-

Please adjust the volume.

First Quarter 2021 Business Results

Greetings and Summary

Greetings. I am Peter Kwon, the Head of IR at KBFG. We will now begin the 2021 first quarter business results presentation. I would like to express my deepest gratitude to everyone for participating in our call. We have here with us our group CFO and Senior Executive Vice President, Mr. Hwan-Ju Lee, as well as other members from our group management. We will first hear major financial highlights from our CFO and Senior Executive Vice President, Mr. Hwan-Ju Lee, and then engage in a Q&A session. I would like to invite our CFO to walk us through the major financial highlights of first quarter 2021.

Good afternoon. This is Hwan-Ju Lee, CFO of KB Financial Group. Thank you for joining KBFG’s presentation on first quarter 2021 business results. Even in the middle of an unprecedented crisis brought on by the COVID-19 pandemic, I extend my deepest gratitude to our shareholders for your unwavering support and kind patience.

Fortunately, during the first quarter, COVID-19 spread came under control to some extent, and there was vaccination rollout, which brought expectations for economic recovery. As such, Korean economy is displaying signs of improvement, driven by exports and capital investment. And as there were signs of upward trend in the market rate, more positivity was expressed for the banking sector and our share prices outperformed the market for the first time in a long while. But when optimisms abound, we, at KBFG, feel that it is important to focus on the fundamentals and think of ways to enhance corporate value and undertake bold innovations so as to respond to future changes.

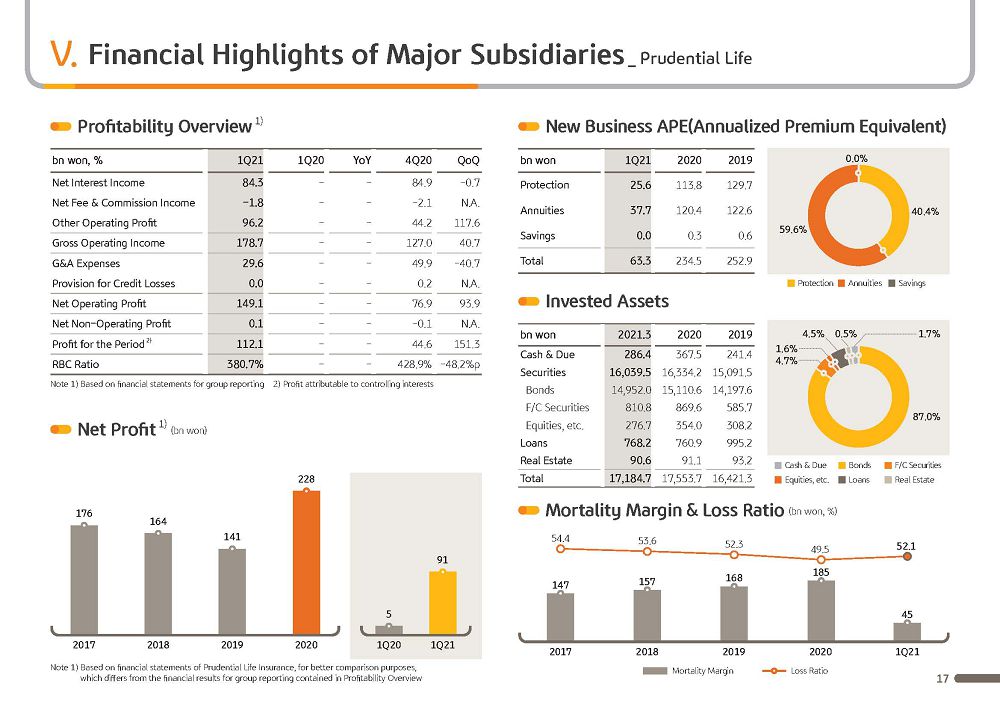

First, we have placed foremost priority on profitability and soundness, thereby, focusing on improving fundamentals for sustainability. This quarter, driven by the bank's core deposit growth and sophisticated loan pricing, we were able to improve NIM by 5 basis points on the quarter. And the insurance business, whose performance was relatively subdued last quarter, managed to recover its profitability supported by loss ratio improvement. Also, on stronger competitiveness of our core businesses, including Trust, WM and Investment Banking, we were able to expand on the group’s net fees and commission income.

To overcome the economic crisis triggered by the COVID pandemic, KB actively joined in on the efforts towards soft landing of the financial system. We have also been quite rigorous in controlling the asset quality through a systematic monitoring of problem-prone exposures and re-examination of the portfolio. Second, we issued KRW 600 billion of hybrid bond last February, securing additional capital buffer against internal and external uncertainties. On top of reinforcing flexibility of the capital structure to realize shareholder value that fall in line with our capital adequacy levels, which is top tier in the industry, we are conducting in-depth reviews of the shareholder return policy as we speak. Lastly, to make the leap and become a #1 financial platform, KB Financial Group is steadfast in implementing its strategic tasks. KB Star Banking application, which now has around 17 million customer base, is integrating the group’s core digital services from the standpoint of customer convenience and thereby transform into an earnings-generating and all-encompassing financial platform. For the credit card business, Liiv Mate, which is a MyData platform, and KB Pay, an open payment platform, formed the basis for delivering product and services in connection with group affiliates as well as expanding product partnerships with many other institutions and have bolstered our competitiveness as an open and comprehensive financial platform.

KBFG will boldly respond to impending crises and risks and will do our best to prepare against future changes to further enhance the group’s core fundamentals and corporate value.

With that I will now move onto first quarter 2021 financial results.

(2p) First Quarter 2021 Financial Highlights-Overview

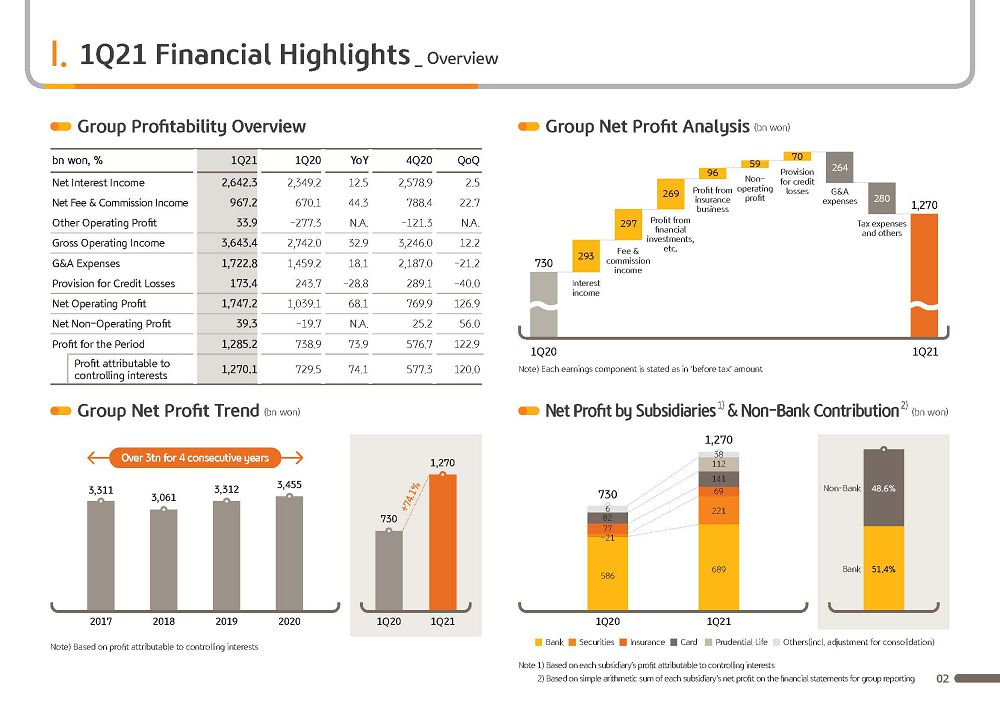

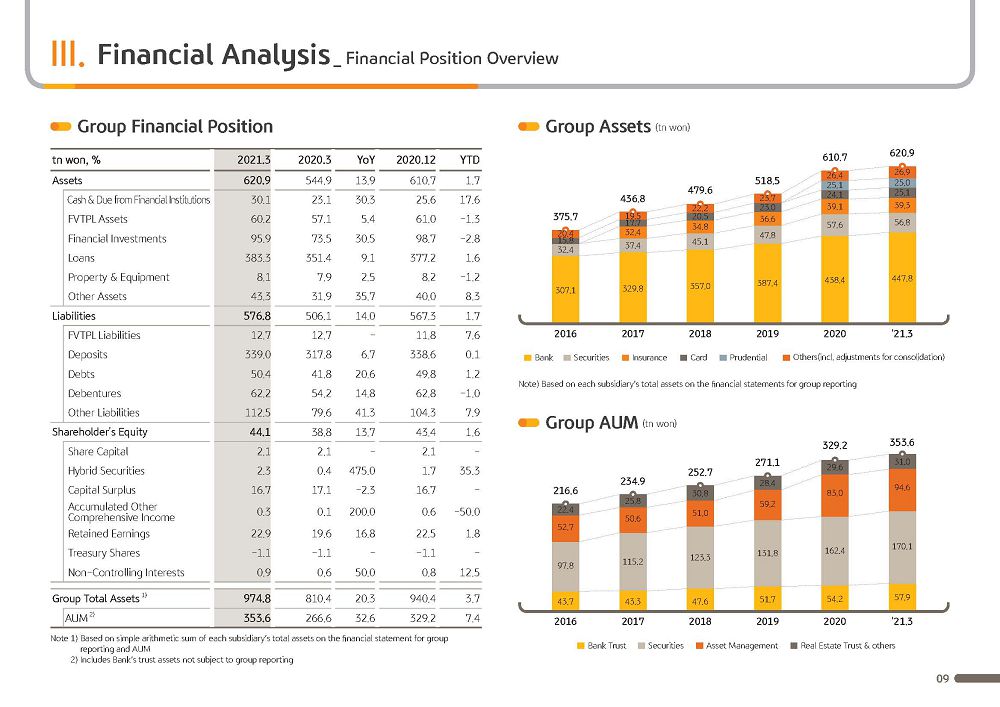

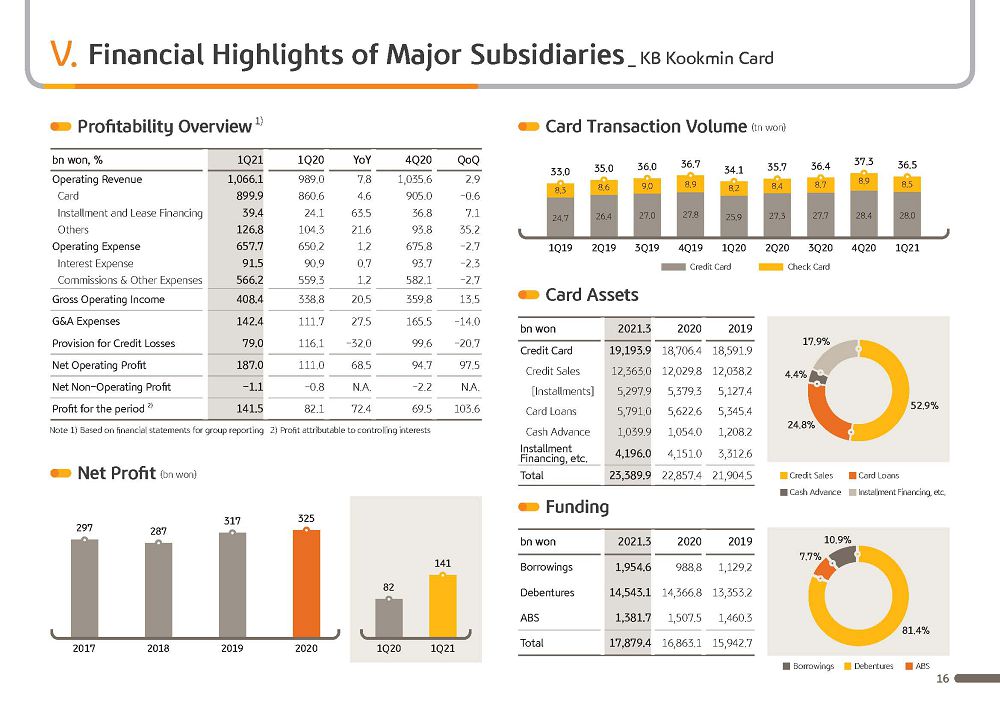

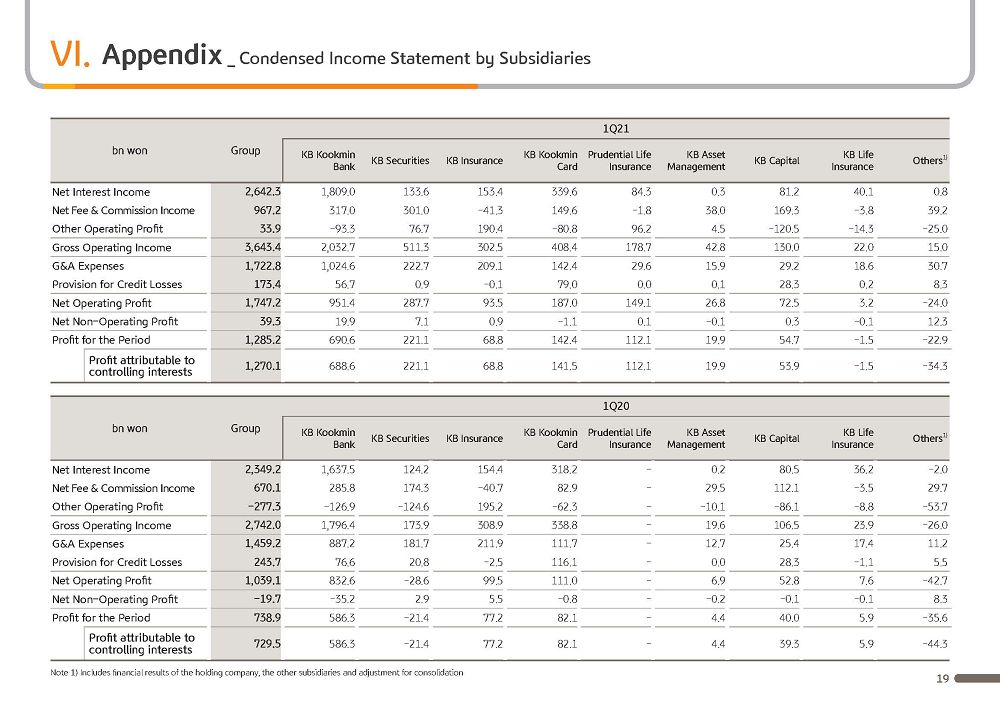

KBFG in Q1 2021 reported a net profit of KRW 1,270.1 billion, which is a historical quarterly performance since the company was launched, driven by our efforts to improve competitiveness of group's core businesses and the result of business portfolio diversification from our M&A efforts. Also, this quarterly figure reported a sizable increase of 74.1% on year, which is attributable to solid core profit growth led by net interest income and net fees and commission income while, at the same time, there was large improvement in other operating income, which had deep impact from sudden volatilities of the financial market in the first quarter of last year. As can be seen from the upper right graph, KBFG meaningfully expanded earnings-generating capacity across all segments over the past year while securing incremental earnings from the capital market and the insurance businesses. We also have proven our unparalleled capability in asset quality management, elevating the group's earnings profile in a stable and robust manner.

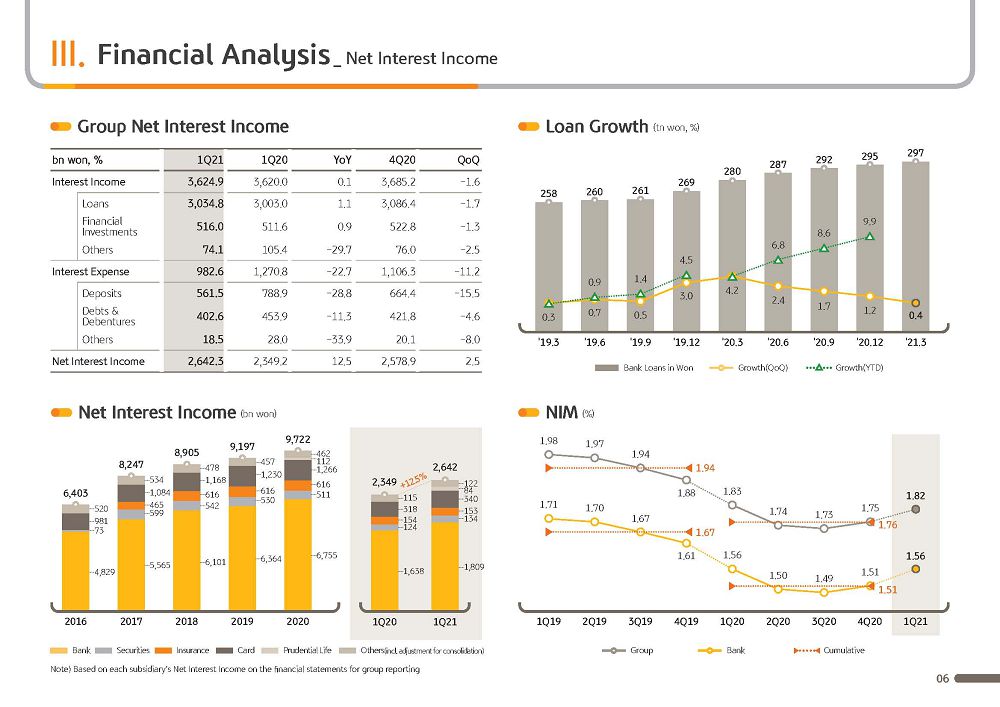

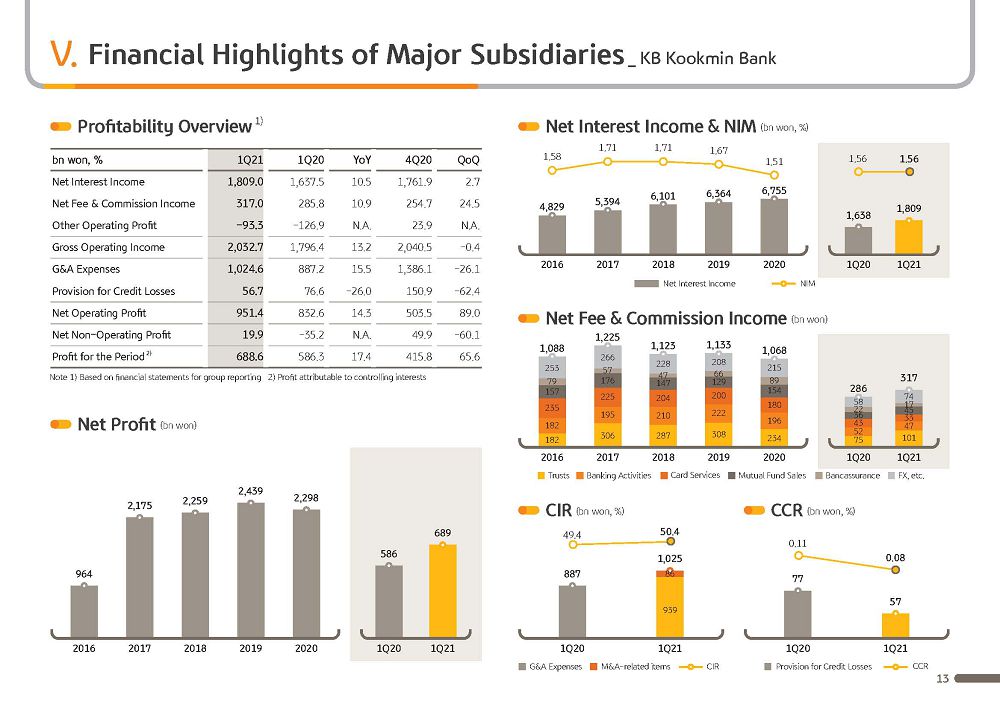

Let's now take a look at each segment in more detail. Q1 net interest income was KRW 2,642.3 billion, driven by M&As, such as acquisition of Prudential Life and solid loan growth from the bank, which led to 12.5% year-on-year increase, while there was an increase of 2.5% versus last quarter due to factors such as improvement in NIM.

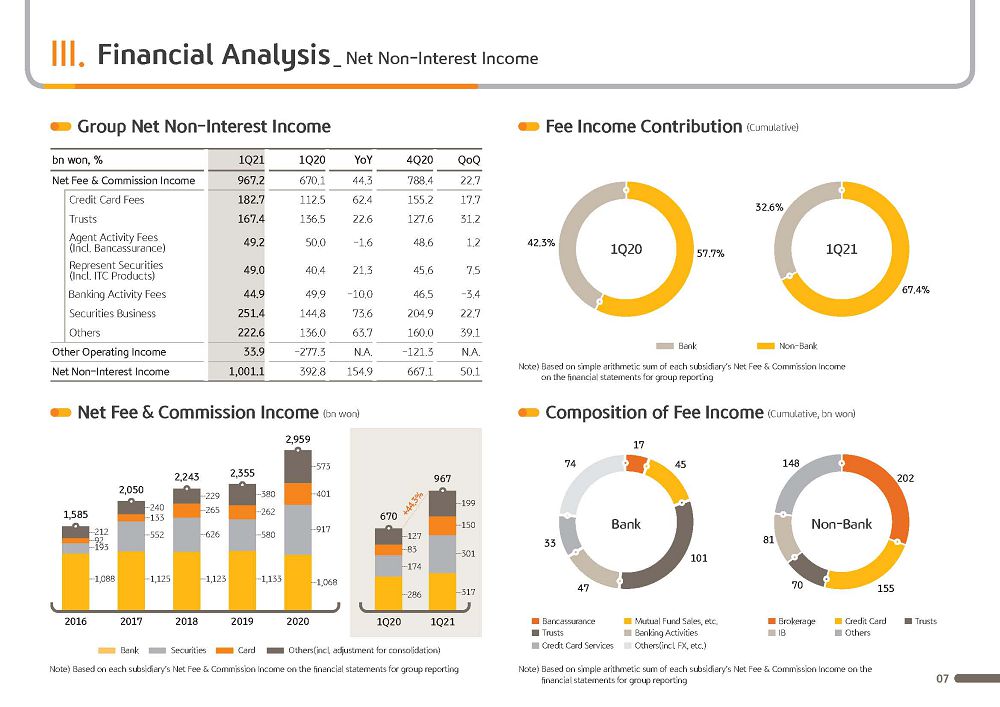

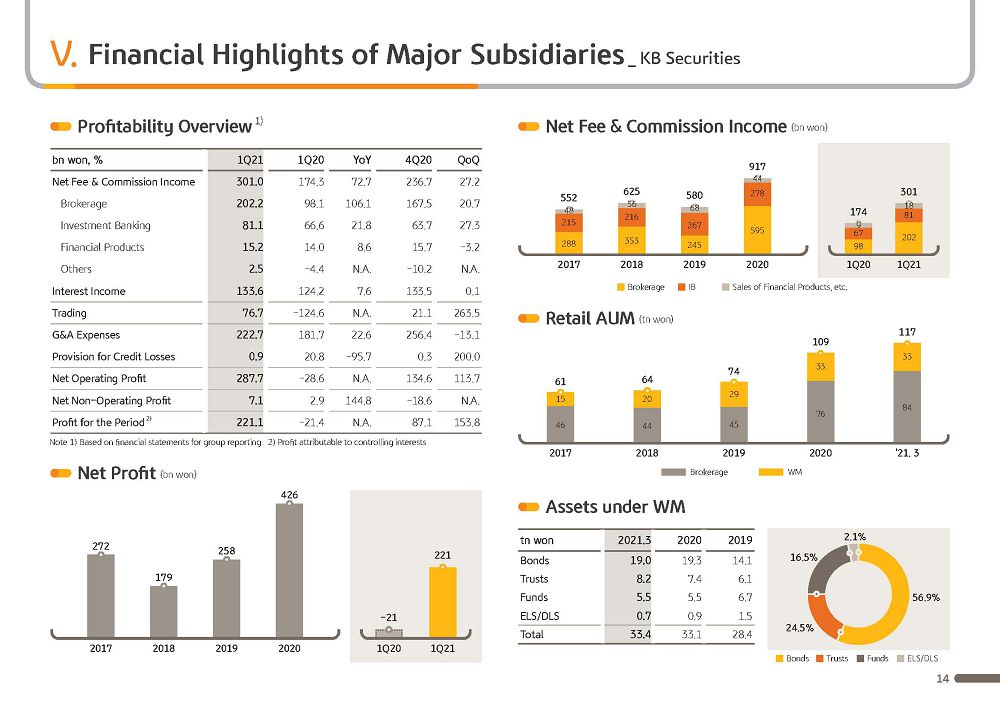

Q1 net fees and commission income was KRW 967.2 billion. There was a sizable increase of around KRW 297 billion on year and KRW 179 billion on quarter, which was driven by significant increase in fee income from securities business on the back of the bullish stock market. Also, there was recovery of trust sales, boosted by trust income for the bank. And then as consumer spending recovered, merchant fees from the credit card business also recorded an increase. Particularly in Q1, bank's trust income, which was somewhat muted for some time due to regulations and worsening market conditions, largely recovered. And by bolstering market competitiveness of the IB business, for the first time on a quarterly basis, the group’s net fees and commission income came in at around KRW 900 billion level, which attests to a more improved earnings capacity in non-interest income.

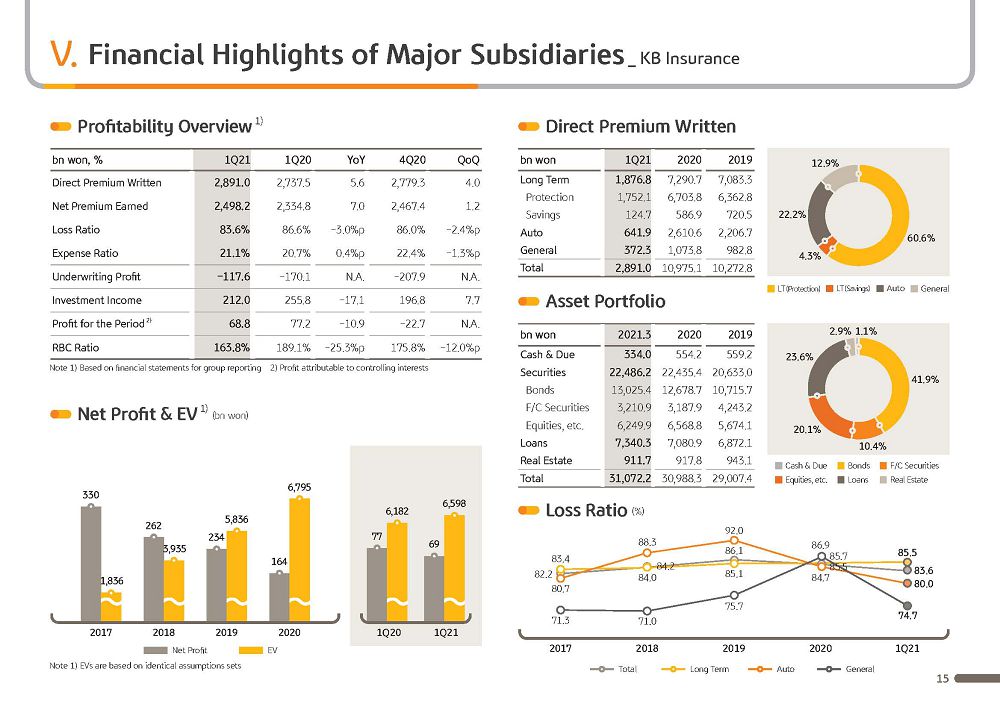

Next is on other operating profit for Q1. With the removal of securities and derivatives and FX-related losses of Q1 of 2020 and consolidation impact of Prudential Life, other operating profit was up KRW 311.2 billion on year. In regard to the insurance business, for non-life, there was improvement in loss ration mostly due to improvements in auto insurance driven by decline in accidents and premium increases. For life insurance, on base effect of year-end guarantee reserves and improved investment yield, there was an overall improvement versus last quarter.

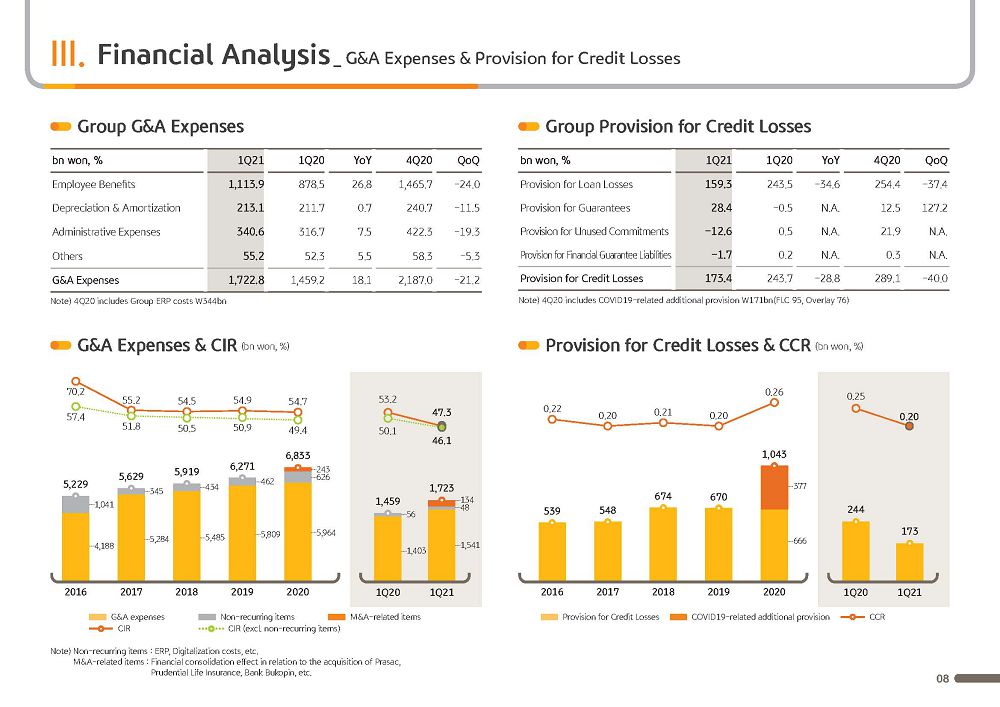

Next is on the group's G&A expense. Q1 group G&A was KRW 1,722.8 billion, which was up 18.1% year-on-year. While it seems like a notable increase, unlike Q1 of 2020, following the acquisition of Prudential Life, PRASAC, et cetera, KRW 134 billion was booked as related expenses. And also, there was additional expense adjustments for employees' welfare fund and year-end special bonuses. If we were to exclude such factors, G&A is being well controlled.

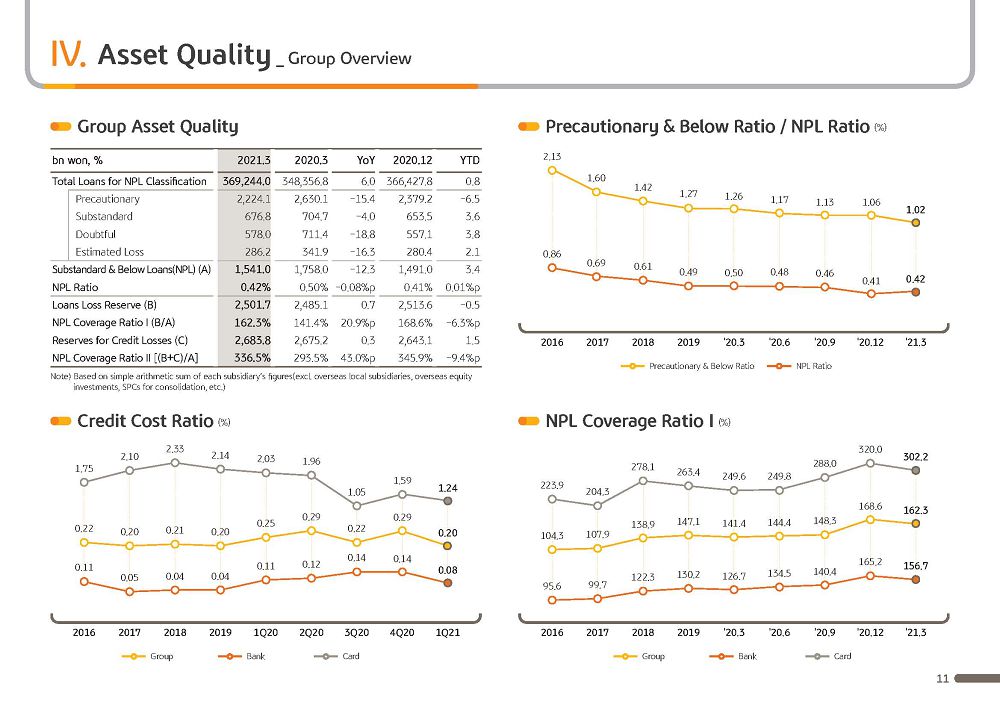

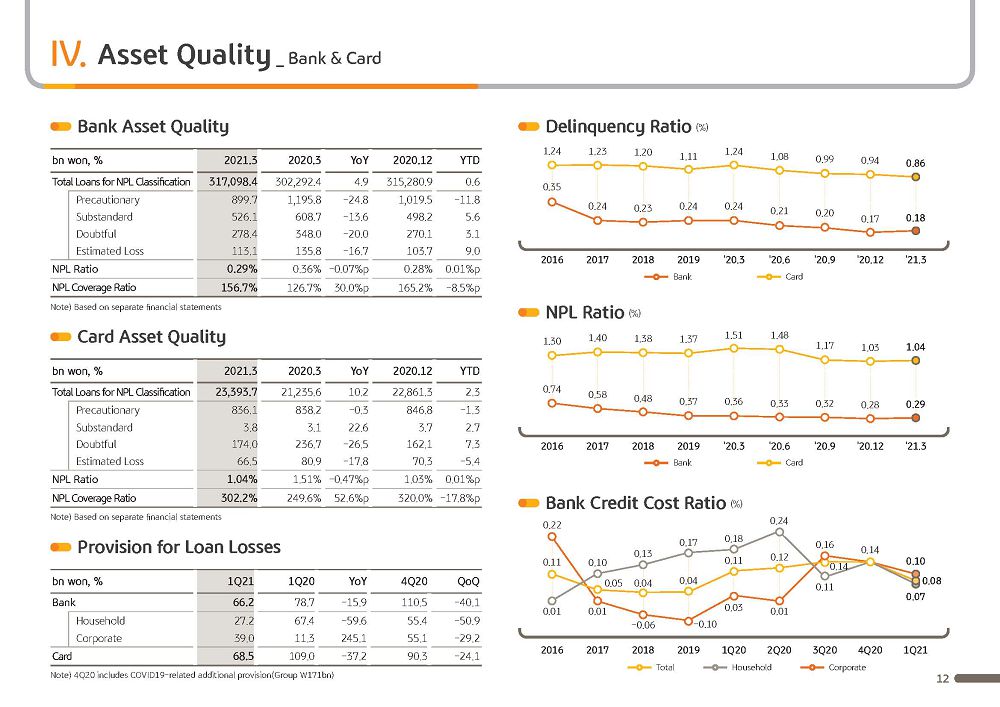

Next is on PCL. Q1 group PCL was KRW 173.4 billion. Despite group's loan growth of KRW 37 trillion in the past year, PCL was actually down KRW 70.3 billion year-on-year. And thanks to our continuous effort towards improving the quality of our loan portfolio and preemptive risk management, we are keeping asset quality at a steady level.

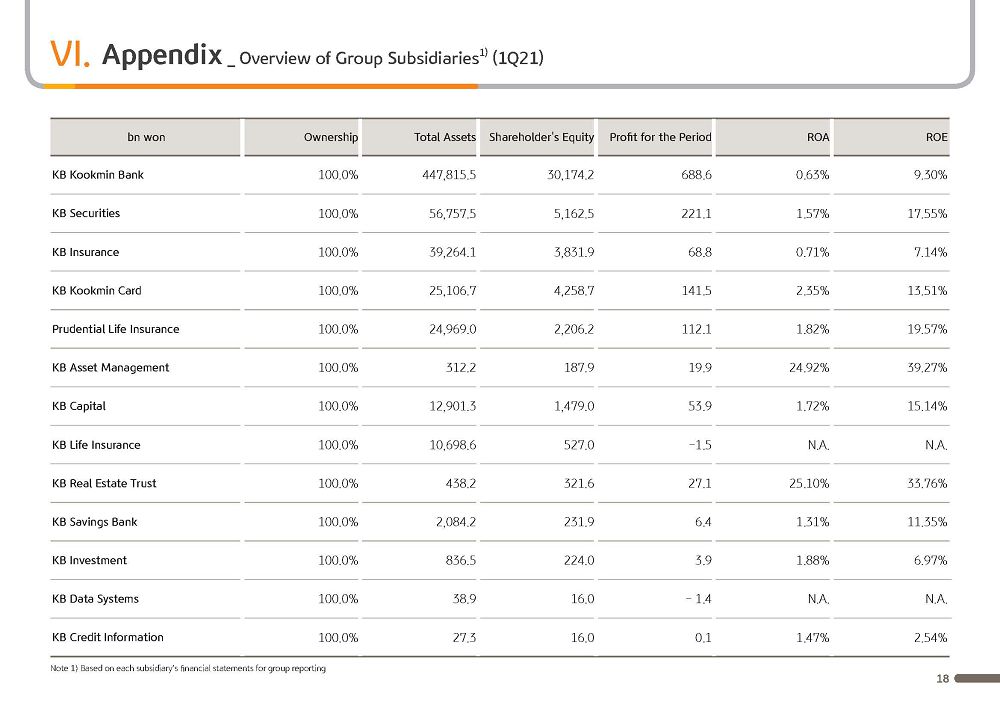

Next, if you look at the bottom-right graph, KBFG has been expanding its earnings capacity by driving our core competitiveness of each of its subsidiaries. And as a result, nonbanking businesses as of Q1 account for 48.6% of the group's net income. As such, company's overall earnings profile has improved.

For the banking business, in order to overcome the difficult business environment in the domestic market, we sought out for inorganic growth opportunities in the global markets, reinforcing our earnings capacity. For the securities business, aside from brokerage services, we strengthened profitability across all of the businesses, including wealth management, capital market and investment banking. And while for insurance, by acquiring Prudential Life, we were able to increase its contribution to the performance of the group.

(3p) First Quarter 2021 Financial Highlights-Key Financial Indicators

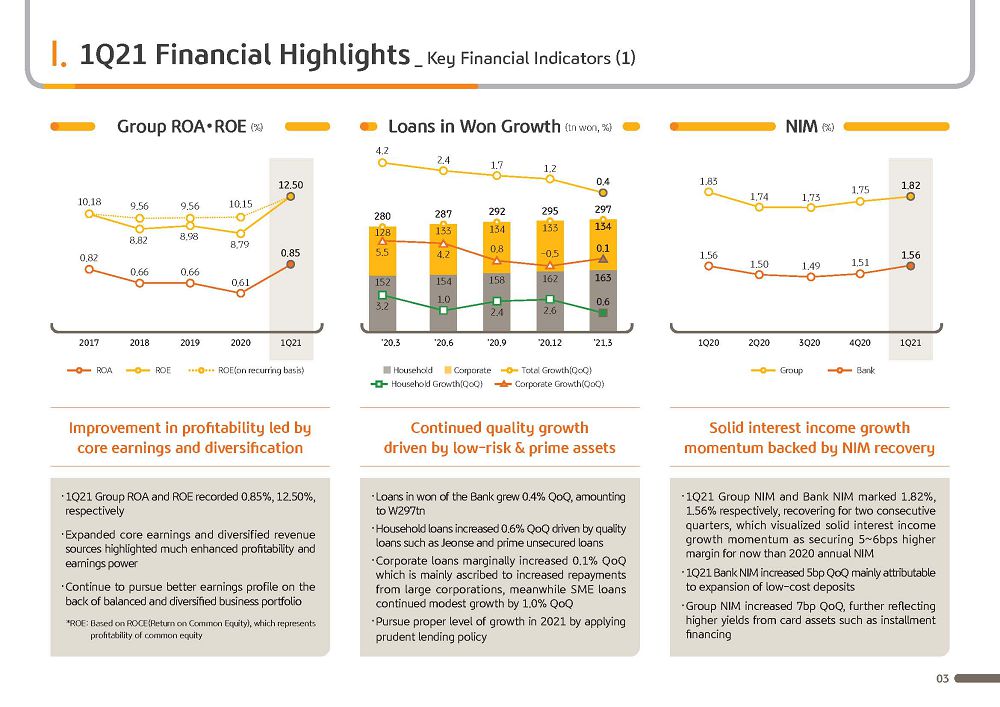

Next page is on key financial indicators. Q1 group ROA and ROE each posted 0.85% and 12.5%, respectively. Through interest income and fee income-centered core earnings growth and group level revenue diversification, we are improving profitability and maintaining sound earnings fundamentals.

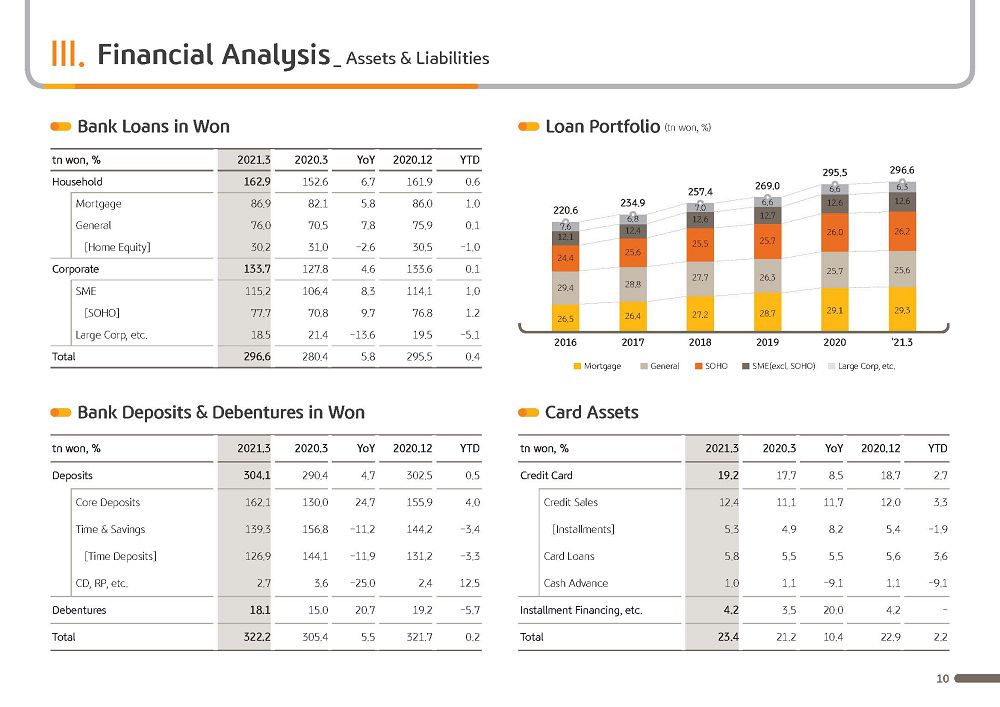

Next, to elaborate on bank's loans in won growth, as of the end of March 2021, bank's loans in won posted KRW 297 trillion, growing 0.4% YTD. Household loans posted KRW 163 trillion, growing 0.6% YTD mostly driven by Jeonse loans and prime unsecured loans. Considering the overall household debt level and loan portfolio mix, we are partially controlling the speed of growth compared to the previous year. Corporate loans grew 0.1% YTD, a marginal increase. In the case of corporate loans, due to the revitalization of corporate loan issuing market, there was overall loan demand decrease. And in March, temporarily, there was a great increase of repayments leading to around KRW 1 trillion decrease YTD. SME loans, driven by growth in SOHO loans, increased 1% YTD recording a stable growth.

Next is the net interest margin. 2021 Q1 group and bank NIM posted 1.82% and 1.56%, respectively. As was the case in the previous quarter, the net interest margin is maintaining its growth momentum. The visibility in the growth of net interest income for this year has become more clear on the back of such strong growth in NIM, which has already increased 5 to 6 basis points compared to the end of last year.

Going into further detail, in the case of the bank NIM, core deposits increased by around KRW 6 trillion for the quarter. And with the proportion of low-cost deposits among total deposits continuously increasing, which alleviates the overall funding cost burden, bank NIM increased by 5 bp Q-on-Q. In the case of the group NIM, reflecting card asset yield improvement, centering on installment financing, coupled with bank NIM improvement, it increased by 7 basis points Q-on-Q.

(4p) First Quarter 2021 Financial Highlights-Key Financial Indicators

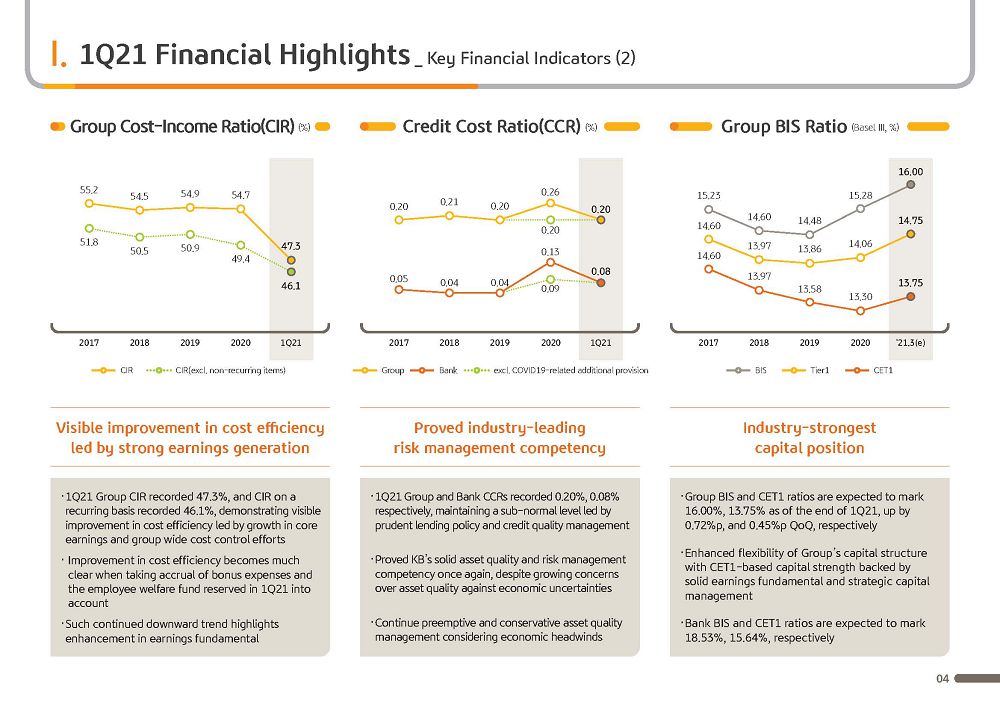

Let's go to the next page. First, I would like to cover the group's cost income ratio, the CIR. The group CIR for 2021 Q1 posted 47.3%, our efforts to increase core earnings and control costs gaining visibility. On a recurring basis, excluding factors such as digitalization costs, the CIR posted 46.1%, highlighting a gradual downward trend. For your reference, when taking into consideration the cost adjustment effect from employee welfare fund reserves for this quarter and year-end bonus expenses accrual, the cost efficiency improvement trend is much more visible. And on the back of sound top-line expansion and group-wide cost control efforts, we expect such improvement in cost efficiency to continue.

Next is the credit cost. 2021 Q1 group and bank credit cost, as a result of our continued prudent lending policy and credit quality management, posted 0.20% and 0.08%, respectively. They are being maintained at stable and low levels, proving KBFG's advanced risk management efforts. In consideration of the continued uncertainty surrounding COVID-19, we plan to maintain our preemptive and conservative asset quality management.

Next is the group's capital ratio. As of end March 2021, the group’s BIS ratio posted 16% and the CET1 ratio posted 13.75%, increasing by 72 basis points and 45 basis points, respectively, on Q-on-Q. Based on our solid earnings fundamentals, we are maintaining one of the highest CET1 levels in the industry and we are improving the flexibility of our capital structure as well, through strategic capital initiatives such as issuance of hybrid bonds.

(5p) First Quarter 2021 Key Takeaways – KB Digital Channel Competitiveness

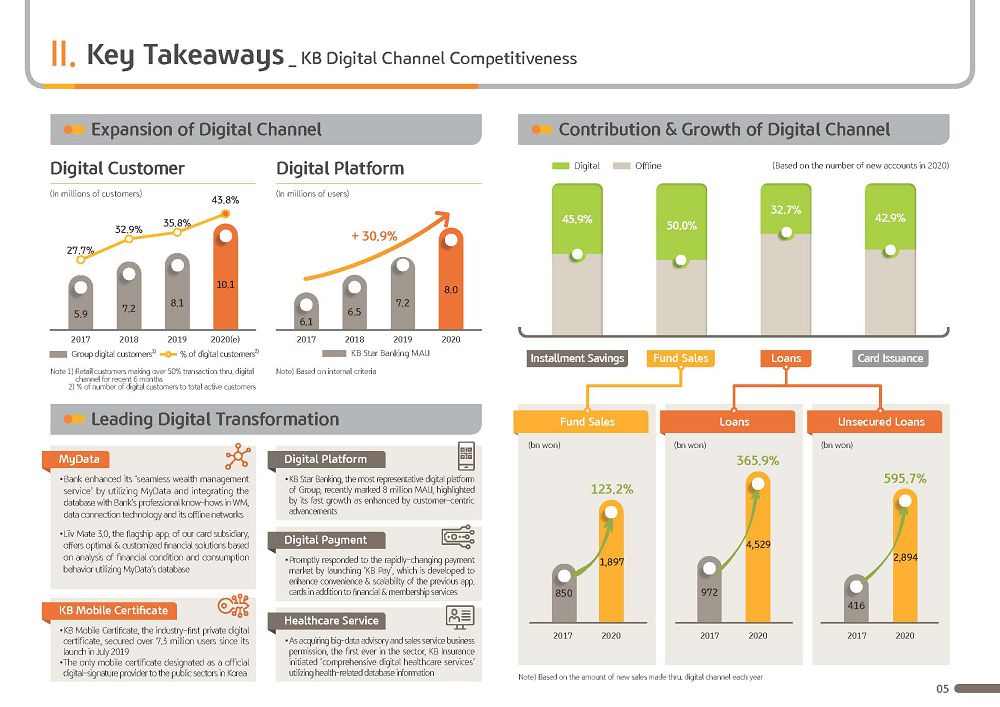

Let's go to the next page. From this page, I will cover KBFG's competitive in the digital channel. With the development of IT technology, platform models are fast evolving and in light of this, service expediency and efficiency are rapidly improving. There is higher customer preference for the digital channel with changes in the demographic such as increase of single-person households and the rise of the MZ generation. The COVID-19 pandemic has further accelerated such shift towards the digital channel, transferring the center gravity of financial transactions from the traditional face-to-face channel to the digital channel.

KBFG has been preemptively responding to these changes and as of the end of last year we have secured more than 10 million digital customers, representing approximately 44% of the group’s total active customers. In addition, the bank’s KB Star Banking, which is our group's most representative digital platform, has secured around 8 million monthly active users, MAU, maintaining its leading position in the industry. Its MAU is rapidly growing as a result of improved customer experience based on customer-centric upgrades in UI/UX and the diversity of products.

In looking at the financial transactions on the digital channel, about 50% of new accounts for installment savings and major investment products, including various funds, are being opened in the digital channels such as internet and mobile banking. Loans, which in the past had relatively low levels of digital transactions, are fast growing in the digital channels due to our efforts to revamp online loan products and simplify the transaction process. In particular, while unsecured loan accounts opened in the digital channels recorded around KRW 40 billion for the year back in 2017, this number increased to around KRW 3 trillion last year and is continuing to expand.

Next, I would like to elaborate on some of the major efforts that we're making to bolster our group's digital channel competitiveness. In January of this year, the bank and the card company became the first among our subsidiaries to acquire the MyData business license, and are aiming to launch their service in August of this year. The bank, through its KB Star Banking platform, plans to build a comprehensive financial platform that integrates all of the group’s core services and is currently advancing its wealth management service to seamlessly connect our wealth management expertise with data technology. KB Card plans to innovate is Liiv Mate 3.0, a comprehensive open platform that partners with around 130 other financial institutions to offer the most optimized and customized financial product solutions.

In addition, KB Mobile Certificate, which has been highlighted by the market for being the industry's first private digital certificate and for being selected as the official digital signature in the public sector, has gained clear competiveness in customer convenience and security and as a result, has accumulated over 7.3 million registered users in just 1 year and 8 months after launch. We expect such trend to continue and that the mobile certificate will contribute greatly to the customer experience.

In addition, KB Card has innovated its app card service to launch “KB Pay” to gain competitive edge in the fast-changing payment market. KB Insurance also plans to offer a highly customized digital healthcare service based customer health information in order to secure a new level of competitiveness.

Last but not least, KBFG plans to go beyond innovating its digital channel and seeks to elevate the quality of service in wealth management advisory and loan consulting, which are areas that the traditional face-to-face channel still has great importance, by providing specialized advisory services and differentiated products. Through a seamless connection between the digital channel and the face-to-face channel, we are doing our best to maximize customer convenience and satisfaction and maintain our position as the leading financial group in the middle of this paradigm shift in the financial industry.

The next pages cover more detailed information regarding our earnings that I covered in the previous pages.

With this, I will conclude KBFG's Q1 2021 Business Results Presentation. Thank you for listening.