-

1H19 Business Results

Greetings and Summary

I am Peter Kwon from KBFG IR. I am the IR Head, and I would like to introduce the 2019 First Half Business Results of KBFG. Thank you very much for your attendance. I would like to introduce our CFO and Deputy President, Kim Ki-Hwan and other executives who are here with us today. Today, we will have the 2019 first half business results presentation by our Deputy President and CFO, Kim Ki-Hwan, and then engage in a Q&A session. I will now like to invite our Deputy President and CFO.

Good afternoon. I am Kim Ki-Hwan, CFO of KB Financial Group. Thank you for joining KBFG's 2019 first half earnings presentation.

Before moving on to the earnings results, let me briefly first update you on the operational backdrop. KBFG has seen sustained increase in the bank's interest income with nonbank subsidiaries, such as securities and insurance profitability stabilizing as it regains earnings resilience at the recurring level. But as you know, business environment around the financial industry is worsening than expected.

Prolonged trade conflict between the U.S. and China is having its impact on the Korean economy. And the compounding effect of export declines and sluggish domestic demands led to 1Q GDP growth to be in the minus, with the overall economy feeling great difficulties. And we expect such economic sluggishness may continue into the second half of the year.

Also recently, with higher expectations over rate cuts in the United States, this morning, BOK announced 25bps policy rate cut. And it's such heightened uncertainties in, both domestic and overseas operational environment, we believe it's most important to gain market trust through achieving robust performance. To that end, we are focusing on qualitative growth around safe and prime assets and on broadening stable sources of revenue.

First of all, for the bank, in order to foster qualitative growth around prime assets, we have been selective in loan origination and applied conservative loan policies, at the same time, strengthening pre-monitoring on quality indicators. Also nonbank subsidiaries are endeavoring to diversify sources of earning in order to enhance profit-making capabilities.

The case in point is KB Securities, who after acquiring license for short-term finance business by FSS in May, started issuing promissory notes last month, adding another support for revenue creation. IB business is also leading the efforts to expand fee income by utilizing its superior corporate network and sourcing capabilities.

At the holding company level, in order to diversify funding sources from the international financial market, where there are ample investment appetite, we recently received credit ratings from global ratings agencies, Moody's, and it was rated A1, which is the highest rating among Korean financial holding companies.

We expect the strong credit worthiness and funding capability will greatly contribute to performances at the group level in relation to overseas and IB business in the future.

Now I will move on to First Half 2019 Earnings Results.

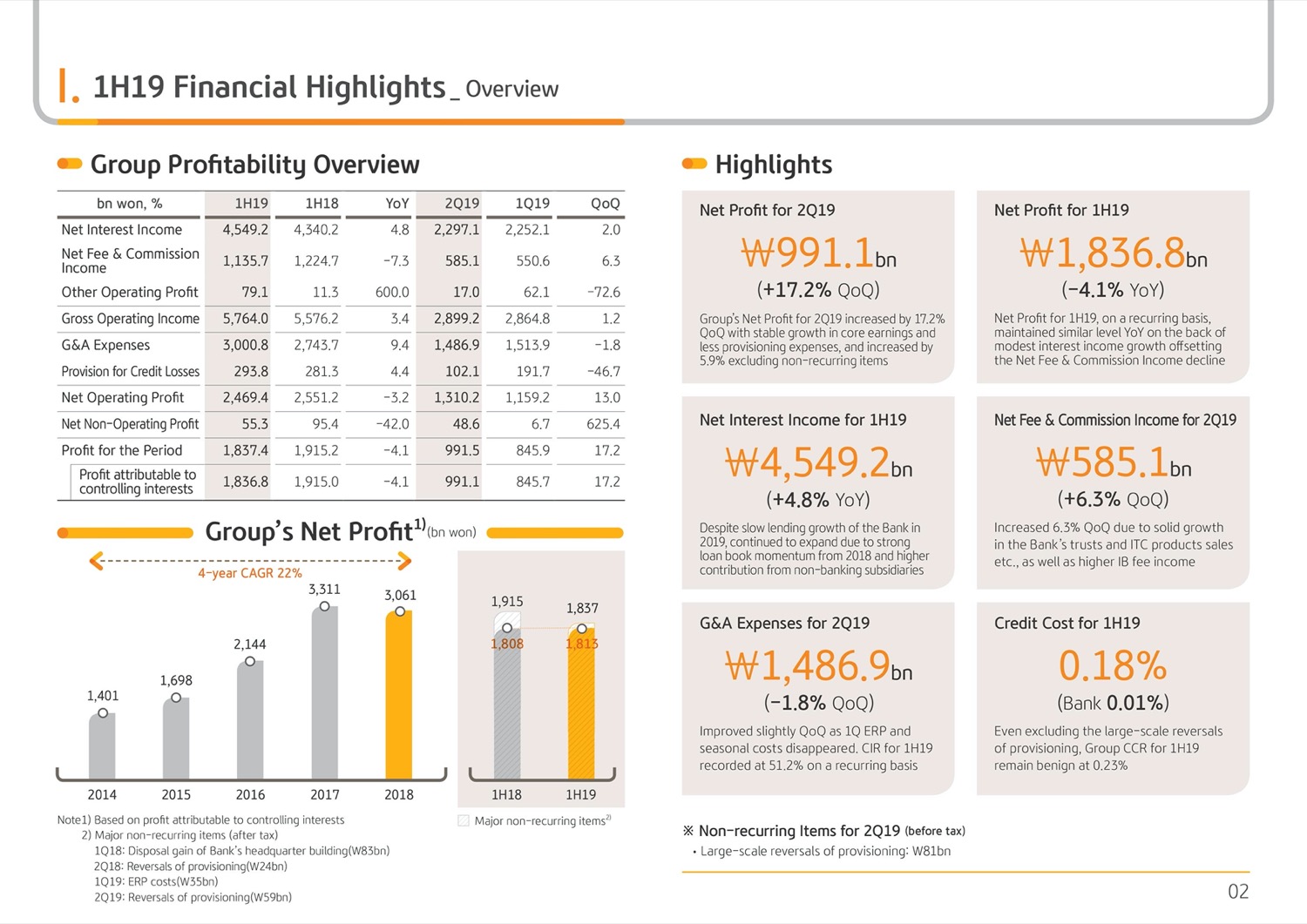

(2p) 1H19 Financial Highlights-Overview

KBFG's 2Q 2019 net profit was KRW 991.1 billion, driven by stable growth in core profit and lower provision for credit losses. Net profit was up 17.2% QoQ.

Excluding the key one-offs, such as write-backs following debt-to-equity swap from Hanjin Heavy Industries & Construction, 2Q net profit was around KRW 932 billion, up 5.9% from 1Q's recurring basis profit, clearly showing recovery of the group's earnings capacity.

First half 2019 net profit was KRW 1 trillion 836.8 billion down 4.1% YoY. But on recurring basis, carving out last year's gain from sale of Myeongdong office building and this year's ERP expense, profit was YoY flat, thanks to robust growth in interest income, despite the decline in net fee and commission income on the back of bearish equity market.

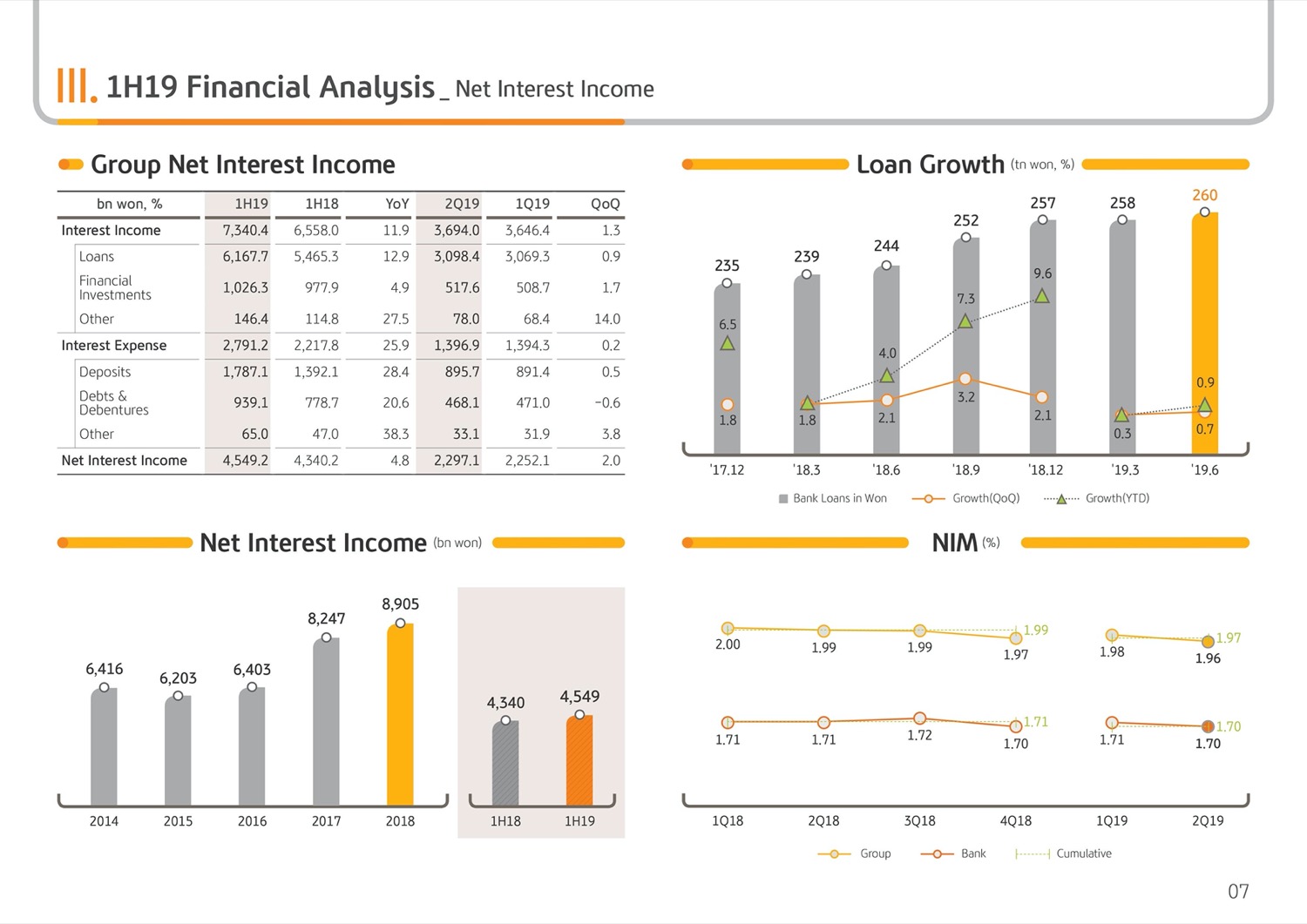

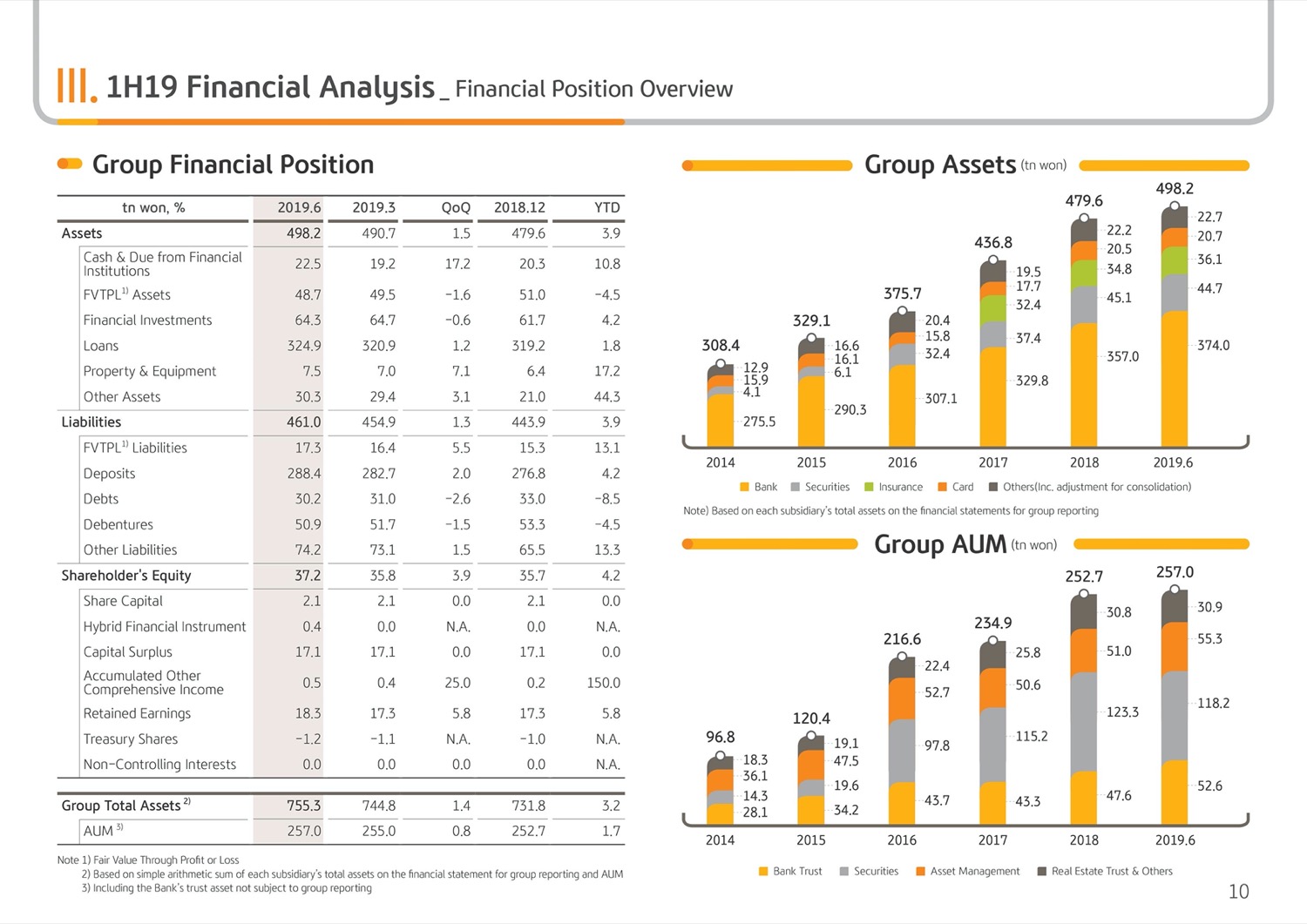

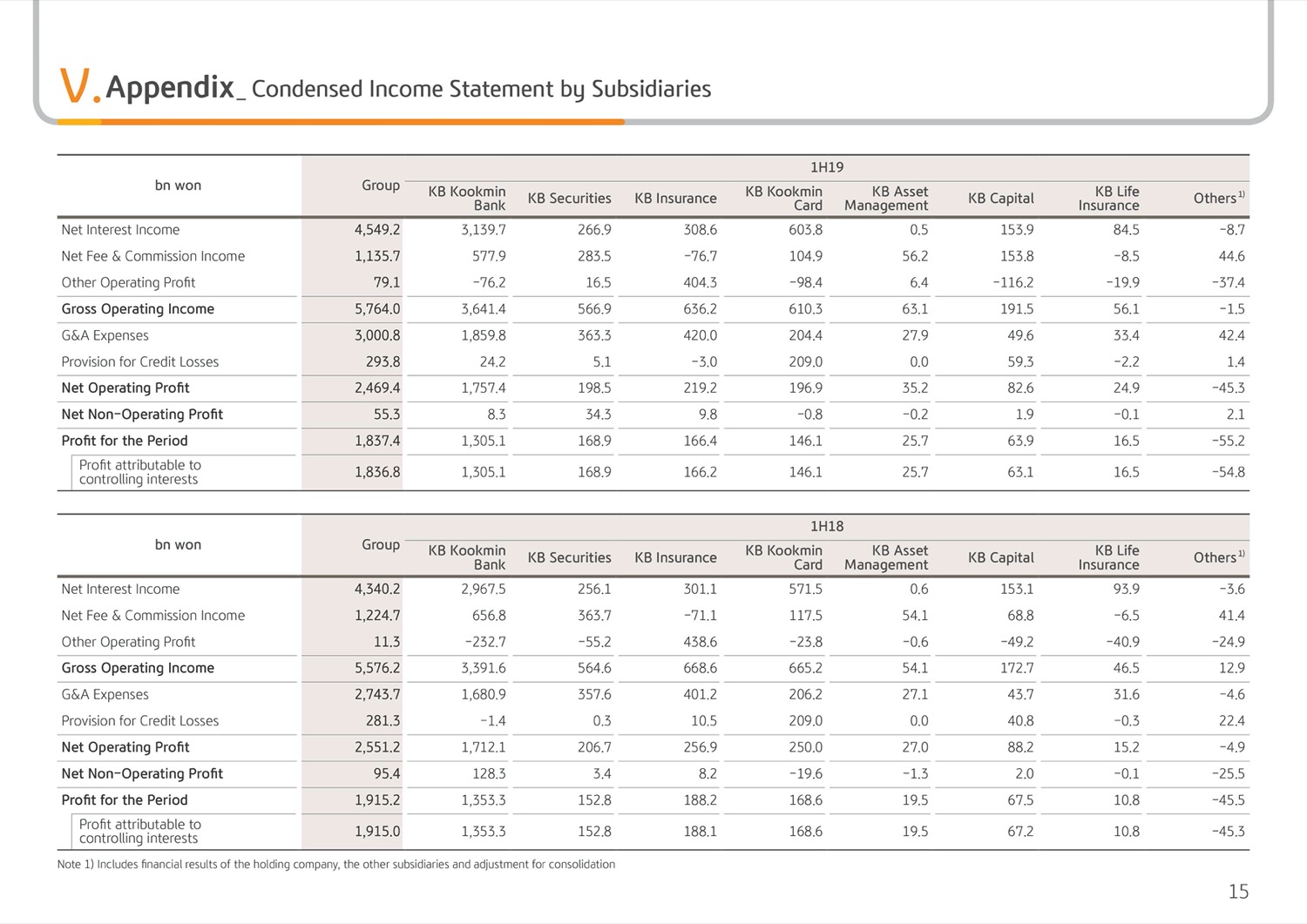

Taking a deeper look by each business. First half net interest income was KRW 4 trillion 549.2 billion, up 4.8% YoY. This is thanks to increase in average balance of loans and sustained growth in interest income contribution from nonbank subsidiaries, such as KB Card and Securities, and its somewhat slow loan growth from the bank.

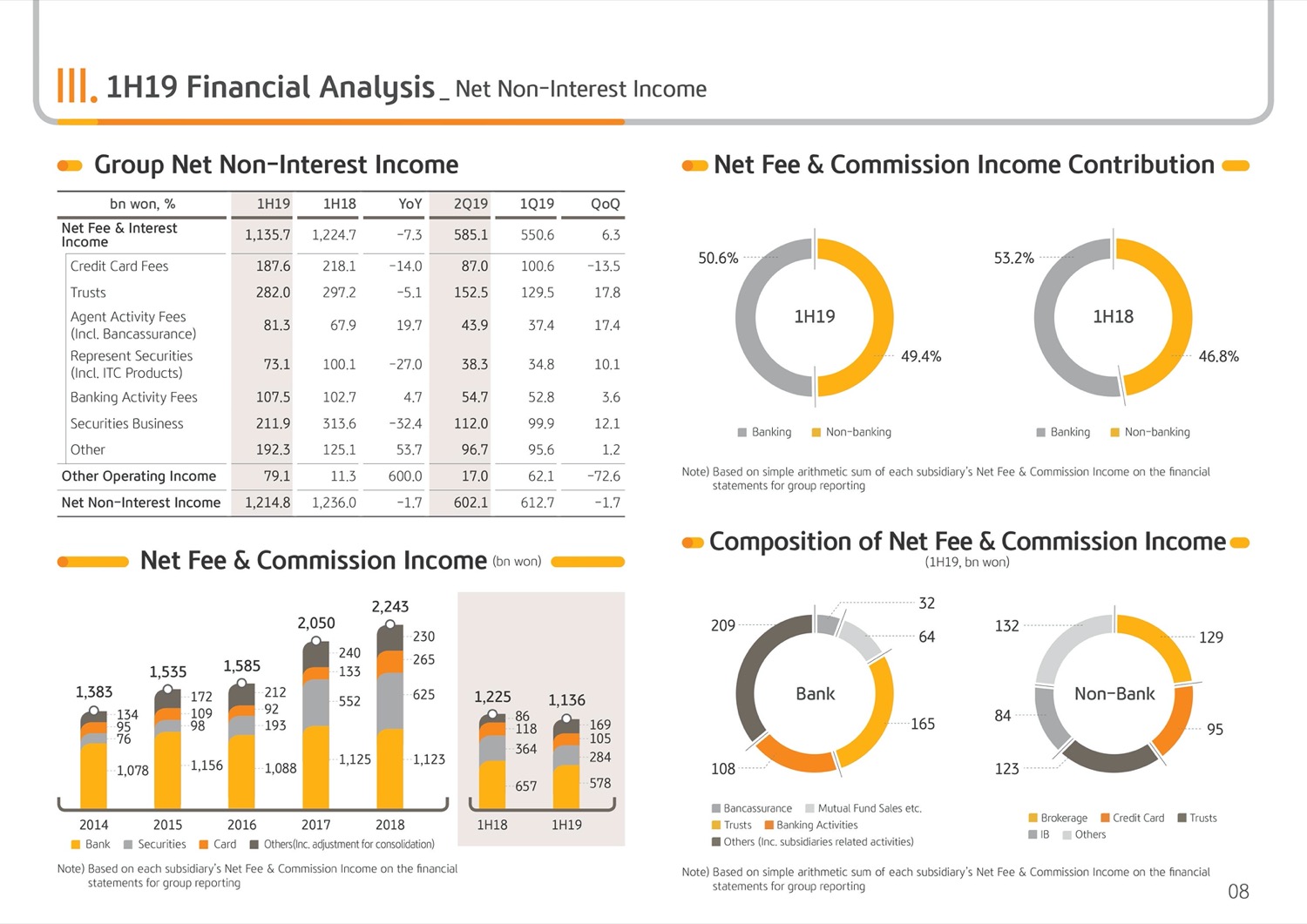

2Q net fee and commission income was KRW 585.1 billion, driven by stronger drive behind bank's fee business, i.e., trust and fund sales. In KB Securities IB fee improvement, there was a growth of 6.3% QoQ. First half net fee and commission income was KRW 1 trillion 135.7 billion, which is down YoY basis. But through company-wide efforts to strengthen sales activities and expand businesses, net fee and commission income is displaying a sustained growth trend this year.

First half other operating profit was KRW 79.1 billion, driven by rate declines which led to improved return from bonds and beneficiary certificates and other marketable securities. Performance was good YoY. But 2Q other operating profit dipped QoQ on overall sluggish equity market and index decline. However, driven by improvement in general and long-term insurance's loss ratio and higher investment yield from KB Insurance, underwriting income was up 11.9% QoQ, gradually improving from the poor performance of the fourth quarter.

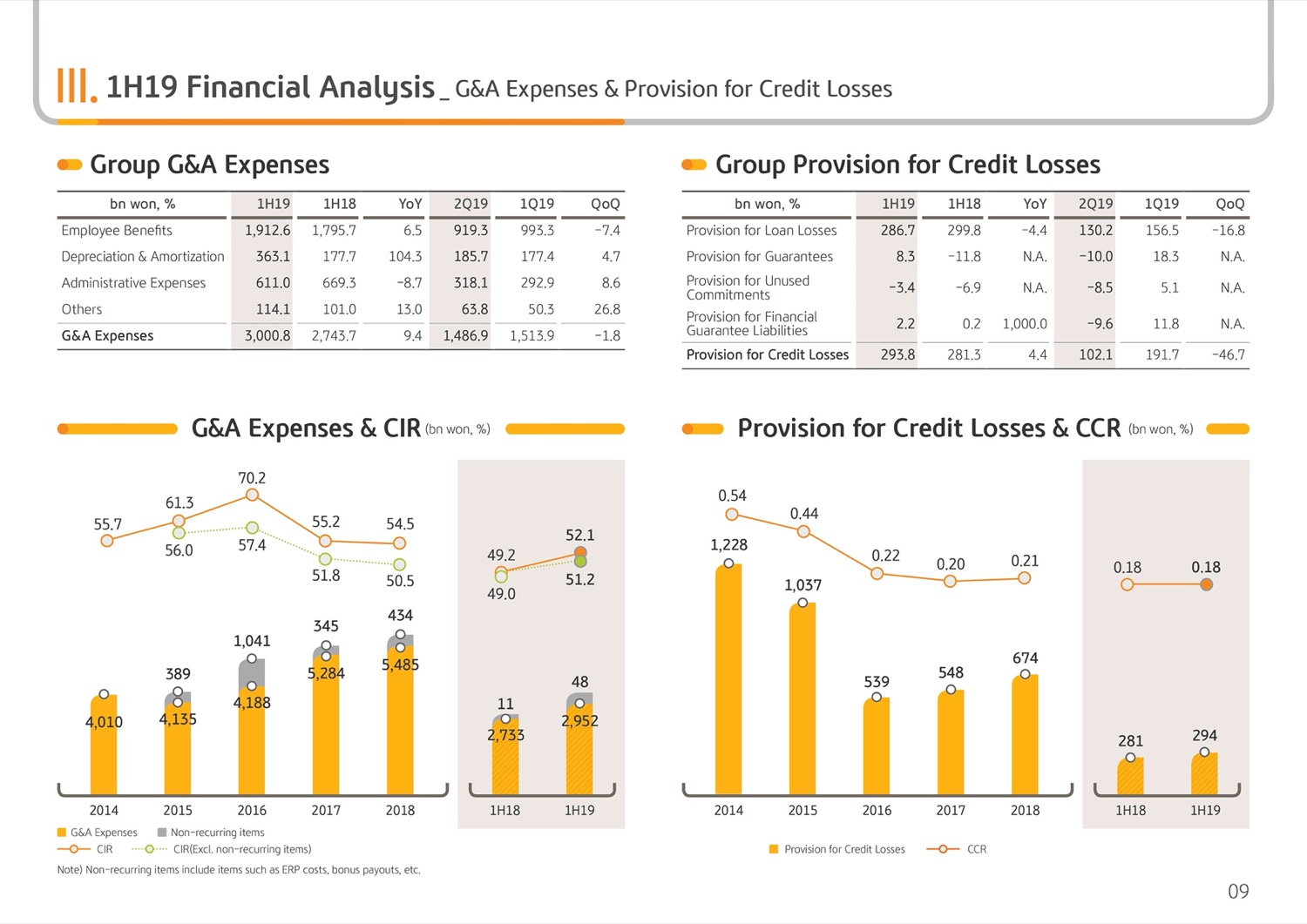

Next is on G&A expense. First half G&A expense was KRW 3 trillion 0.8 billion, up YoY on the impact from 1Q ERP expense. 2Q G&A was KRW 1 trillion 486.9 billion, down 1.8% QoQ. In light of the fact that large-sized nonrecurring items, such as employee benefit contributions and ERP expenses, in the 1Q were absent this quarter, 2Q expense may look elevated. So allow me to provide you with some background information.

First, KB Bank at the year-end booked bonus expenses according to the annual performance evaluation, all at once at 4Q. But starting this year, in order to enhance visibility of quarterly performance, we changed the policy to a portion and adjust projected year-end payout on a quarterly basis. Accordingly, we set the bank's payout amount at 100% of ordinary wage level, recognizing KRW 31 billion in 2Q, amount to which corresponds to the first half of the year.

Also in light of recent agreement reached and collective widening for 2018 reaches for KB Insurance, we booked additional year-end bonus of KRW 18 billion.

Next is PCL, Provision for Credit Loss. 2Q PCL was KRW 102.1 billion and Hanjin Heavy debt-to-equity swap and sale of Orient Shipping's pledged assets, which entail the write-back of KRW 81 billion pre-tax bases, PCL declined by 46.7% QoQ.

On a cumulative basis, group credit cost for the first half was 18 bps flat YoY. On a recurring basis, excluding the write-back impact, it was 23 bps, being well kept still at a quite sound level.

Lastly, first half nonoperating profit was KRW 55.3 billion, which is slightly less YoY. Since last year, there was KRW 115 billion impact of gains from sales of Myeongdong office.

Next is on key financial indicator.

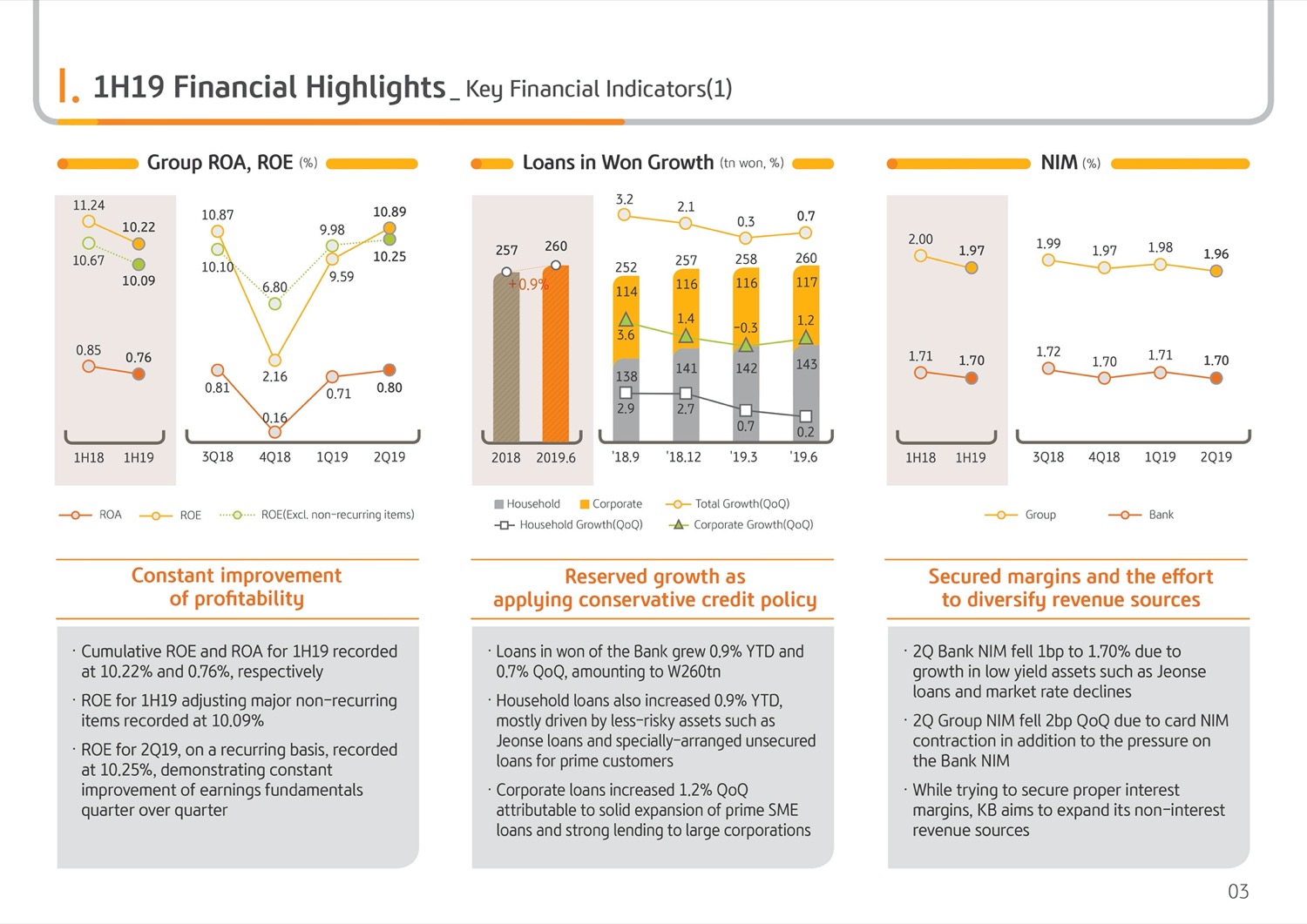

(3p) 1H19 Financial Highlights-Key Financial Indicators

The 2019 cumulative first half group ROA posted 0.76% and ROE posted 10.22%, respectively. In addition, 22 ROE recorded 10.89%, a sizable improvement QoQ, and the recurring level of ROE excluding one-off items posted 10.25%, showing a continuous quarterly earnings improvement.

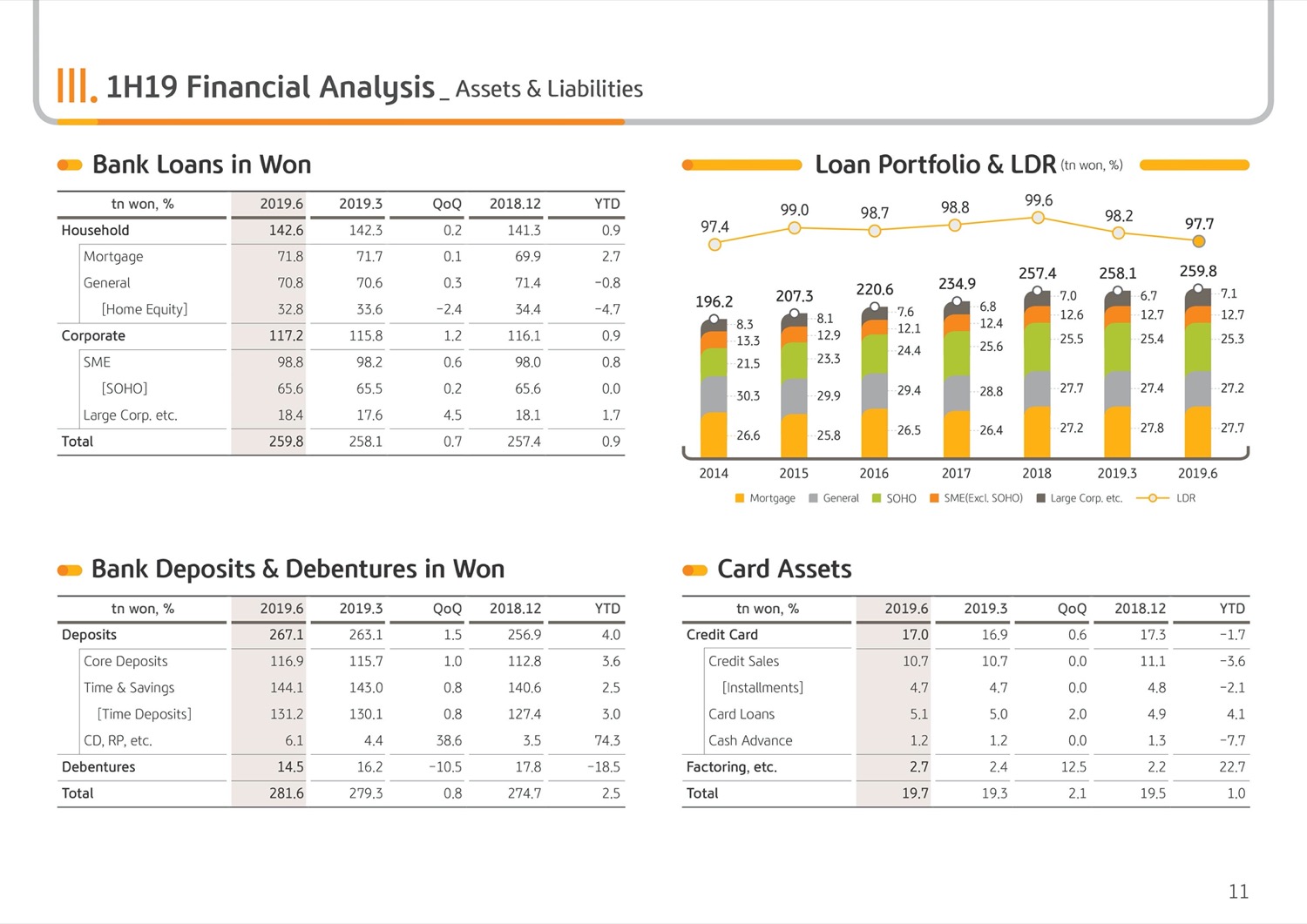

Next, I would like to elaborate on the bank's loans in won growth. If you look at the graph in the middle, you can see the bank's loans in won as of end June 2019, which posted KRW 260 trillion, a 0.9% increase YTD.

Looking at the different segments, the household loans grew 0.9% YTD, driven by prime safe assets, including Cheonse and monthly lease loans, as well as Police Officer and Public Servant loans. In the case of corporate loans on the back of steady increase of prime SME loans and large corporate loan growth recovery, corporate loans grew 1.2% QoQ. In order to preemptively respond to the economic downturn cycle and to focus on prime borrower-driven, quality-based growth, we are continuing to rebalance for potential NPLs and maintain a conservative loan policy. However, recognizing the fact that the earnings base growth is partly needed from a mid- to long-term perspective, in the second half, we plan to expand loan growth through a more flexible loan policy.

Next is the NIM, Net Interest Margin. 2Q Bank NIM posted 1.70%, a 1 bp QoQ drop. This was mostly driven by the growth of prime safe asset-based growth, including Jeonsae and monthly lease loans and benchmark interest rate declined, despite the alleviation of the funding burden following the time deposits and bank-issued bond rate decline.

On the other hand, the 2Q group NIM posted 1.96%, following the credit card loan interest rate decline, leading to card NIM contraction, resulting in the group NIM dropping 2 bps QoQ. Taking into account the overall market competition environment and the interest rate trend, it seems that this year's NIM expansion will not be easy. But based on our biggest strength of superior sales capability, we will focus on expanding low-cost deposits and try our utmost to safeguard the NIM.

(4p) 1H19 Financial Highlights-Key Financial Indicators

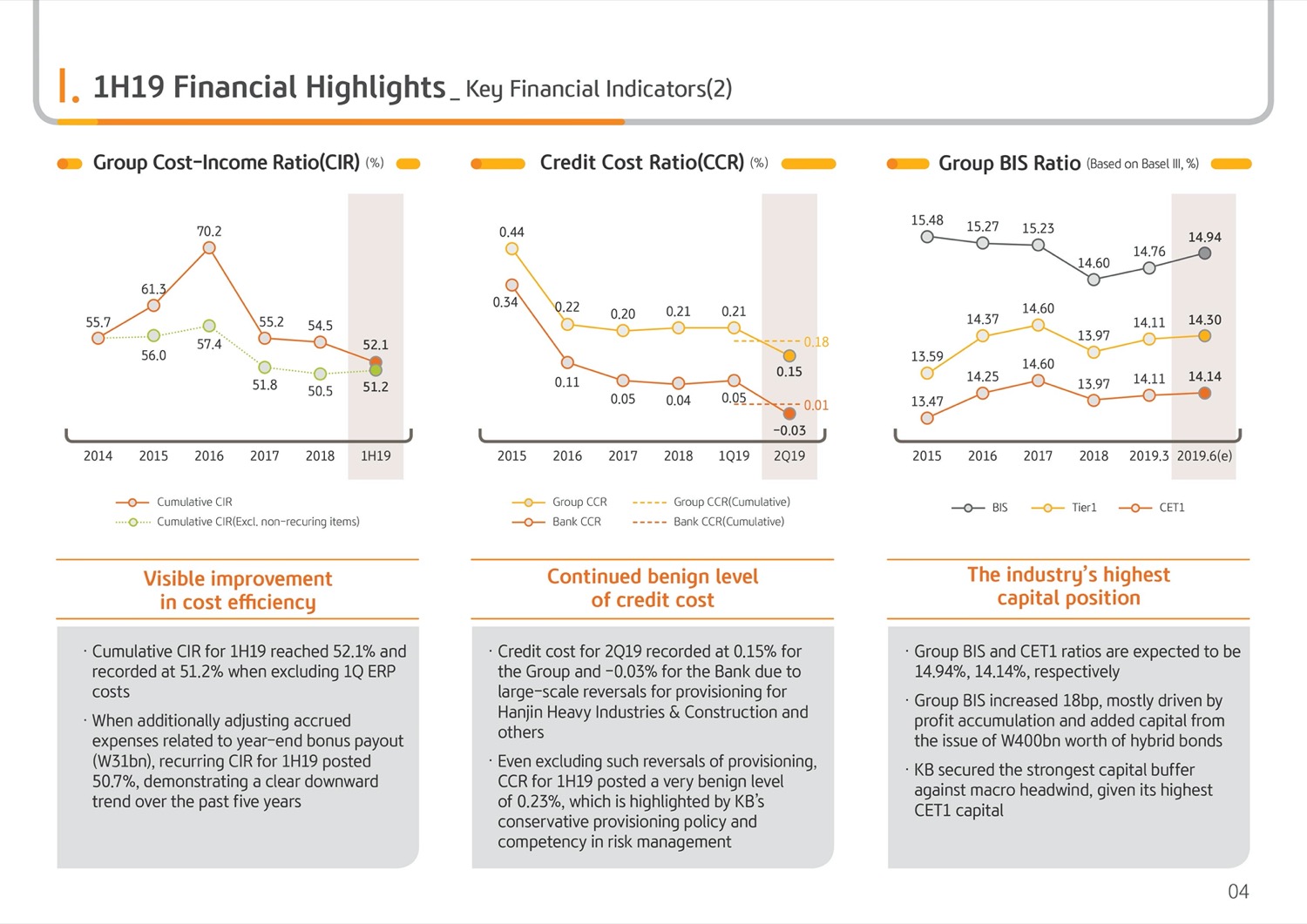

Next is the group's cost-income ratio. 2019 first half cumulative group CIR posted 52.1%, and on a recurring basis, excluding ERP costs, posted 51.2%. Taking into consideration the KRW 31 billion sized bank expense adjustment effect mentioned previously, CIR maintained a 50.7% level, showing that for the past 5 years, the downward stabilization trend of recurring CIR level is continuing.

We forecast that with continued robust topline growth and realization of the group-wide cost-cutting efforts, the group's cost efficiency can additionally improve.

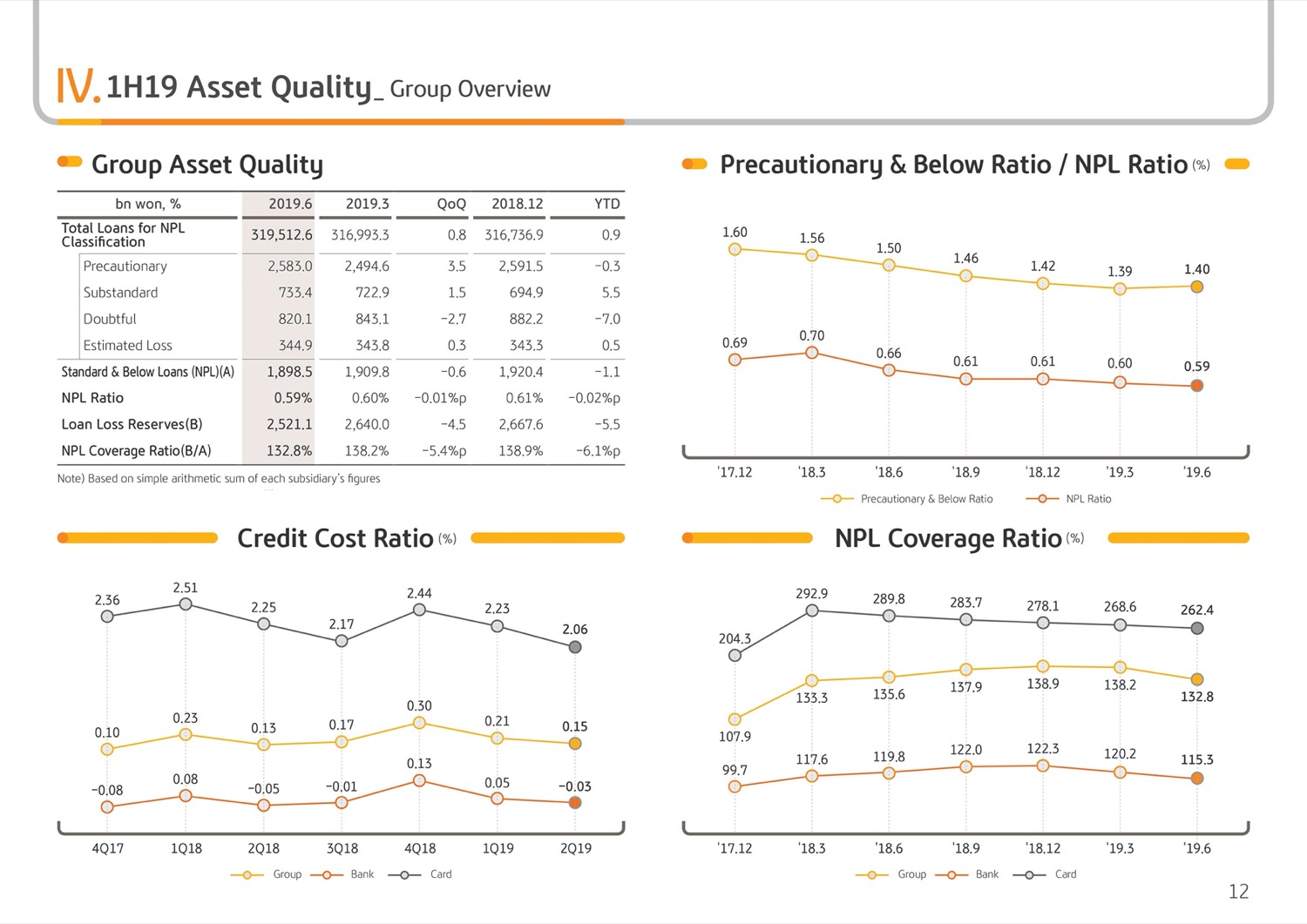

Next, I would like to remark on the credit cost ratio. 2Q19 group and bank credit cost each posted 0.15% and - 0.03%, respectively, and is being maintained at a 0.18% and 0.01% level in the first half on a cumulative basis, respectively, and is being maintained and managed at a sub-normal level. In particular, even when the write-backs of large-scale provisioning is excluded from this quarter, the group's first half credit cost posted a 23 bps level, proving KB's differentiated risk management capability.

Next, I would like to elaborate on the group's capital adequacy ratio. In the graph on the right, as of end June 2019, the group's BIS ratio and CET1 ratio, each recorded 14.94% and 14.14%, respectively, and went up 18 bps and 3 bps QoQ, respectively, on the back of robust net profit and hybrid bond issuance and is still maintaining the highest level of capital adequacy in the financial industry.

Let's go to the next page.

(6p) 1H19 Financial Highlights-KB Insurance Value-driven Management

From Page 6, I would like to elaborate on KB Insurance's value-driven management philosophy. Currently, in the nonlife insurance industry, following last year, with the GA channel-based new business competition continuing, concerns about increasing sales expenses and relaxation of underwriting standards is increasing. And going forward, there are voices, warning of mid- to long-term profit deterioration and increased risk.

Early this year, there was a stronger forecast that the insurance industry performance would enter into a improvement cycle, driven by insurance premium, rationalization, centering on auto insurance. However, with the continuing of the overheated market in the first half, now we have to be concerned about not only net performance, but also about the possibility of future value deterioration. Against this backdrop, we want to share with you KB Insurance's management principle at this earnings' release and share the future strategic direction with you to date.

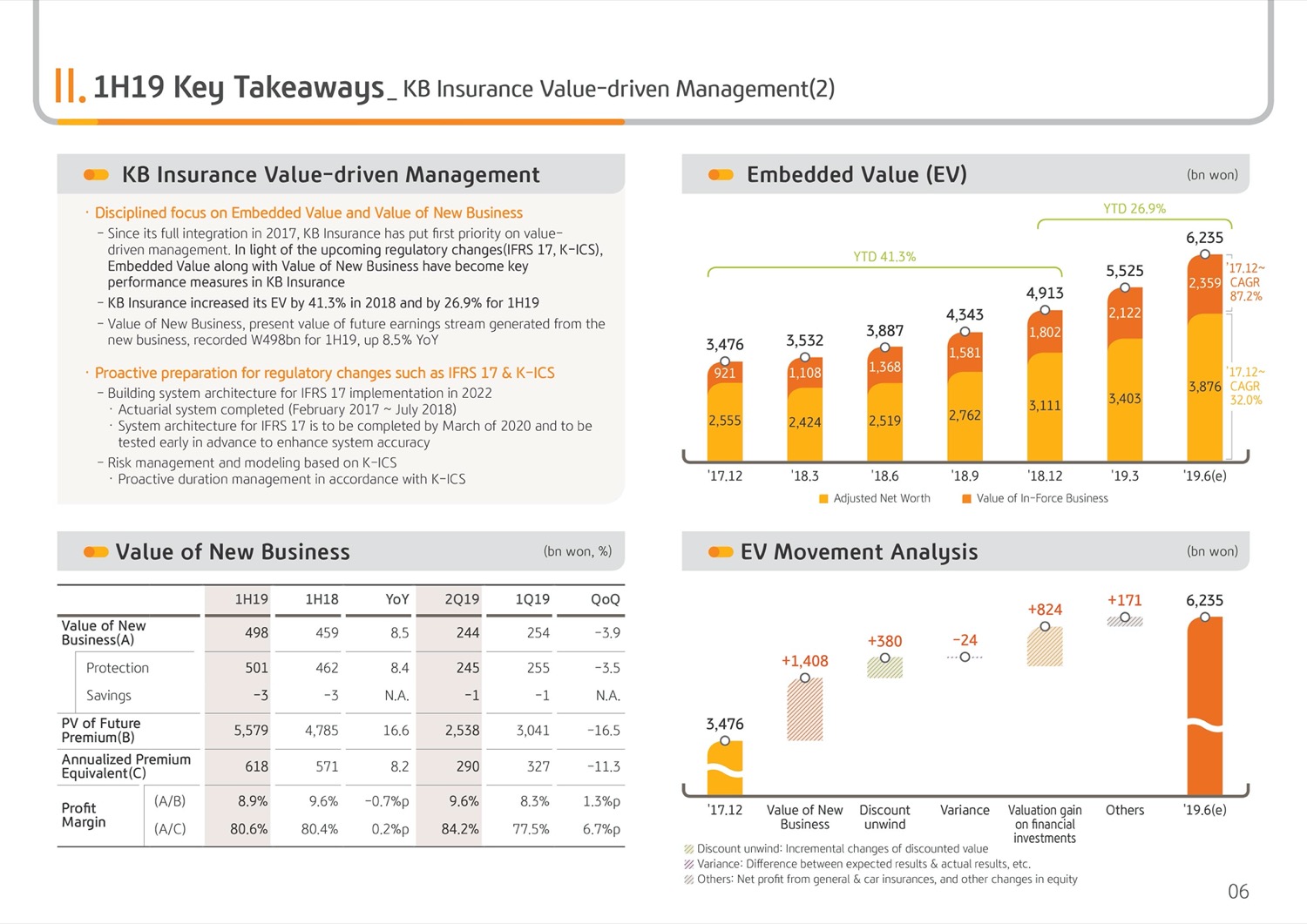

KB Insurance, after becoming fully integrated as a wholly owned subsidiary of KB Financial Group in 2017, has been continuing value-driven management, enhancing future value-based on mid- to long-term soundness and stability, rather than on short-term results and external growth. We believe that because of the insurance business' characteristics and because of the limitations posed by the current accounting standard, we find that our current performance does not always guarantee future value. And that there is a limit to the future value being completely reflected in our current performance.

Accordingly, rather than managing short-term performance indicators, such as net income and net insurance sales, we believe that indicators measuring insurance policies, qualitative growth and future value, such as embedded value and new business value, should be enhanced, and this should be the core management philosophy of KB Insurance.

As you can see on the right-hand graph on Page 6, KB Insurance's embedded value, or EV, has reached KRW 6.2 trillion as of late June 2019 and has grown 41.3% yearly from 2018. And it has grown 26.9% YTD in the first half of this year and is maintaining a robust growth rate. The adjusted net worth amount KRW 6.2 trillion of embedded value posted KRW 3.9 trillion and is steadily increasing from KRW 2.6 trillion as of late 2017. The value of in-force business, the stream of future earnings achieved KRW 2.3 trillion. And when compared to end 2017, when KV Insurance became integrated as a wholly owned subsidiary, a compound annual growth rate, or CAGR, posted a 87.2% growth rate.

The graph on the bottom left refers to the value of new business, which is the present value of future earnings stream after capital expenses have been taken out. The value of new business generated in the first half of this year recorded KRW 498 billion, a 8.5% increase YoY. And even in a fiercely competitive market, there has been appropriate management and quality with 2Q new business margin rates slightly increased in QoQ.

On the other hand, KB Insurance has been working diligently, preemptively, to prepare for the new regulatory environment changes, including the adoption of IFRS 17 and K-ICS. To prepare for the implementation of IFRS 17 in 2022, we will complete the relevant system by the first half of next year and enhance system stability through sufficient pilot operations. At the same time, we are strengthening the comprehensive duration management to prepare for the adoption of K-ICS, and engaging in risk management to cut down on risky assets.

As mentioned previously, with concerns of earnings deterioration growing, the nonlife insurance industry is in a very difficult situation overall, with average duration widening in an unfavorable interest rate environment. However, even in these times, KB Insurance will not be swayed by external competition and endeavor to steadily build future value through growth based on quality.

The following pages are details about the earnings results previously mentioned, and please refer to them as needed. With this, we will conclude KB Financial Group 2019 first half earnings release presentation.

Thank you for listening.