-

3Q18 Business Results

Greetings and Summary

Greetings. This is Peter Kwon in charge of IR at KB Financial Group. We will now start the 2018 third quarter earnings conference call. Thank you very much for joining us. We have our CFO of KB Financial Group, Ki-Hwan Kim, as well as executives of our subsidiaries present on today's conference call. We will start with a presentation by our CFO, Ki-Hwan Kim, on our third quarter earnings before taking your questions. Now our CFO, Kim, will go over our third quarter earnings.

Greetings. This is Ki-Hwan Kim, CFO, of KB Financial Group. Thank you very much for joining our third quarter earnings conference call.

Now before going into our third quarter results I would like to share some business updates. In 3Q KB Financial Group once again recorded healthy results thanks to solid loan growth and stable cost management. In particular we delivered solid growth around high quality household unsecured loans and SME loans with KB Bank's Korean won loans growing by 7.3% YTD and 3.2% QoQ.

However, overall, outlook for the financial sector has been turning towards negative. As trade dispute between U.S. and China takes on a long-term nature, the Korean economy has started to feel actual pressure also with accelerated U.S. rate increases, concern of capital outflow from emerging market has been increasing resulting in a higher level of global volatility.

At the same time, the Korean economy continues to face domestic challenges such as slowdown in exports, weak employment and concerns over household debt which has led to downward adjustment of our economic growth rate projections. Overall, concerns over the economy has been increasing. Accordingly, KB has strengthened its monitoring of various risk indicators as a part of its group-wide effort for preemptive risk management. Also each line of business is thoroughly preparing against change in their respective business environments. In particular, given the realistic possibility of the bank's growth being limited due to various household loan regulations and economic slowdown we will strategically prepare against such concerns at the entire group level.

In the case of KB Kookmin Bank we will leverage our customer base as well as sales network competitiveness to gain a larger share of growth in the market while actively seeking growth opportunities such as mid-range interest rate loans by using our group level integrated credit management system. At the same time, we are accelerating overseas business expansion to overcome the limited domestic growth opportunities and to gain drivers for our future sustained growth.

Acquisition of stake in the Indonesian Bukopin Bank last July is a part of this initiative and we plan to continue to expand overseas at an active pace especially around Southeast Asian market with strong growth potential such as Vietnam, Indonesia and Cambodia by leveraging KB's retail bank expertise, risk management capabilities and digital technology.

As such, despite the challenging business environment as a leading financial group KB will continue its efforts to enhance enterprise value by persistently identifying future growth engines, strengthening the fundamental competitiveness of each subsidiary and maximizing intercompany synergies. Now let's go over the third quarter results.

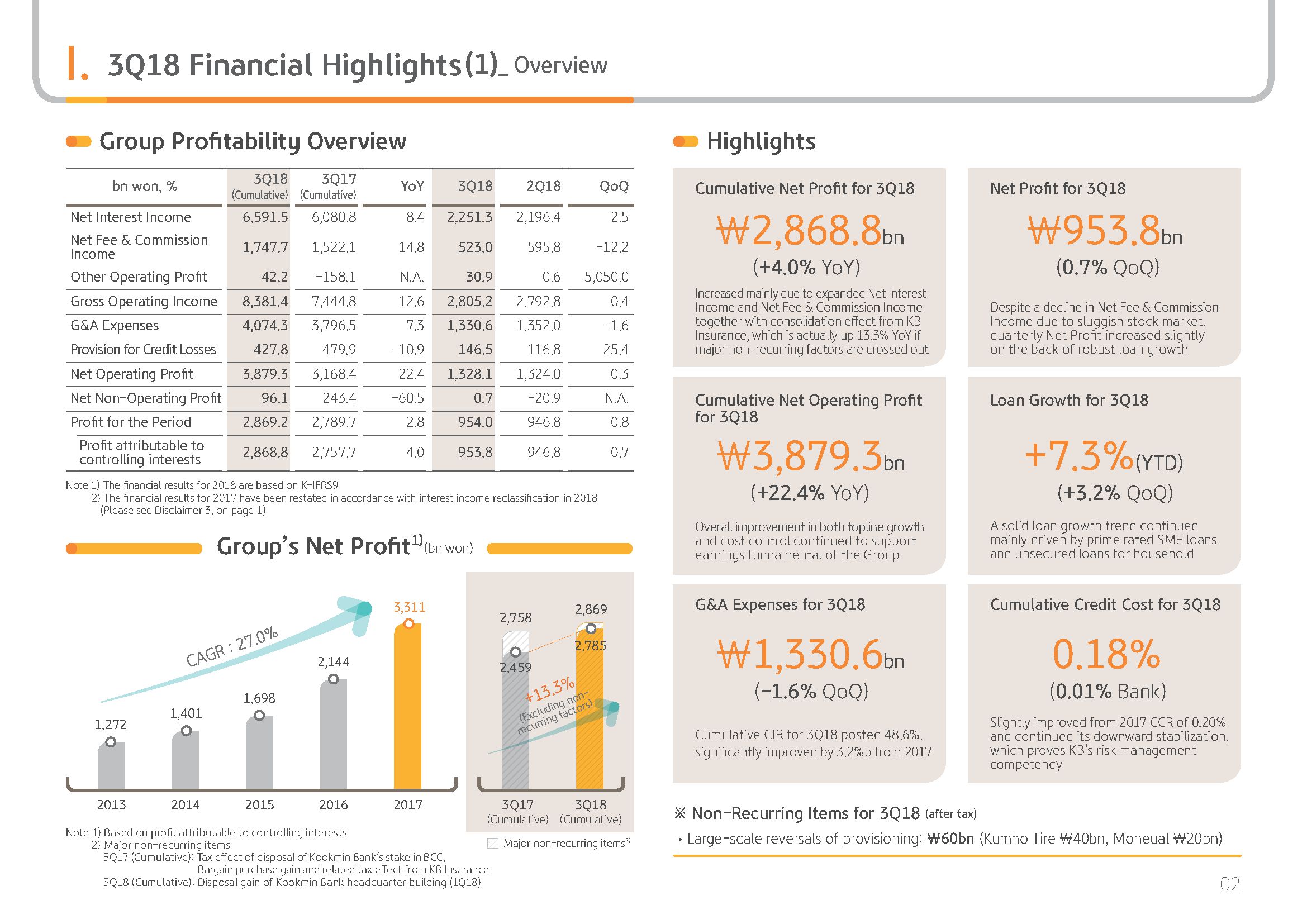

(2p) 3Q18 Financial Highlights-Overview

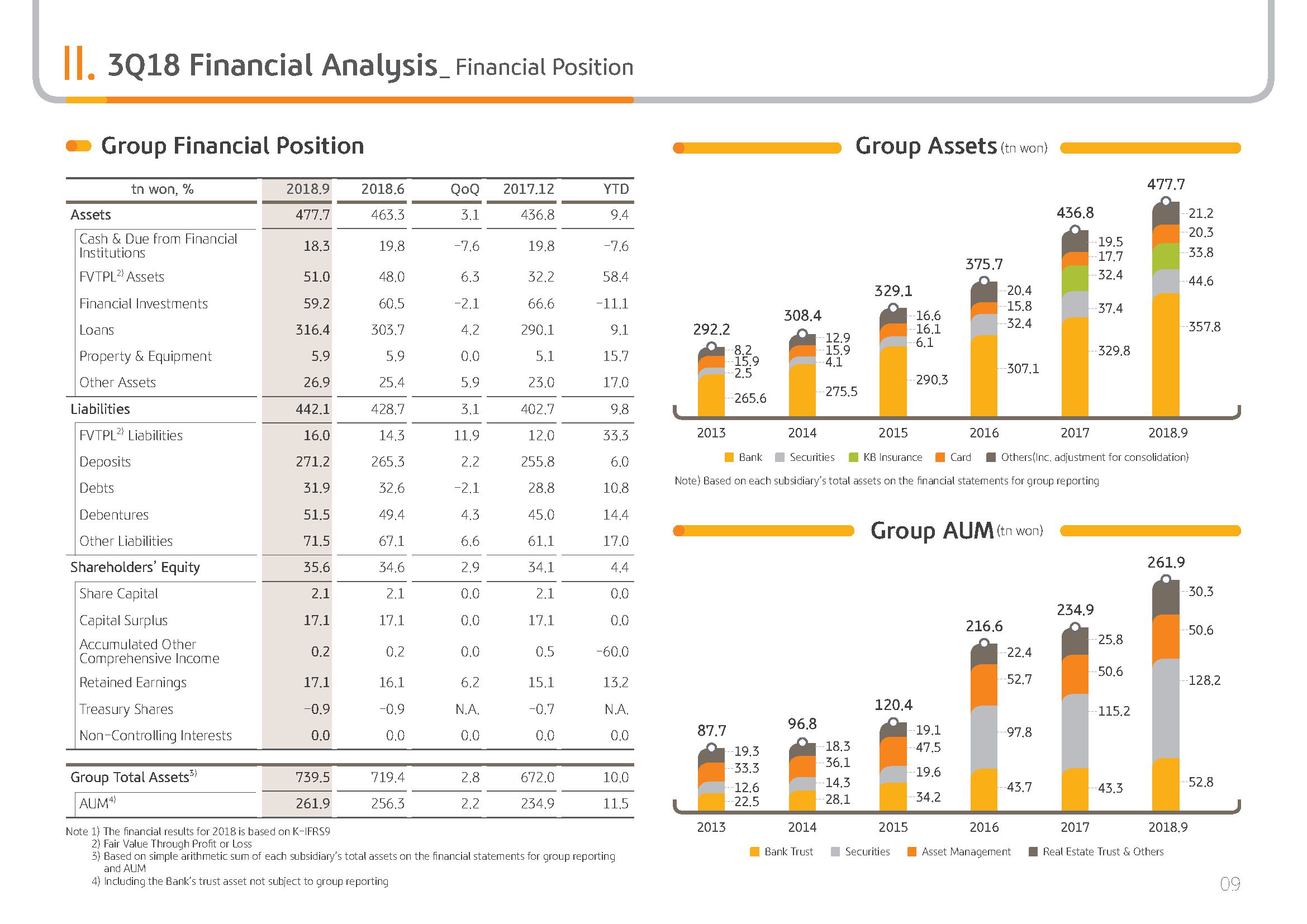

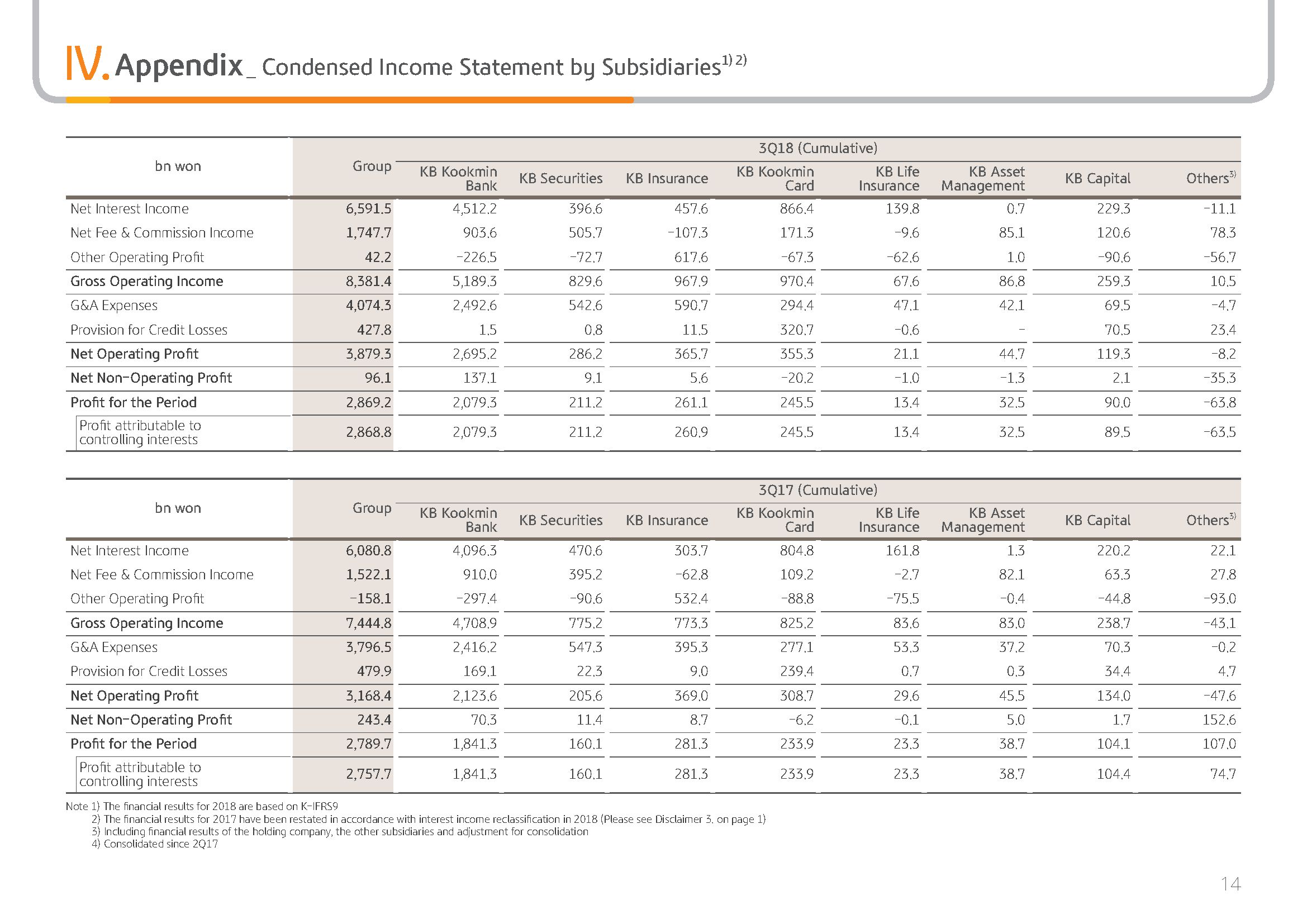

3Q18 cumulative net profit was KRW 2,868.8 billion which is a 4% growth YoY thanks to balanced growth in both interest and noninterest income as well as the effects from consolidation of KB Insurance. When one-off factors from last year such as bargain purchase gain & related tax effect from KB Insurance and corporate tax effect resulting from disposal of BCC as well as this year's gain from disposal of KB Kookmin Bank Headquarter building in Myeongdong building accounted for, this is approximately a 13.3% YoY increase.

3Q net profit was KRW 953.8 billion which is a slight increase thanks to solid loan growth despite overall decrease in net fee income and commission income including bank trust commissions and security commissions due to weak stock market. Also third quarter cumulative net operating profit was KRW 3,879.3 billion which is a 22.4% growth YoY, reflecting structural improvement in the group's profitability as top line continues to improve while cost remains stable.

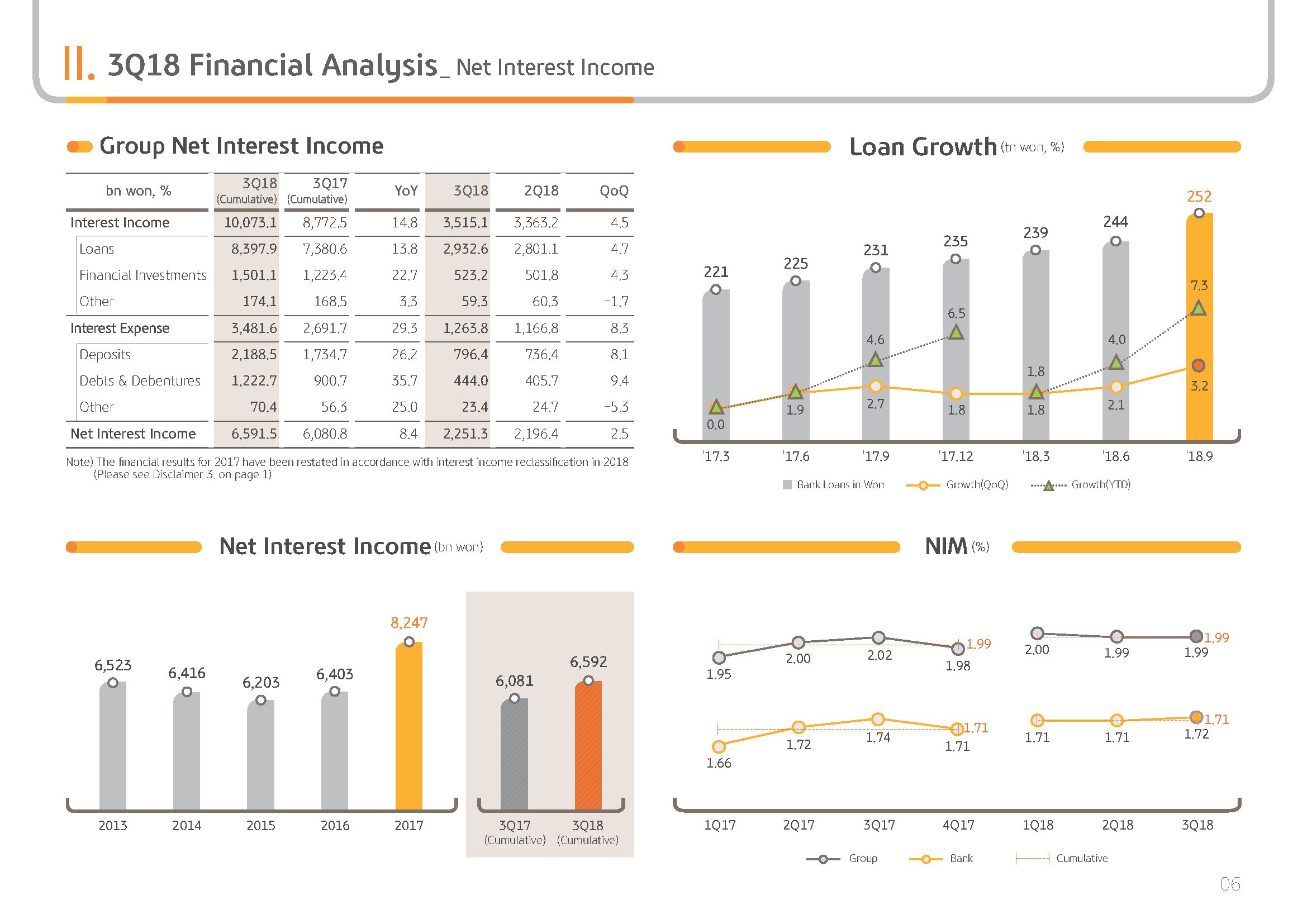

Now let's look at the results in more detail. 3Q cumulative net interest income was KRW 6,591.5 billion which is a 8.4% YoY growth. KB Kookmin Bank's loans in won alone grew by 7.3% cumulatively leading to increased interest income. And also interest income contribution by nonbank subsidiaries is also continuing to expand.

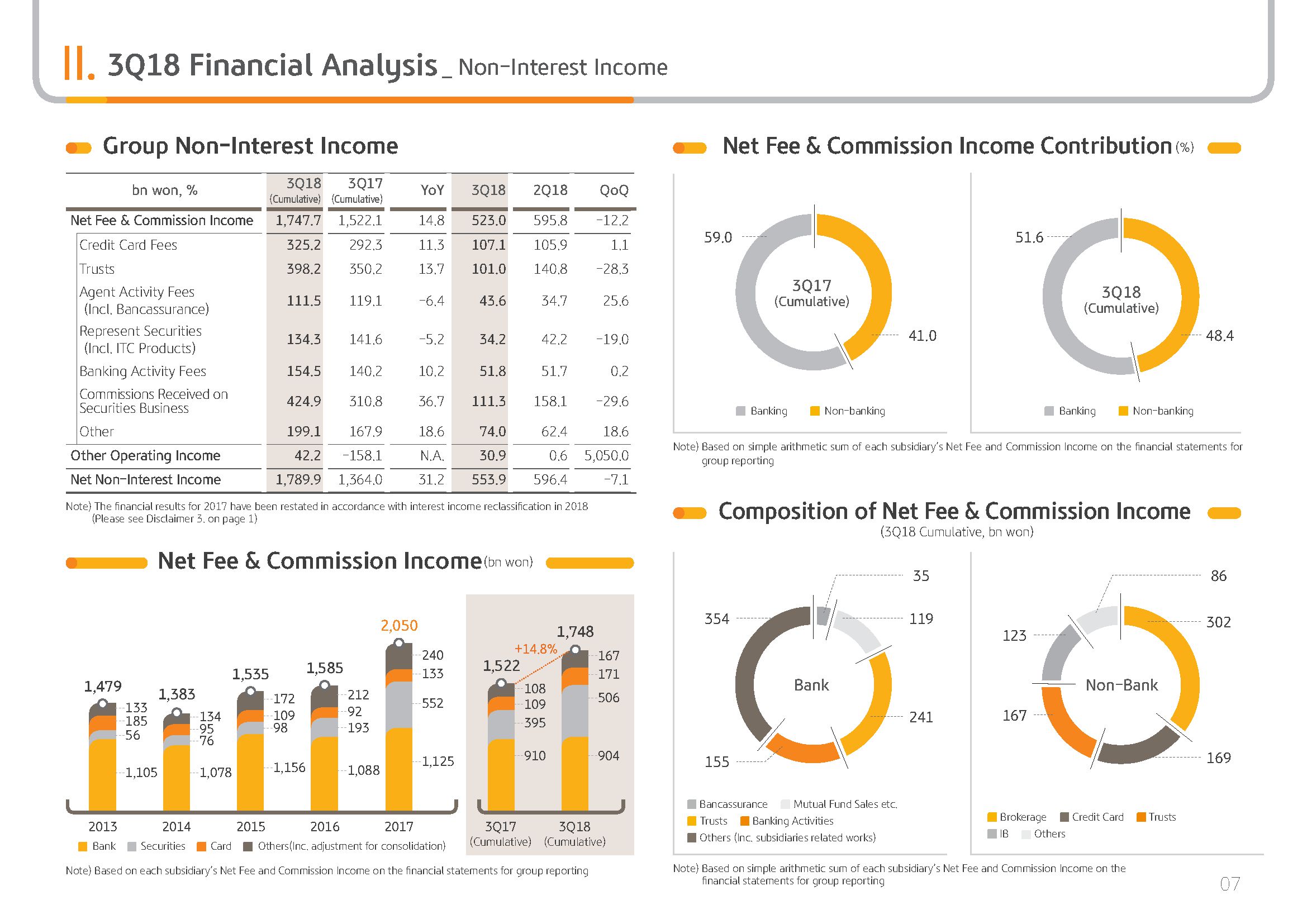

Next, the group's net fee and commission income. 3Q cumulative net fee and commission income was KRW 1,747.7 billion which is a 14.8% YoY increase. This is mainly thanks to increased sales of investment products such as ELS and ETF with a strong equity market in the first half and also significant increase in trust income and security commissions with increased securities trading.

However when we just look at third quarter, fee and commission income was KRW 523 billion, which is a 12.2% decrease QoQ as a result of significant decrease in bank trust income due to decrease in new and early redemption of ELS with the overall weak stock market. Stock market related fee and commission income continues to slow down with greater volatility in the stock market in the second half of this year. And KB plans to expand fee income while at the same time managing volatility by decreasing dependence on certain products, increasing fee income base through active marketing to corporate customers and enhancing the competitiveness of KB's IB business.

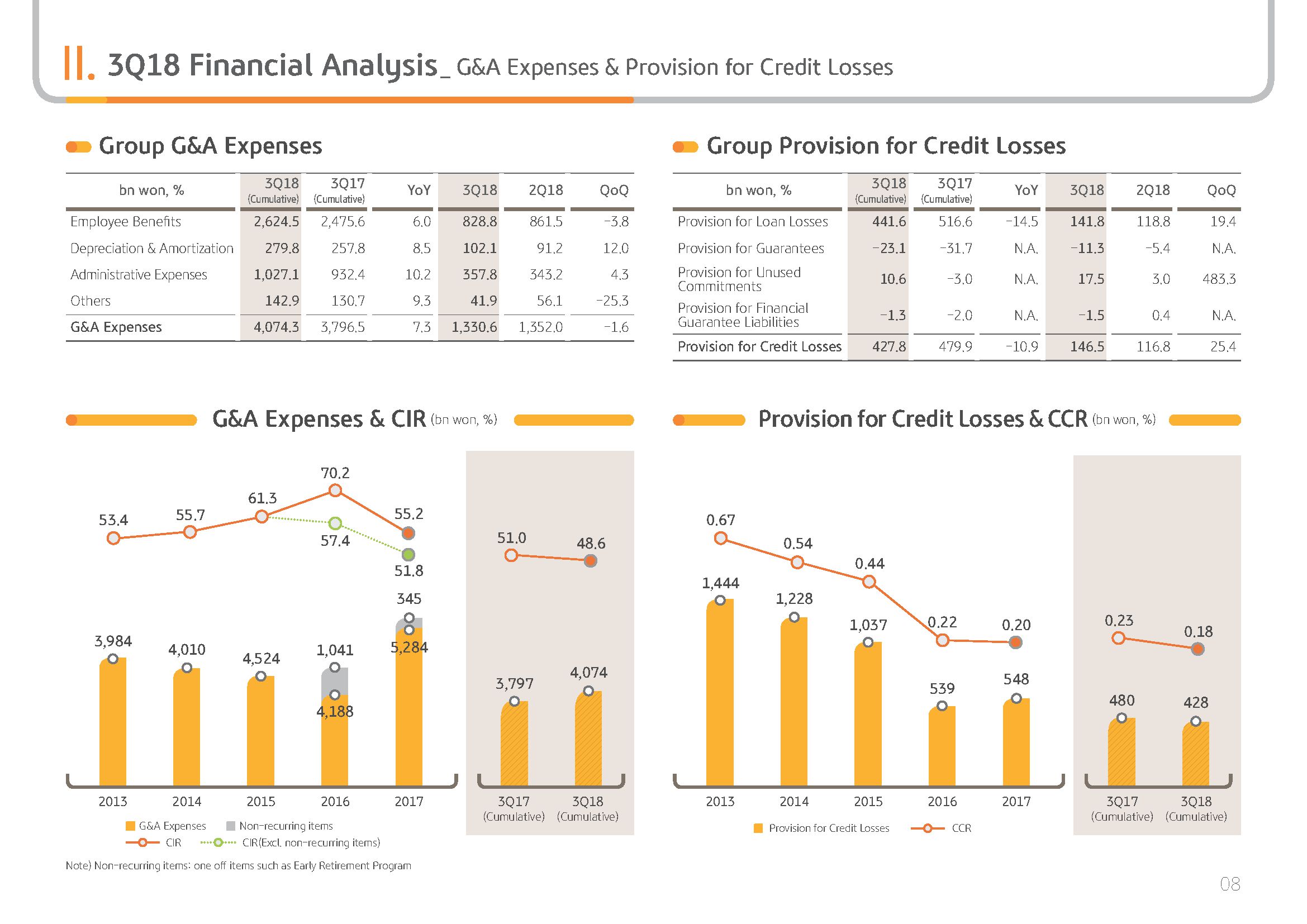

Third quarter cumulative other operating income was KRW 42.2 billion which is a significant YoY increase, thanks to consolidation of KB insurance. Also this is a slight QoQ improvement resulting from interest rate and lower exchange rate in 3Q which has helped increase security related income and derivatives and FX conversion related income. 3Q cumulative G&A was KRW 4,074.3 billion which is a 7.3% YoY increase. When effects of KB Insurance consolidation is excluded G&A only increased by 2.4% and remain under good control.

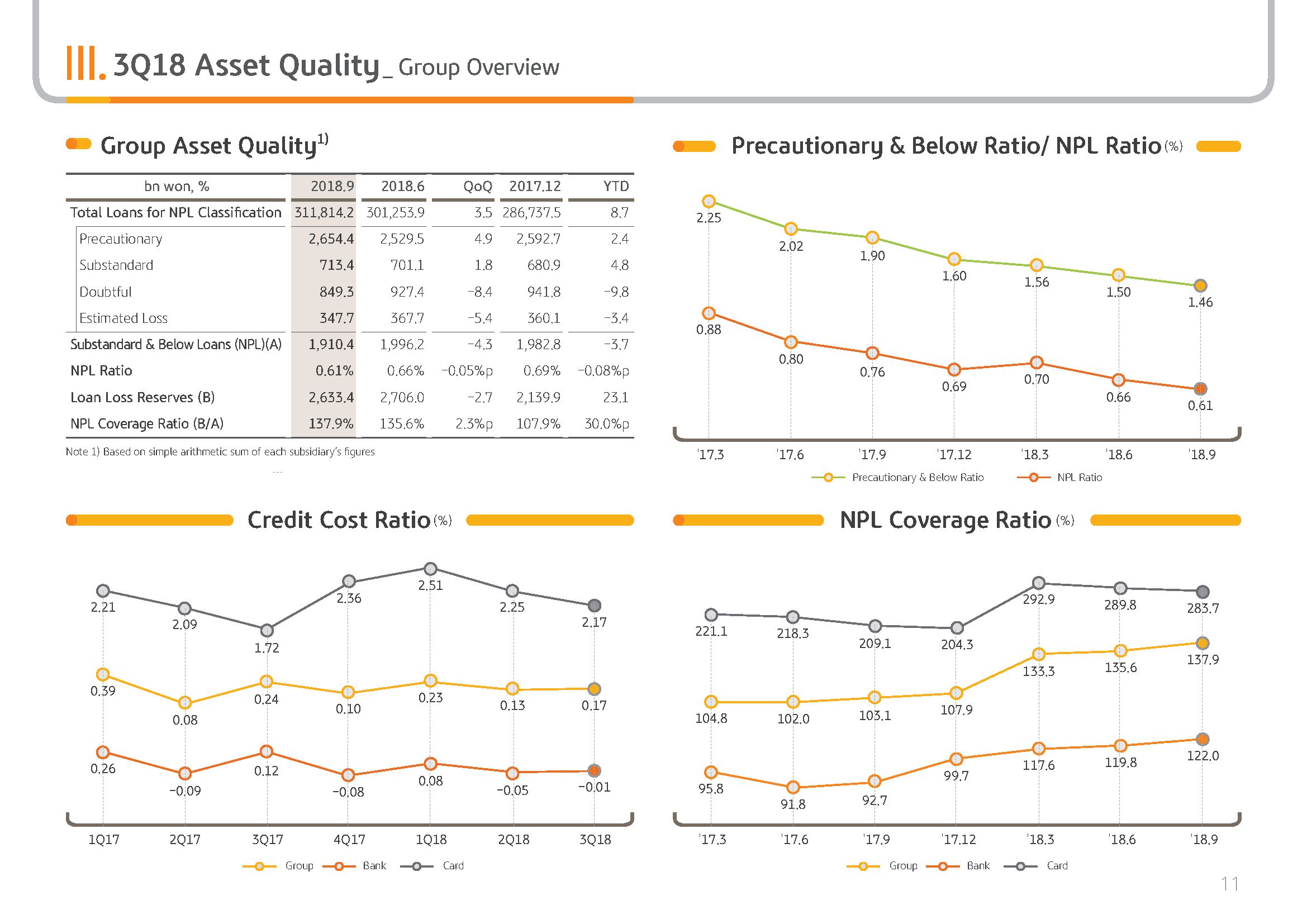

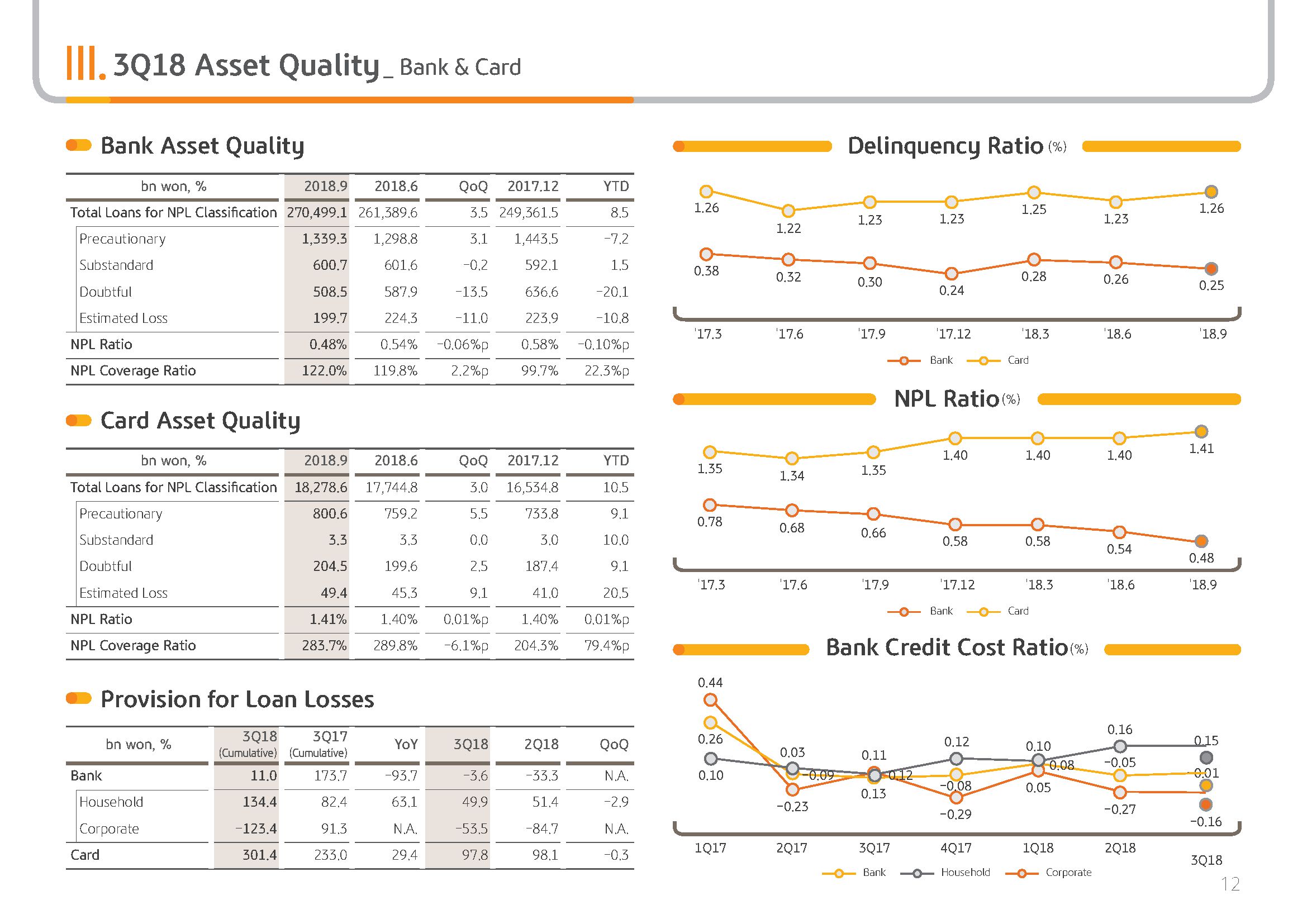

Next, provisioning for credit loss. Third quarter cumulative credit loss provisioning expense was KRW 427.8 billion which is a 10.9% YoY decrease despite increased loan assets, thanks to preemptive asset quality management and portfolio credit quality improvement efforts.

Credit loss provisioning expense in 3Q was KRW 146.5 billion and a large reversal of loan loss provisioning of approximately KRW 93 billion including Kumho Tire continued in 3Q keeping overall provisioning expenses at well controllable levels. 3Q cumulative non-operating income was KRW 96.1 billion which decreased significantly YoY due to one-off factors last year including bargain purchase gain & related tax effect from KB Insurance. Next page is about our major financial indicators.

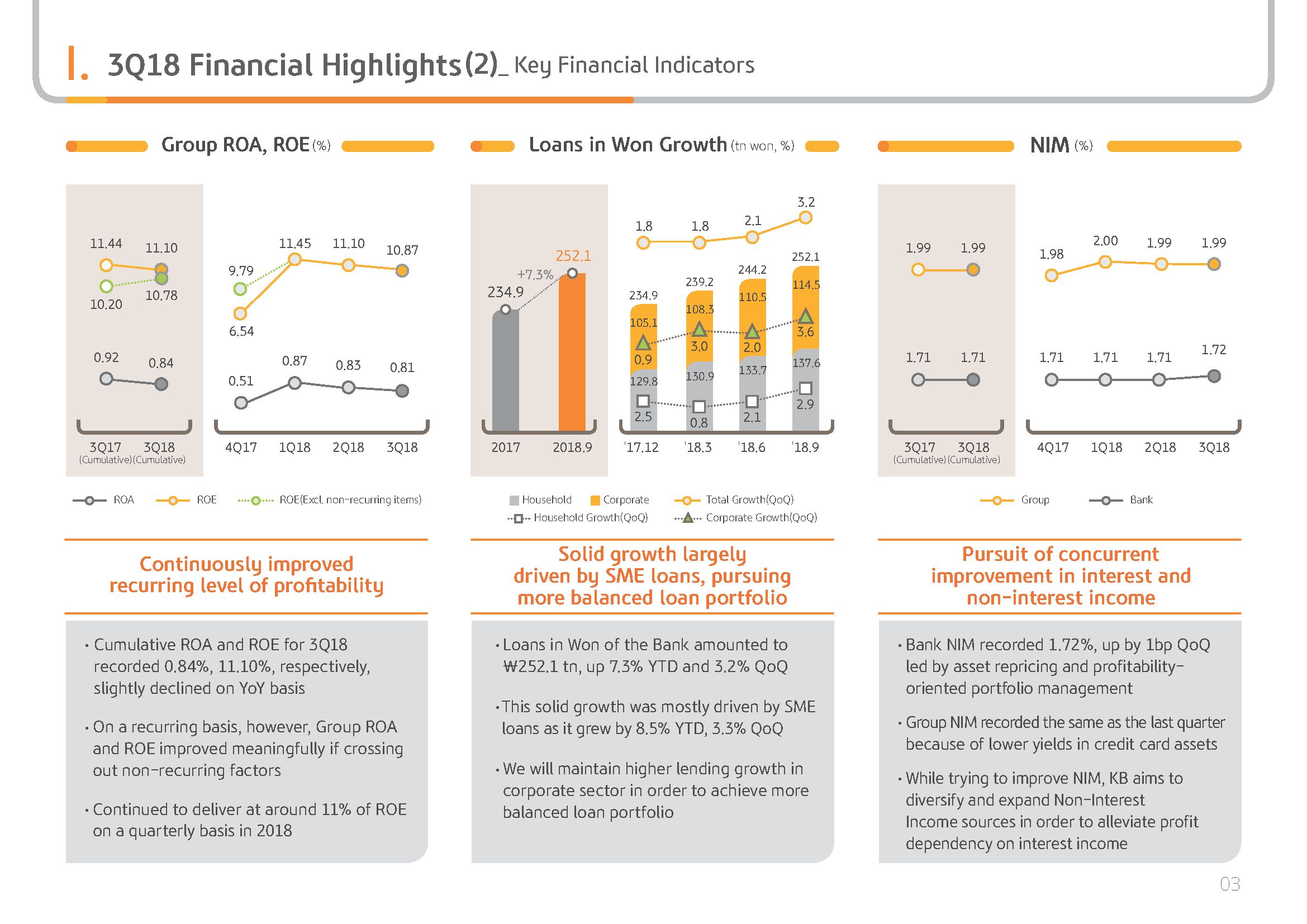

(3p) 3Q18 Financial Highlights-Key Financial Indicators

3Q18 cumulative group ROA posted 0.84% and ROE posted 11.10%. This was a slight drop YoY. But taking into consideration the aforementioned one-off gains in 2017, including KB Insurance gains from bargain purchase, the group's recurring profitability is meaningfully improving and is steadily posting at around 10% to 11% of ROE on a quarterly basis this year.

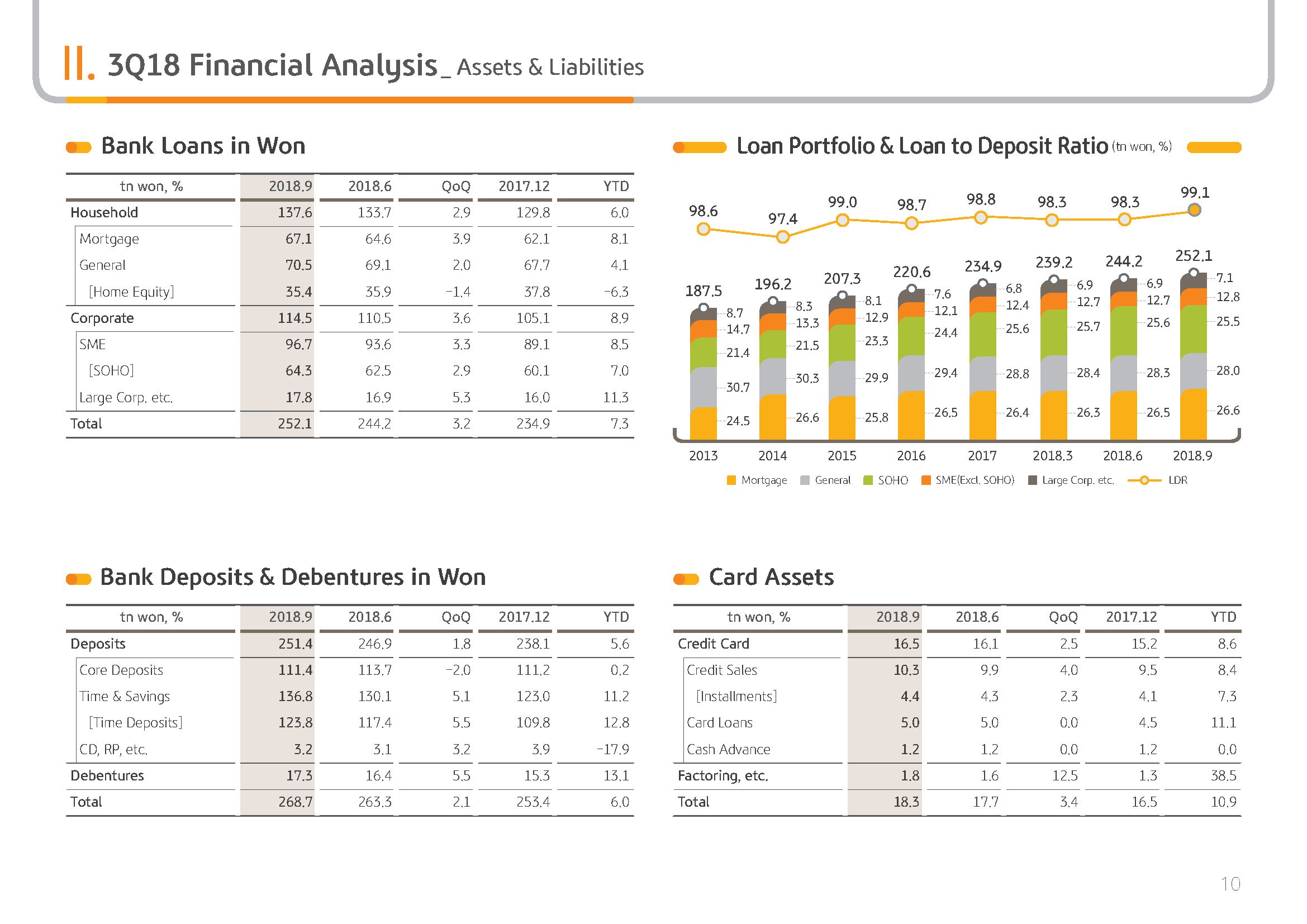

Next is the bank's loans in won growth. Looking at the graph in the middle, as of September end 2018 bank's loans in won reported a 7.3% YTD and 3.2% QoQ increase and posted KRW 252.1 trillion. Household loans increased 6% YTD and 2.9% QoQ, centering on prime unsecured loans and jeonsae loans and corporate loans grew 8.9% YTD and 3.6% QoQ centering on prime SME loans.

We have been growing household loans in a limited manner for the past few years and have been growing based mainly on SME-centered corporate loans. We wish to continue these efforts so that we can pursue a more balanced loan portfolio.

Next, looking at the NIM. 3Q group NIM posted 1.99% and bank NIM posted 1.72%. First regarding the bank NIM, because of the recent market environment low cost core deposit growth was slightly modest and the time deposit funding proportion expanded leading to a continued overall funding cost burden. However, due to the asset repricing reflecting this market interest rate rise and profitability centered portfolio management efforts NIM slightly increased QoQ.

However, the group NIM despite the bank NIM improvement as a result of credit card asset yield decline leading to the card NIM drop maintained the previous quarter levels. We will exert all efforts to improve the NIM, including strengthening marketing capabilities to expand the low cost core deposit funding and managing profitability centered portfolio for different business segments. At the same time we will continuously diversify noninterest income sources so that the group's interest income dependence can be gradually improved. Let's go to the next page.

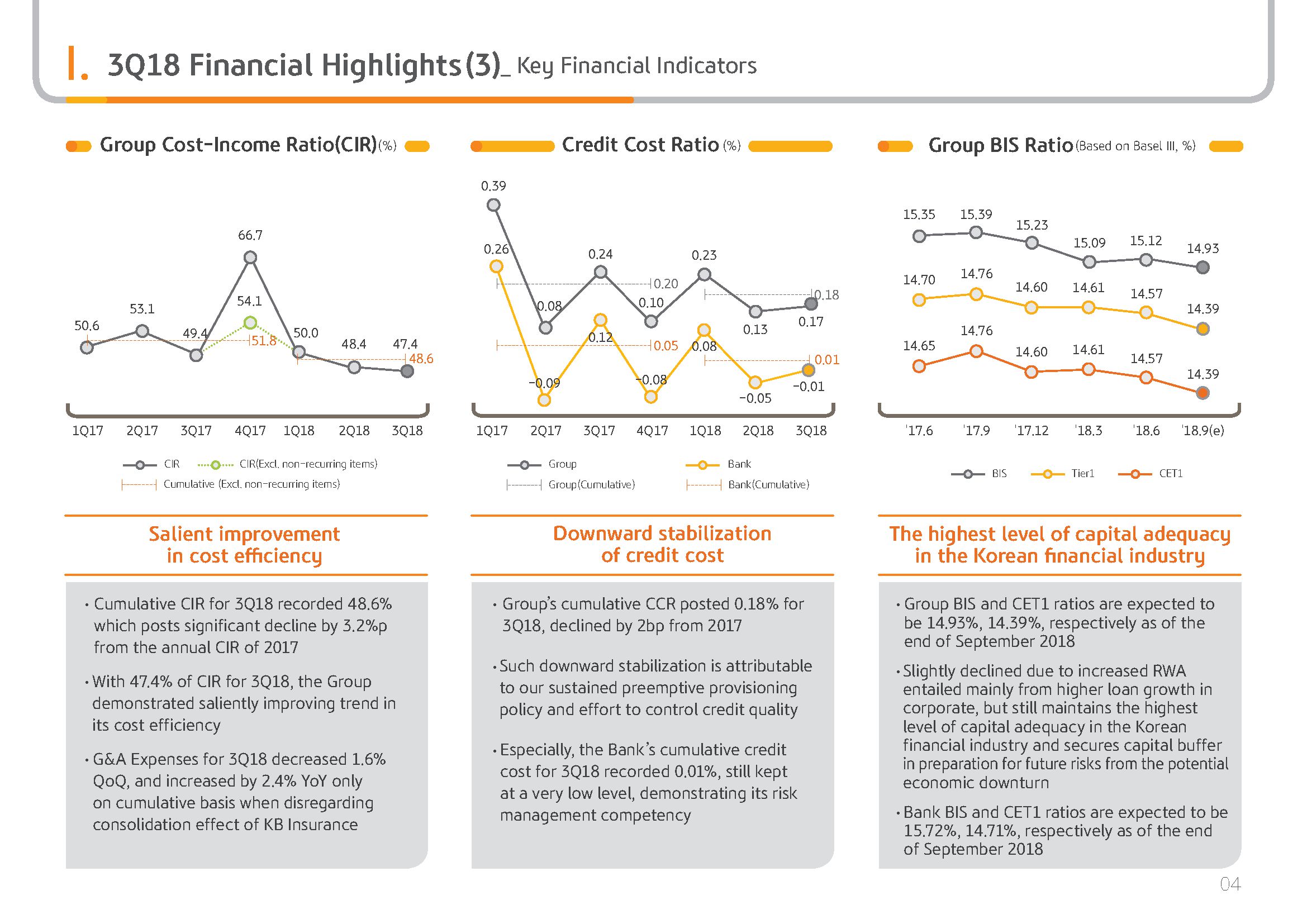

(4p) 3Q18 Financial Highlights-Key Financial Indicators

Next is the group's cost-income ratio. On the CIR graph on the left side, 3Q cumulative group CIR posted 48.6%, a significant improvement YoY, thanks to group-wide efforts for cost efficiency improvements and is showing a clear quarterly improvement trend this year. Going forward with realization of the solid growth on the top line and cost cutting efforts, the group CIR is expected to improve in the mid to long term to a mid-40% level.

Next is the credit cost ratio. 3Q18 cumulative credit cost ratio compared to group's total loans posted 0.18%. This was a result of the group's efforts for preemptive asset quality management and portfolios credit quality improvement efforts and with the 2bp improvement YoY downward stabilization is continuing. In particular, the bank's 3Q cumulative credit cost recorded 0.01% and is being maintained at a very low level.

The group's capital adequacy ratio as of end September 2018 posted BIS ratio 14.93% and CET1 ratio 14.39% respectively. And with corporate loans centered growth RWA has been increasing leading to a slight decline QoQ. But still the highest level of capital adequacy in the financial sector is being maintained. In a situation where internal and external issues are leading to continued uncertainty, solid capital power of KB will be regarded as our competitiveness. From Page 5, I will explain about KB's loan growth for the past 5 years and the future growth strategy.

(5p) KB Growth Strategy

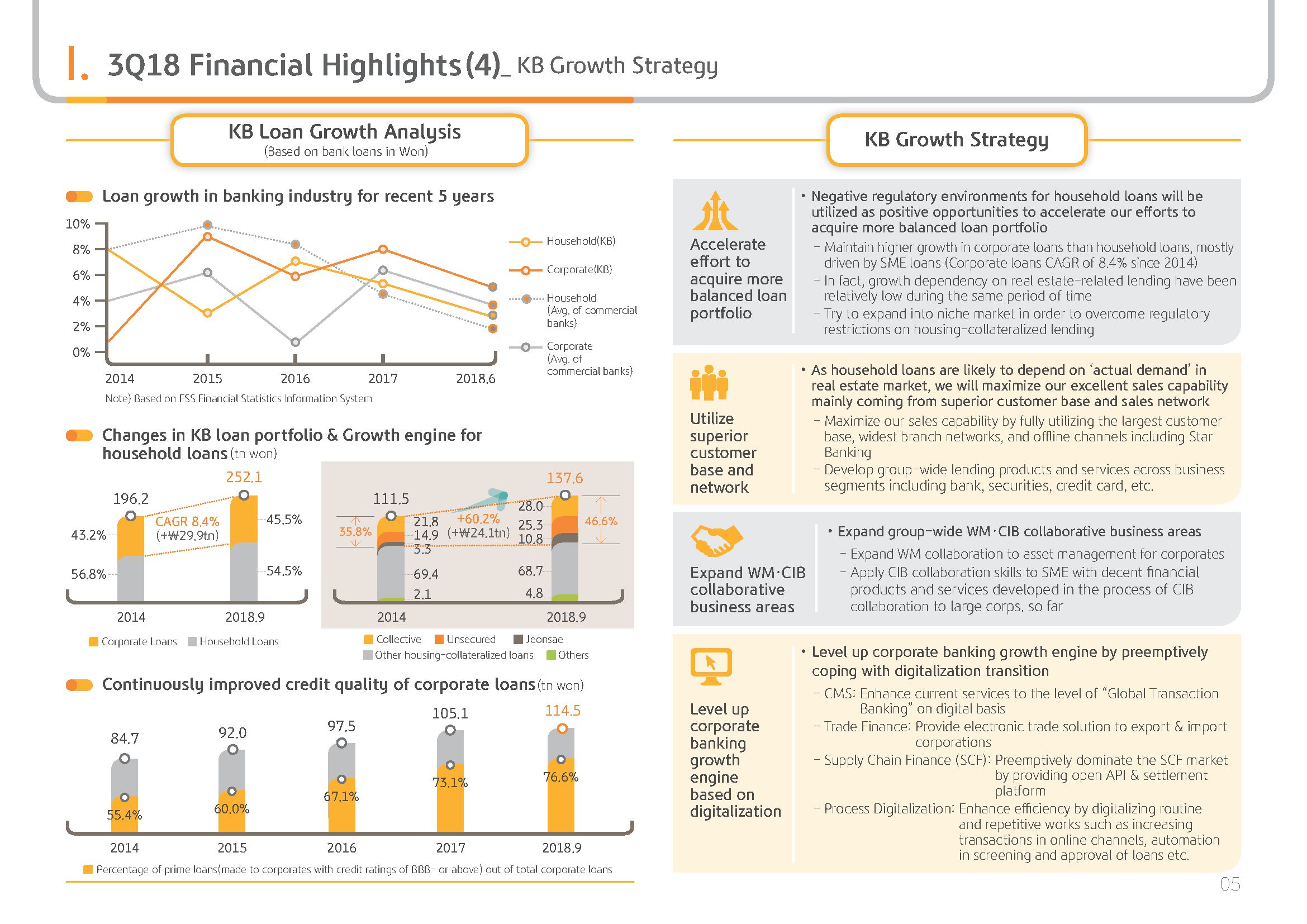

As mentioned previously, there have been concerns about future bank rules with household loan regulation strengthening and the economic turn down. I believe the explanation given on this page will be helpful for your understanding. KB in order to better balance the loan asset portfolio has been expanding corporate loans centering on SMEs and has lowered the growth dependence on household loans, including housing collateralized loans.

As can be seen in the first graph, Kookmin Bank from 2015 has been selectively handling household loans and have seen limited growth compared to the market. However in the case of corporate loans, a relatively high growth rate has been achieved. With this the loan portfolios corporate loan proportion which stood at 43.2% at 2014 end has grown to 45.5% as of end September 2018, and the corporate loan size has grown approximately by KRW 30 trillion. In the same time period the corporate loans compound annual growth rate or CAGR posted 8.4% level, a result of the efforts of KB to break away from the existing household loan centered loan structure to better balance the loan portfolio.

On the other hand, as can be seen from the graph in the middle right-hand side, after 2014 the major growth drivers of our household loans were 3 types of loans, including unsecured loans, jeonsae loans and collective loans. The size of the loans grew by KRW 24 trillion, and the proportion of these loans in the overall household loans expanded from 35.8% in 2014 end to 46.6% percent. On the other hand, in the case of other housing collateralized lending as a result of selective handling for portfolio adjustment and risk management, there was a reverse growth in the same period.

On the whole, KB clearly changed the household loan growth momentum. To add, we have been expanding our corporate loans but also steadily improved our portfolio's credit quality. As an example, as you can see on the graph on the bottom, the loan proportion of prime borrowers with a credit rating of triple BBB- or higher among corporate loans has expanded greatly from 55.4% at end 2014 to September end 2018, 76.6% respectively.

Next, I would like to elaborate on KBFG' growth strategy. First, KB aims to utilize the current situation of household loan regulation strengthening as a positive opportunity to accelerate efforts for balanced growth between the household and corporate portfolio. Since we have been focusing on prime household unsecured loans and SME loan growth strategically and lowering our growth dependence on real estate related loans, we believe that the shock from the regulations will not be relatively high and we wish to focus more on prime SME loan expansion.

Second, since the real estate market under the influence of many regulations is expected to change to an actual demand-based market based on our exceptional customer base and channel network, this will be an opportunity where KB's sales capability can be exerted. In particular, we want to respond from a group-wide basis collaborating between all subsidiaries including banks, securities, card and capital.

Third, in order to gradually lower the dependence on loan assets in growth and to expand the growth basis, we wish to widen the collaboration scope between WM and CIB. In the case of WM, we want to expand the group collaboration system to the subsidiary's asset management efforts. In the case of CIB, through expanding SME customers, with proven cooperation capabilities and programs to the large corporate, we want to expand synergy creation opportunities.

Lastly, with the digitalization turning point we want to preemptively expand the corporate sector's growth momentum. We have established a mid- to long-term corporate finance digitalization road map centering on CMS and trade finance from 2017, which has implemented in stages. And have also tangible results including the first new product launched in the financial industry in the area of supply chain finance.

KB Financial Group has for the first time in the financial industry integrated the subsidiary data in the group, leading to the establishment of the group integrated credit rating system. Based on this we will activate the group's integrated mid-interest rate loan service.

Likewise, we will actively uncover growth opportunities in the difficult business environment and expand the growth momentum so that the corporate values can be strengthened. Please refer to the detailed information on the next pages for your reference.

With this we will conclude KBFG' 3Q18 business results presentation. Thank you for listening.