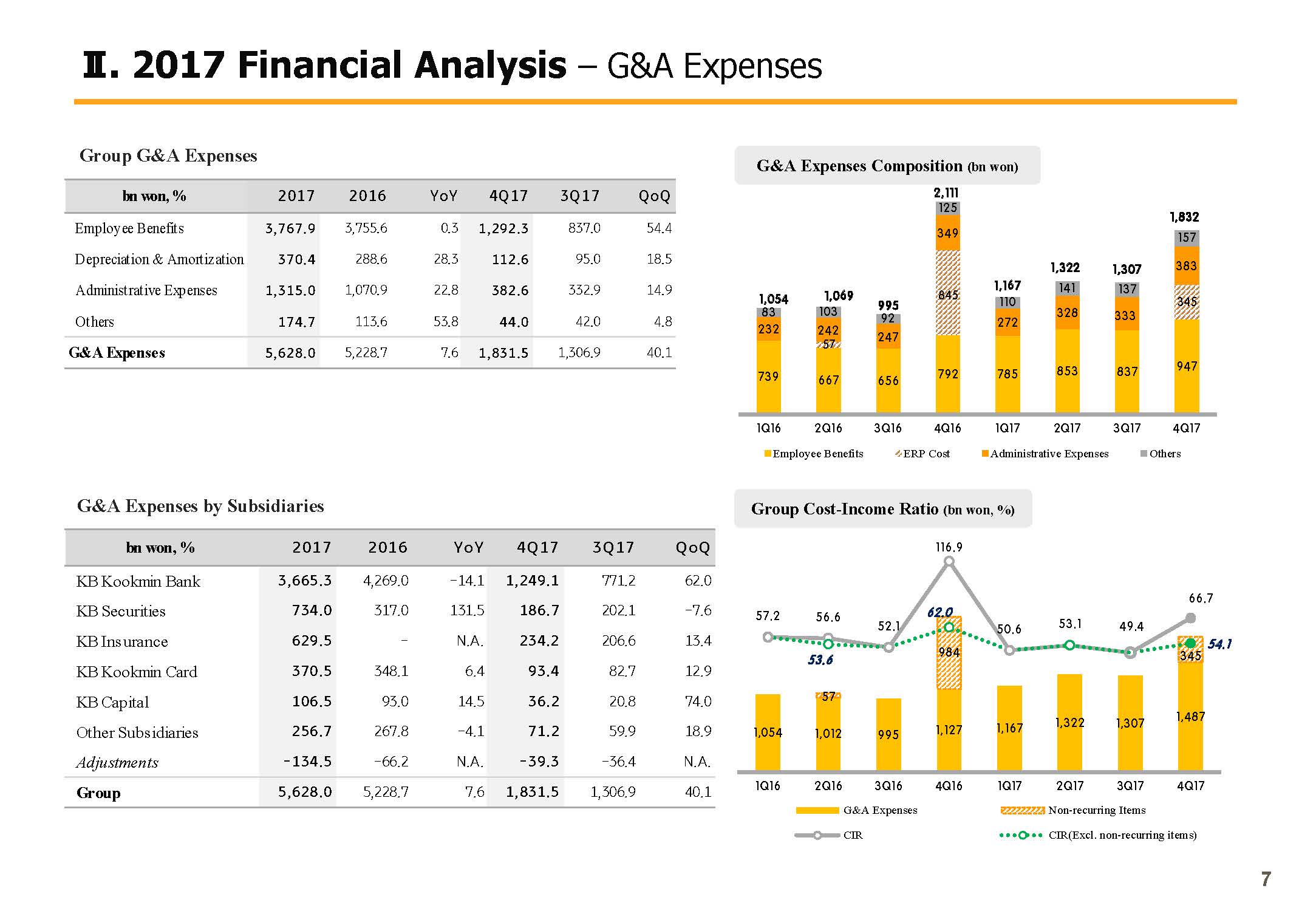

The SG&A for 2017 Q4 posted KRW 1,831.5 billion, and rose 40.1% Q-o-Q with the profit-sharing cost following the bank performance improvement and ERP. Excluding the KRW 345 billion of one-off costs, it is at a recurring level. 2017 G&A expenses posted KRW 5,628 billion and rose 7.6% Y-o-Y. But excluding the, as aforementioned, one-offs and the effects stemming from the consolidation with KB Insurance, the cost efficiency is actually improving greatly.

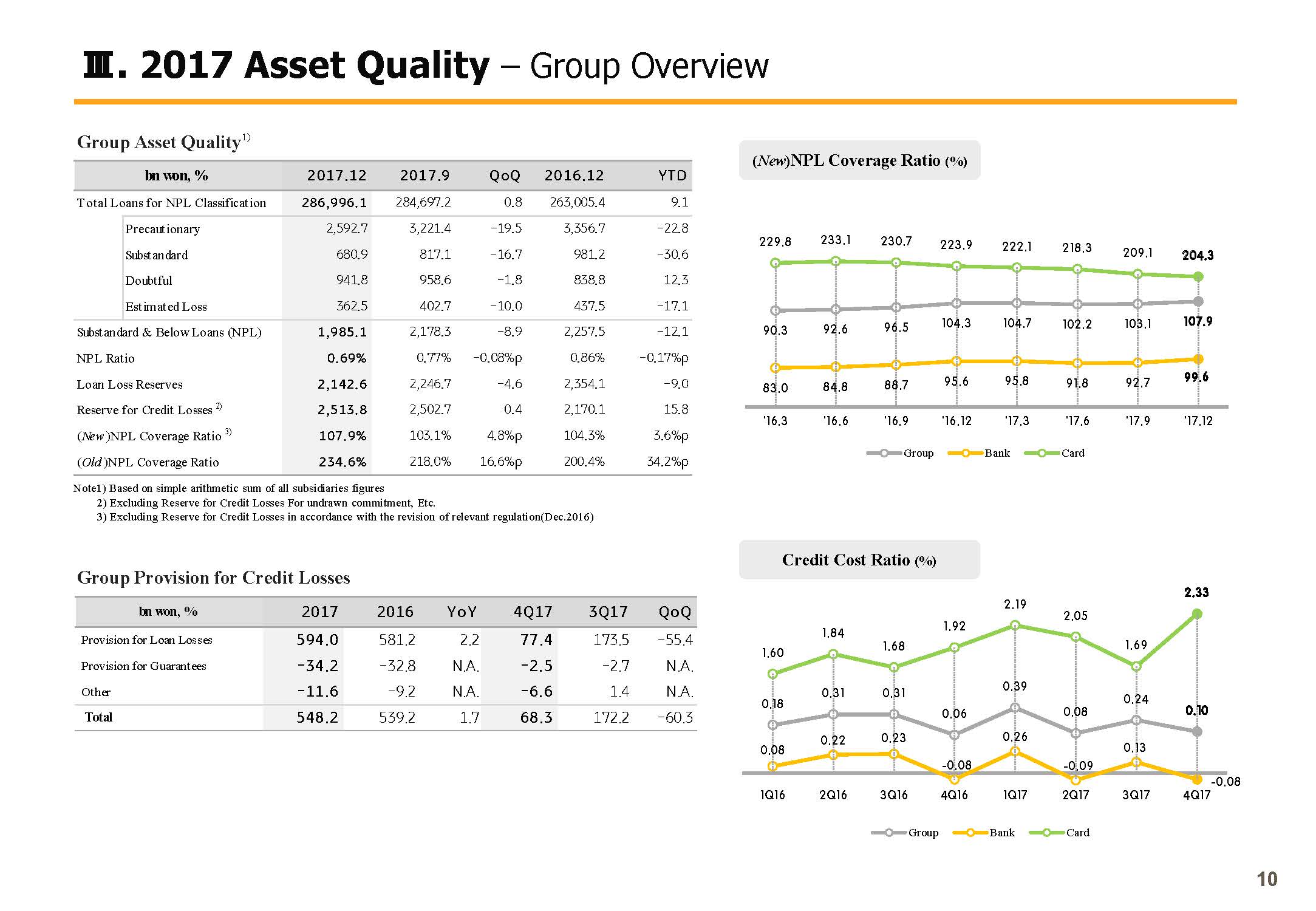

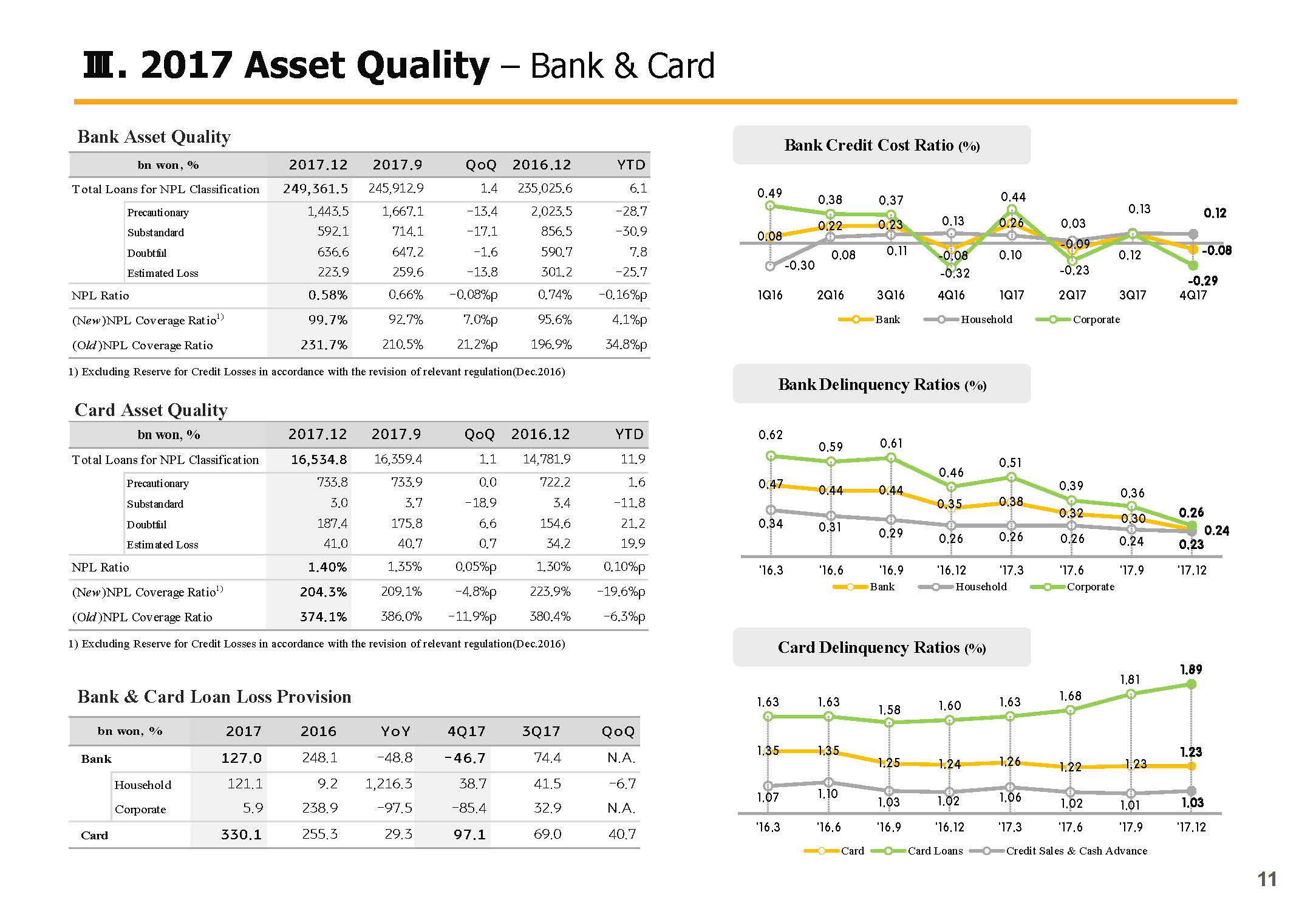

2017 provision for credit losses posted KRW 548.2 billion, and posted a similar level to the previous year, and posted KRW 68.3 billion in Q4 and went down 60.3% Q-o-Q.

The reason Q4 provisioning greatly decreased was because of the sizable reversal of provisioning from written-off assets and because of the base effect caused by previous quarter's Kumho Tire provisioning.

Finally, the 2017 cumulative non-operating income was down substantially over last year as the KRW 800 billion in gains from bargain purchases recognized in 2016 were absent in 2017. In Q4, due to the impact of unclaimed share contributions to the Korean Inclusive Finance Agency, non-operating income posted KRW 120.2 billion in losses.

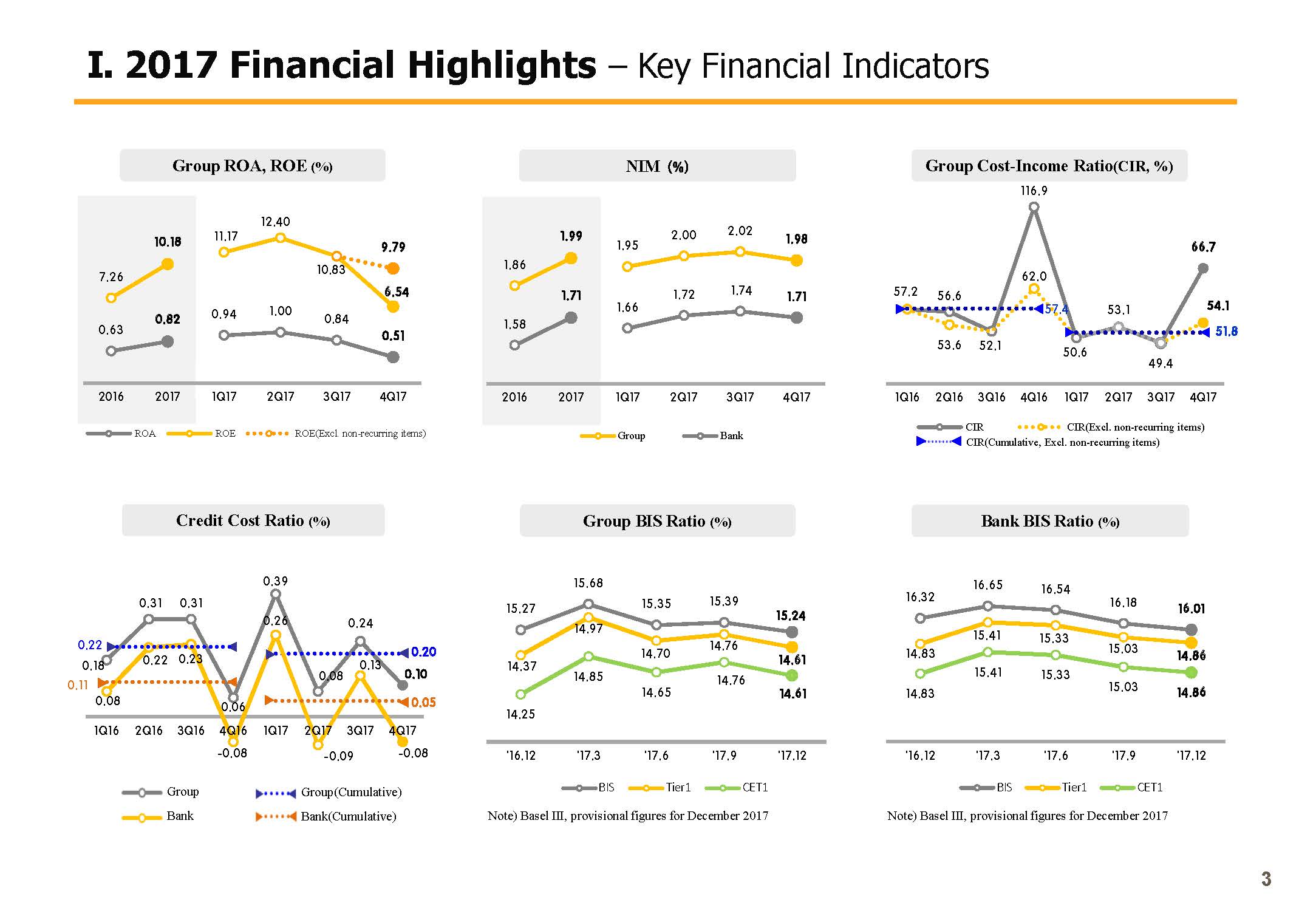

(3p) Financial Highlights

Next on Page 3, I will explain about the key financial highlights. First the group's 2017 ROA is 0.82%. ROE posted 10.18%, showing meaningful improvement in the group's profitability. ROE in Q4 declined considerably Q-o-Q. However, if the one-off factors mentioned above are excluded, ROE will come to 9.79%. In 2017, the full year group's NIM posted 1.99% to group; the bank, 1.71%, improving 13bps over 2016. This is a result of expanding low-cost deposits and fine-tune to pricing efforts and highly profitable asset-centered growth amidst a rate-rising environment. However, NIM in Q4 went down 4bp Q-o-Q for the group and 3bp for the bank, owing to funding cost burden. In the fourth quarter, loans increased steeply while time deposits funding grew over long low-cost deposits. And time deposit rates increased substantially, reflecting the market rate hikes.

Although the NIM went slightly down in Q4 temporarily, starting from 2018 Q1, asset re-pricing will begin in earnest, and we expect the NIM to continue a moderate rising trend.

In Q4, the group's cost-income ratio posted 66.7%, rising significantly. But if PS and ERP expense are excluded, it comes down to 54.1%. Given the seasonality of the fourth quarter, we can say that the costs are well controlled.

In 2017, on a recurring basis, the full year CIR posted 51.8%, greatly improving over the 57.4% of last year, demonstrating the visible results of headcount restructuring and cost-saving efforts.

On the bottom left-side graph, which shows the growth to provisioning ratio in Q4, provisioning ratio to total credit came to 0.1% for the group, minus 0.08% for the bank on the bank of reversal of provisioning for written-off assets. On a full year basis for 2017, the group posted 0.2% and the bank 0.05% and is being managed at a very low and stable level.

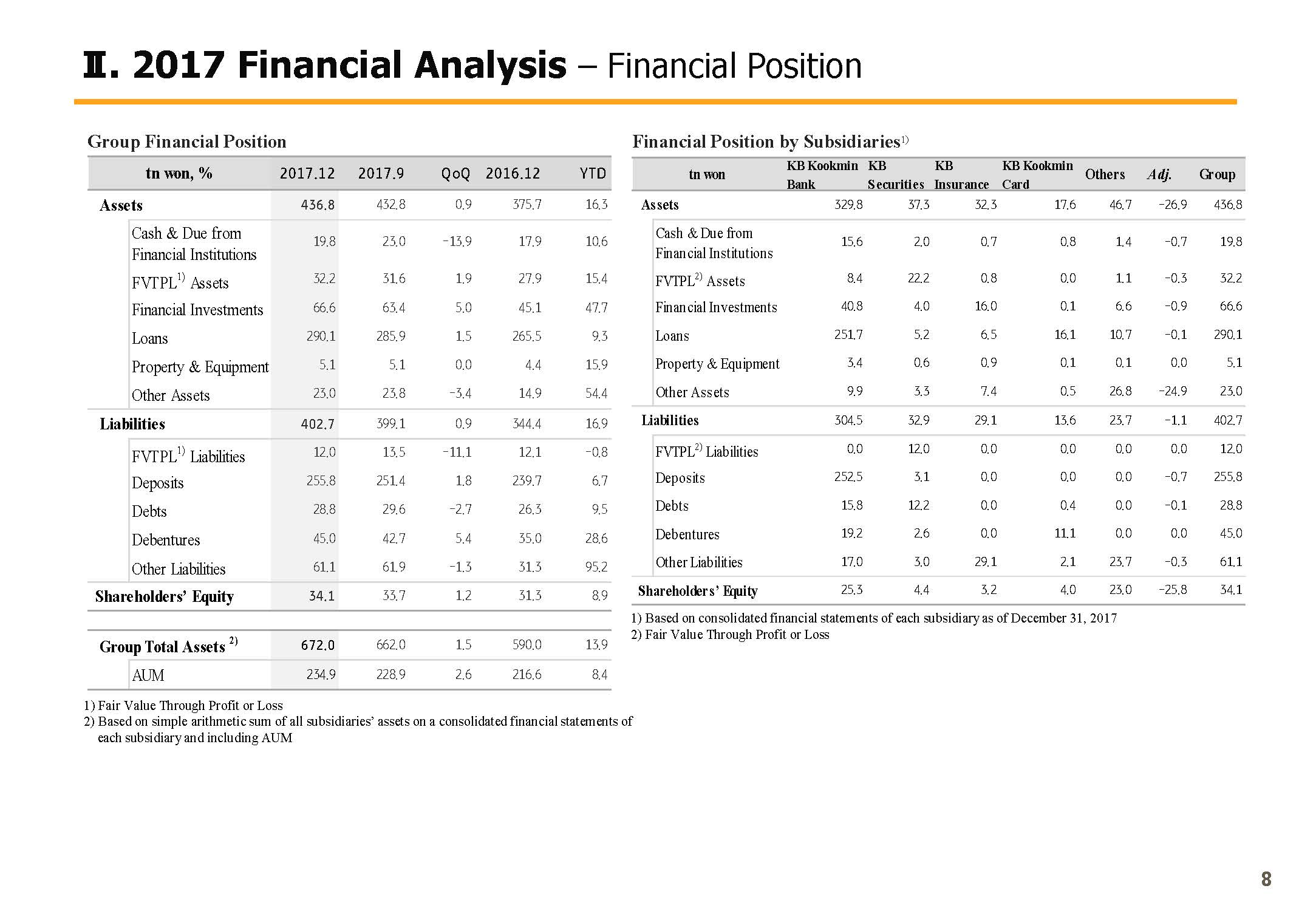

As of the end of December, the group's BIS ratio and the CET1 ratio are 15.24% and 14.61%, respectively. The bank's BIS ratio and CET1 ratio are 16.01% and 14.86%, respectively.

Owing to the impact of year-end dividend and treasury stock buyback, the group's BIS ratio is down slightly Q-o-Q, but still maintains the highest capital adequacy level in the financial sector.

(4p) Key Agenda for 2018

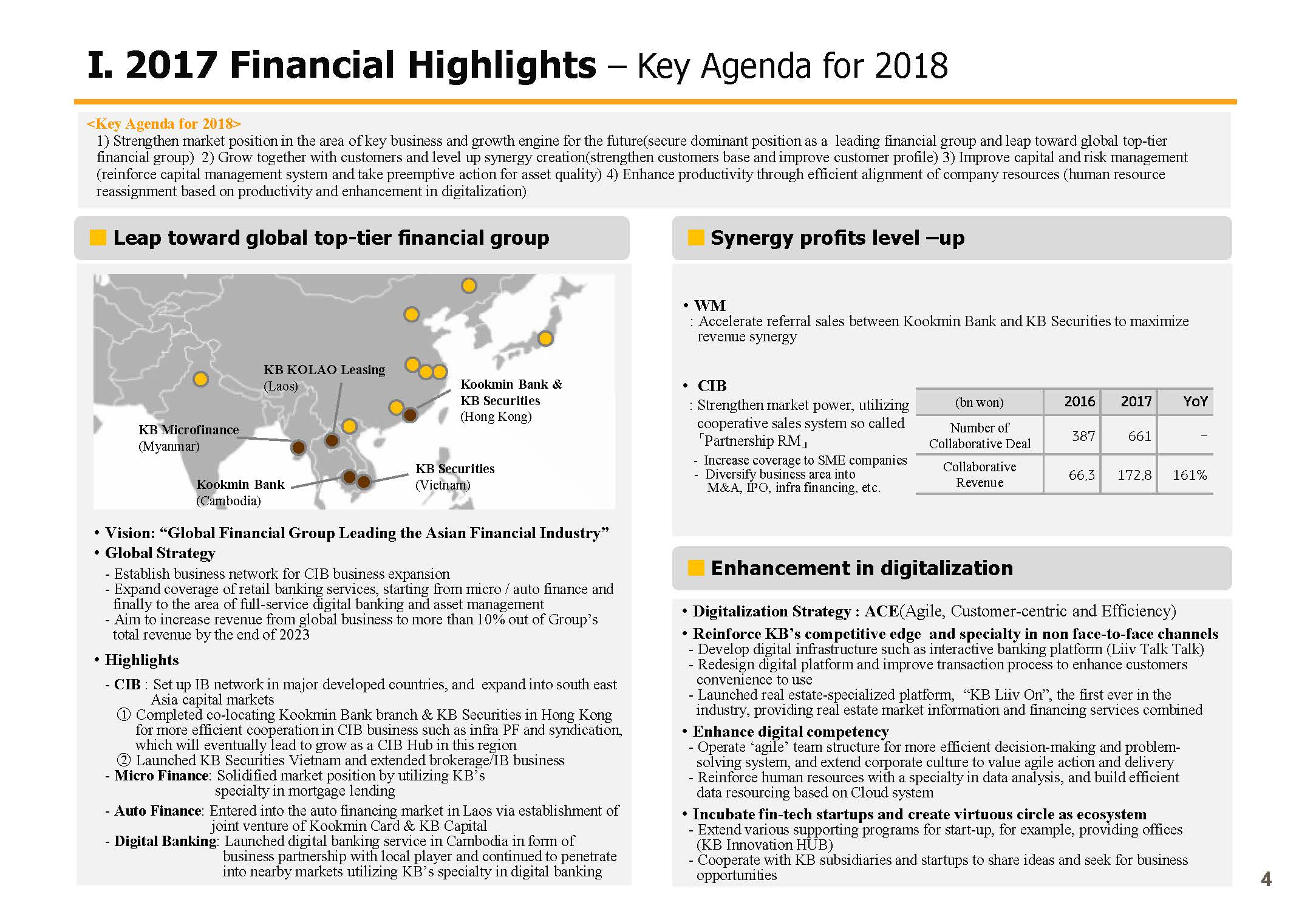

Next on Page 4, let me explain to you the group's 2018 business strategies. In 2018, KB Financial Group plans to pursue the following key agenda in our business plan to establish ourselves as the regional leading banking group. It's the following 4; first, to reinforce our overwhelming market dominant position in core business and new growth sectors; second, achieved shared growth that is centered on customer value and level up synergy-based profits; third, further advance capital and risk management structures; and fourth, enhance productivity through efficient resource allocation.

Let me elaborate more on the global strategy and the achievement so far. Gains based on group synergies, and finally, advanced digitalization strategy among the key agenda items.

First of all, the group is implementing a differentiated strategy for each business area to take us to the top tier in global business. To undertake the global CIB business, we're building networks in the hub markets of the developed countries as well as seeking to enter the securities market in Southeast Asia. As part of such strategy, we have completed a co-location of KB bank's Hong Kong branch with the KB Securities Hong Kong overseas unit, also an infrastructure PF and syndication field collaboration is underway in earnest.

In the case of retail banking, beginning with micro financing and auto finance, we intend to gradually extend our coverage in the Southeast Asian market based on our technological capabilities in digital banking and expertise in the housing finance market.

At present, KB has entered the 13 markets, including Myanmar, Laos and Cambodia. And by 2023, we plan to raise the global profit level to 10% approximately.

Next, results stemming from the group synergies. First, wealth management has seen large increases in the number of customer and customer assets in the back of active referral marketing in the past year. And based on this, starting from 2018, we expect wealth management synergies to yield highly visible results.

CIB has been posting positive achievements in M&A, IPO and infrastructure financing through forming an RM joint sales system between the bank and the securities firm. In 2018, such successful collaborations schemes will be extended to SMEs as well.

Finally, let me explain about our company's digital advancement strategy. Our digitalization policy can be summed up as ACE, which means Agile, Customer-centric and Efficient digitalization.

Toward this end, non face-to-face channels platform has been simplified and the UI/UX restructure, so that we have now have a stronger focus in customer convenience and strengthen competitiveness. We've also become the first financial company to create and launch a comprehensive real estate finance platform called ‘KB Liiv On’. They're seeking to offer differentiated non face-to-face services.

In addition to bolster our digital capabilities at the group level, internally, we're expanding project-based agile organizational structures and building up talent pool in the data analyst field. Externally, we're also promoting virtuous cycle with the outside ecosystems through fostering start-up companies, leveraging the KB Innovation HUB and providing support to perform business relationships with group's subsidiaries.

From the next page on, you'll find more detailed information of what I have explained so far. So please refer to it at your leisure.

With this, I would like to conclude the 2017 full year business results presentation of KB Financial Group. Thank you very much for your attention.