-

Please adjust the volume.

1H21 Business Results

Greetings and Summary Greetings. I am Peter Kwon, the Head of IR at KBFG. We will now begin the 2021 first half business results presentation. I would like to express my deepest gratitude to everyone for participating in our call. We have here with us our group CFO and Senior Executive Vice President, Mr. Hwan-Ju Lee, as well as other members from our group management. We will first hear major financial highlights from our CFO and Senior Executive Vice President, Mr. Hwan-Ju Lee, and then engage in a Q&A session. I would like to invite our CFO to walk us through the major financial highlights of first half of 2021.

Good afternoon. This is Hwan-Ju Lee, CFO of KB Financial Group. Thank you for joining KBFG’s presentation on 2021 first half business results. Before moving onto the business performance, let me first brief you on the operational background.

In the second quarter, despite the continuing COVID-19 vigilance, exports and CapEx investments continued their positive trends and with the full-fledged vaccine rollout, pent-up demand drove higher private consumption, providing the momentum towards Korea's economic recovery. As for the banking sector, share prices outperformed the market reflecting market expectation on rate hikes, improved financial performance and shareholder return. As such, it was largely regarded that banks have entered a re-rating cycle.

On the other hand, the financial industry still faces many uncertainties, including the spread of the delta variant and concerns over inflation, especially from the U.S. Even in such difficult environment, KB Financial Group is doing its utmost to enhance shareholder value through continued earnings expansion and efficient capital management. At the same time, we are determined to fulfill our role and responsibility befitting a leading financial group in Korea.

Today, our board of directors, for the first time in the group’s history, resolved to declare an interim dividend of KRW 750 per share to shareholders as of the end of June 2021. Based on our industry-highest capital adequacy and strong earnings fundamental, we wish to provide to our shareholders more stable and fluid cash flow and also to continue with KB's steadfast progressive dividend policy. Going forward, we plan to continue to explore various ways to use our capital efficiently and expand shareholder value in order to enhance shareholder value.

Next, I would also like to emphasize that as a leading financial group, KB continues to make robust progress in its green leadership in the financial industry. In order to provide financial support to companies that drive environmental and social values, KBFG is issuing various different types of ESG bonds and are actively participating in the government's new deal project by way of launching a new deal infrastructure fund of KRW 200 billion, making investments into renewable energy sources, environmental facilities and electric vehicles. As such, we've been undertaking various ESG initiatives with quite some speed.

Last June, we were the first domestic financial group to disclose carbon emissions from our asset portfolio and declared “KB Net Zero Star” (S-T-A-R), which is a goal to achieve carbon neutrality by 2050. This was meaningful in that KB was able to transparently disclose carbon emissions from its loan book and other assets by scientifically measuring carbon emission with application of global standards such as PCAF* and SBTi**.

* Parnership for Carbon Accounting Financials

** Science Based Target Initiatives

Going forward, KB Financial will continue to improve its level of ESG management by incorporating such global initiatives and will continue to deliver on our promise to bring about financial services shaping a better future for all.

With this, I will now move onto the earnings for the first half of 2021.

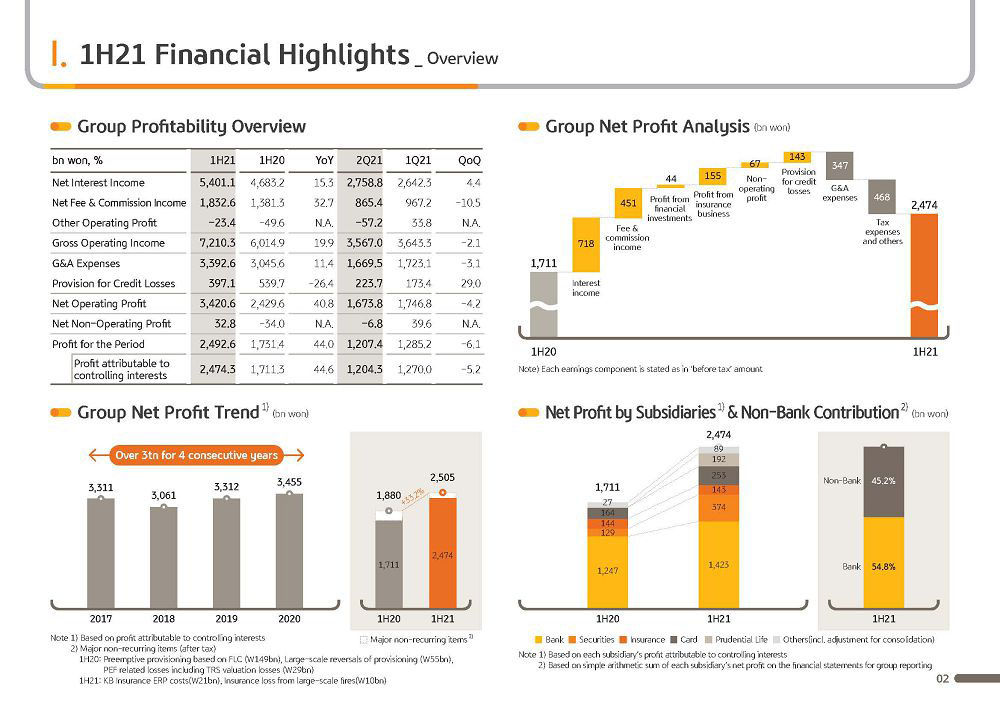

(2p) 2021 First Half Financial Highlights-Overview

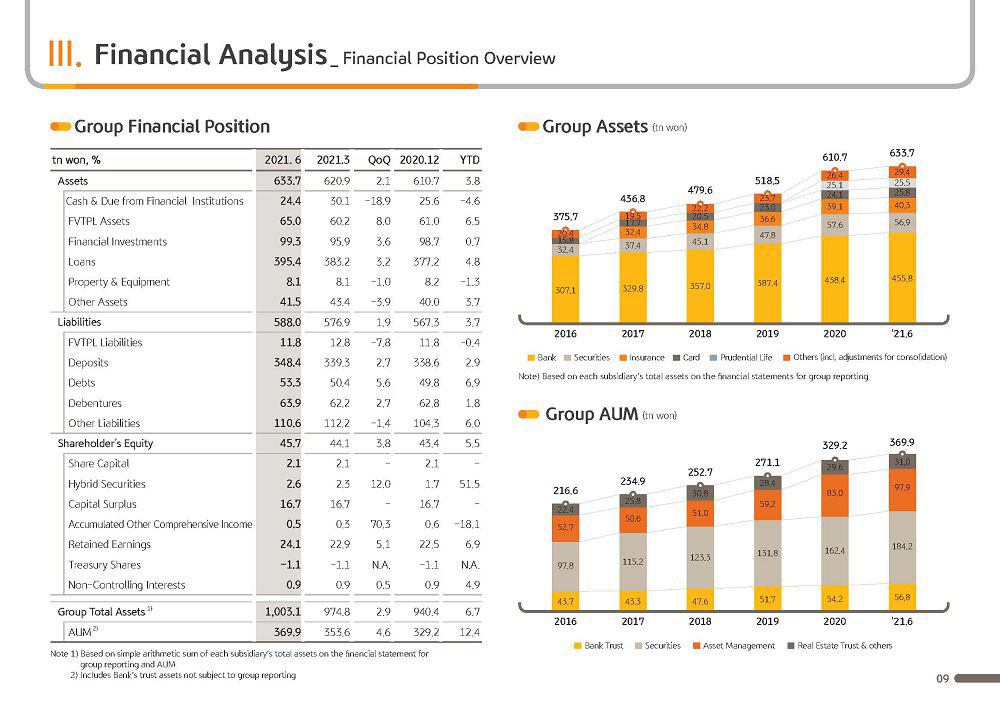

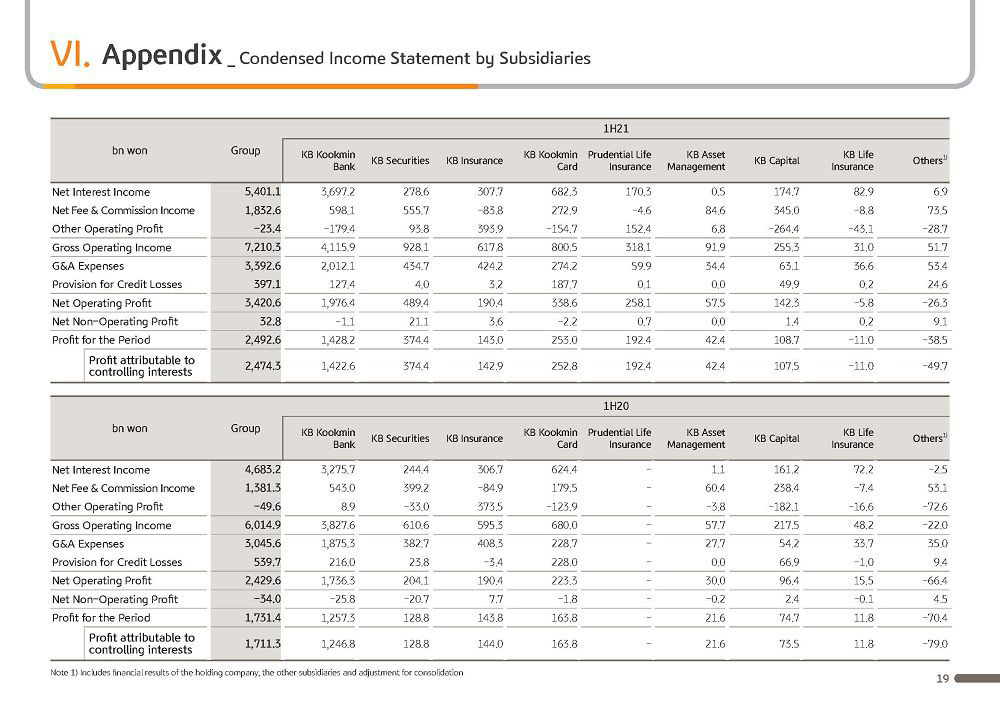

KB Financial Group's 2021 first half net profit was KRW 2,474.3 billion. Driven by solid growth from core earnings, as well as stronger earnings stability from inorganic growth and the base effect from additional provisioning in the second quarter of last year, net profit was up 44.6% on year, recording biggest half year figure since the establishment of the company.

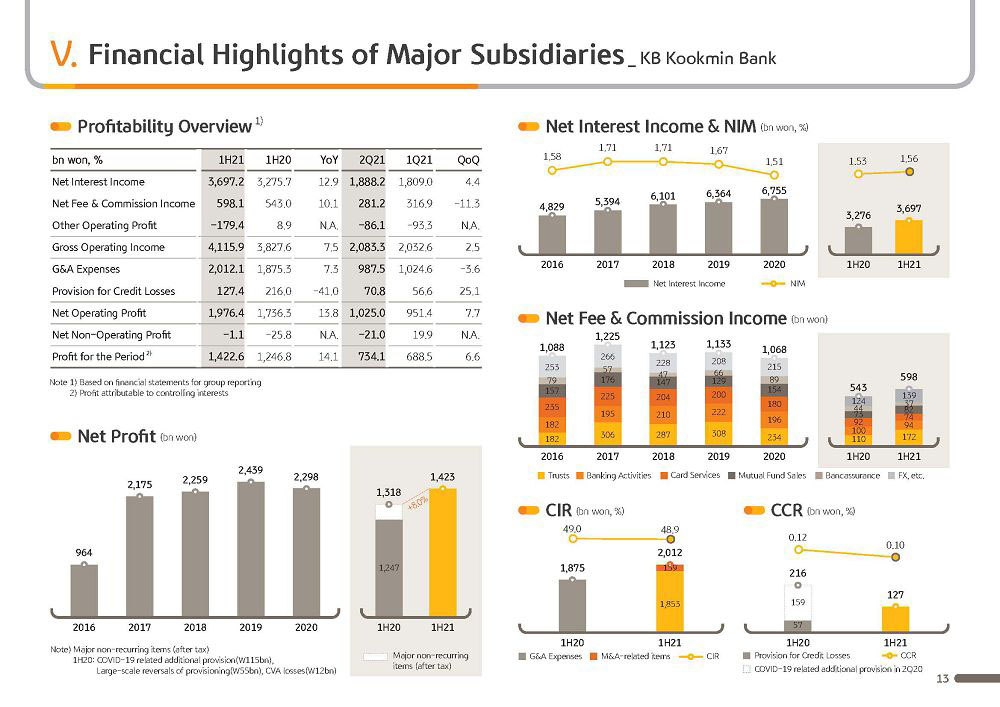

Q2 net profit was KRW 1,204.3 billion, which is a 5.2% decline QoQ. While net interest income continued to improve on the back of solid loan growth, net fee and commission income growth was somewhat subdued due to a decline in sales from securities brokerage and bank trusts. Additionally, valuation gains from bonds declined on higher market interest rate. On a recurring basis, however, excluding factors such ERP expenses from KB Insurance, Q2 earnings showed a solid performance. Let's now look at each of the segments in more detail.

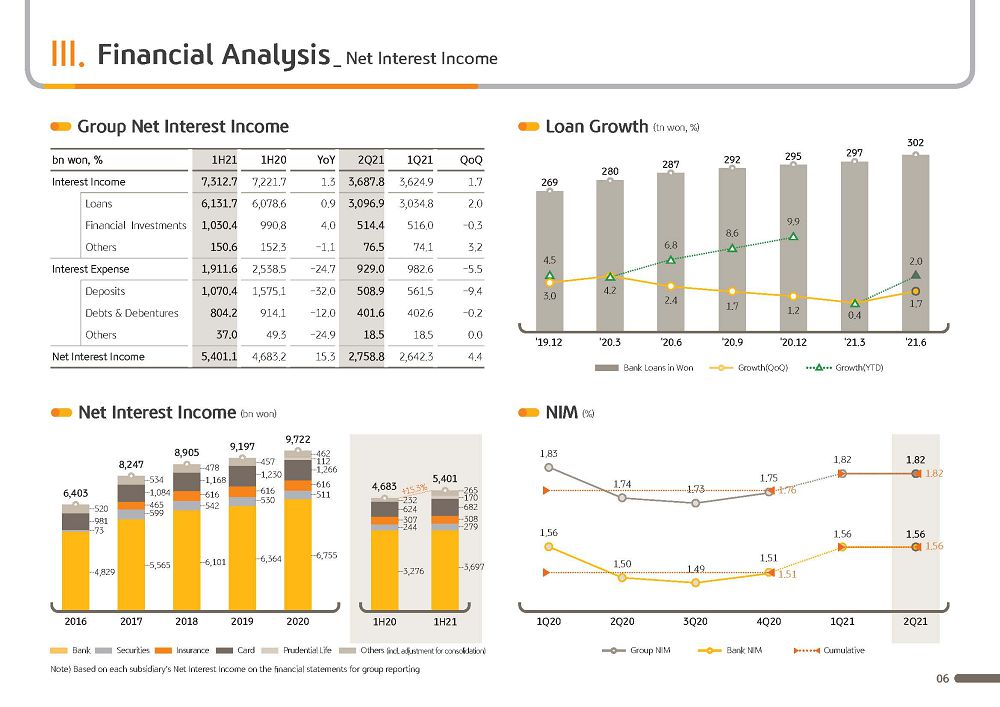

Group's net interest income for the first half of 2021 was KRW 5,401.1 billion. Driven by inorganic growth such as acquisition of Prudential Life, the bank's solid loan growth and increased contribution from non-banking subsidiaries, net interest income improved 15.3% YoY.

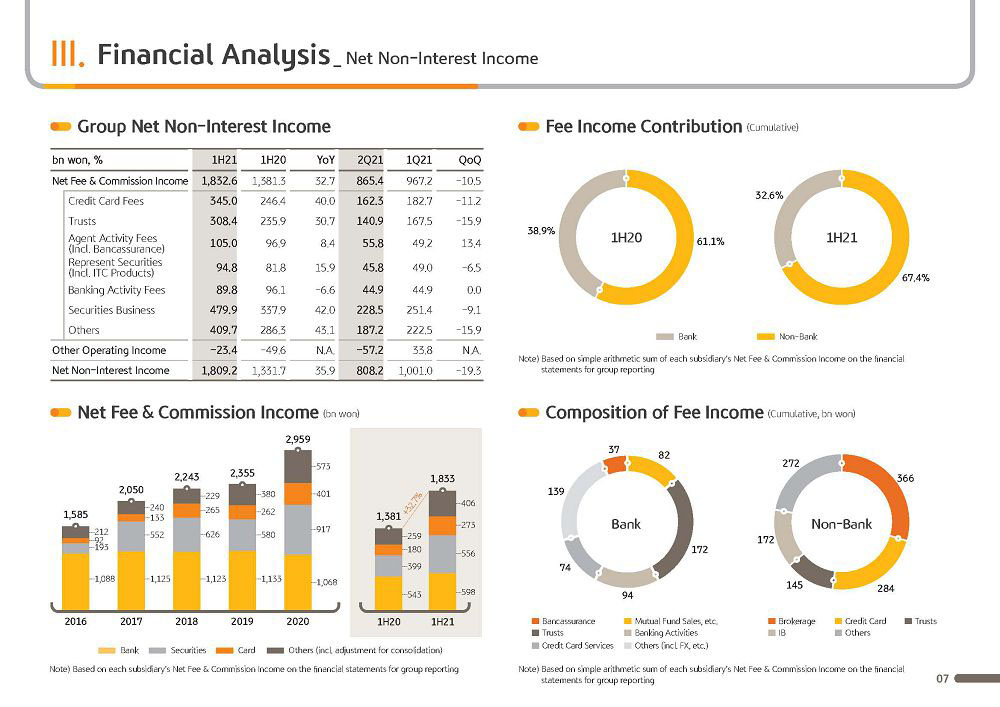

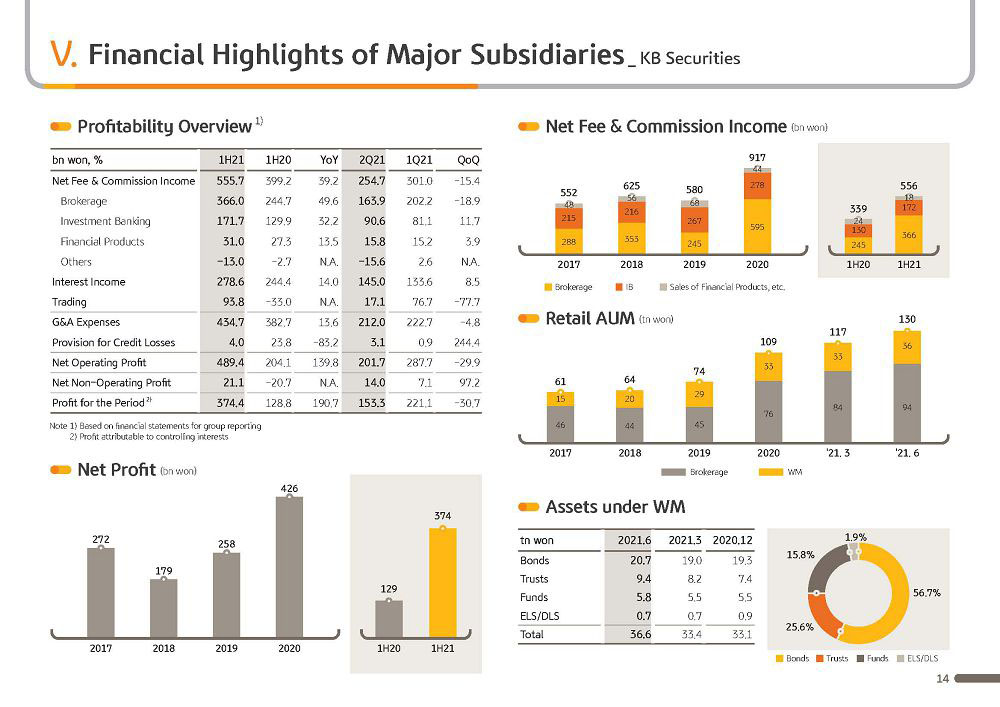

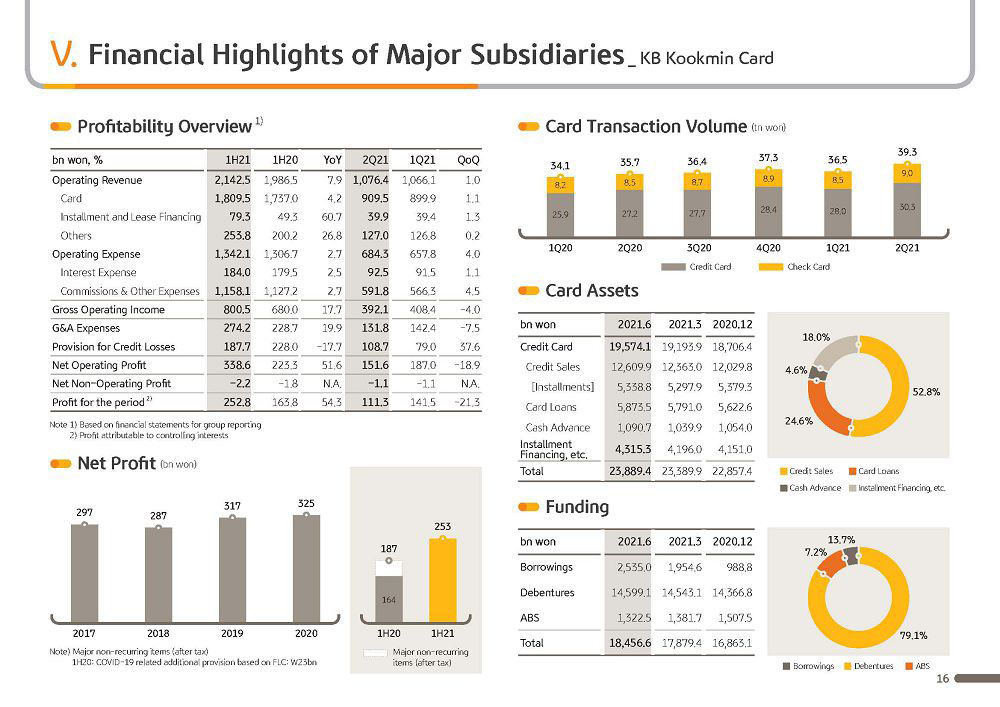

First half group net fees and commission income was KRW 1,832.6 billion, which improved 32.7% or KRW 451.3 billion YoY. Such sizable improvement was driven by growth in brokerage assets as well as continued expansion in the IB business, which led to significant improvement in income from securities business, as well as increased sales of bank trusts and expanded card merchant fees based on recovery of private consumption.

However, second quarter's fee commission income was KRW 865.4 billion, which was down 10.5% QoQ. Despite solid growth in the IB business, retail trading volume decreased in the second quarter, leading to decline in brokerage fees, and fee income from bank trusts also declined based on reduced sales.

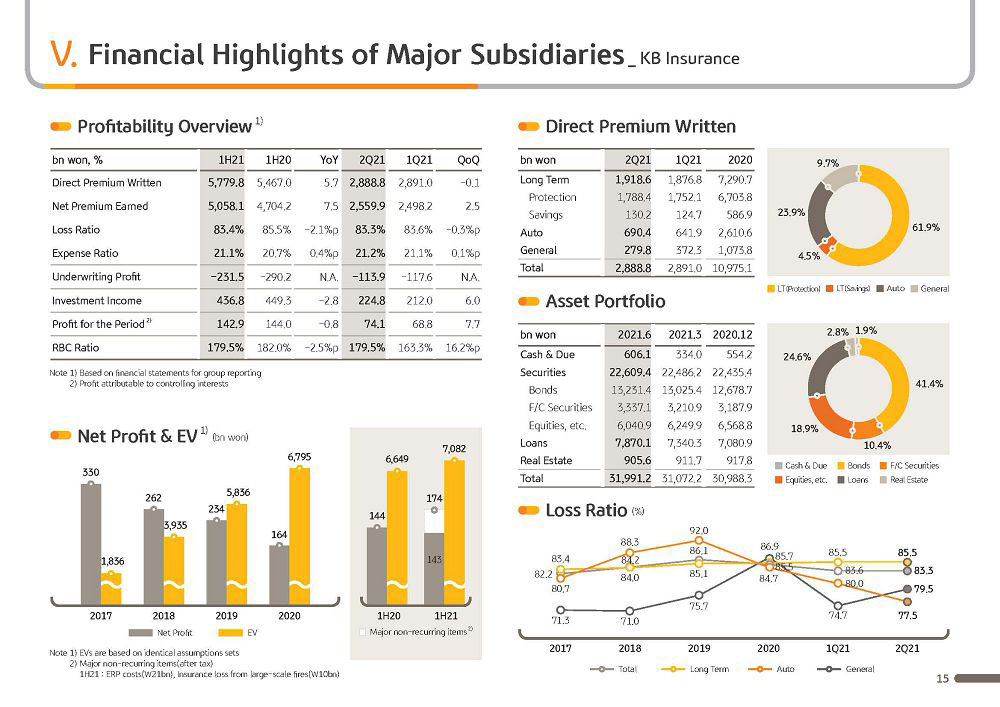

Second quarter other operating loss recorded KRW 57.2 billion, which is somewhat subdued QoQ mainly due to lower valuation gains on bonds against the market rate hike. In Q2, insurance underwriting profit recorded KRW 161.7 billion. Apart from one-off factors such as payment for large-scale fire, it was able to record a slight improvement QoQ, driven by improvement in the loss ratio, especially auto insurance, based on lower auto accident rate and increases in insurance premium.

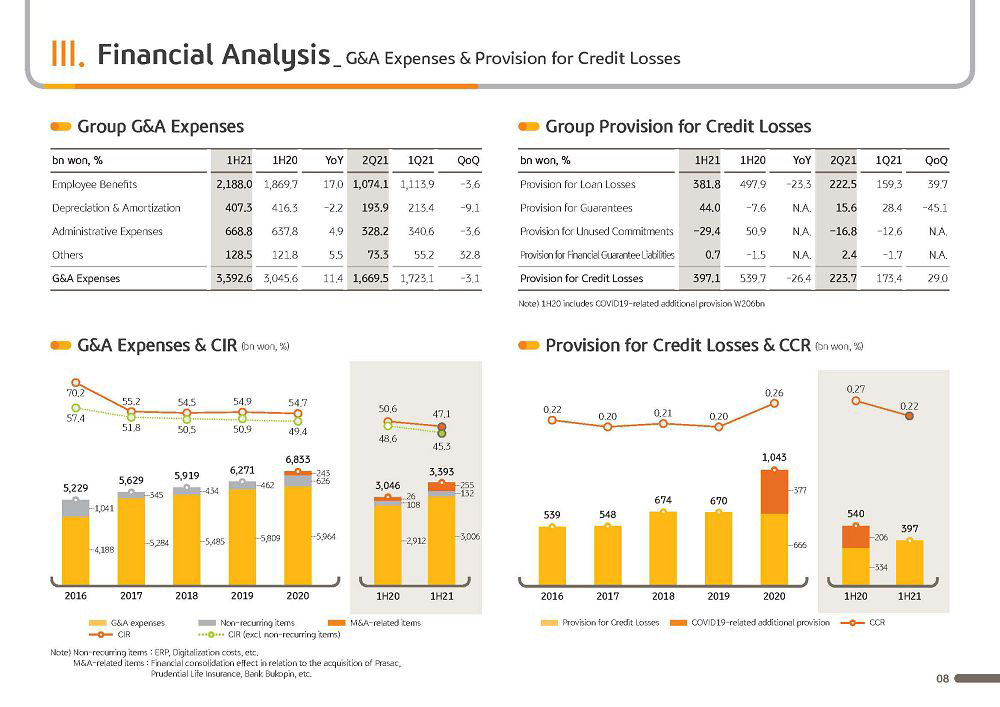

Next is group's G&A costs. Q2 group G&A recorded KRW 1,669.5 billion. On the back of cost-saving efforts across the group, as well as the forgone impact from last quarter’s expenses in employee welfare funds, G&A expenses declined by 3.1% QoQ. Excluding this quarter’s ERP costs, G&A expenses declined by 5% QoQ. Meanwhile, first half G&A recorded KRW 3,392.6 billion. It seems slightly elevated YoY, but this is due to consolidation effect from M&As including Prudential Life as well as the ERP expense from KB Insurance. Excluding these factors, G&A is being managed quite well.

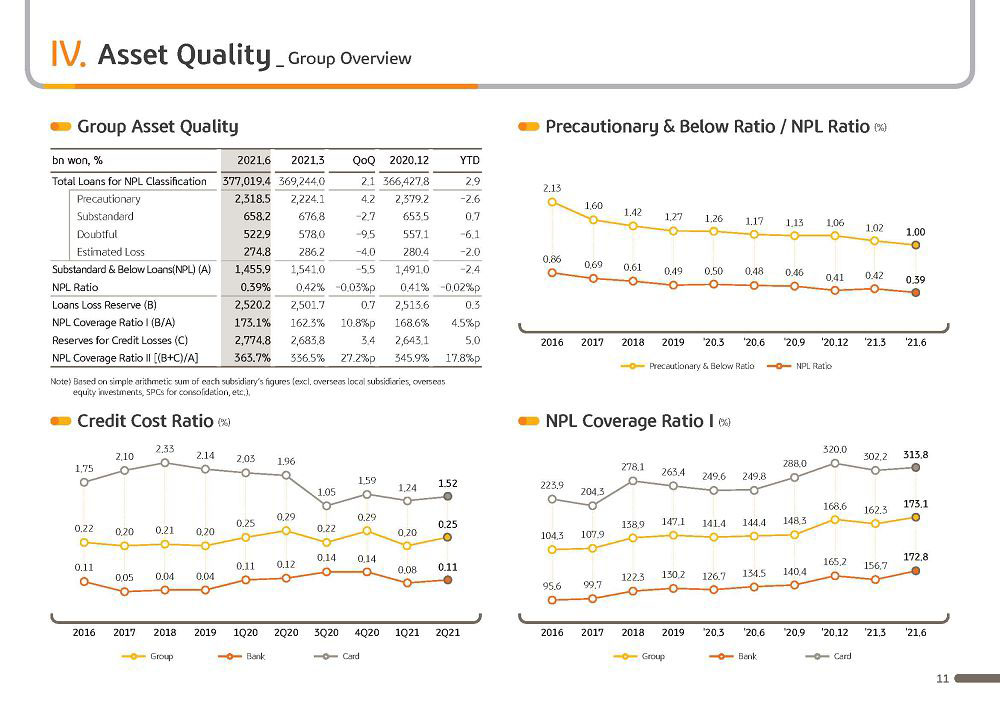

Next is on PCL. Group's first half PCL reported KRW 397.1 billion. Together with quality growth around prime assets and preemptive risk management efforts, as well as the forgone impact from additional provisioning in Q2 of last year, PCL was down significantly by 26.4% YoY. Q2 group PCL was KRW 223.7 billion, increasing 29.0% QoQ due to factors such as bank’s asset growth and decline in reversals. Group credit cost, however, recorded at 0.25%, maintaining stable asset quality levels.

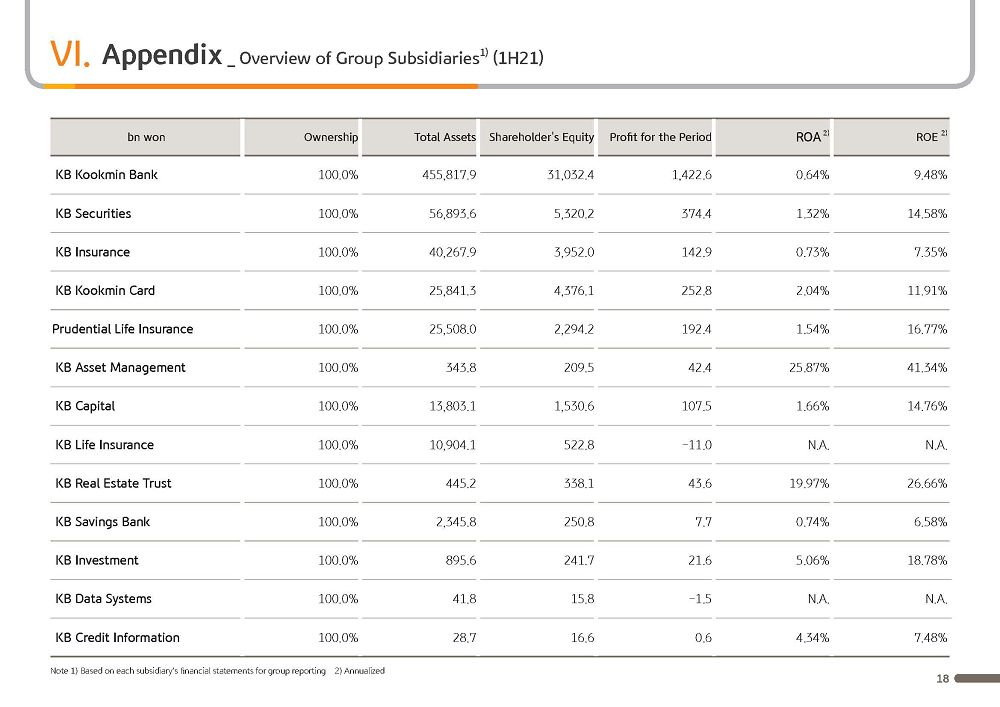

Next, if you look at the graph on the lower right, nonbank share of group's net profit in first half of 2021 was around 45.2%. This was achieved through KB’s efforts in diversifying its business portfolio through M&A and expanding the revenue base through strengthening of core businesses. We will continue to discover new sustainable growth engines in order solidify our business portfolio and strengthen the core competitiveness of our subsidiaries and in turn, we will enhance KB Financial Group’s corporate value.

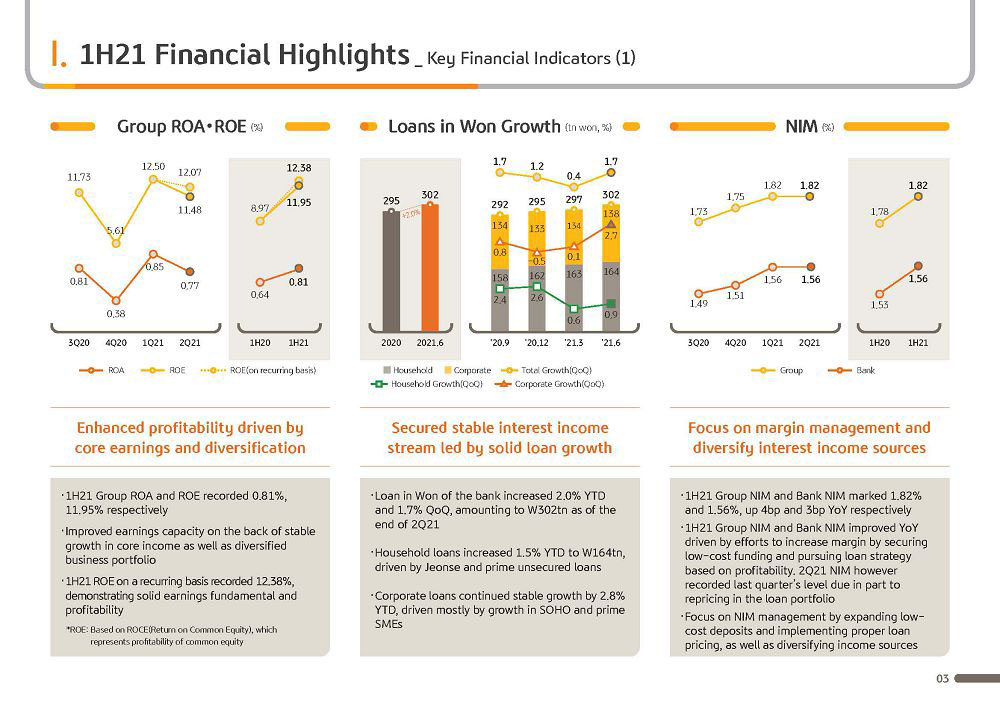

(3p) 2021 First Half Financial Highlights-Key Financial Indicators

Next page is on key financial indicators. 2021 first half cumulative group ROA and ROE each recorded 0.81% and 11.95%, respectively. Earnings capacity improved on the back of stable growth in core income as well as diversified business portfolio through M&As. When taking into account major one-offs, recurring ROE also posted 12.38%, maintaining a sound fundamental earnings level and profitability.

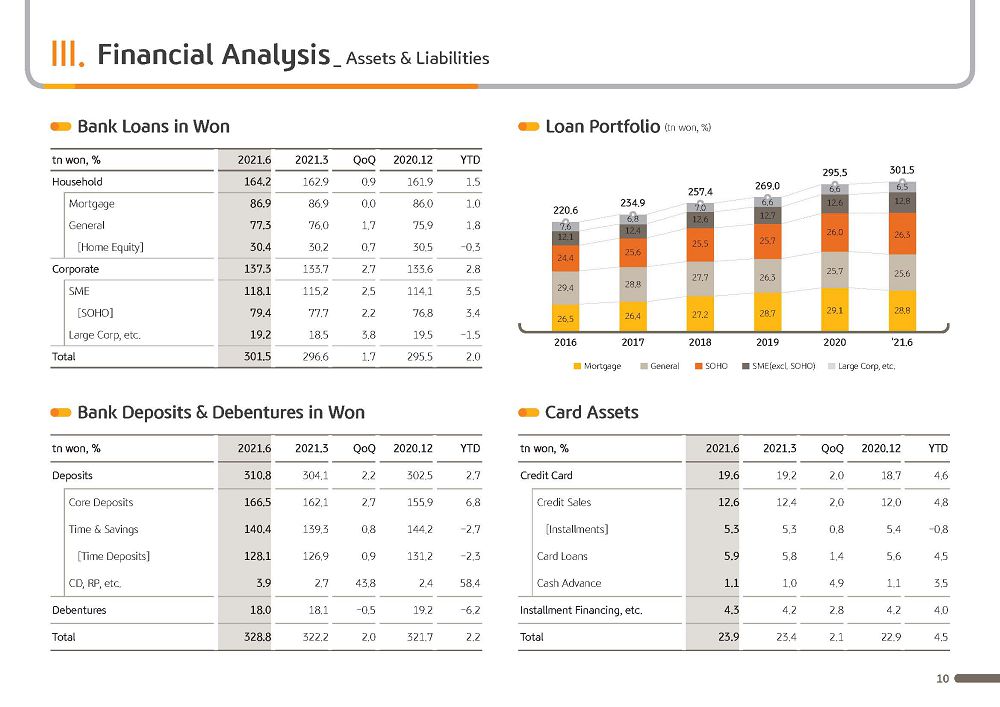

Next, to elaborate on the bank's loans in won growth, as of the end of June 2021, bank's loans in won posted KRW 302 trillion, a 2.0% increase YTD. And in Q2, on the back of profitability and asset quality-centered qualitative growth and increased sales, loans in won increased 1.7% from the end of the previous quarter. Household loans posted KRW 164 trillion, increasing 1.5% YTD and 0.9% from the end of last quarter, driven by Jeonse and prime unsecured loans. Corporate loans continued stable growth, driven mostly by SOHO and prime SMEs and grew 2.8% YTD and 2.7% from the end of last quarter.

KB Financial Group will closely monitor developments in the economy and household debt in the second half and continue qualitative growth centering on asset quality, but also apply a flexible and timely pricing policy to secure a growth basis.

Next is the NIM. 2021 first half group and bank NIM each posted 1.82% and 1.56%, respectively, which increased by 4 bp and 3 bp YoY, respectively. NIM expansion continued as a result of reduced funding costs based on our efforts to expand low-cost deposits, as core deposits increased by KRW 11 trillion and saving deposits decreased by KRW 4 trillion, and increased margins based on profitability-centered loan strategy. Q2 NIM however recorded at the previous quarter’s level due to the loan asset repricing effect from interest rate cuts last year.

Based on our highest level of channel competitiveness domestically, KB will focus on expanding low-cost deposits. And also, through a more sophisticated loan pricing method, we will improve asset yields to expand NIM and do our best to diversify our group’s income sources. Let’s go to the next page.

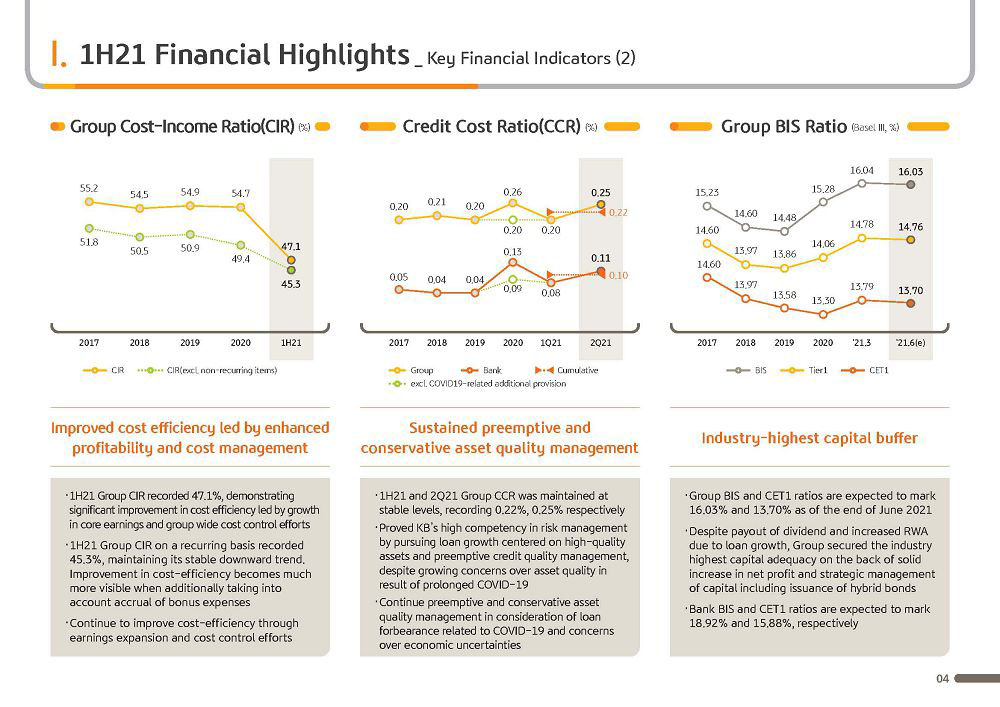

(4p) 2021 First Half Financial Highlights-Key Financial Indicators

Next, I would like to cover our group cost/income ratio, CIR. 2021 first half cumulative CIR posted 47.1%, recording a significant improvement YoY as a result of top line growth and cost control efforts. Excluding one-offs, including ERP costs, recurring CIR posted 45.3%, continuing a stable downward trend and making more visible the cost efficiency improvement. Going forward, we will do our best to further improve cost efficiency through continuing earnings expansion efforts and group-wide cost control.

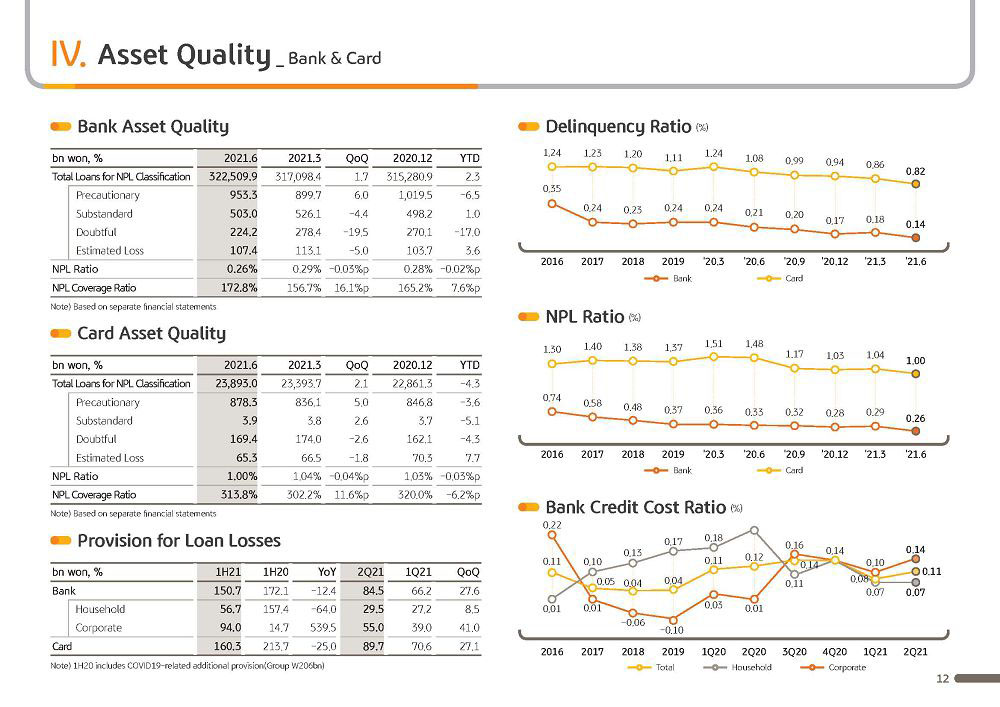

Next, I would like to cover the CCR, credit cost ratio. 2021 first half group and credit cost posted 0.22% and 0.10%, respectively. As a result of high-quality assets centered positive growth and preemptive risk management efforts, CCR recorded at a stable and low level. We are aware that there are concerns over asset quality deterioration that may rise after the end of forbearance programs related to COVID-19. But in regard to interest forbearance, which the market is most worried about, the principal on these loans recorded around KRW 300 billion, which makes only 0.1% of the total amount of loans in won. In addition, the percentage of these loans that is prime-rated is 70% and the percentage of these loans secured by collateral is 90%. In considering that the loan balance continues to decline due to voluntary repayment from borrowers, we expect to be able to fully manage the potential asset quality risks upon the end of the forbearance support.

The group also made additional provisions of KRW 380 billion and since we have secured a preemptive buffer, we believe that the possibility that the group's credit cost will rapidly increase is very limited. KB will continue to carefully manage potential NPL loans and improve the sophistication of the risk management system by industry and borrower. In maintaining our preemptive and conservative risk management stance, we expect asset quality numbers will continue to be stable in the near future.

Next, I would like to cover the group's capital ratio. As of the end of June 2021, group BIS ratio posted 16.03% and CET1 ratio posted 13.70%. Despite the increase of risk-weighted assets from loan growth and the payout of interim dividends, on the back of net income growth and strategic capital management including issuance of hybrid bonds, KB’s capital adequacy remains among the highest levels in the industry.

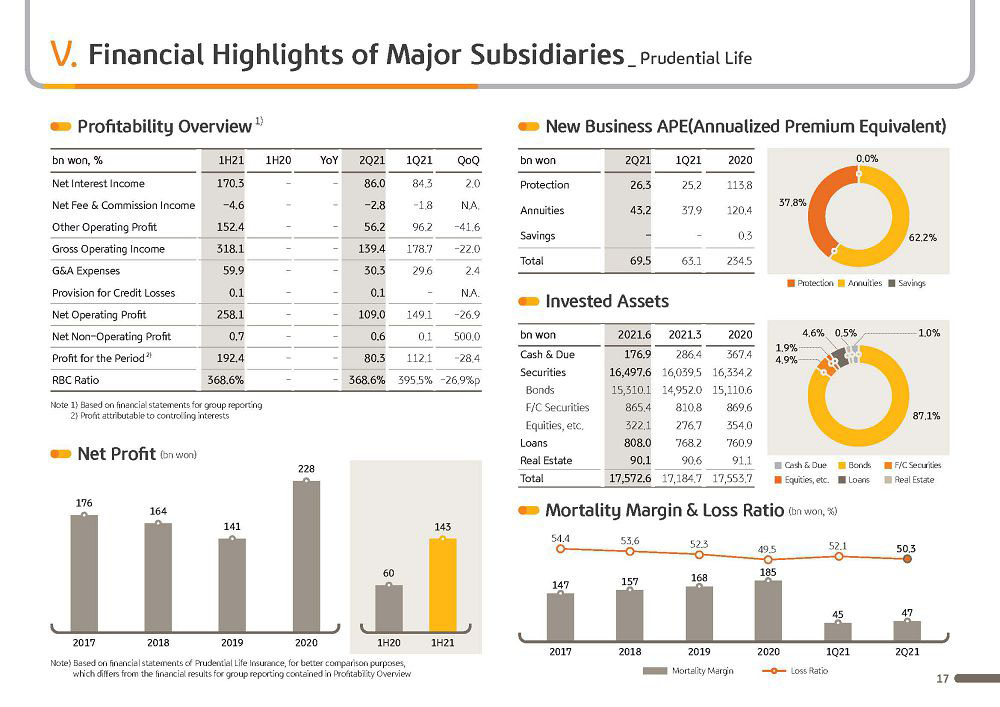

(5p) 2021 First Half Key Takeaways – Strengthening the Insurance Business

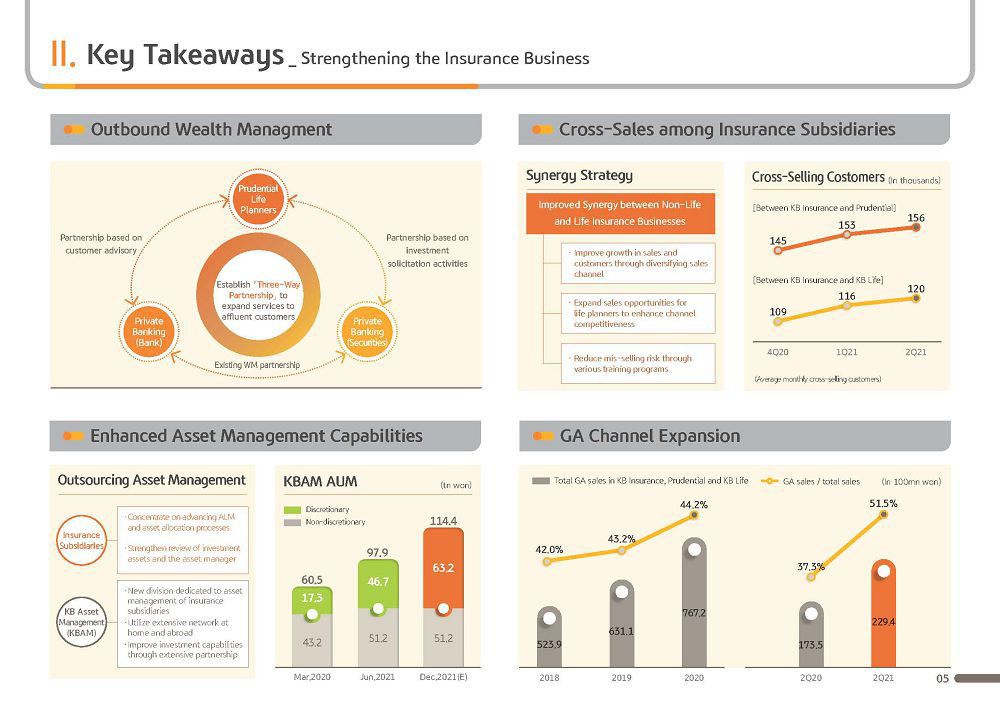

On the next page, I would like to discuss our strategy to strengthen collaboration among our insurance businesses. Through acquiring Prudential Life in August of last year, we have strengthened our life insurance business portfolio and in providing financial services to customers in every stage of their life cycles, we expect the roles of our insurance subsidiaries, KB Insurance, Prudential Life and KB Life, will continue to expand as we strive to remain closely intact with customers’ financial needs and strengthen our customer contact points. In order to increase group business value and synergy, KB is strengthening our collaboration system in all areas, including product, channel and organization.

First, we have established Star WM (Wealth Manager), which is in its pilot operation, and through this program, we are aiming to strengthen our sales in the affluent customer market by advancing our WM business through collaboration between Prudential’s life planners and private bankers at the bank and the securities company and integrated advisory services that encompass inheritance, retirement and pension.

In addition, we are in the process of expanding outsourcing of assets held by insurance subsidiaries to KB Asset Management. Insurance subsidiaries will concentrate on planning and reviewing the allocation of assets and advancing its ALM processes, while the asset management company will seek to improve its asset management capabilities by utilizing its economies of scale, expert asset managers and networks at home and abroad.

KB Asset Management’s AUM increased to KRW 98 trillion as of the end of June after absorbing assets from KB Insurance and KB Life Insurance. When it absorbs assets from Prudential Life, we expect its AUM to increase to KRW 114 trillion, which will establish KB Asset Management among the top two in the industry based on AUM. At the same time, we are expanding collaboration among our insurance subsidiaries. Through activating cross-selling between insurance subsidiaries, we will increase customer inflow by securing more sales channels. And through expanding opportunities to sell products from other subsidiaries, we will strengthen sales competitiveness of our dedicated channels. And through systematic planner training and management, we will reduce mis-selling sales risk, leading to greater synergy among insurance subsidiaries.

For your reference, the number of cross-selling customers among insurance subsidiaries in Q2 was about 280,000 customers, and it increased by about 9% after Q4 of last year right after acquiring Prudential Life. Going forward, through sales of high-value products and expanding sales manpower, we plan to systematically expand cross-selling activities. We are also aware of the increasing influence of the GA channel, resulting from the widespread trend in separating product manufacturing from product sales. In addressing this, KB Insurance and KB Life Insurance collaborate on their marketing efforts towards the GAs in order to maximize efficiency in operation of the GA channels.

New sales through the GA channels currently make up about 52% of the total sales as of Q2. Through balanced growth of the dedicated channel and the GA channel, we aim to continue to increase our market share. Apart from this, we are also expanding synergy by establishing shared service centers that is available to all insurance subsidiaries. Before the adoption of IFRS 17 in 2023, our insurance subsidiaries will closely coordinate and underwrite products that can deliver high value. We are also improving cost efficiency in many ways, including co-operation of IT and call center and utilization shared infrastructure to execute digital marketing to secure a sustainable growth momentum

From the next page, we have the details regarding the results that I have aforementioned. With this, we will conclude KB Financial Group's 2021 First Half Earnings Presentation. Thank you for listening.