-

2020 Business Results

Greetings and Summary

Greetings. I am Peter Kwon, the Head of IR at KBFG. We will now begin the 2020 business results presentation. I would like to express my deepest gratitude to everyone for participating in our call. We have here with us our group CFO and Senior Executive Vice President, Mr. Hwan-Ju Lee, as well as other members from our group management. We will first hear major financial highlights from our CFO and Senior Executive Vice President, Mr. Hwan-Ju Lee, and then engage in a Q&A session. I would like to invite our CFO to walk us through 2020 major financial highlights.

Good afternoon. This is Hwan-Ju Lee, CFO of KB Financial Group. Thank you for joining KBFG’s presentation on 2020 business results. Before moving on to our earnings results, let's briefly look back on last year's operational environment and KBFG's key business results.

Due to the COVID-19 pandemic, global real economy fell into steep contraction and 2020 was an unprecedented year with high volatilities for the financial market as well. For the banking industry, since the 75 basis point cut in the rate by BOK, policy rate continued to be at its historical low, and with greater possibility of asset quality deteriorations with prolonging COVID-19 impact, there were concerns over fall in profitability which lead to share price declines. Notwithstanding such internal and external challenges surrounding the company, KBFG was able to bring meaningful results in 2020.

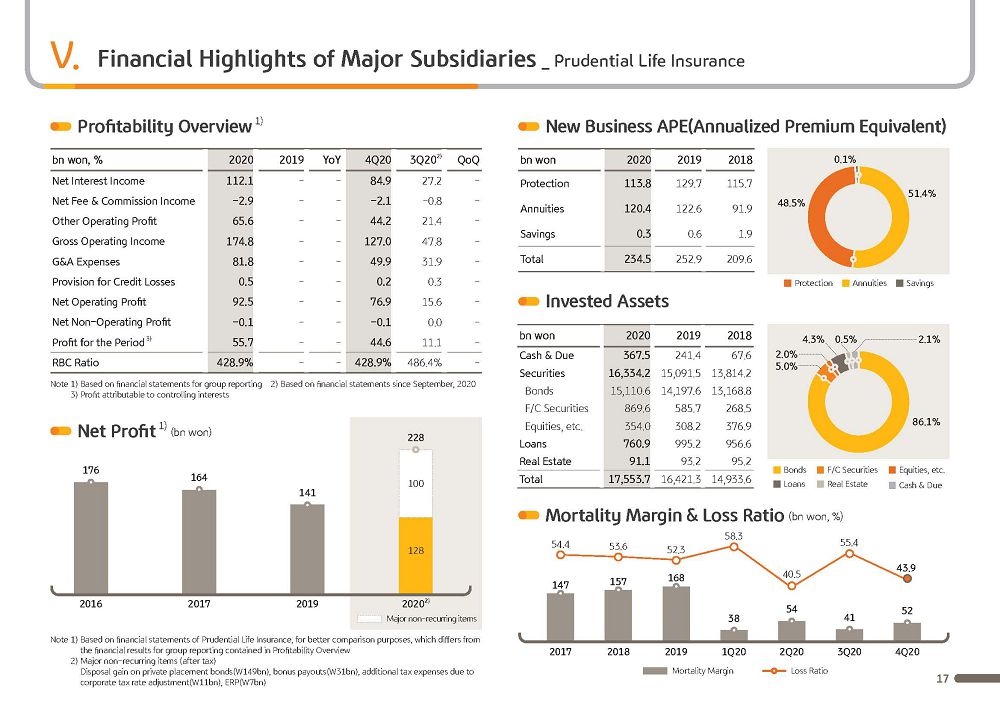

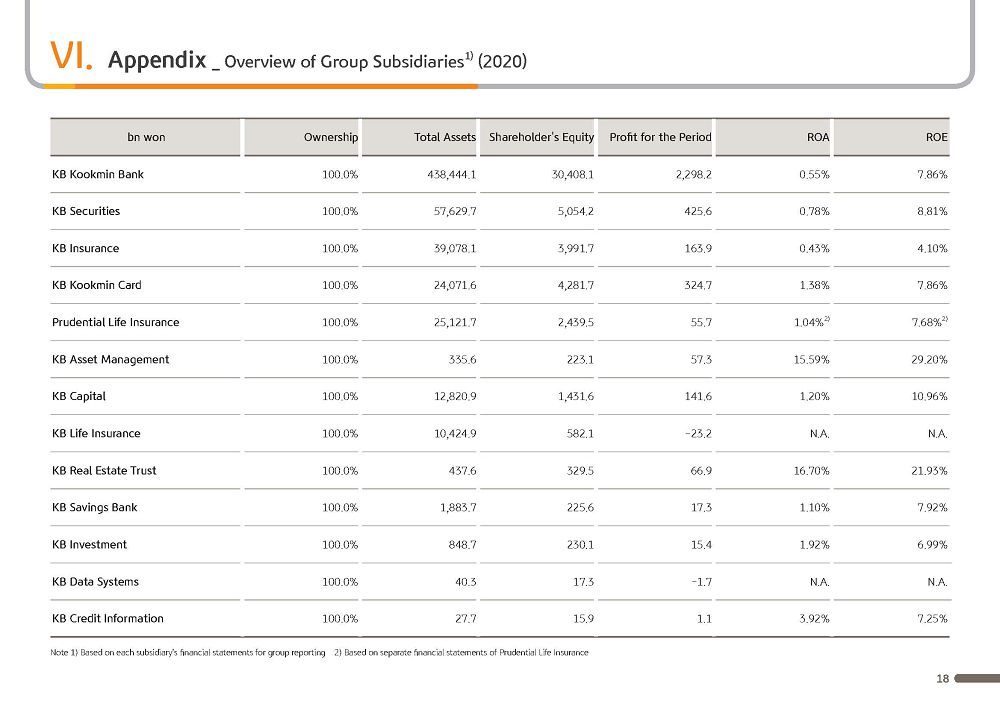

Last August, Prudential Life, industry's top-tier life insurer, became our subsidiary. We completed our business portfolio, ranging from bank, securities, non-life insurance, credit card, and finally life insurance, which enabled us to gain solid competitiveness. We also completed acquisition of Cambodia's biggest micro financing institution, Prasac, as well as Bukopin Bank, which will be a foothold into the Indonesian market. As such, we made significant progress in our global business and further enhanced the group’s sustainability.

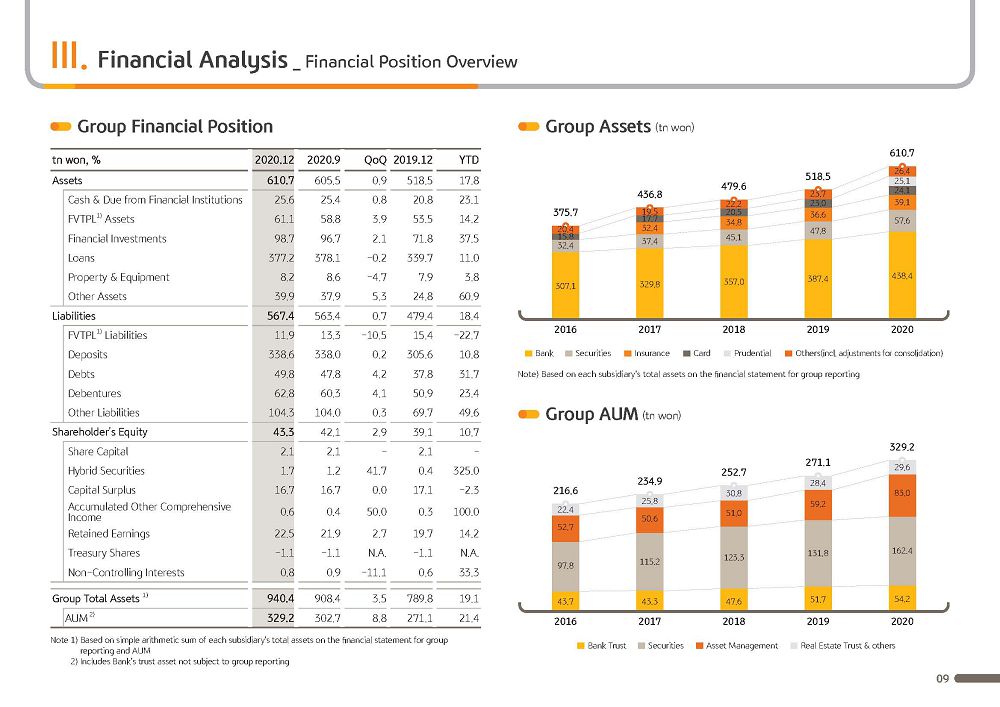

In terms of financial performance, despite NIM contraction following the rate cut and continuation of macro uncertainties, driven by solid loan growth, which drove sustained increase in interest income, as well as sizable increases in net fees and commission income from nonbank subsidiaries, we saw a balanced earnings improvement across bank and non-banking business. Also, our inorganic growth through M&A brought tangible results leading to around KRW 3.4 trillion of net profit as we continue to sustain solid fundamentals.

Today, the board of directors has decided on this year’s payout ratio of 20% and DPS at KRW 1,770. As we are mindful of possible economic depression against prolonged COVID-19 impact and macro uncertainties at home and abroad, we believe conservative capital management and supportive measures for the real economy are required. Hence, payout has been slimmed somewhat compared to last year. However, underpinned by solid earnings resilience and industry's top capital adequacy, we will continue to abide by progressive dividend policy as we've done so far. And commit yet again that we will be at the forefront of implementing various shareholder return policies that live up to the global standard.

As you are aware, Korean economy is entering the New Normal, characterized by ultra-low rate and low growth. Also, the financial market paradigm is changing fast. To respond to changing financial environment preemptively, KB Financial Group will enhance its business portfolio. And based on KB's distinct all around financial services capabilities, superior customer base and channel competitiveness, we will rise to become a #1 financial platform company.

To this end, we named this year's strategic direction as “RENEW 2021.” Renew stand for R, reinforced core; E, expansion of global and new business; N, number one platform; E, ESG leadership; and W, world-class talent and culture.

In 2021, we will strengthen competitiveness of core businesses of each of our business lines of the group. And on top of our traditional financial business, we'll bolster non-financial businesses, i.e., auto, real estate and health care so as to secure growth engines for the future. At the same time, we will become a #1 financial platform company that offers differentiated and comprehensive financial solutions via customized financial products and services that are deeply based on data analysis.

With that, I will move on to earnings results for fiscal year 2020.

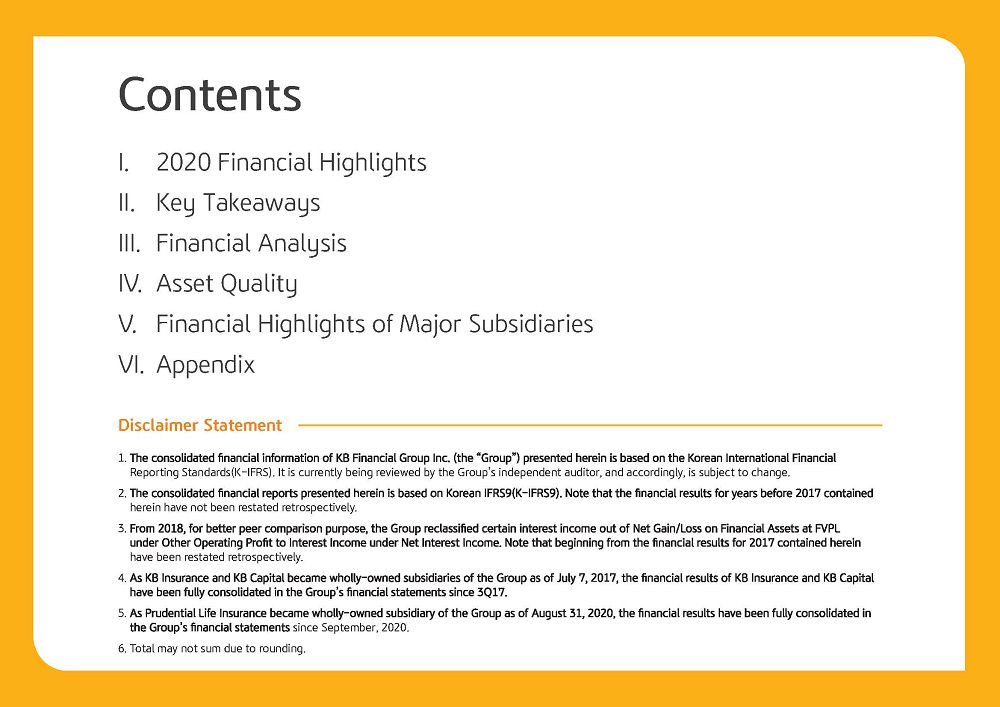

(2p) FY2020 Financial Highlights-Overview

KBFG's full year net profit for 2020 was KRW 3,455.2 billion. Despite challenging business environment at home and abroad, driven by robust core earnings growth and tangible results from inorganic growth through M&As, there was 4.3% growth year-on-year as we maintained solid earnings fundamentals. However, Q4 net profit was down significantly Q-on-Q at KRW 577.3 billion, on the back of ERP expenses and additional provisioning related to COVID-19 and the base effect from booking of negative goodwill benefit from Prudential Life previous quarter. Excluding these one-off factors, Q4 net profit on recurring basis was flat on quarter-to-quarter.

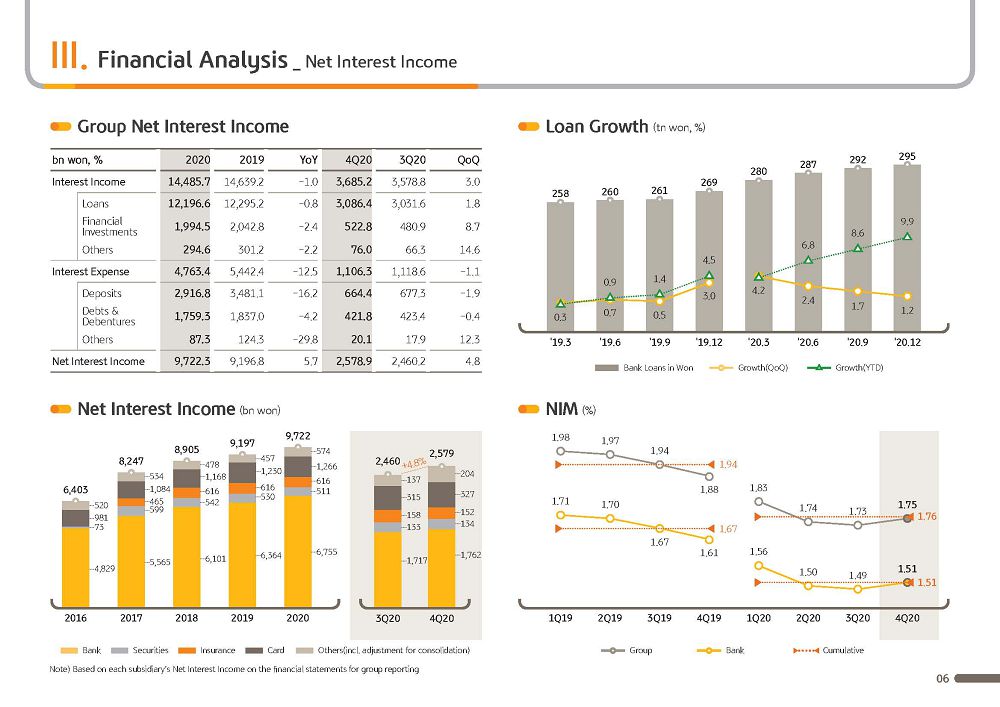

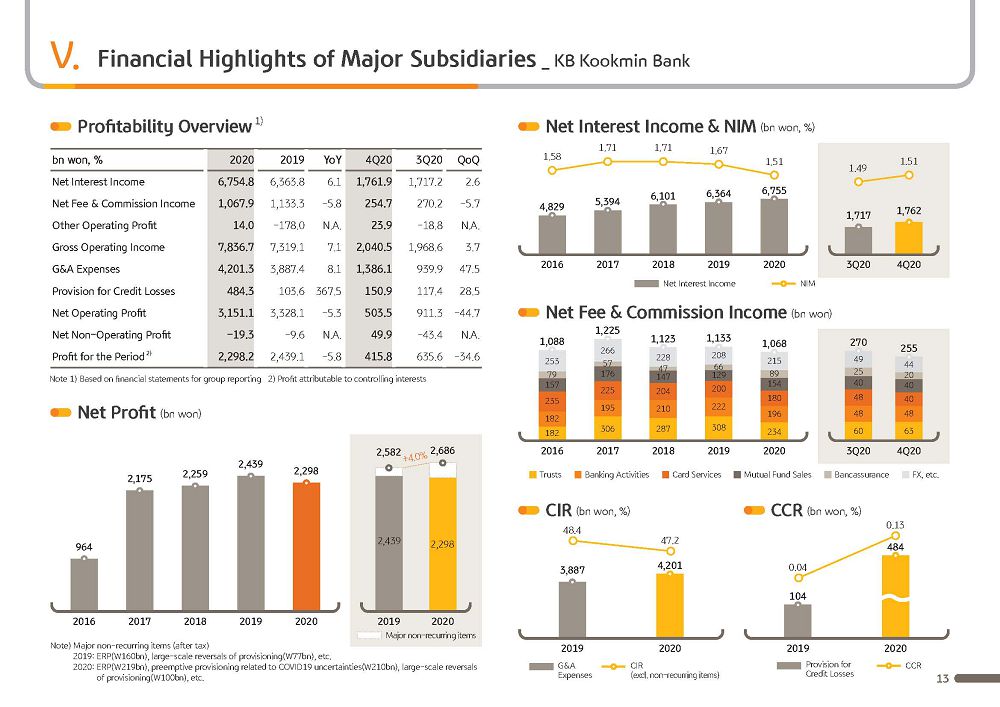

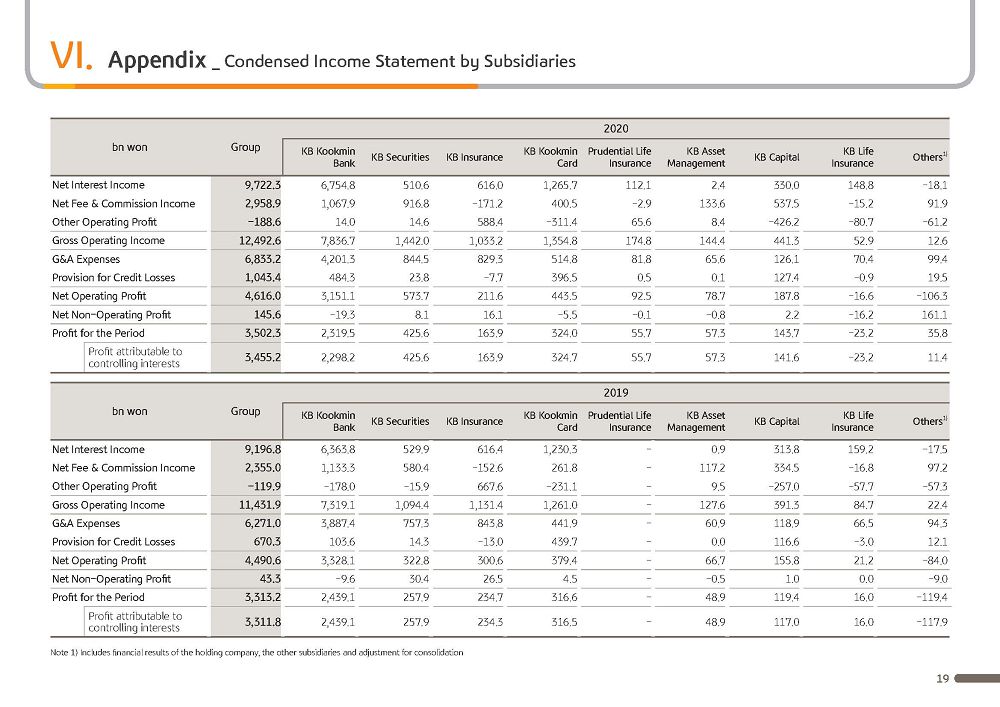

Now moving on to the details, Group's 2020 net interest income was KRW 9,722.3 billion, up 5.7% on year, continuing to show a stable growth trend despite falling rates. This is due to bank's solid loan growth, which helped to secure stable earnings base and the result of inorganic growth through M&As.

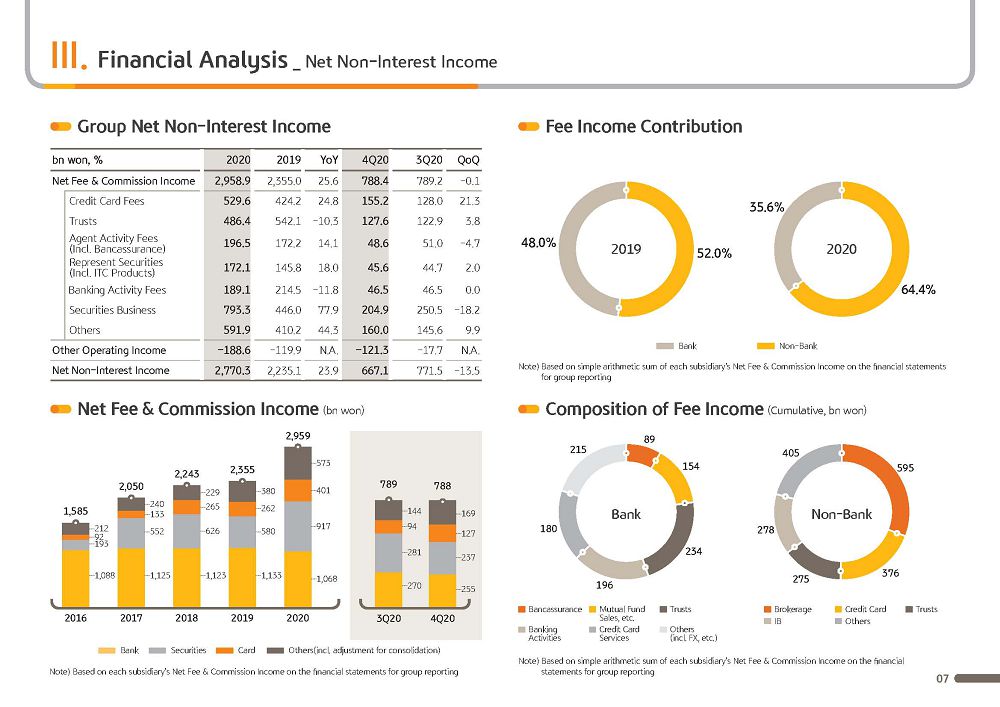

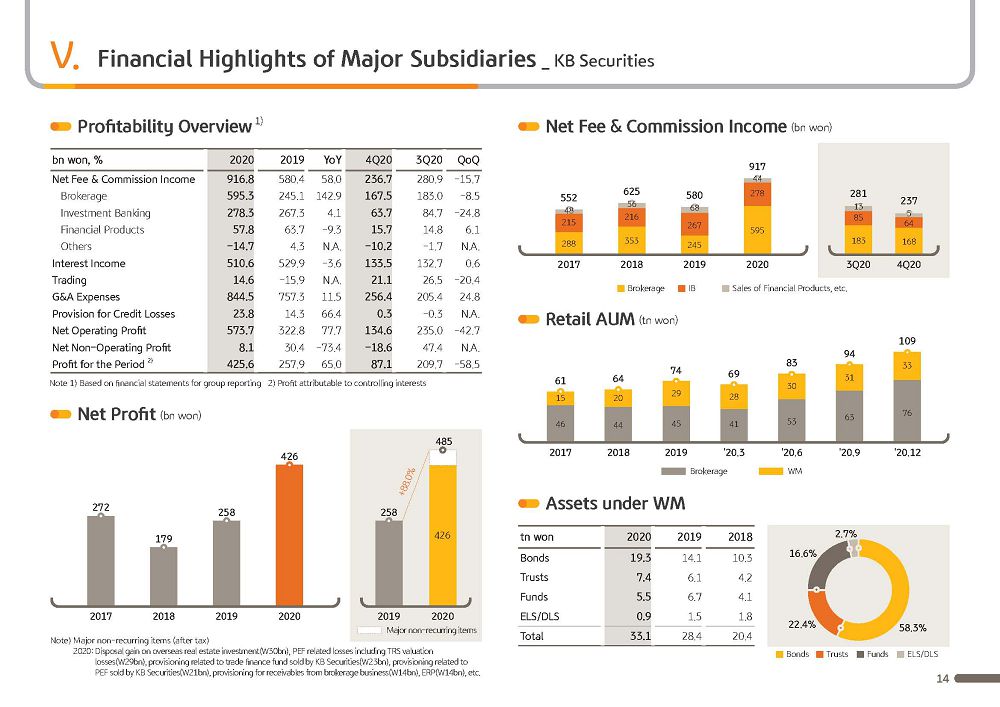

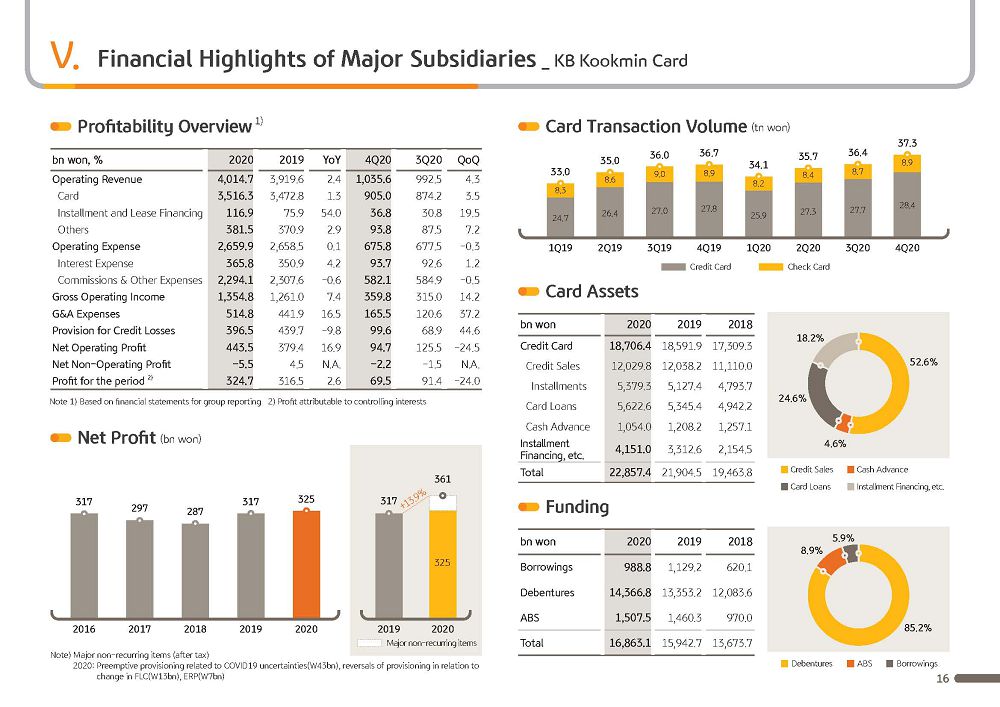

Next, 2020 net fee and commission income was KRW 2,958.9 billion, up 25.6% year-on-year or KRW 603.9 billion on year, providing a big support to the group's core earnings growth. Such growth in net fees and commission is driven by sizable increase of KRW 347 billion from mostly brokerage fees in the securities business, as well as higher credit card fees on the back of robust marketing and cost savings efforts, which led to better performances from nonbank subsidiaries. Meanwhile, Q4 net fee and commission income was KRW 788.4 billion. Although securities business fee income declined slightly due to lower average trading volume, credit card fees increased on the back of year-end increase in credit card transaction volume, driving the total fee and commission income to be flat Q-on-Q. In the past, quarterly net fee commission income was around KRW 500 billion, but now has expanded to around KRW 800 billion since the beginning of the year, continuing to show solid growth.

Next is other operating profit. In 2020, there was KRW 188.6 billion of other operating loss for the group, mainly from increase in other operating expenses including credit and deposit insurance and depreciation on operating leases. But we've seen meaningful improvements in our core businesses such as securities, derivatives, FX, driven by favorable market in conditions in the stock and bond markets, as well as our efforts to increase invested assets and improve portfolio diversification.

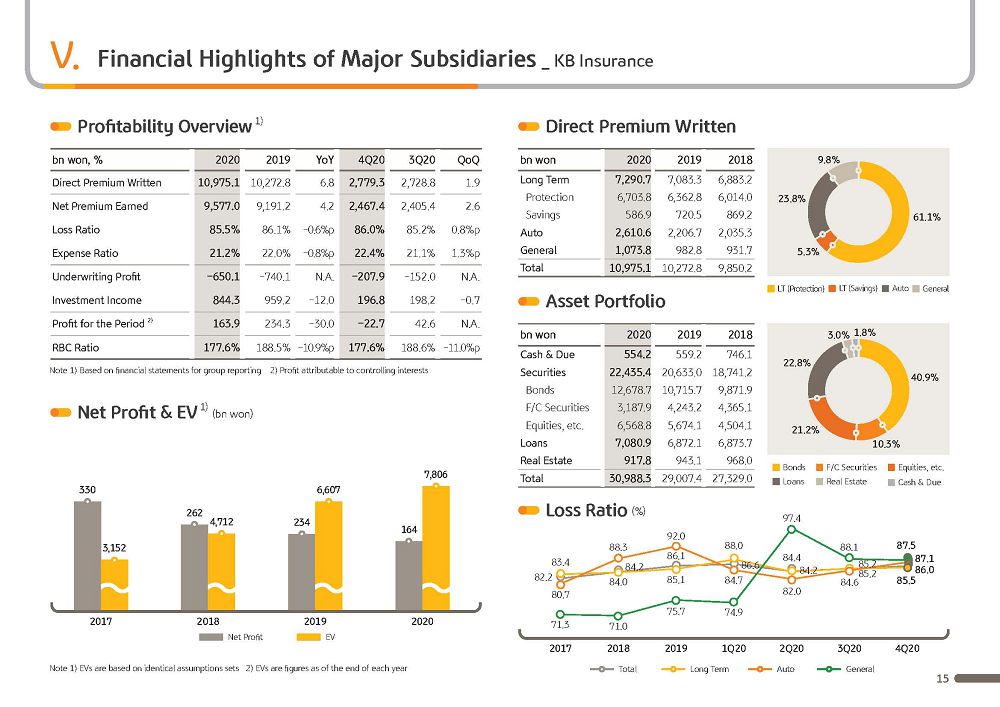

Other operating profit for Q4 decreased QoQ due to seasonality impact of year-end cold weather and increase in medical expense claims, leading to deterioration of loss ratio for auto and long-term insurance which constrained the insurance business.

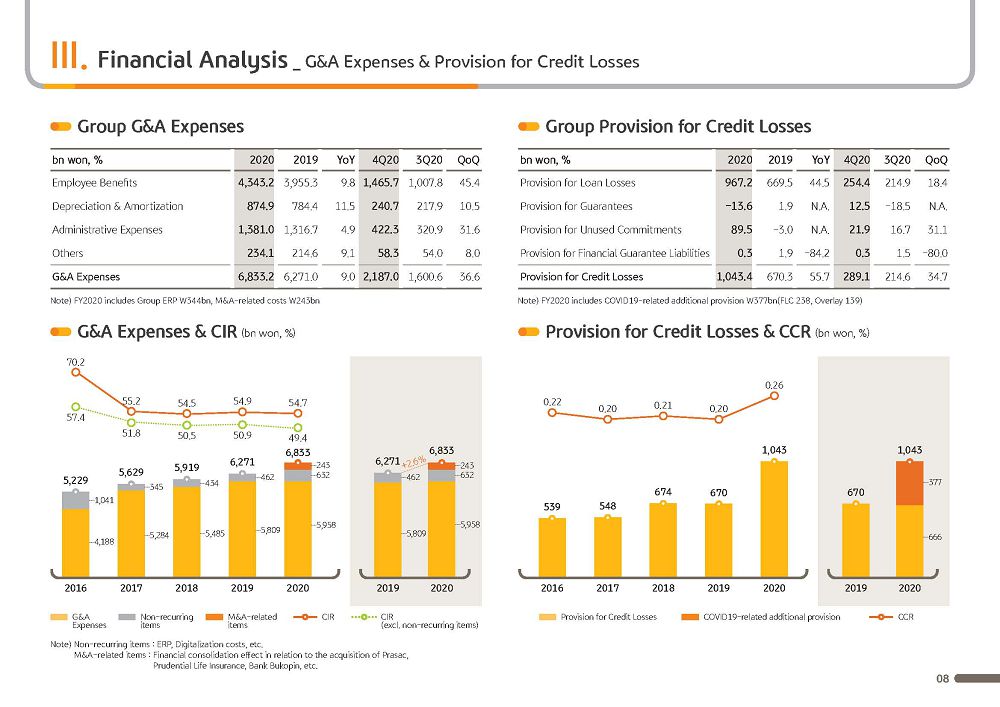

Next is on the group's G&A expense. Group's 2020 G&A expense was KRW 6,833.2 billion. This year, with ERP size growing for the group, there was approximately KRW 344 billion of ERP expense. And with the consolidation of Prasac, Prudential Life and Bukopin Bank of Indonesia into the financial statement, there was around KRW 243 billion of additional expense recognized, pushing up G&A expense, 9% year-on-year. The rise may seem significant this year, if excluding one-off factors like the ERP expense and the M&A impact, G&A expenses on a recurring basis increased 2.6% on year.

Q4 G&A expense reported KRW 2,187 billion, which was a sizable increase Q-on-Q. And once again, this is due to ERP and other seasonal impact as well as expenses from Bukopin Bank, which was consolidated as a subsidiary as of September.

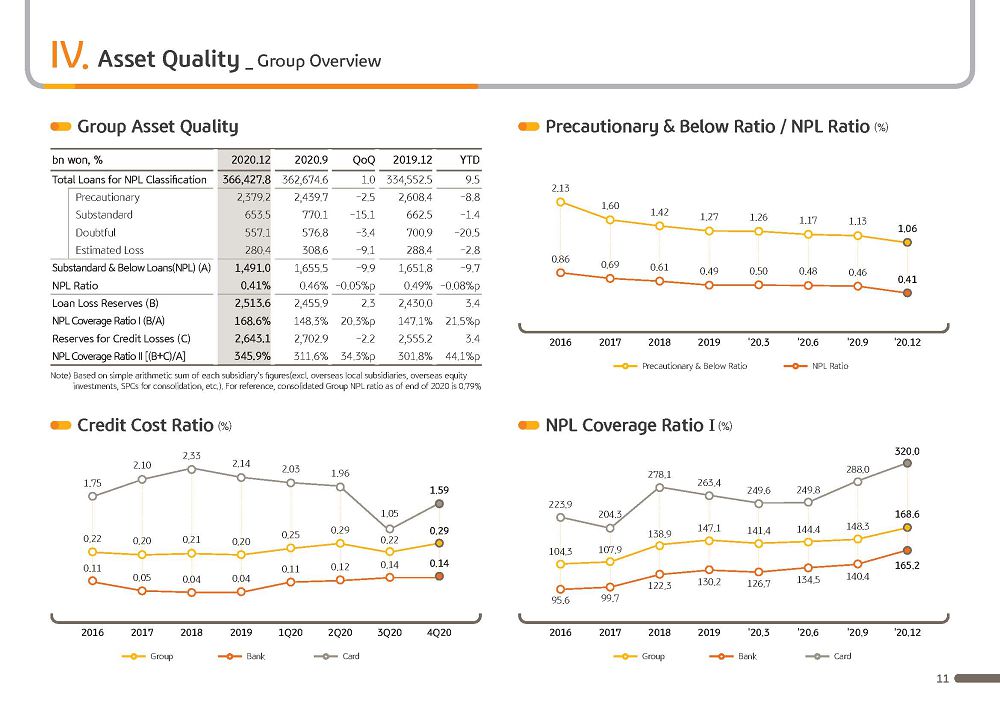

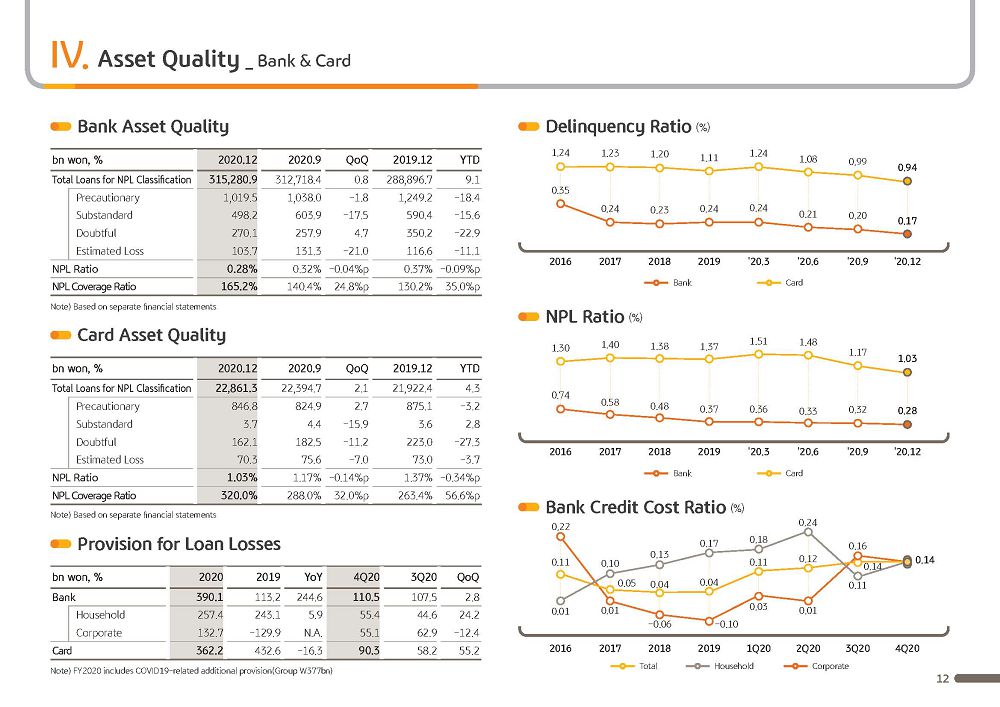

Next is on PCL, provision for credit loss. Group's PCL for 2020 reported KRW 1,043.4 billion, up KRW 373.1 billion year-on-year. In order to preemptively counter uncertainties arising from COVID-19, we have added KRW 171 billion of provisioning this quarter in addition to the KRW 206 billion of provisioning during incurred in the second quarter, which in total amounts to KRW 377 billion for this year. Excluding such additional provisioning, PCL remained flat year-on-year.

For the fourth quarter, PCL was KRW 289.1 billion. Despite additional provisioning, due to sale of bank loans and write-backs related to specialty bonds, the increase was only KRW 74.5 billion Q-on-Q.

(3p) FY2020 Financial Highlights-Key Financial Indicators

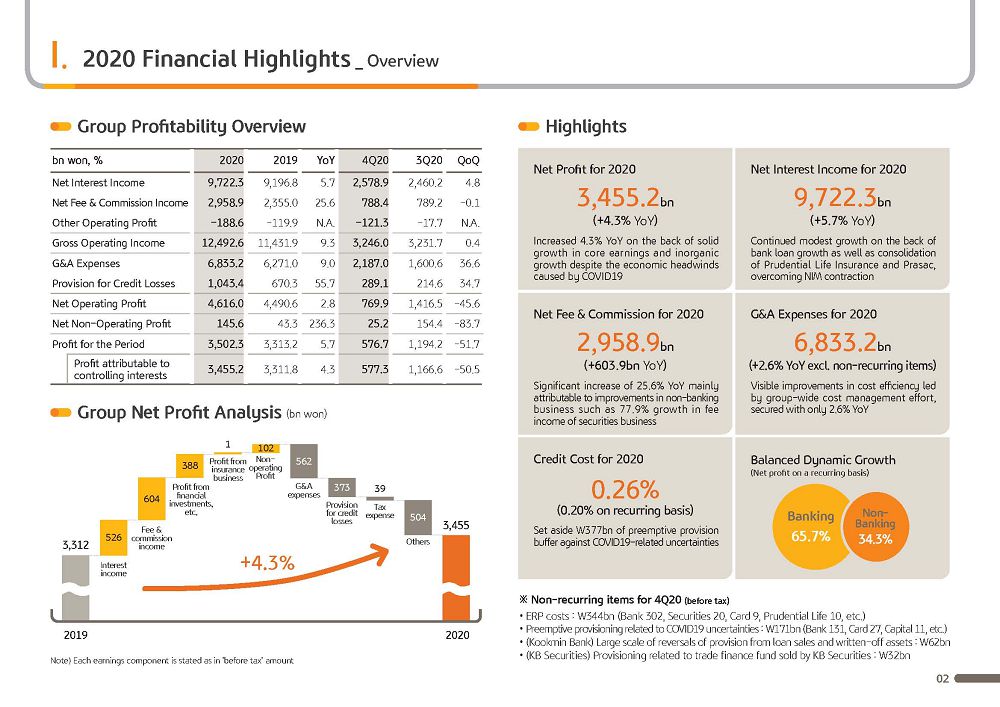

Next is on key financial indicators. You can see the group ROA and ROE on the top left-hand side. Before I go further, I would like to mention that in the overall industry, there is increasing issuance of hybrid bonds, which is recognized as supplementary capital, and there is also the global trend of profitability indicators. Taking these factors into consideration, we would like to inform you that from this quarter, our ROE is based on ROCE, which is return on common equity, a profitability indicator centering on common equity, excluding the effects of supplementary capital.

In 2020, KBFG's ROE posted 8.79%, a slight drop for the year. However, the recurring ROE excluding one-offs such as preemptive provisioning and ERP costs stands at a 10.17% level. Even in a difficult operating environment with the downturn in the real economy and fall in the interest rate, we have maintained stable profitability with increase in core income and inorganic growth.

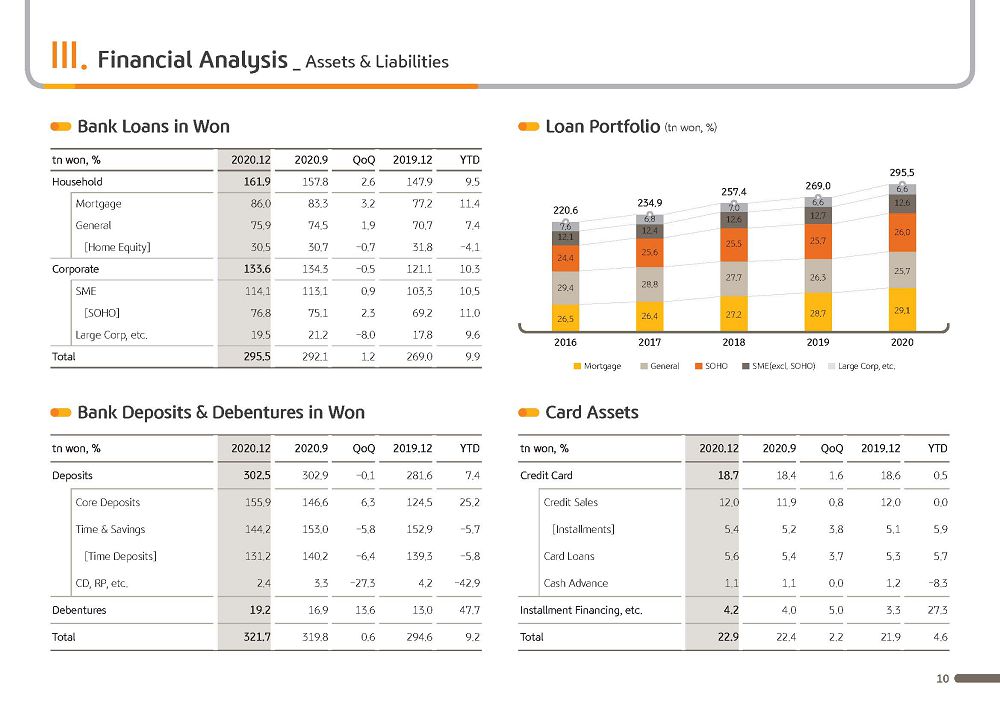

Next, I would like to comment on the bank's loans in won growth. As of the end of 2020, bank's loans in won posted KRW 295 trillion and based on balanced qualitative growth of household and corporate it increased by 9.9% YTD and 1.2% compared to the end of September.

Looking at the breakdown, in the case of household loans, with the sound growth in Jeonse loans and prime unsecured loans, there was a 9.5% growth YTD and 2.6% growth compared to September. In the case of corporate loans, there was an even growth of SOHO, SME and large corp loans and grew 10.3% YTD. Compared to September, centering on large corporate loans, there was an increase of debt redemption at the end of the year, leading to a 0.5% decrease.

In 2020, loan growth was faster than was initially planned with the increase in loan demand and financial aid support due to COVID-19. However, from this year, we plan to take into consideration factors such as economic circumstances and household debt situation and focus on profitability and asset quality centered qualitative growth and managed loan growth at a more conservative level.

Next is the NIM. Group and Bank NIM in 2020 and Q4 each posted 1.75% and 1.51%, respectively. Even in a situation where asset yield contraction continued following the interest rate decline, both group and bank NIM improved 2 basis points Q-o-Q as a result of our strict margin management efforts. In particular, the bank NIM was well defended due to favorable funding, with approximately KRW 9 trillion growth in core deposits for this quarter alone and sizable decrease in time deposit, as well as selective loan growth centered on profitability. However, on a yearly basis, affected by the interest rate cut, there was a great contraction in both the group and bank NIM Y-o-Y. And because we expect that the effect from interest rate decline will continue for a while, we will make all our efforts to manage our NIM by increasing core deposits based on our superior sales capability and channel competitiveness and applying more selective pricing to loans.

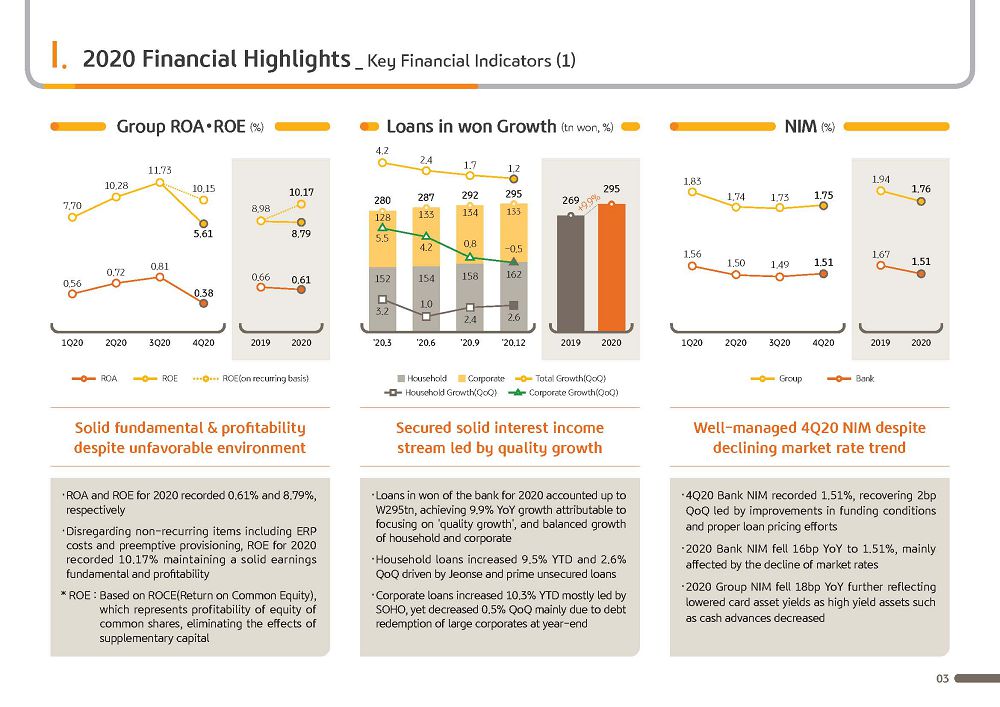

(4p) FY2020 Financial Highlights-Key Financial Indicators Let's go to the next page. I will now elaborate on the group's cost-income ratio. 2020 CIR posted 54.7%. And despite the group's ERP expansion and M&A-related one-off cost increase, as a result of improved overall revenue generation, it maintained the previous year's level. In particular, the recurring CIR, excluding one-offs, stood at 49.4% level and has been steadily, downwardly stabilizing for the past 5 years, thanks to our group-wide cost cutting efforts. Next, I would like to remark on the credit cost ratio. The group credit cost in 2020 posted 0.26%. And as a result of preemptive provisioning related to COVID-19, there was a slight increase Y-o-Y. But the credit cost, excluding such provisioning, stands at just 0.20% level and is still being managed at a stable level.

With COVID-19 becoming prolonged, there are increasing concerns about asset quality. However, in order to preemptively prepare for these uncertainties and to improve our capability to respond, we have additionally provisioned conservatively to secure a buffer. And at the same time, we have considerably stepped up our risk management efforts by fine tuning our risk management system for different industries and borrowers and by strengthening monitoring for vulnerable borrowers. As such, we believe that our asset quality will be managed stably.

Next is the group's BIS ratio. As of end December 2020, the group's BIS ratio posted 15.27%, and CET1 ratio posted 13.29%. Despite the risk-weighted asset increase following the year-end dividend and loan growth, on the back of strategic capital management, including a solid net profit increase and issuance of hybrid bonds, we are still maintaining the highest level of capital adequacy in the Korean financial industry.

(5p) FY2020 Key Takeaways - KB ESG Leadership

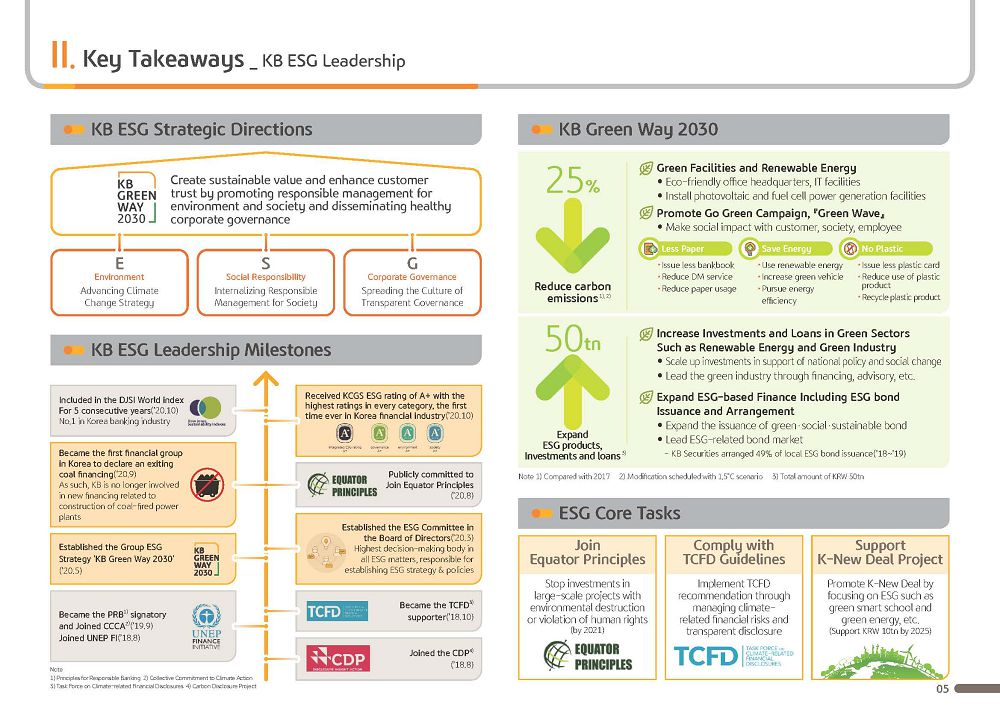

Now let's go to the next page. From this page, I would like to cover ESG management leadership, among KBFG's 2021 core management strategies.

Around the globe, ESG management has become both a core value of companies and also an essential management strategy to secure sustainability. In particular, due to COVID-19 with a globally heightened sense of crisis regarding environmental change, including climate change and natural disasters, the importance of ESG management is becoming more and more pronounced.

KBFG, which has been always one step ahead of these changes as for the first time as a Korean financial institution, in March of last year, newly established a ESG committee within the board of directors. The ESG committee in May set the ESG strategic goal to create sustainable value and enhance customer trust by promoting responsible management for environment and society and disseminating healthy corporate governance and establish the KB Green Way 2030, a mid- to long-term ESG strategy road map.

KB Green Way 2030 holds the commitment that KBFG will preemptively respond to the crisis of environmental change and secure green leadership, which will lead the environmentally friendly financial ecosystem. We have the core goal of reducing our group's carbon emissions by 25% by 2030 when compared to 2017 and to expand the ESG financial product sales, investment and loan size which stands at about KRW 20 trillion level now to KRW 50 trillion level by 2030.

Keeping in step with this, in August, we have publicly declared our commitment to the Equator Principles, a global guideline for environmentally friendly finance and are focusing our efforts on completing membership this year. And in September, we have announced for the first time as a Korean financial group that we are exiting coal financing, providing and proving that KB's ESG management philosophy is at a level higher than the others and showcased our speedy execution capability.

Going forward, KB Financial Group, following the recommendation of TCFD, Task Force on Climate-Related Financial Disclosures, are managing various climate-related risk factors and are disclosing related information transparently. On the other hand, we are also establishing an advanced climate change response system and we are working hard to faithfully implement the TCFD recommendations step by step.

We were recognized for our differentiated ESG management efforts. And recently, for the first time as a Korean financial company, we received the highest grade of A+ from Korea Corporate Governance Service, or KCGS, in all categories, including environment, society and corporate structure.

Last but not least, we are actively participating in the government's Korean New Deal projects and have strengthened core area support in ESG, including innovative growth companies, green smart schools and green energy to create social values. We promise that we will exert ESG management leadership and do our utmost fulfilling our responsibility and roles that befit our status as a leading financial institution.

Please refer to the following pages for details regarding the business results that I have just covered.

This marks the end of the earnings presentation. Thank you for listening.