-

3Q19 Business Results

Greetings and Summary

Greetings. I am Peter Kwon, the Head of IR at KBFG. Let's begin the 3Q19 business results presentation. My appreciation goes to all the participants in today's meeting. We have here with us Ki-Hwan Kim, CFO and Deputy President of KBFG as well as other executives from the group.

We will first hear from our CFO and Deputy President Ki-Hwan Kim regarding our 3Q19 business results and then have a Q&A session. I will invite our CFO and Deputy President to cover our 3Q19 business results.

Good afternoon. I am Ki-Hwan Kim, CFO of KB Financial Group. Thank you for joining KBFG's 3Q19 business result presentation. Before moving on to our earnings, let me briefly present on the operational backdrop.

In 3Q, on the back of continued U.S.-China trade conflict, global trade contracted with Korean economy experienced a slowdown in trade and lower current account and deteriorating domestic demand with issues identified as concerns starting to rise up to the surface. And on top of it all, there was a trade restriction from Japan further growing concerns over economic depression.

In light of this backdrop, BOK moved to cut rates last July, again making another cut in October, leading to lowest ever policy rate at 1.25%. As the operational environment is unfavorable to the financial businesses, concerns over bank's profitability are growing. But KBFG was able to defend margin contraction as much as possible through its margin-focused operations. And with quality-based growth around prime and safe assets, we maintained our earnings resilience supported by careful management of asset quality.

However, for the time being, in a downward rate cycle, bank's NIM contraction is inevitable. We will, therefore, bring reasonable level of loan growth around prime SME loans to solidify interest income basis and also focus on growing nonbank profitability. To that end, we will further strengthen collaborations between securities and banking to expand the performance outcome from WM and CIB.

For the group's capital markets, through integrated group level management, we are currently employing strategies to enhance efficiency and synergies.

Also as domestic financial market has limited boundaries, overseas expansion is imperative. Hence we will speed up overseas expansion mainly to Southeast Asia as those are markets with high growth potential and good fit for our competitive edge.

Since it is quite difficult to expand revenue including interest, fee and commission income, we will endeavor to accelerate cost efficiency through corporate wide digital transformation in order to protect the group's earnings fundamentals.

Lastly, KBFG has been steadfast in implementing strategies to secure new growth engine for KBFG. For example, KB Bank has applied for financial regulatory sandbox and was designated as innovative financial services receiving MVNO, mobile virtual network operator, license from FSC last April. MVNOs can lease the network from a telecom company to offer telecom services at a reasonable price point. In November, KB Bank will launch Liiv M Service, which brings convergence between telecom and financial services.

Through industry first digital innovation Liiv M, will be offering new experience in financial convenience and will help broaden service touch points with its 34 million banking customers.

Also from mid-to-long term, we will organically connect financial products and services from other subsidiaries to further up competitiveness of our core financial business through telecom as a medium. And by using data generated from this convergence between telecom and finance, we would be able to create new added value and secure additional growth engine.

All in all, despite it being an uncertain period for KBFG, we will be steadfast in strengthening our fundamentals and will continue our efforts to gain competitiveness and growth engine for the future.

Now with that, I will move on to 3Q19 business results.

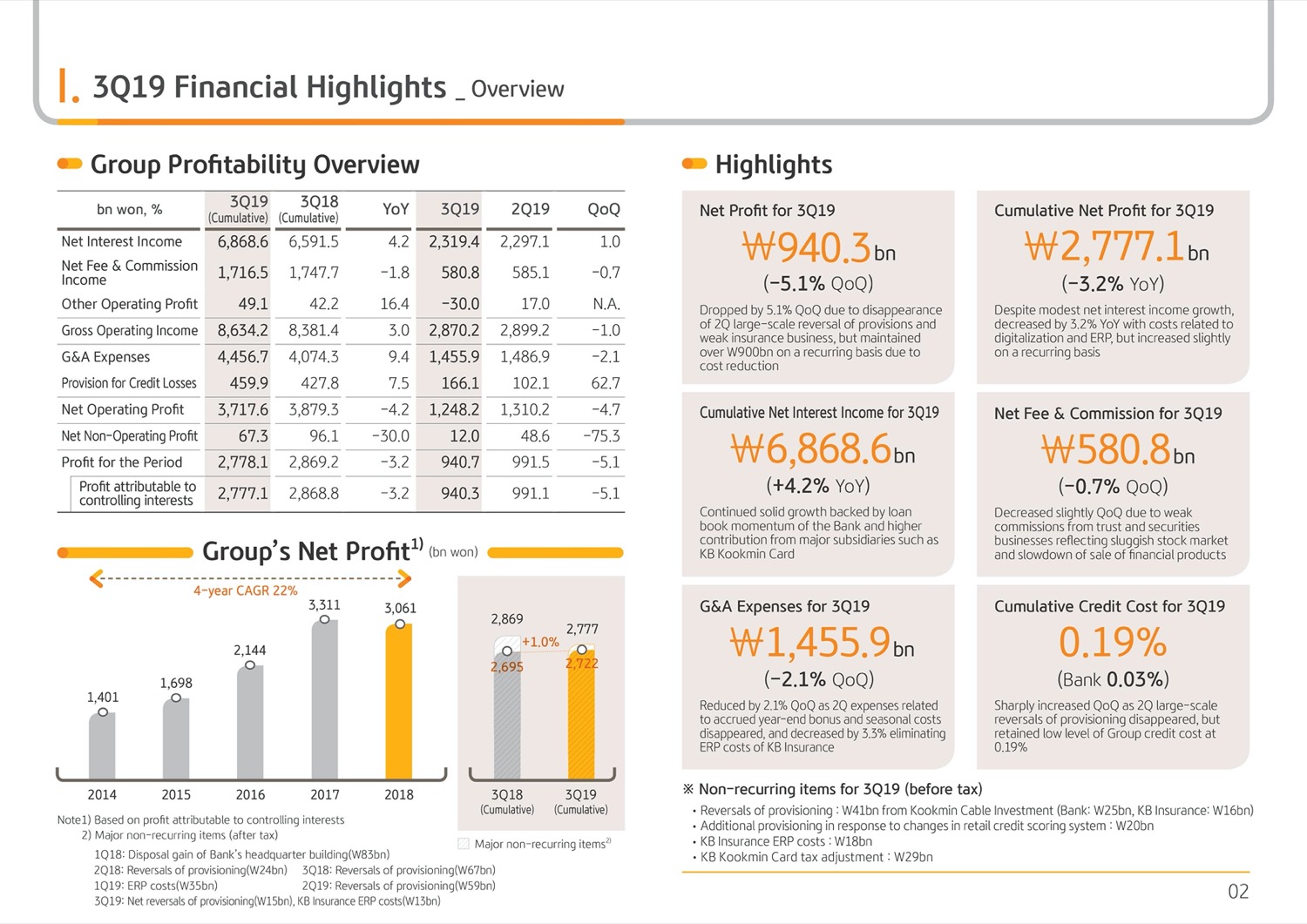

(2p) 3Q19 Financial Highlights-Overview

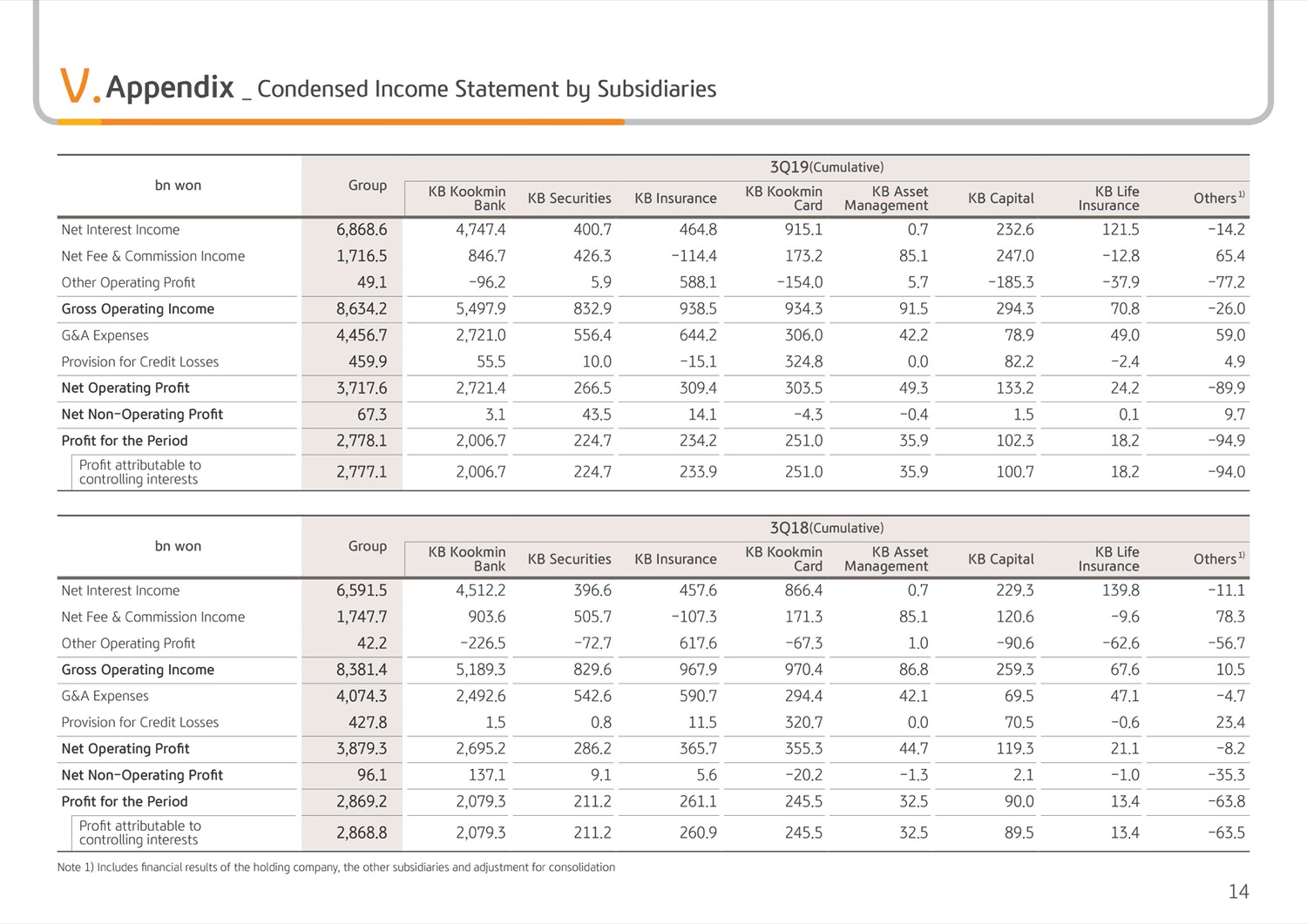

KBFG's 3Q19 cumulative net profit was KRW 2,777.1 billion. On a YoY basis, it is 3.2% decline. If you take out one-offs including last year's gain from sale of bank's headquarter building and write-back of provisions, on a running basis there was a marginal increase YoY.

Despite robust interest income growth and stable asset quality management, performance improvement was somewhat limited due to slightly higher expenses on the back of group's digitalization and ERP expenses from the bank and the insurance.

3Q alone net profit was KRW 940.3 billion. On lower one-off profit from provision write-back and weak insurance performance, net profit fell on a QoQ basis. But KRW 900 billion of net profit on a recurring level is currently being maintained.

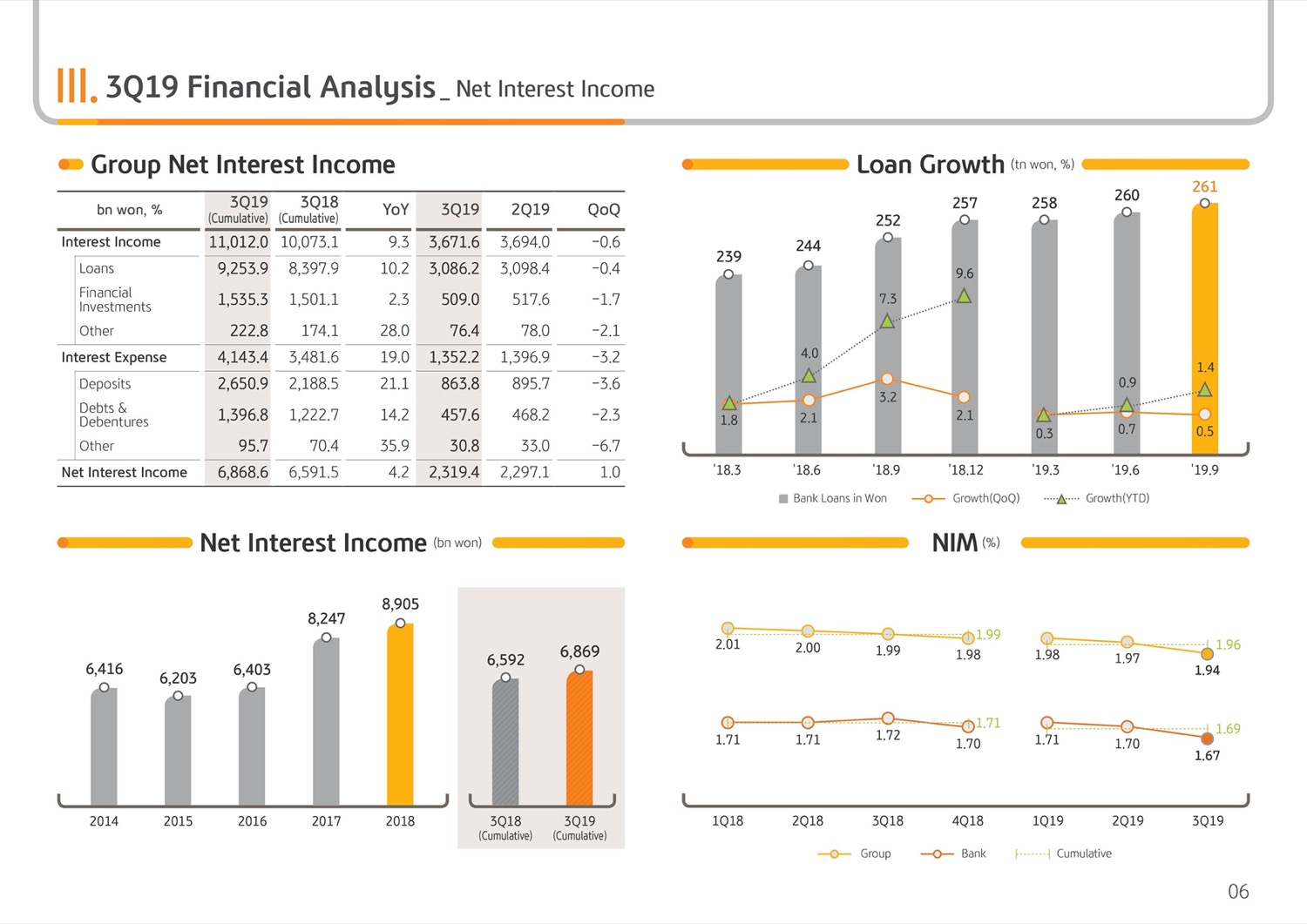

Moving on, I will delve into more details. Net interest income on 3Q cumulative basis was KRW 6,868.6 billion, driven by average loan balance increase of the bank, interest income increased leading to 4.2% NII growth YoY. Net interest income for 3Q alone was KRW 2,319.4 billion. On higher financial and installment asset of KB Card, there was a marginal increase QoQ.

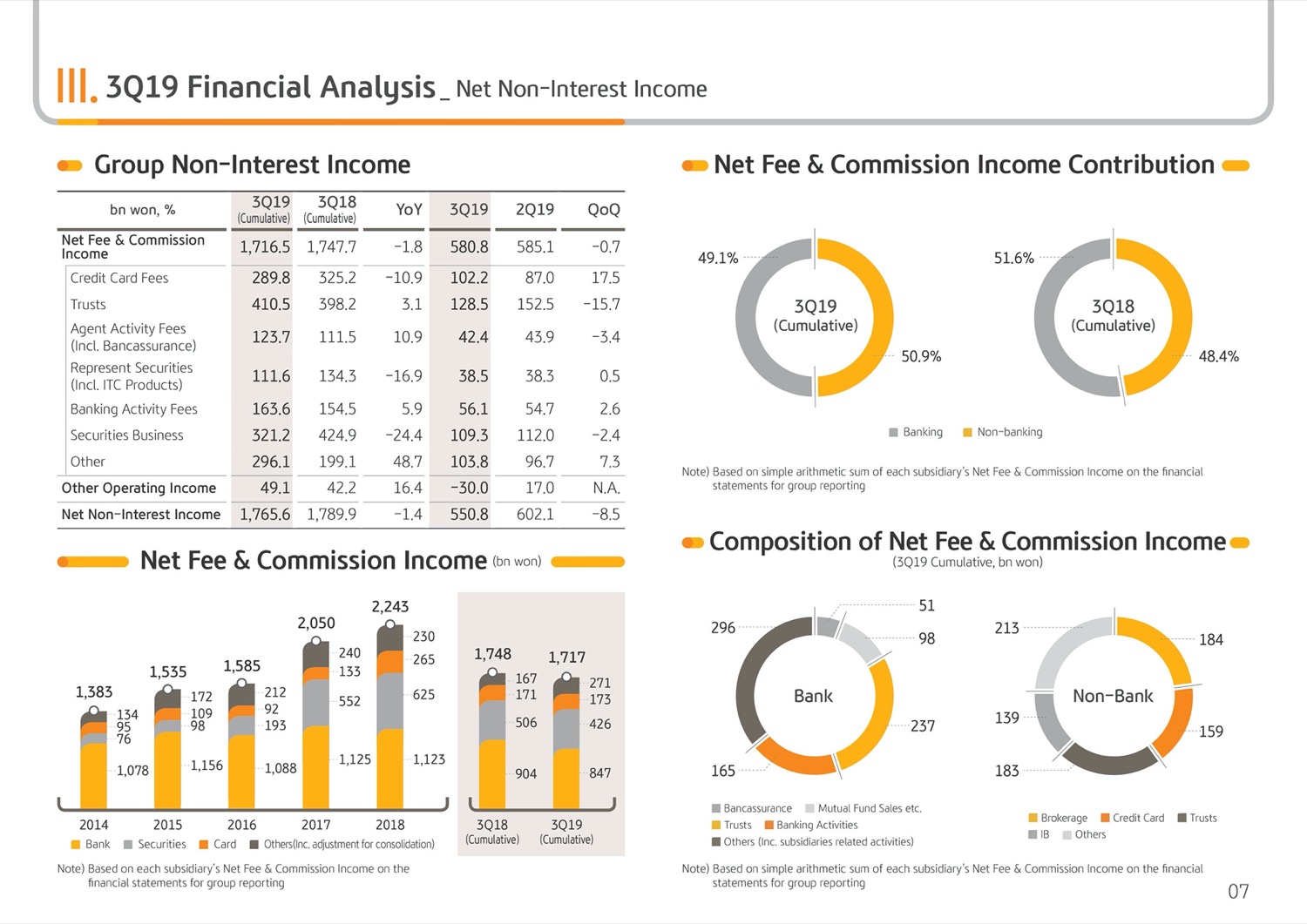

3Q cumulative net fees and commission income was KRW 1,716.5 billion. As last year, there was large increase in securities custody fees on the back of bullish market, YoY there was a decline of 1.8%. But 3Q net fees and commission income, despite sluggish stock market performance and lower financial product sales which lead to softer trust income and securities custody fees on higher credit card receivable volume, which increased fee income from cards, QoQ figure was flat.

3Q other operating loss was KRW 30 billion displaying sluggishness QoQ driven by auto insurance loss ratio of over 90% and overall increase in insurance product claims which lead to poor insurance performance. Also greater market volatility led to higher losses from equity, ETF and other securities.

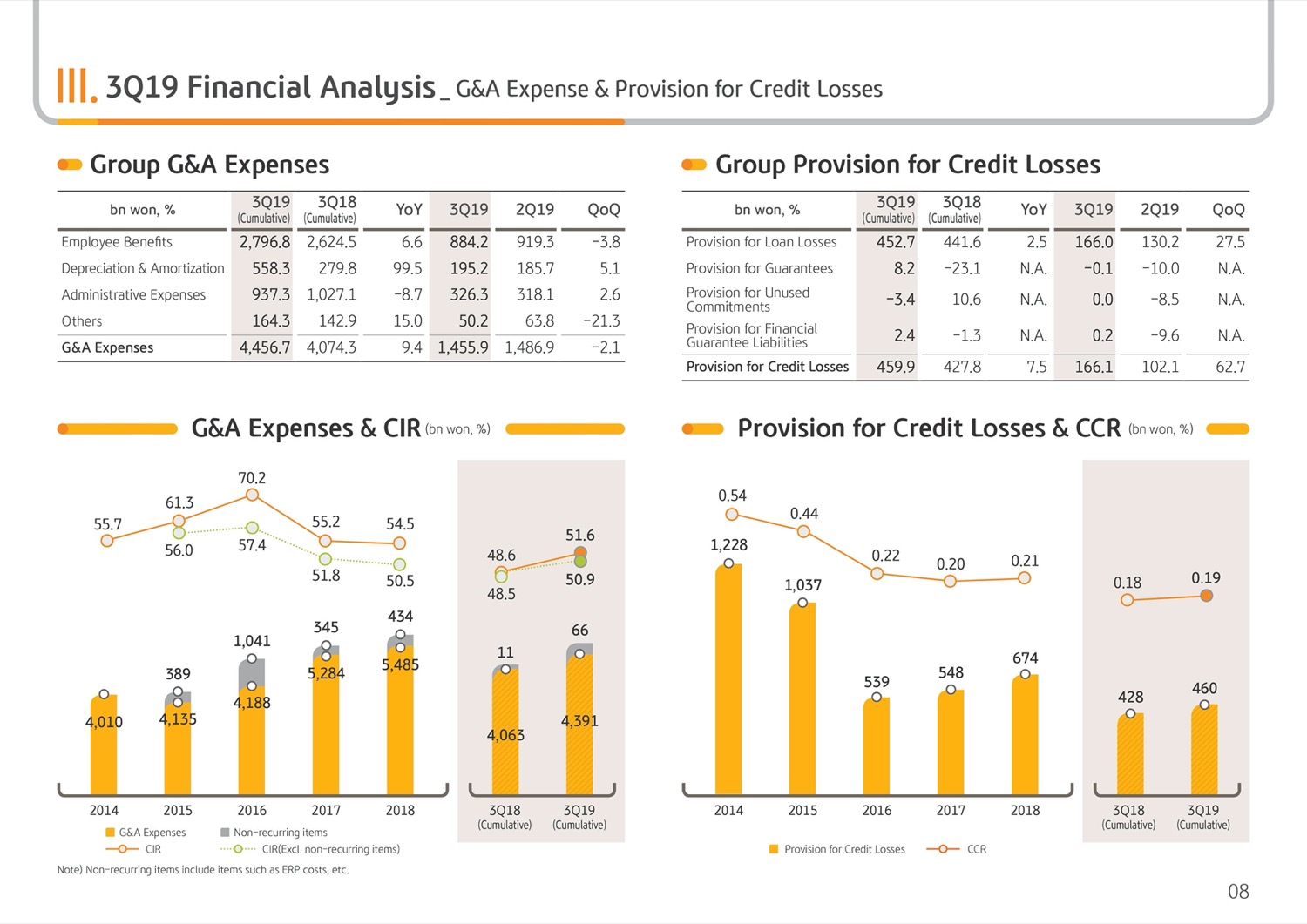

Next is on G&A expense. 3Q cumulative G&A expense was KRW 4,456.7 billion, moderately up YoY. This is due to digitalization related to depreciation cost from the adoption of next generation system this year and ERP expense from the bank and the insurance as well as the accrued expense adjustments made on the yearend bonus payout which all lead to a sizeable increase. Once these factors are taken out, there was YoY increase of around 3.7%. 3Q G&A expense was KRW 1,455.9 billion, down QoQ by 2.1%. After excluding ERP expense from KB Insurance, this quarter's figure was down 3.3%.

3Q PCL was KRW 166.1 billion. Because in Q2 there was reversal of around KRW 81 billion from Hanjin Heavy Industries and others, it seems like a large increase on a QoQ basis. But it is once again still kept at a subnormal level.

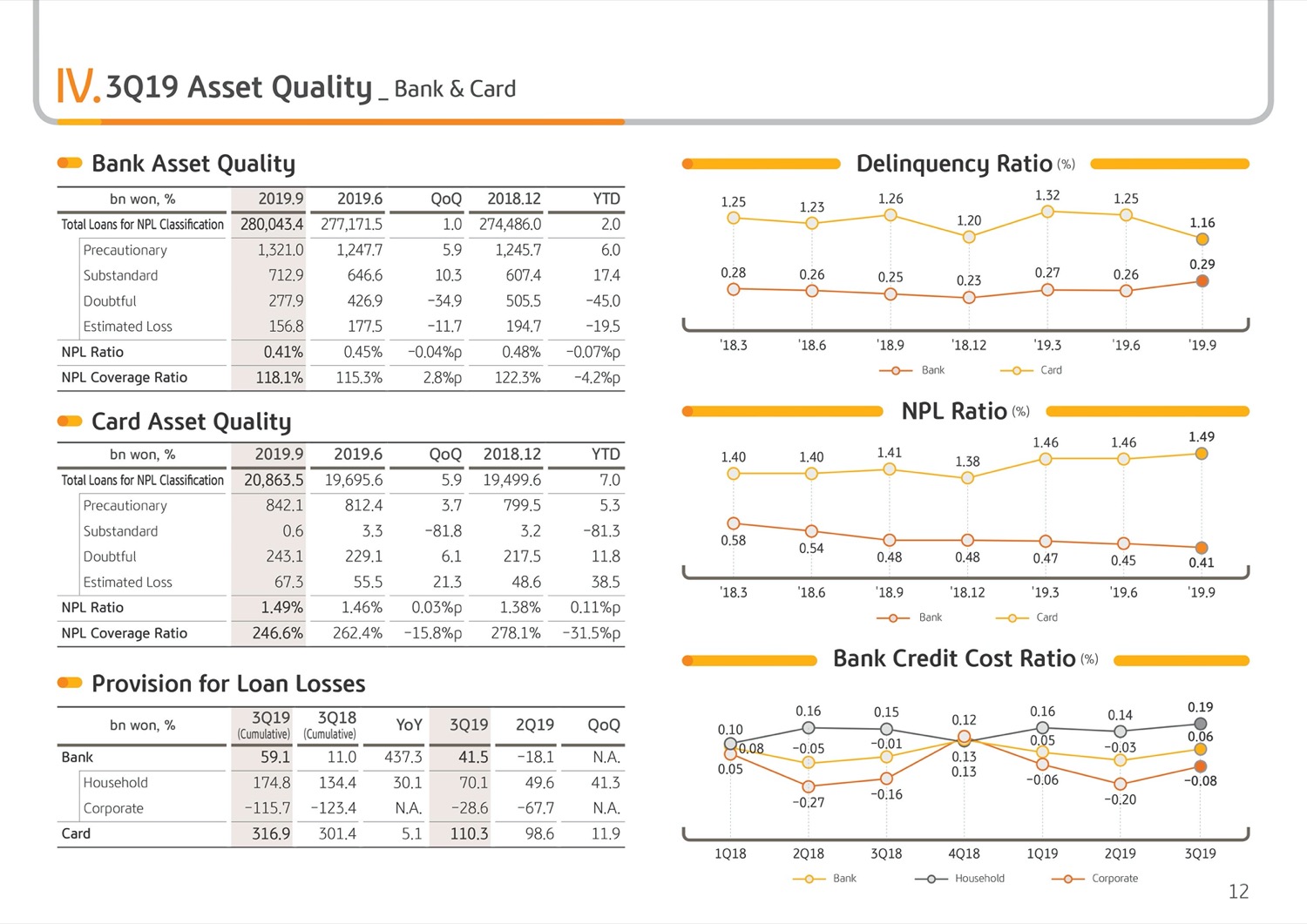

On a 3Q cumulative basis, group's credit cost reported 0.19%, being managed at a benign level underpinned by quality improvement in our loan portfolio and proactive risk management.

Next is on key financial indicators.

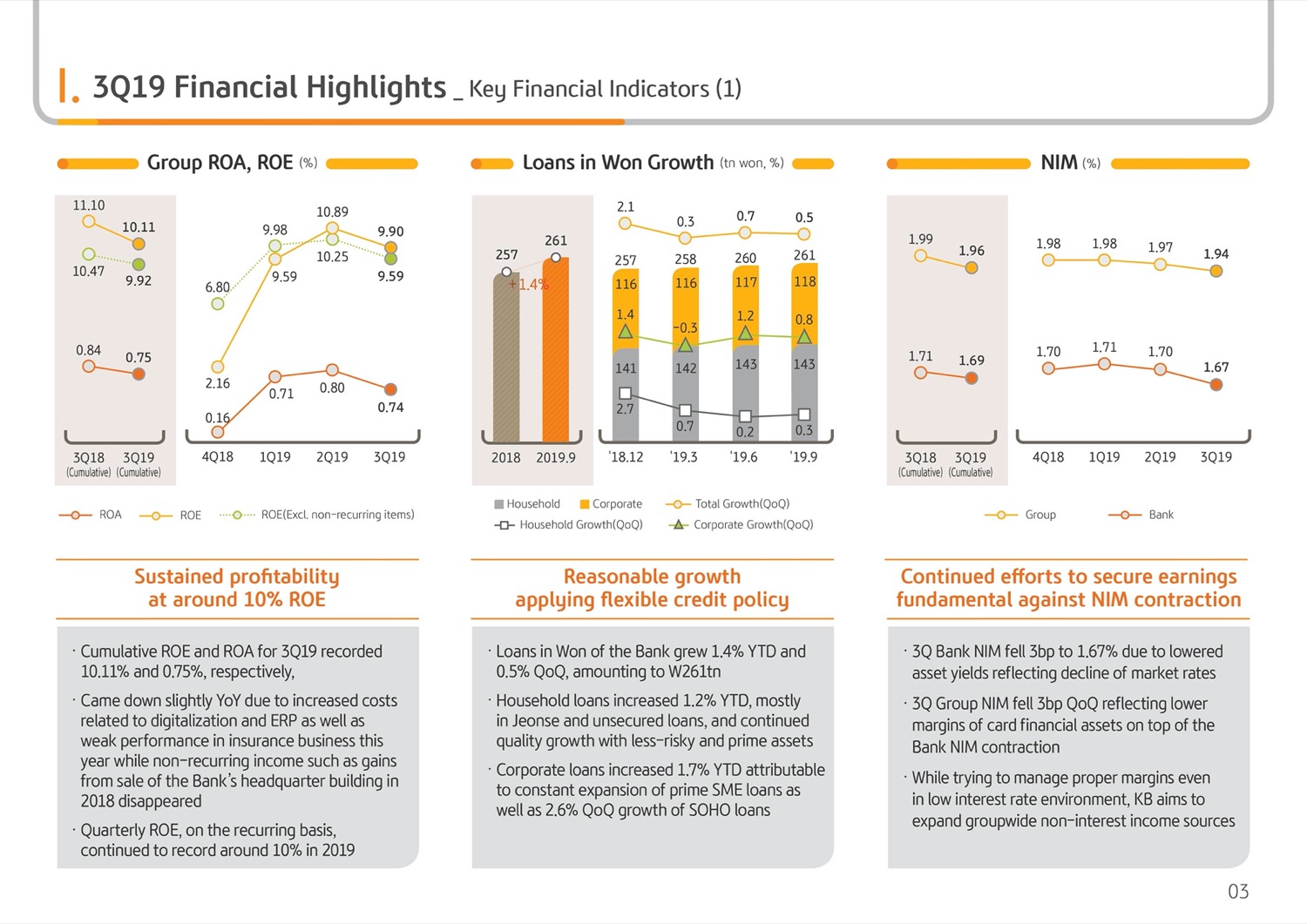

(3p) 3Q19 Financial Highlights-Key Financial Indicators

3Q19 cumulative group ROA and ROE recorded 0.75% and 10.11% respectively. As aforementioned, with nonrecurring income such as last year's gains from sale of the bank's HQ building disappearing, the increased costs related to groups digitalization and ERP, and with the decrease in insurance income, the ROE has slightly decreased YoY, but still is maintaining a 10% level on a recurring quarterly basis.

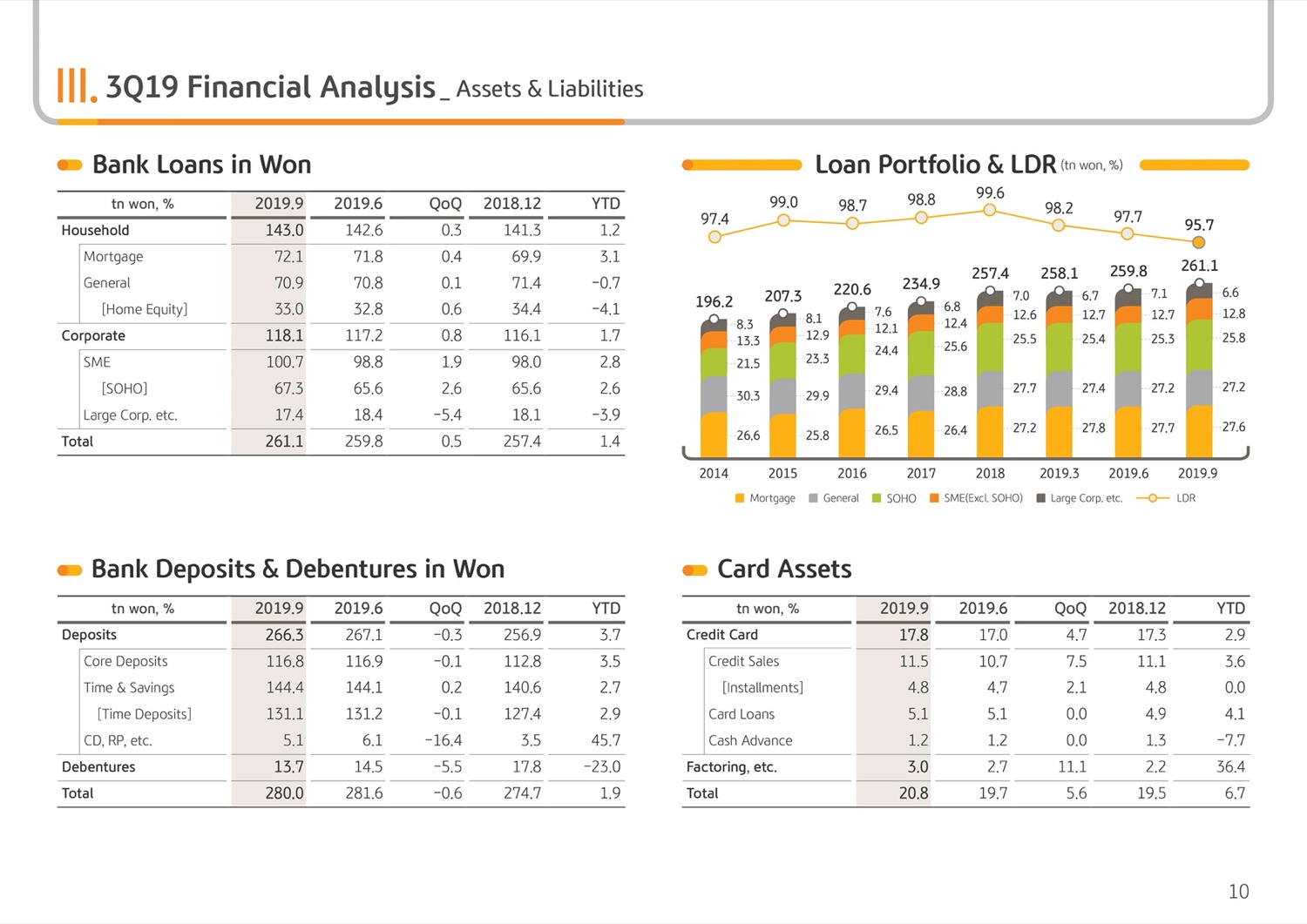

Next is the growth of bank's loans in Won. Looking at the graph in the middle, bank's loans in Won as of end September posted KRW 261 trillion, a 1.4% YTD and 0.5% QoQ increase respectively.

In detail for household loans centering on Jeonse and unsecured loans, it increased 1.2% YTD and 0.3% QoQ respectively. And corporate loans centering on SOHO loans and prime SME loans grew 1.7% YTD and 0.8% QoQ respectively.

Due to our asset quality and profitability based loan policy and market's overheated competition, bank's loans in Won is showing slightly low growth potential. However, from 3Q with a more flexible application of our loan policy and with the market competition easing, centering on SOHO loans, loan growth has been gradually recovering in August and September. Accordingly we believe 2% to 3% level of growth is possible for this year.

Let me now elaborate on the net interest margin. 3Q bank NIM, despite the time deposit and lightened burden of bond issuance with the lowered asset yield following the steep market interest rate cuts, the NIM posted 1.67%, a 3bp drop QoQ.

In addition, group NIM in 3Q posted 1.94% and with the card margin contraction effect caused by factors including the card loan interest rate cut, recorded a 3bp decline QoQ. Taking into account the effect of the BOK rate cut in October and the loan conversion program effect, additional margin decline seems inevitable. However KBFG through more sophisticated loan pricing and growth of low cost deposits will guard against NIM contraction as much as possible and at the same time focus on noninterest income, including fee & commission income.

(4p) 3Q19 Financial Highlights-Key Financial Indicators

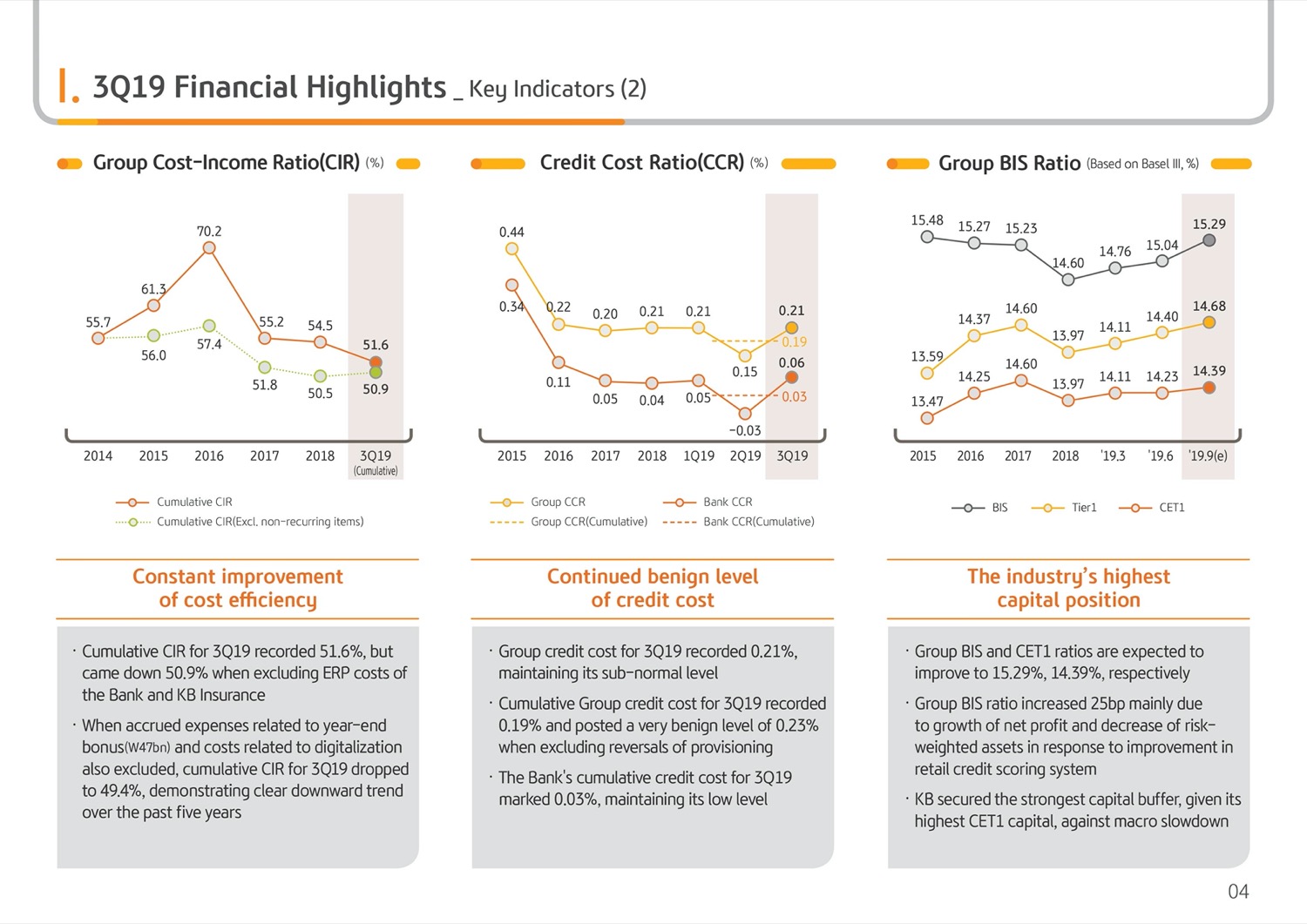

Next is the group's cost income ratio. 3Q19 cumulative group's CIR posted 51.6% and the recurring CIR excluding ERP cost of the bank and the insurance posted 50.9%. For your reference, excluding the cost of adjustment factors including this year's group digitalization costs and the bank's bonus payout, the recurring level of CIR stood at a 49.4% level and with the realization of the ongoing ERP effect so far, the recurring level of CIR for the past 5 years has been showing clear market downward stabilization trend.

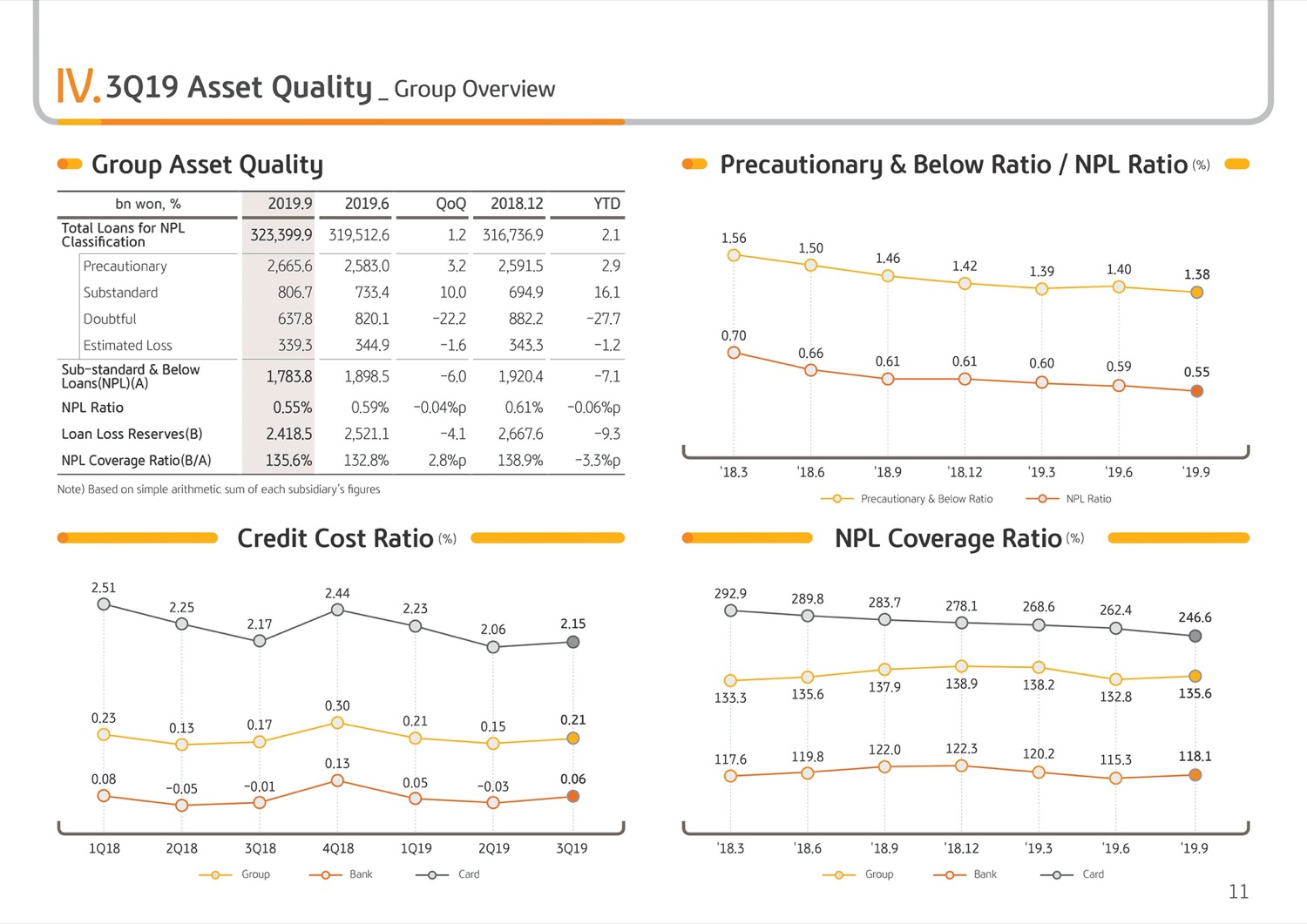

Next I would like to cover the credit cost. The group's 3Q cumulative group and bank's credit cost each posted 0.19% and 0.03% respectively. Excluding KRW 41 billion of credit cost reversal following this quarter's KCI conversion of investment, the group's cumulative credit cost is still being maintained at a low level of 0.23%.

Next I would like to cover the group's capital adequacy ratio. The group's BIS ratio as of September 2019 posted 15.29% and the CET1 ratio posted 14.39%. And according to the impact from the decline of the risk-weighted asset according to the retail of credit scoring model change, it went up by 25bp and 16bp respectively compared to end June. Although it is a period when concerns about economic slowdown are rising, KBFG is maintaining the highest level of capital adequacy and we have sufficient buffer to prepare for future risks, including in cases of economic downturn.

Now let us go to the next page.

(6p) 3Q19 Financial Highlights-Strategic actions for new LDR target & earnings stability

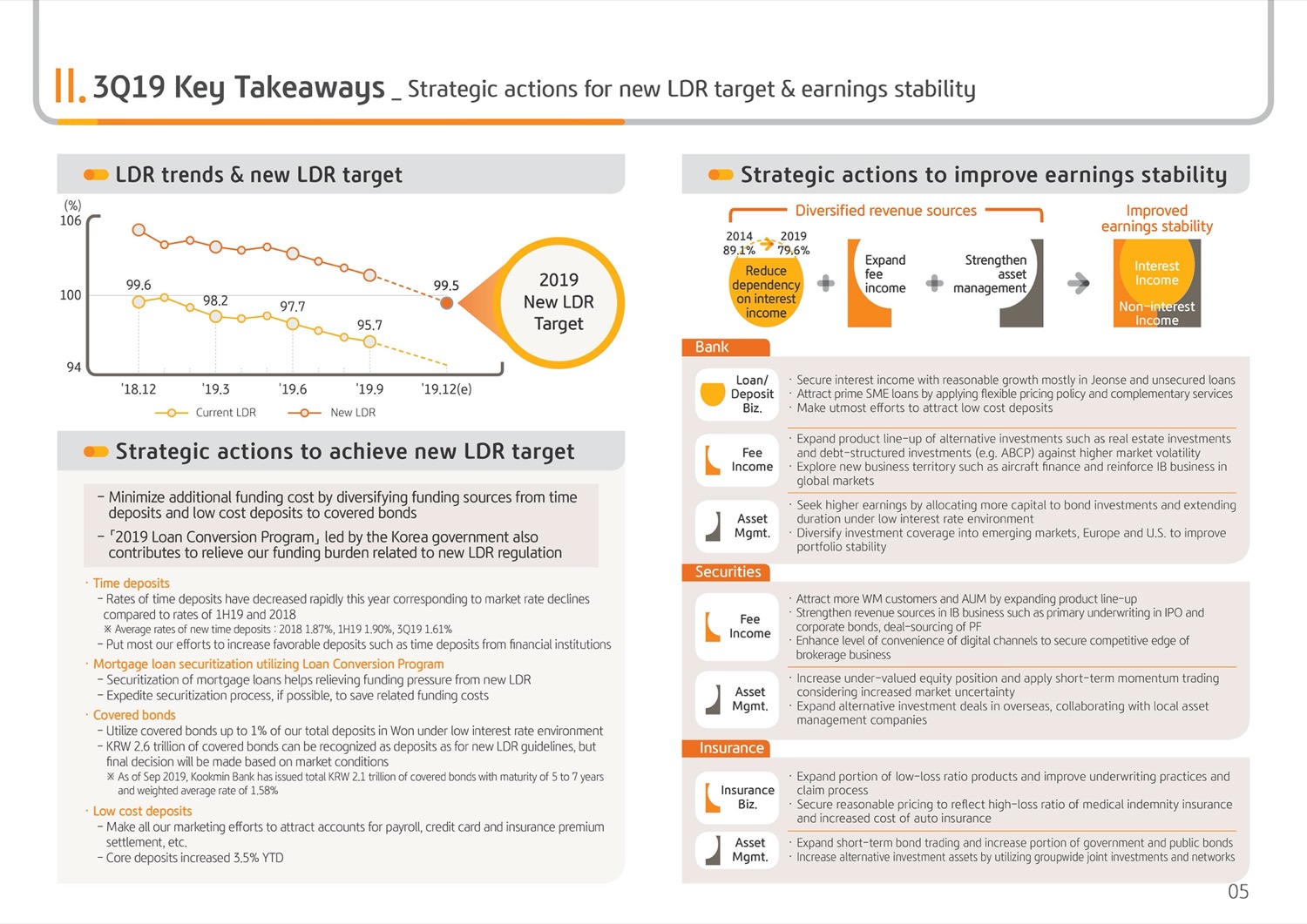

From Page 5, I would like to cover our current situation in our response to the new LDR regulations and our strategies to respond to the new LDR regulations, which will start from January of next year. In addition, since the market is very concerned with the bank's profitability deterioration following the interest decline cycle, according to the economic slowdown, I would like to elaborate on our group's profit stability improvement strategy.

Looking at the new LDR, please refer to the graph on the left side. As of September end, KB Bank's LDR posted 95.7% and is continuously declining through strategic funding and loan growth preparing for the new LDR regulation. The new LDR in particular is declining at a fast speed from the second half of this year and is nearly the level of the 100%, which is the regulated ratio and as of end September and we believe that achieving the internal management goal of 99.5% level before the end of this year will be quite achievable in the case of KB. Since the proportion of the household loans is comparatively high, it is true that there is a funding burden responding to that new LDR regulations.

But we have been closely and comprehensively monitoring the monthly growth and core deposit trends as well as the market interest rate and competitive situation. And we have been dividing the funding period and size, and have strategically responded through diversifying the funding basis through issuing time deposits, low-cost deposits as well as covered bond.

In the case of time deposits, with the favorable interest rate environment continuing from the latter part of this year, the funding burden has been much lighter than expected from the beginning. And taking into consideration the funding cost, we have been expanding this, focusing on financial institutions deposits.

In the case of covered bond, since 1% of the deposits in Won and approximately up to KRW 2.6 trillion can be recognized as deposits, KB Bank issued for the first time in the industry in May KRW 500 billion of Won denominated covered bond and have issued about KRW 2.1 trillion in funding. The covered bond that was unissued until now is a long-term maturity bond between 5 to 7 years of maturity and has a stable funding basis. And even taking into consideration the bank related fees and commission, it is more favorable compared to the time deposits in terms of interest rates.

For your reference, taking into consideration the market situation and additional KRW 500 billion of covered bond can be issued this year additionally. And we believe that loan conversion program will also greatly contribute to fulfillment of the new LDR regulations.

Next I would like to explain about our group's earnings stability improvement strategy. During the past 5 years, KB Financial group has worked hard to lower the interest income dependency and has been gradually increasing our noninterest income in the mid-to-long term. As a result, the proportion of net interest income in our group's total operating income has decreased from 89.1% at the end of 2014 to 79.6% as of September 2019.

In the Korean economy, since the low growth and low interest rate environment can take root, diversifying the group's earnings basis is most important. And KB Financial group is implementing the following strategies for the traditional loan-to-deposit business, fee income and asset management units.

First of all, the bank, which is the representative subsidiary of the traditional loan and deposit business, will convert the past household loan and SOHO base growth access to small and medium business loans, but also link trade finance and CMS and other additional services so that we can have competitiveness and we will also strengthen entry into new growth markets including platform loans.

Next, the fees and commissions are an essential part of our noninterest growth strategy and the securities WM and IB business is focusing on stronger cooperation with the bank so that we can have more tangible results. In particular, in the low interest rate environment, since the demand for investment can increase, the alternative investment product lineup will be strengthened and we want to increase the new IB business including airplane financing to strengthen competitiveness.

Lastly, asset management's importance is growing in the mid-to-long term. And we believe the group's integrated management and support is needed. Accordingly, we achieved efficiency through the collocation of the group's capital market in June, and is continuing to recruit talented management resources and to foster them. In addition, we have been working hard to improve the group's management synergy by including expansion in alternative investment through ways including utilizing our co-investment and network between subsidiaries.

As was mentioned so far, KBFG has established and implemented different strategic test to safeguard earnings fundamentals in a challenging operational environment. We will do our best going forward so that we can become the best leading financial group that is aligned with the market's perspective as well.

Please refer to the following pages for business presentation details.

I would like to conclude the KBFG 3Q19 business results presentation. Thank you for listening.