-

Please adjust the volume.

3Q21 Business Results

Greetings and Summary

I am Peter Kwon, the Head of IR at KBFG. We will now begin the 2021 third quarter business results presentation. I would like to express my deepest gratitude to everyone for participating in our call. We have here with us our group CFO and Senior Executive Vice President, Mr. Hwan-Ju Lee, as well as other members from our group management. We will first hear major financial highlights from our CFO and Senior Executive Vice President, Mr. Hwan-Ju Lee, and then engage in a Q&A session. I would like to invite our CFO to walk us through the major financial highlights of third quarter 2021.

Good afternoon. This is Hwan-Ju Lee, CFO of KB Financial Group. Thank you for joining KBFG’s presentation on 2021 third quarter business results. Before moving onto the business performance, let me first brief you on the operational background.

Last August, in considering factors such as the recovering trend in the domestic economy, inflationary pressure and deepening financial imbalance, BOK hiked its policy rate by 25 basis points for the first time in 15 months. Following the rate hike, although bank share prices temporarily gained a positive momentum driven by expectations on NIM improvement, uncertainties at home and abroad continue to increase based on the spread of the delta variant, concerns over economic peak-out, and early tapering in the United States. In addition, from the entry of the big techs in the financial industry and the possibility of separation of sales and production, there are rising concerns that such factors may undermine the competitiveness of the legacy banks. The current operation environment therefore is presenting many challenges ahead.

In particular, based on the possibility of additional policy rate hike this year and the extension of financial support programs for SMEs affected by COVID-19 by another six months, there is a growing concern over deterioration in asset quality and a growing need to for financial companies to step up their risk management efforts.

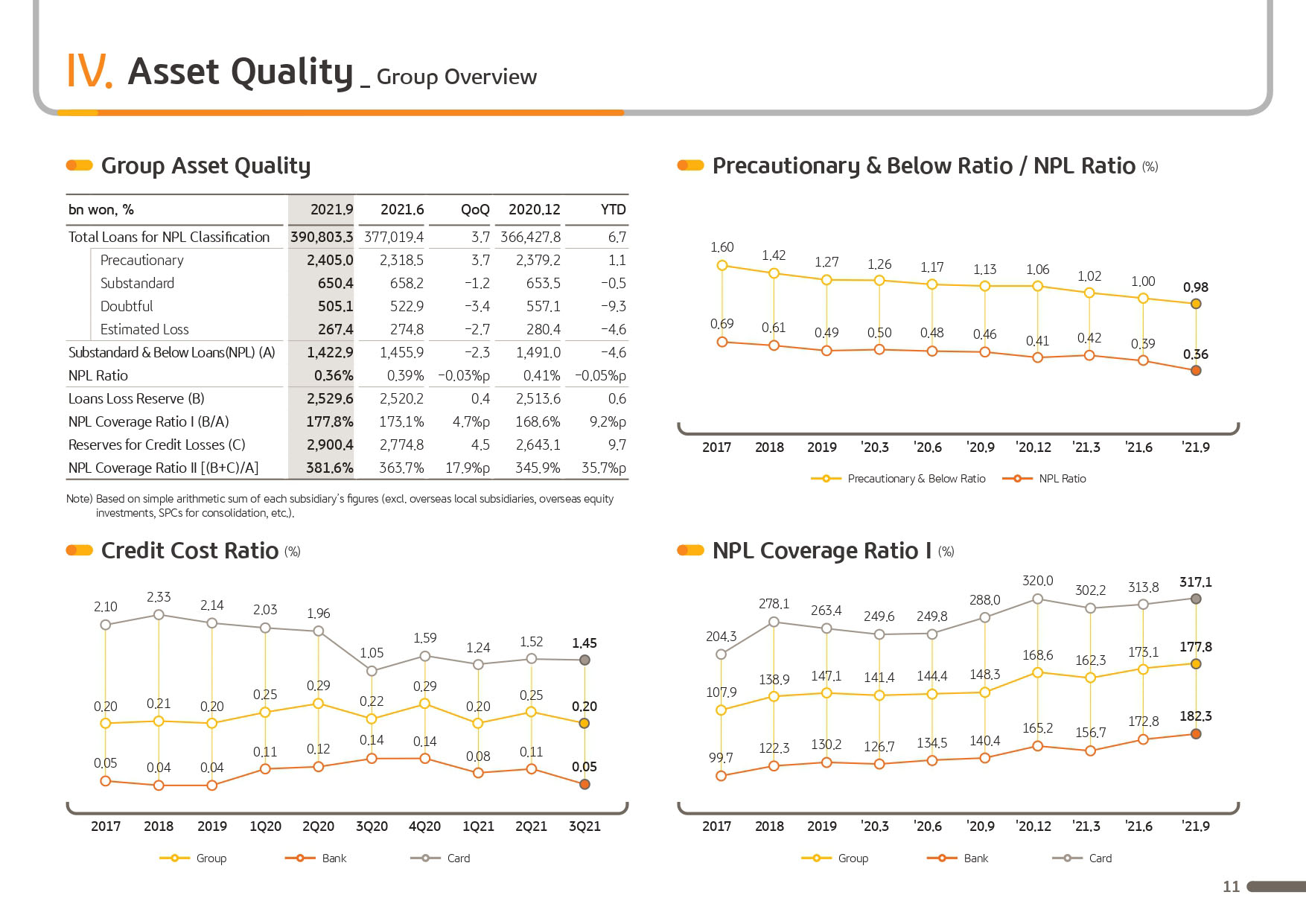

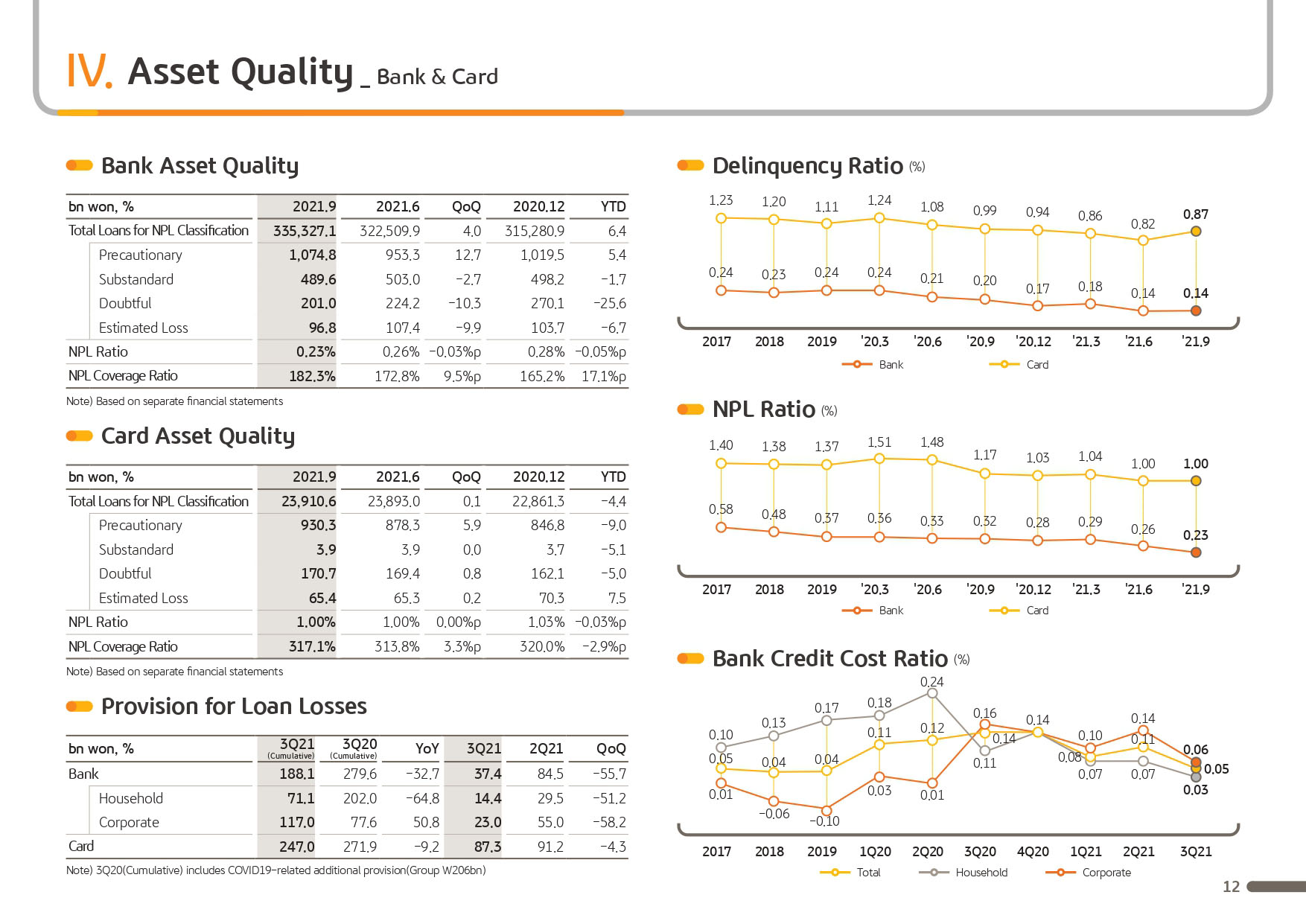

First, let me assure you that KB’s asset quality remains very stable underpinned by our rigorous risk management framework. However, even if the current level of asset quality is very solid, because we cannot completely preclude possible deteriorations at the end of the financial support programs, especially considering the retrospective nature of financial business, we have taken many steps to rigorously defend against the potential risks. In particular, we have initiated a comprehensive plan for loan assets by strengthening credit monitoring of vulnerable borrowers and implementing sector-specific policies for those industries that are more prone to risks of COVID-19.

Also, last year, at the group level, we made around KRW 380 billion in additional provisioning, securing sufficient buffer for future uncertainties. So even with the end of the financial support, we believe there will be limited chance of a sudden drop in asset quality or a surge in credit cost.

Next, in the transformation towards digitalization of financial transactions, which has been largely accelerated by the COVID-19 pandemic, KB seeks to become the number one financial platform, most favored by customers, by expanding digital customer base through accentuating our core competitiveness in financial services and advancing platform capabilities.

To elaborate, last July, Kookmin Bank expanded its implementation of “PG (Partnership Group) 2.0” model, to enhance its competitiveness in the face-to-face channel by moving away from the former standardized branch model to one that assigns special business area such as retail, corporate and wealth management and thereby reflect each branch environment and customer profile. Also by leveraging the MyData service, to be fully launched this year, we seek to integrate customer data and conduct in-depth analysis to deliver hyper-personalized wealth management services. With this, we aim to secure our own unique channel competitiveness consisting of omni channels cutting across both online and offline and delivering seamless services through such channels.

In addition, we have re-invented the group’s core platform, KB Star Banking, from the perspective of user convenience and will be introducing it later this month. This will be an important step for KB in achieving its goal of becoming the number one financial platform. I will be providing further details on KB Star Banking in the following slides. Moving on, KB announced its “KB Net Zero S.T.A.R” which highlights the group’s aim to achieve net zero by year 2050 after applying PCAF and SBTi methods to make transparent disclosures of the group’s carbon emissions from our asset portfolio.

On the 14th of this month, we became the first Korean company and the first financial company in Asia to receive SBTi’s approval on our net zero targets. This is meaningful in highlighting that KBFG's carbon-neutral strategy, or “KB Net Zero S.T.A.R.” is not just a declaration but has been rigorously analyzed and proven to be in line global standards.

With the SBTi approval, we have completed the first step towards carbon neutrality in establishing net zero targets. From this point, we will continue to provide strong support to companies and clients to reduce carbon emissions and expand eco-friendly investments. We will also continue to collaborate with various global initiatives to lead ESG management in Korea.

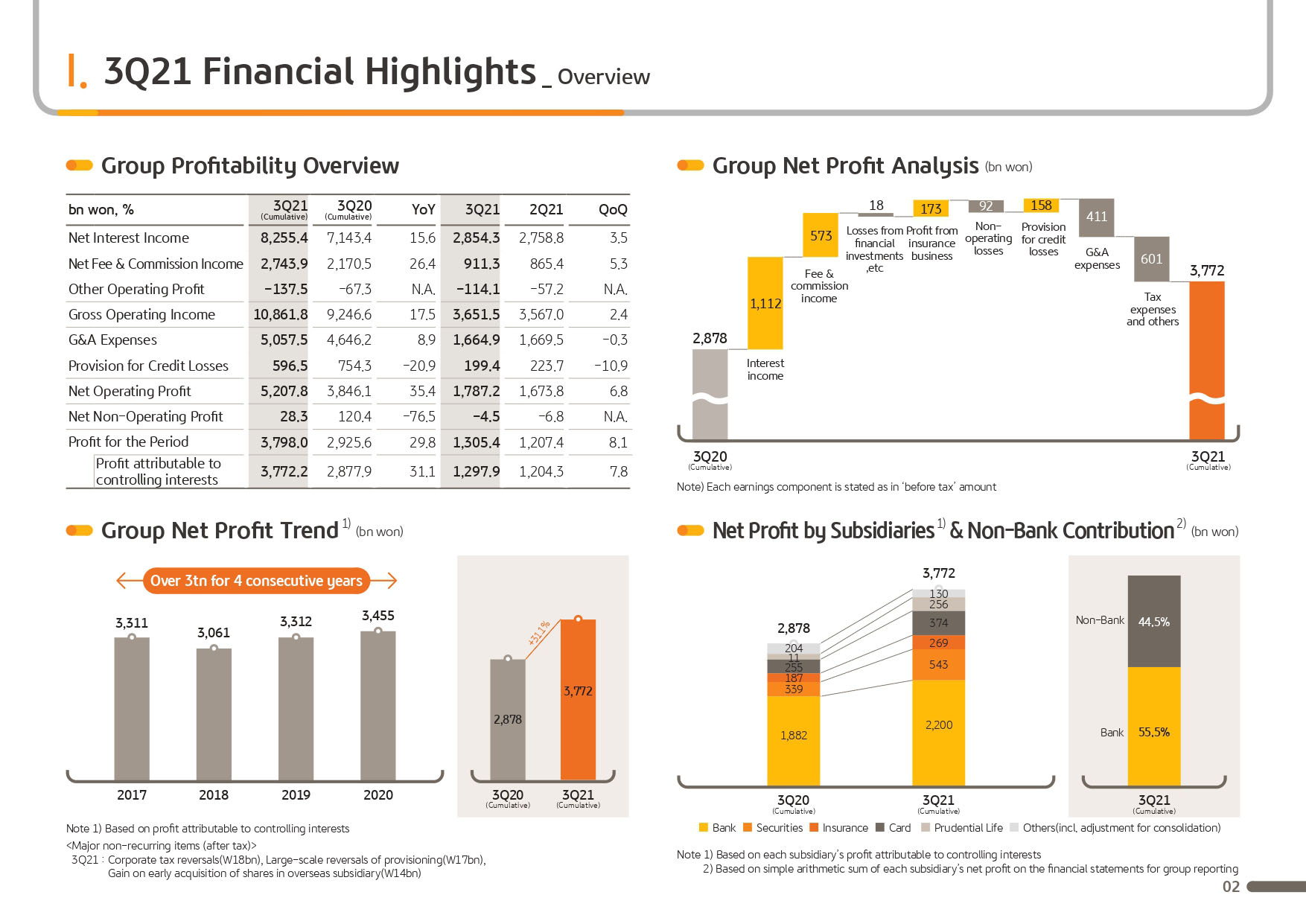

(2p) 2021 Third Quarter Financial Highlights-Overview

Now let me walk you through our third quarter business results. KBFG's 2021 third quarter net profit reported KRW 1,297.9 billion, increasing 7.8% QoQ driven by solid growth in net interest income and net fees and commissions income, as well as reversal of provisioning for Hanjin Heavy Industries after the end of the walk-out procedure and the base effect from KB Insurance's ERP costs last quarter. Excluding non-recurring factors, including the reversal of provisioning, net profit recorded around KRW 1,250 billion, maintaining a solid earnings trend backed by core income growth and group-wide cost management efforts.

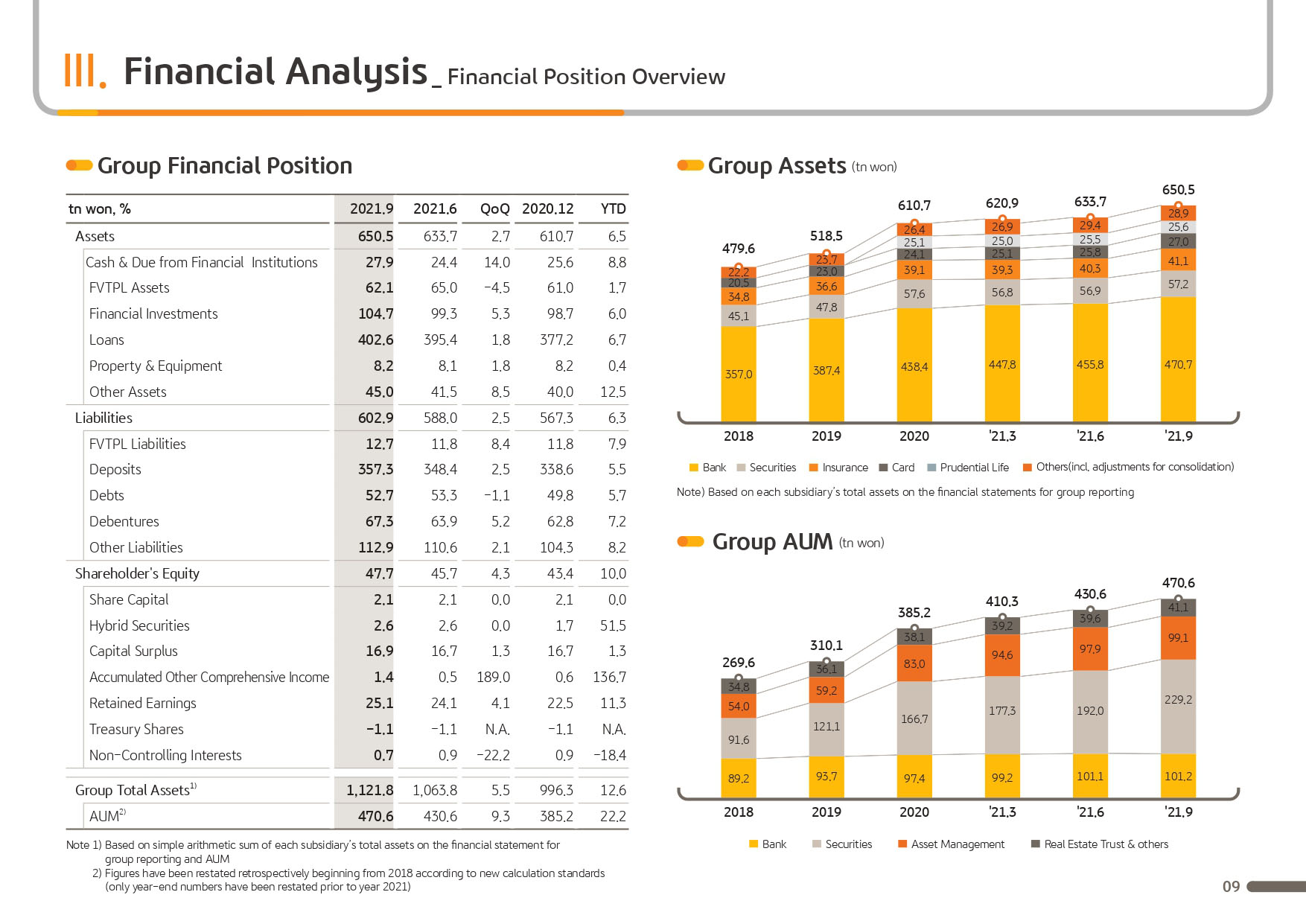

Net profit on cumulative basis was KRW 3,772.2 billion in the third quarter. Despite the difficult conditions in the operating environment, we were able to drive up our cumulative net profit by 31.1% YoY through reinforcing our core business areas to expand the group’s revenue base and diversifying our business portfolio through various M&A activities.

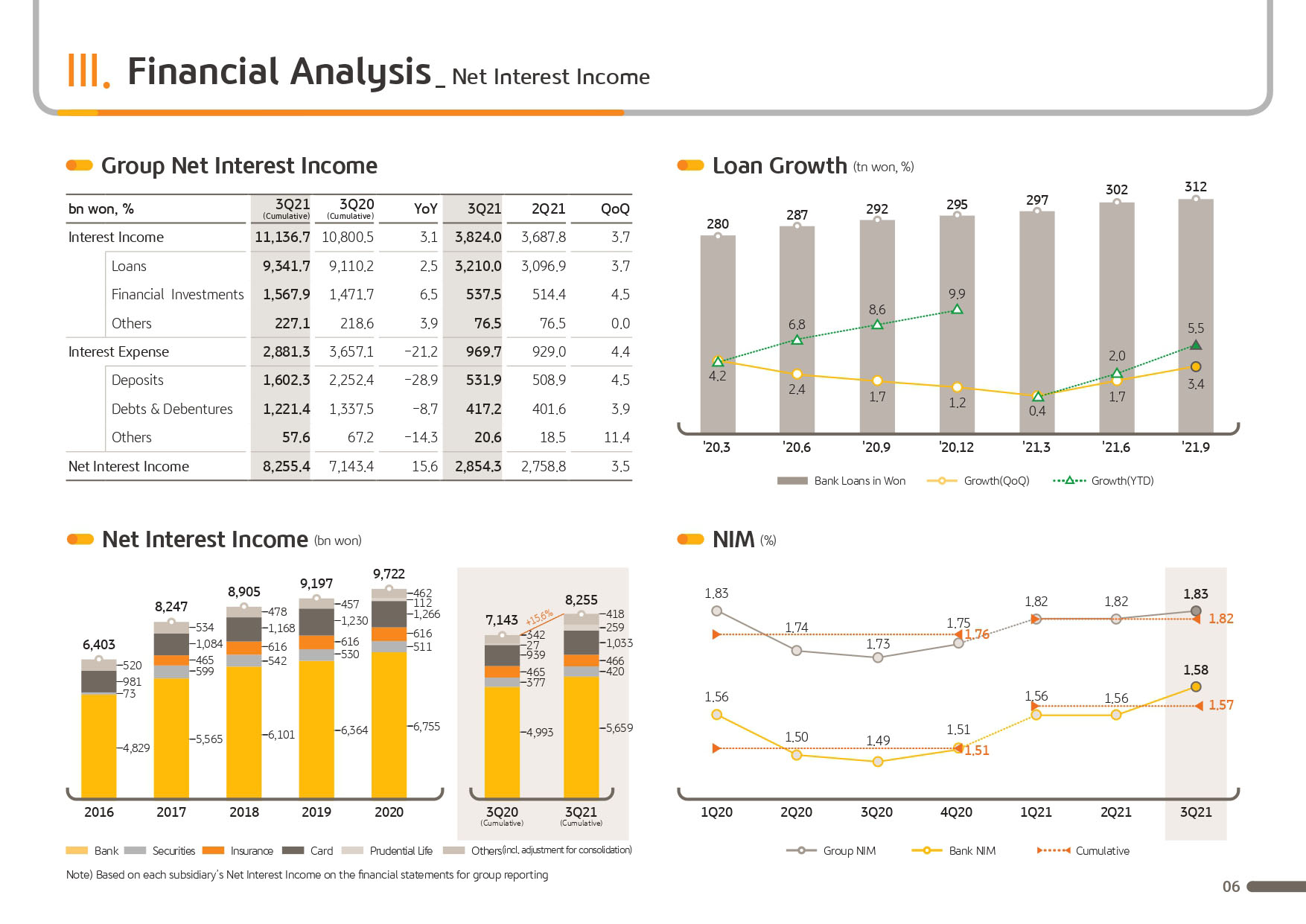

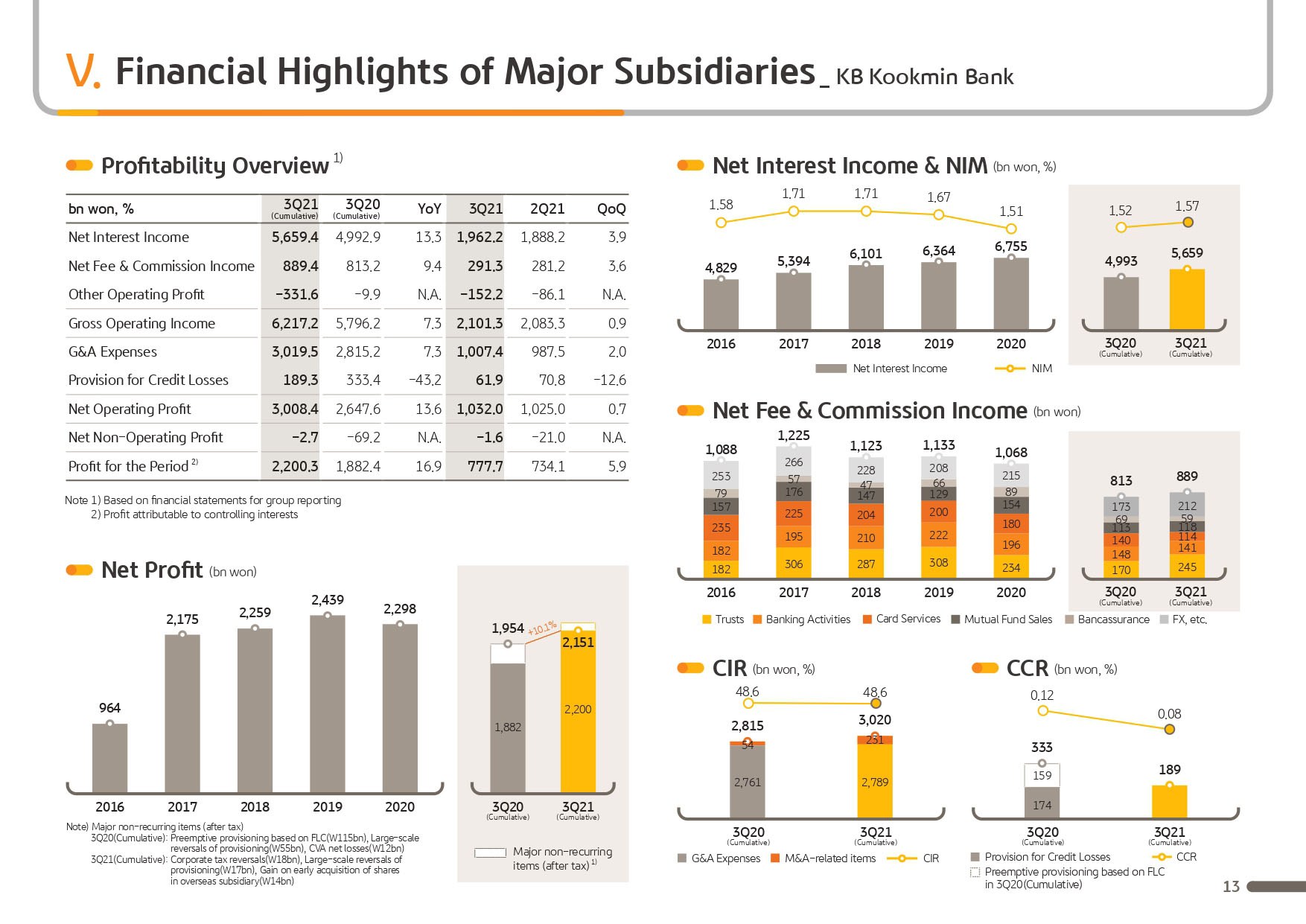

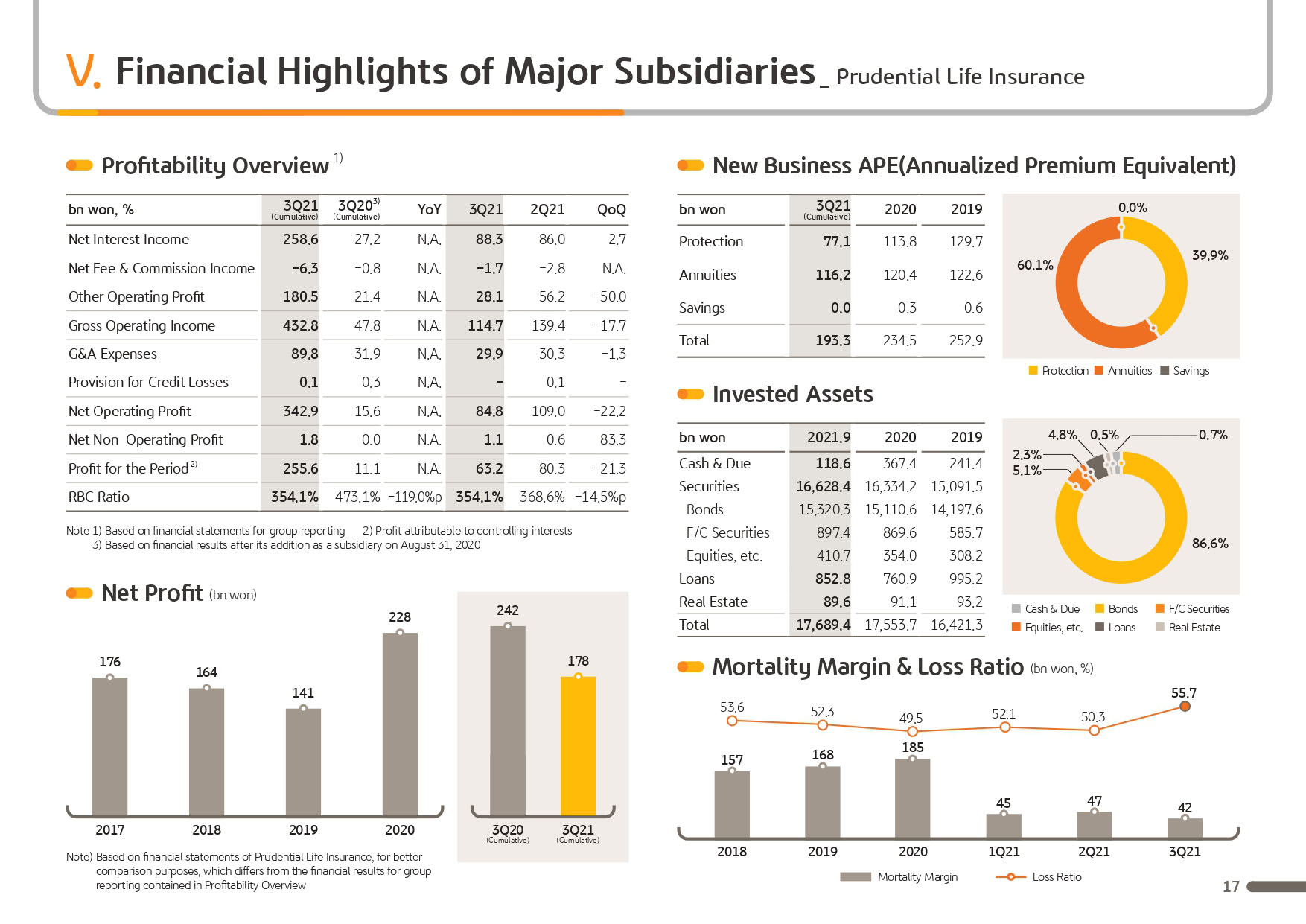

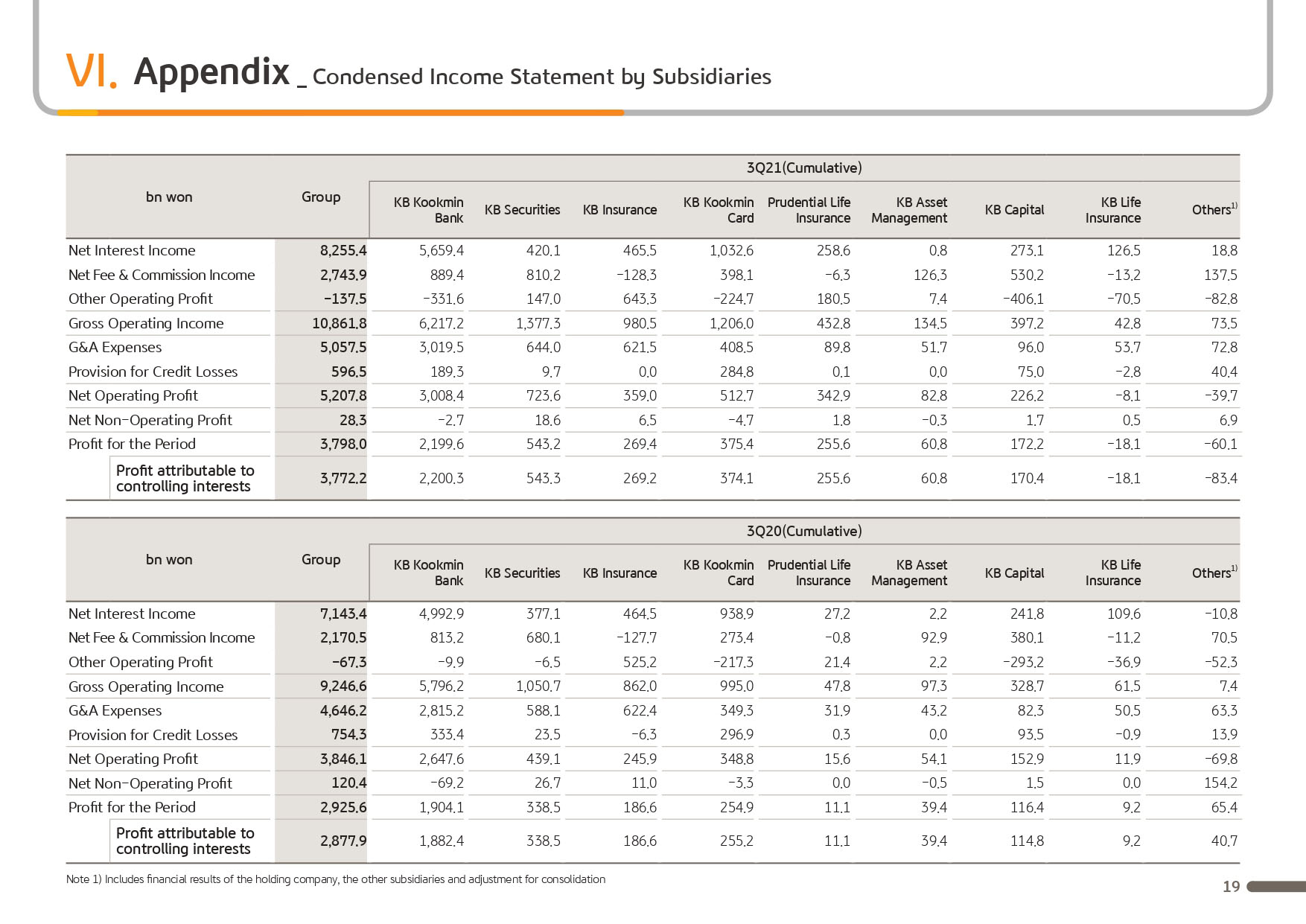

Let us now take a look at each of the segments in more detail. Third quarter cumulative net interest income was KRW 8,255.4 billion, which is up 15.6% YoY. This was mainly driven by Kookmin Bank’s strong loan growth, as the bank’s loans in won grew 5.5% YTD, NIM expansion, and increasing net interest income contribution from non-banking subsidiaries that includes the consolidation effect of Prudential Life.

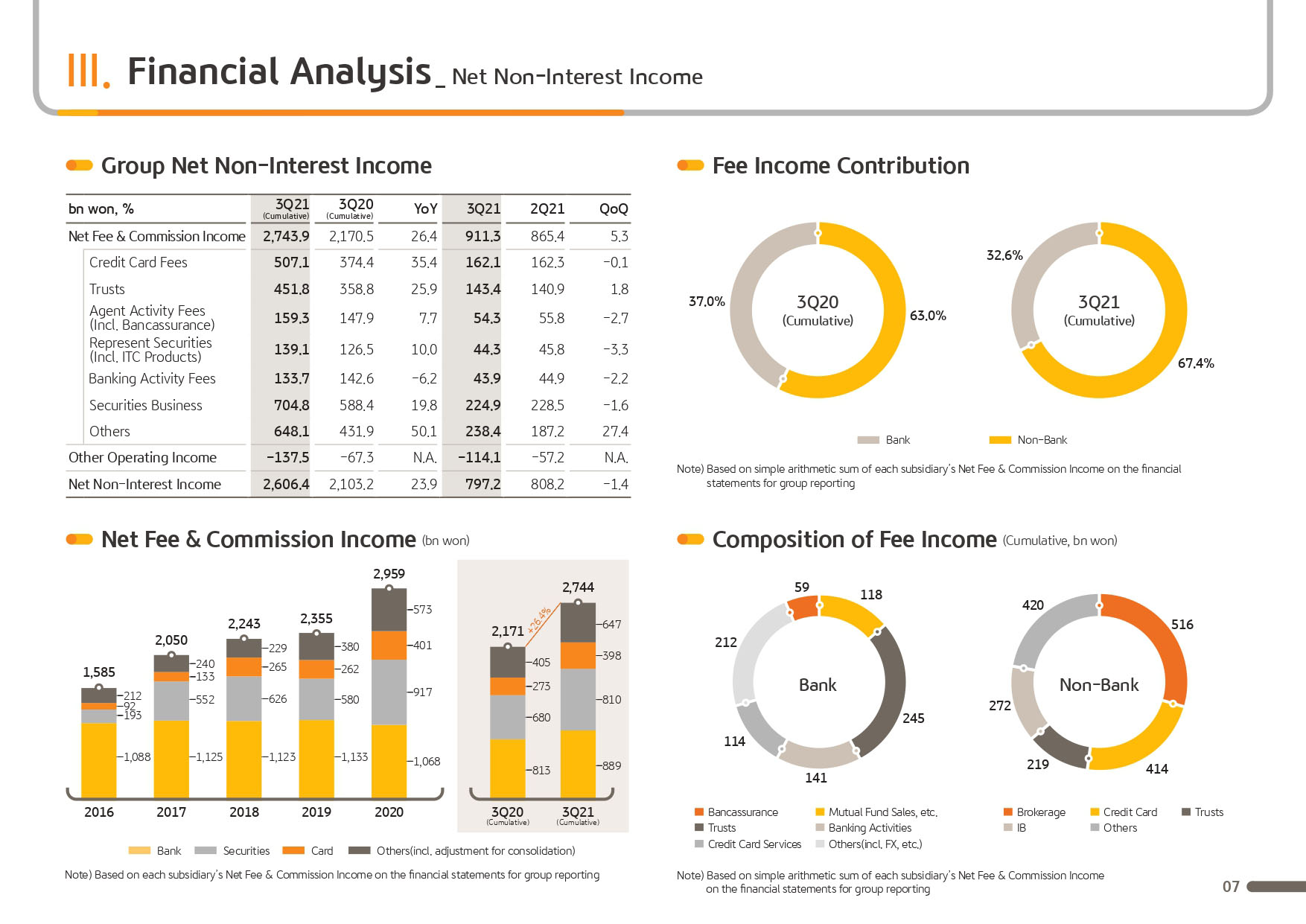

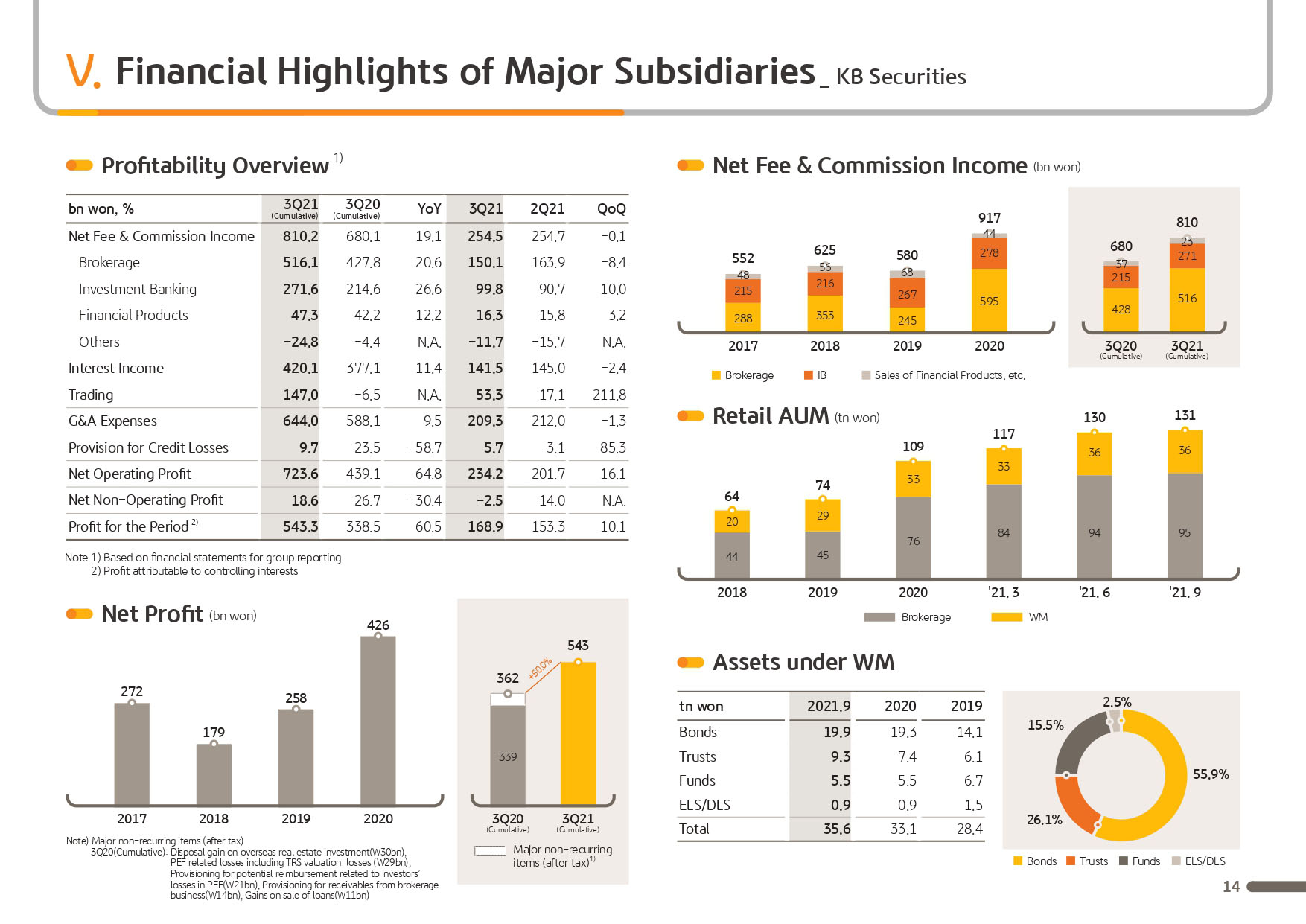

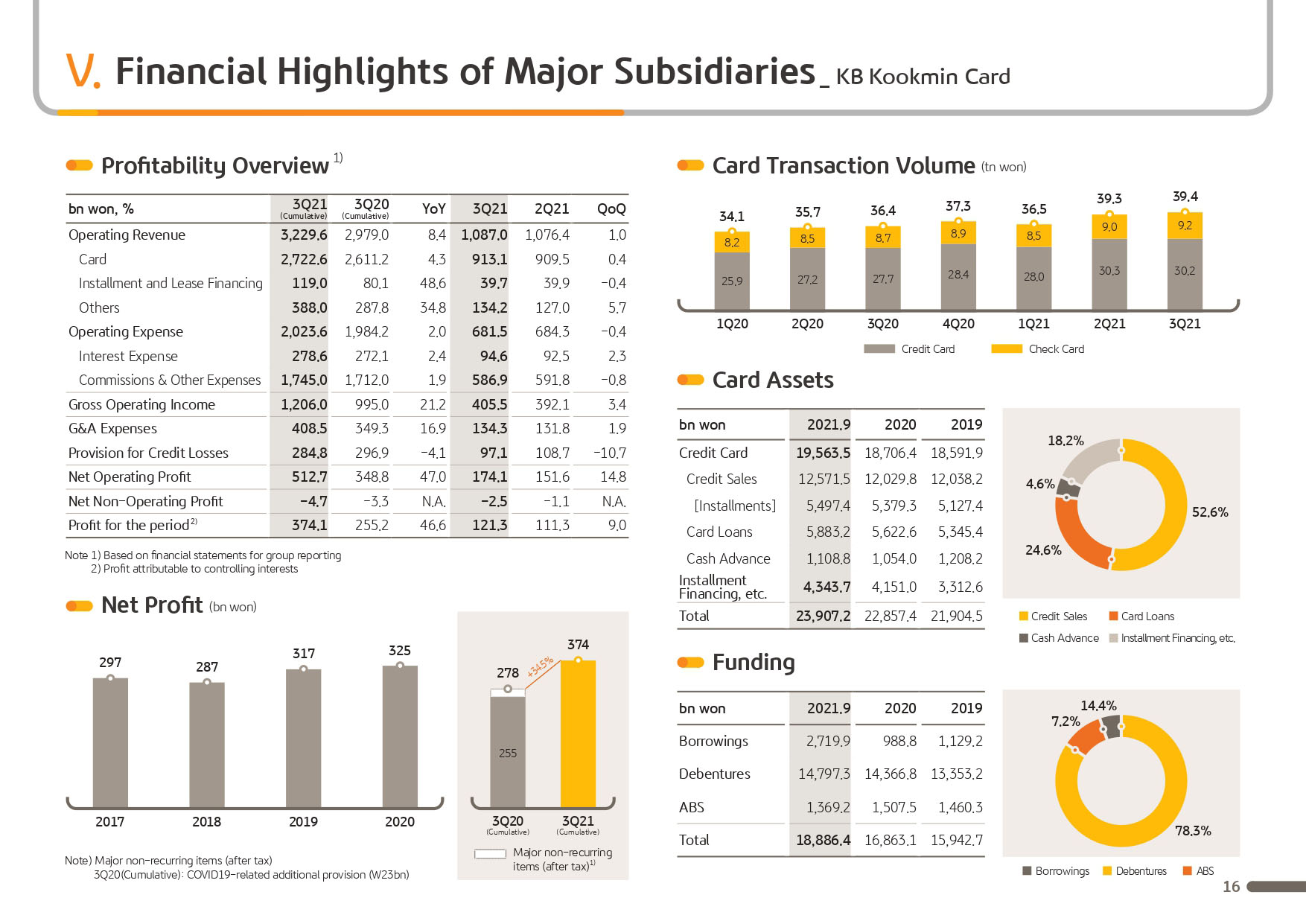

Third quarter cumulative net fee and commission income was KRW 2,743.9 billion, which is up 26.4% YoY or KRW 573.4 billion. This was driven by improved performance from non-banking subsidiaries, such as the fees from securities business increasing by KRW 116.4 billion mainly from the brokerage and IB businesses and the increase in card merchant fees from expanded transaction volume, as well as improvements in banking trust income from the increase in ELS redemption and expansion in new sales.

Third quarter net fees and commission income recorded KRW 911.3 billion. Despite the decrease in brokerage fees from factors such as declining stock trading volume, it increased 5.3% QoQ largely due to improvement in income from IB business in the bank and the securities company as a result of group-wide efforts to increase the competitiveness of the IB business.

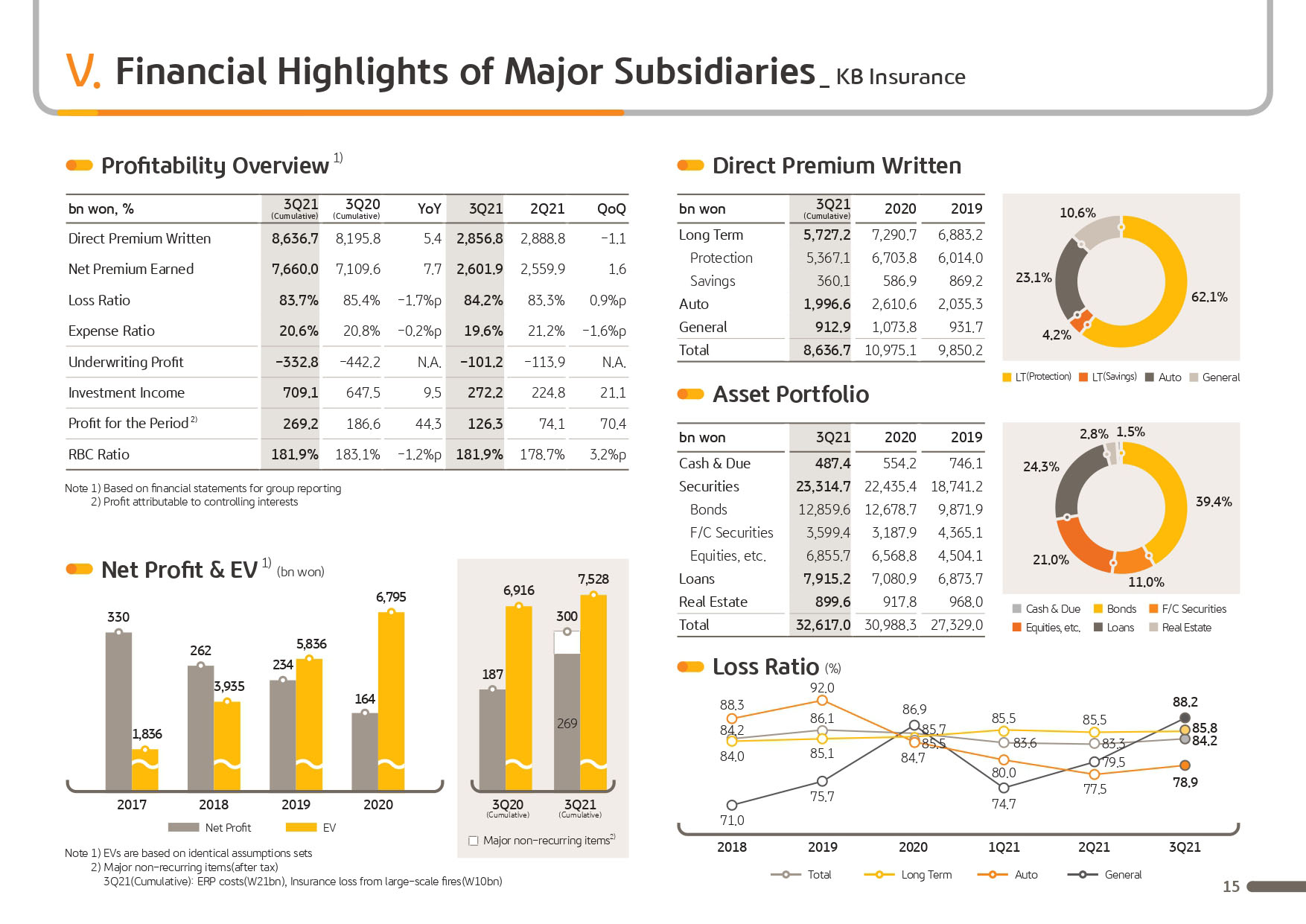

Third quarter other operating profit reported a loss of KRW 114.1 billion, which was somewhat sluggish compared to last quarter. This was due to the rise in interest and exchange rates in the third quarter that led to reduced gains from securities, derivatives and FX, as well as higher loss ratio in KB Insurance due to seasonality factors and increase in guarantee reserves in Prudential Life from higher volatility in the stock market.

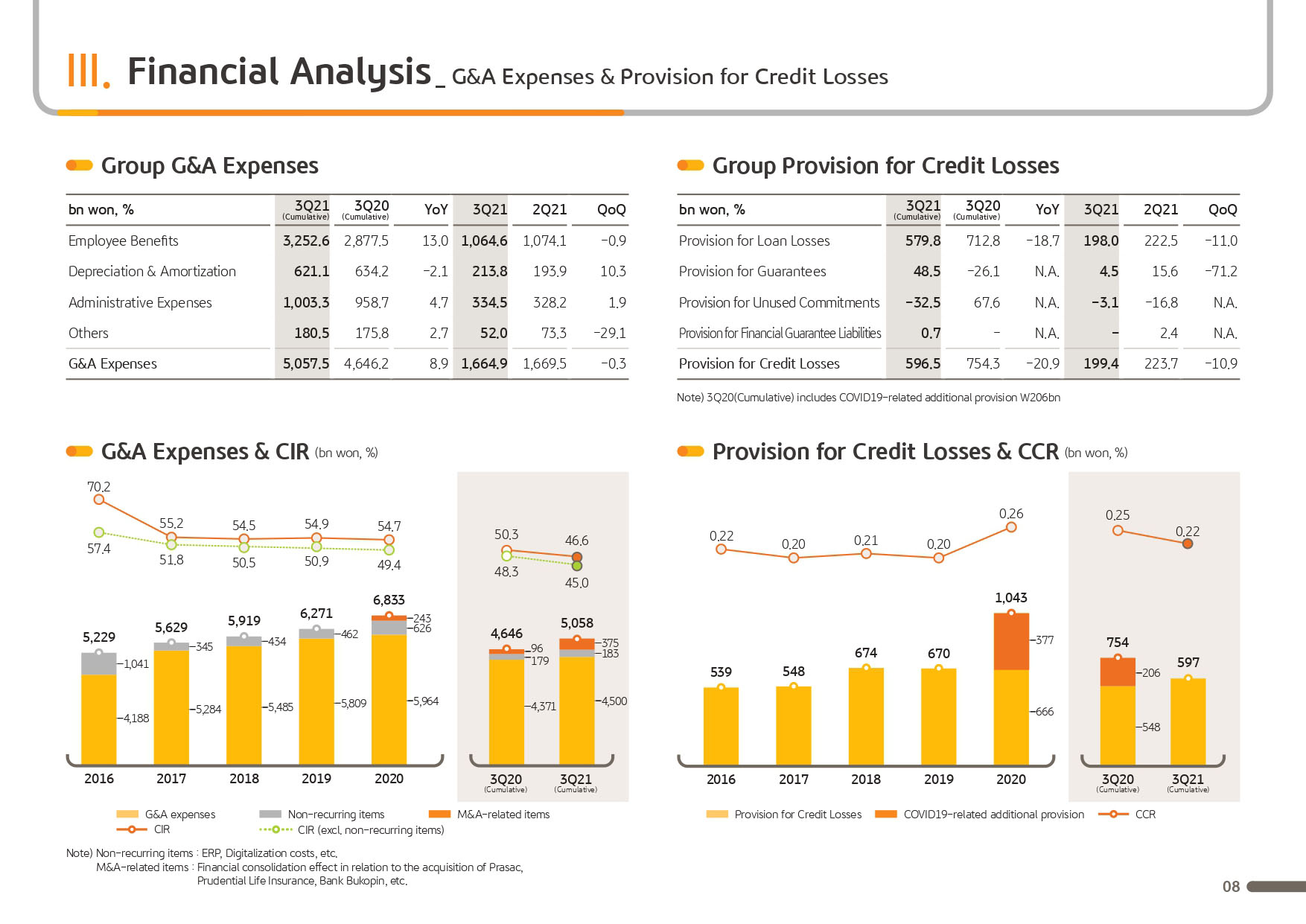

Next is on the group's G&A expense. Third quarter group G&A reported KRW 1,664.9 billion showing a marginal decrease QoQ due to the base effect from last quarter’s ERP costs in KB Insurance and other seasonal costs such as taxes. On a cumulative basis, G&A reported KRW 5,057.5 billion. While on the surface the group G&A seems to have picked up YoY, when accounting for costs related to M&A consolidation and ERP expenses from KB Insurance, the group’s G&A is being maintained quite stably.

Next is provision for credit losses. Third quarter cumulative provision for credit losses posted KRW 596.5 billion decreasing by KRW 157.8 billion YoY. Such result was based on quality loan growth centered on safe and prime assets and our continuous efforts to monitor and manage the overall credit quality, in addition to the base effect from additional provisioning related to COVID-19 in the second quarter of last year. Credit cost also remained at 0.22% further highlighting the very sound level of asset quality. Third quarter provision for credit losses posted KRW 199.4 billion. Despite the increase in loan assets, it remained at a low level due to quality loan growth centered on prime assets and approximately KRW 23 billion in reversal of provisioning related to Hanjin Heavy Industries.

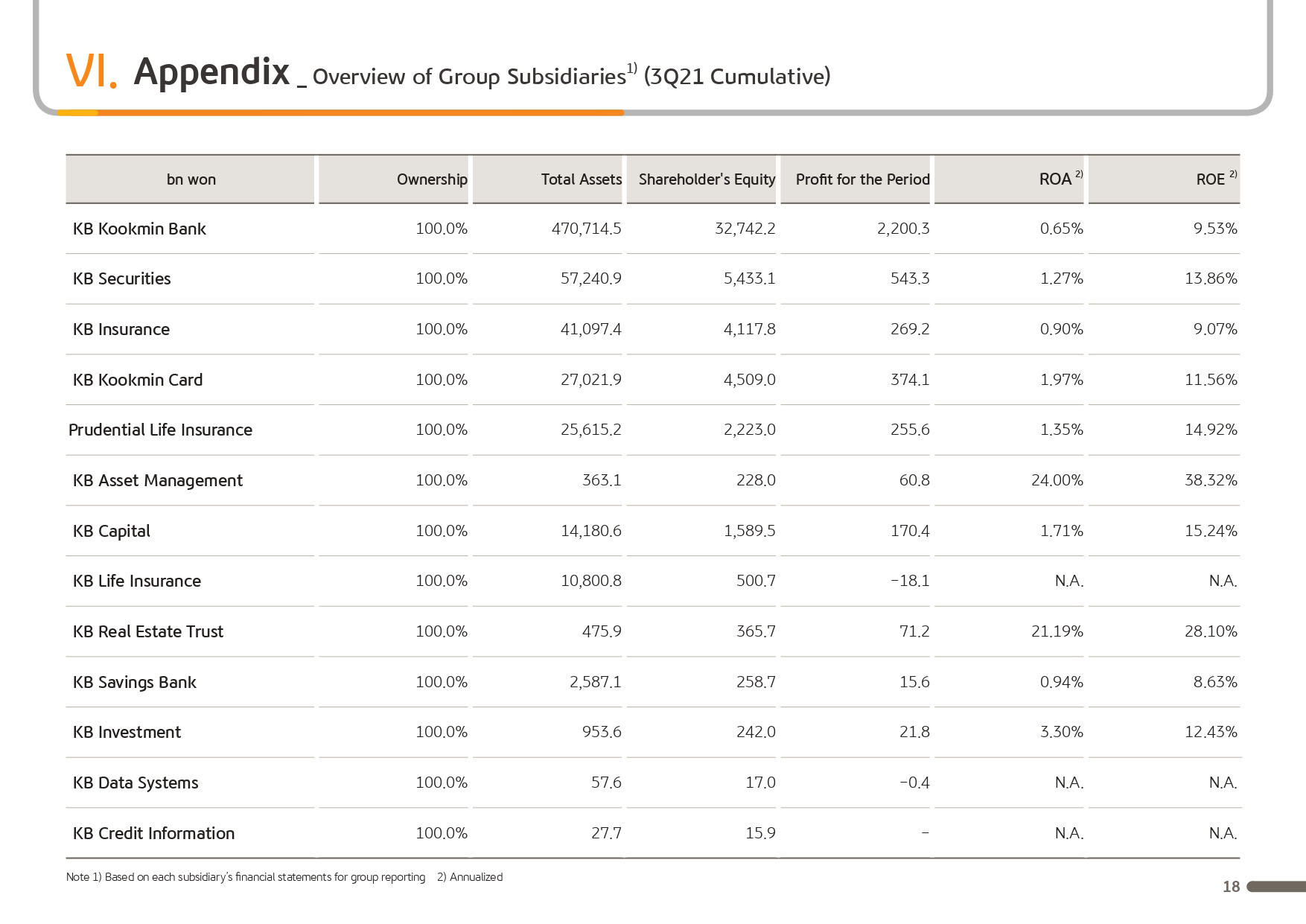

In looking at the graph on the bottom right, the non-banking contribution in the group's third quarter cumulative net profit recorded around 44.5%. Such result is based on the group’s expansion in earnings capacity from inorganic growth in the financial investment and insurance businesses, as well as the reinforcement of the group’s core businesses and capabilities.

As a means to overcome limitations in the domestic market and to secure sustainable growth engines overseas, KB is actively expanding its presence in Southeast Asia as well as advancing our competitiveness in the advanced markets. In Southeast Asia, Kookmin Bank recently acquired a 100% stake in Cambodia PRASAC and KB Securities will soon acquire Valbury Securities in Indonesia. In the advanced markets, Kookmin Bank has recently launched a regional hub in Singapore for IB and capital market businesses.

Going forward, KB, based on its extensive experience and success in the local market, will continue to expand our global business and advance our earnings capacity, in turn delivering greater corporate value.

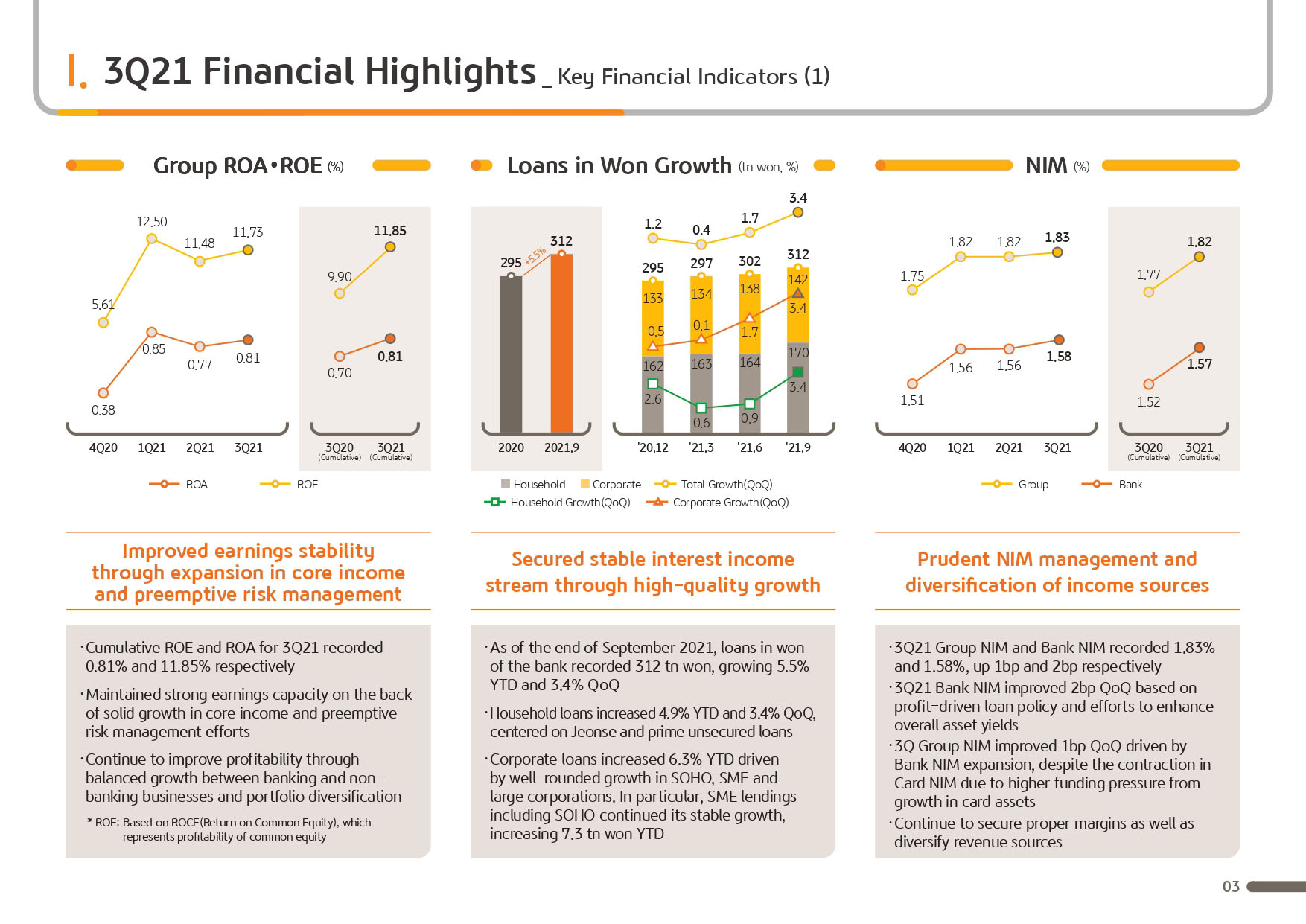

(3p) 2021 Third Quarter Financial Highlights-Key Financial Indicators

From the next page, I will go over the major financial indicators. 2021 third quarter cumulative group ROA and ROE recorded 0.81% and 11.85% respectively, driven by group's core income growth and conservative asset quality management. When taking into account non-recurring items, ROE recorded at 12.06%, maintaining sound fundamentals and profitability.

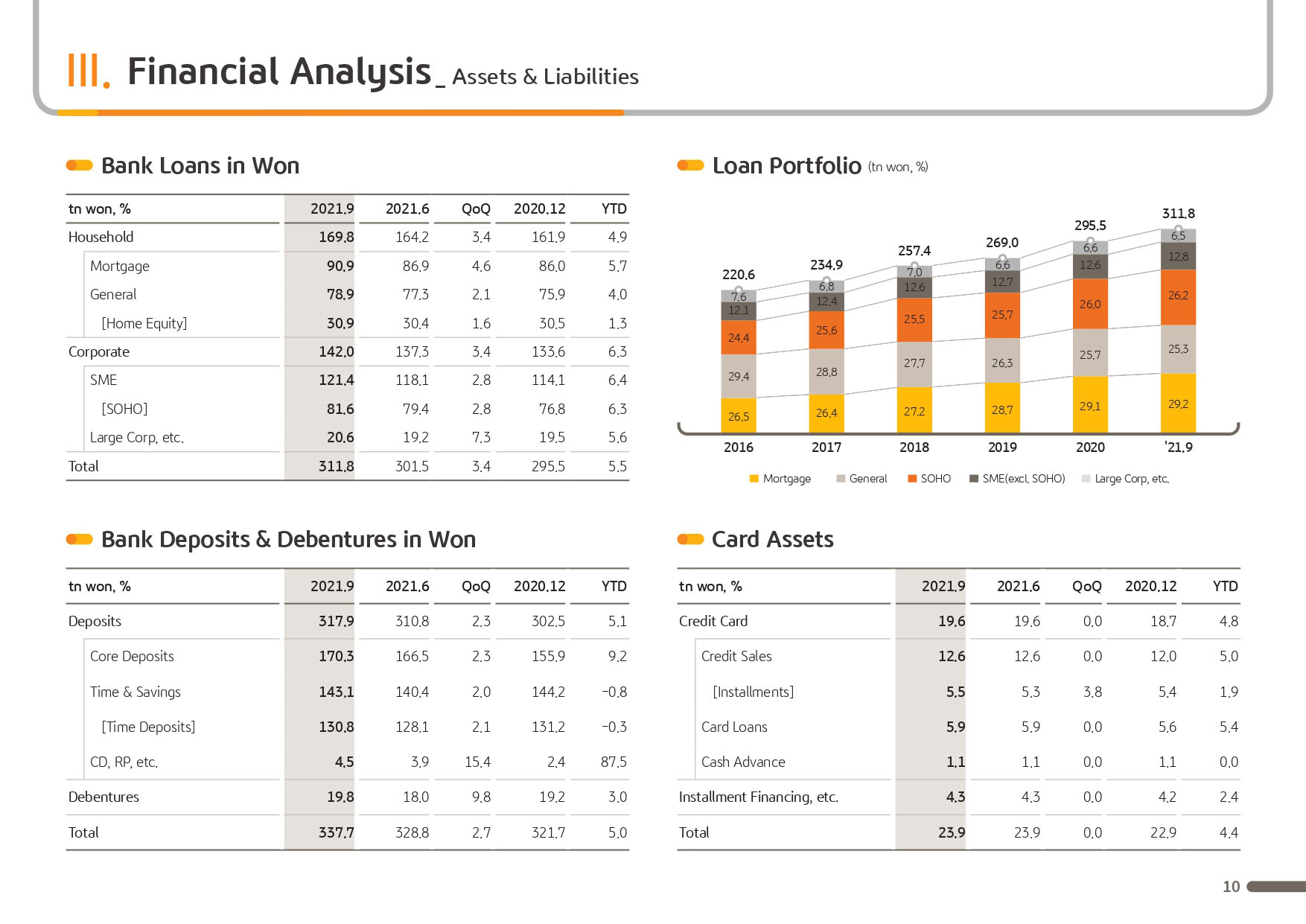

Next, I would like to cover bank's loans in won growth. As of the end of September 2021, the bank’s loans in won increased 5.5% YTD and 3.4% QoQ to record KRW 312 trillion. In detail, household loans increased 3.4% from the end of June mainly driven by jeonse and prime unsecured loans. Corporate loans also increased by 3.4% from the end of June based on improving economic trends and increase for loan demand. SME loans grew 2.8% from the end of June mainly driven by SOHO and prime SMEs, and large corporate loans grew substantially by 7.3% from the end of June.

Next is net interest margin. 2021 third quarter bank NIM posted 1.58%, increasing by 2 basis points QoQ. Despite the fact that repricing effect in funding rates from the big rate cuts last year is almost finished, bank NIM improved on the back of stronger loan pricing policy and our efforts to improve the yields on managed assets.

In the case of the group NIM, despite the contraction in card NIM due to higher funding costs from growth in card assets, it improved 1 basis point QoQ based on the bank NIM improvement. Going forward, KB will fully utilize its high competency in the sales channels to expand low-cost deposits such as settlement accounts and corporate core deposits and continue to improve NIM by securing proper margins through flexible pricing policy centered on profitability and asset quality.

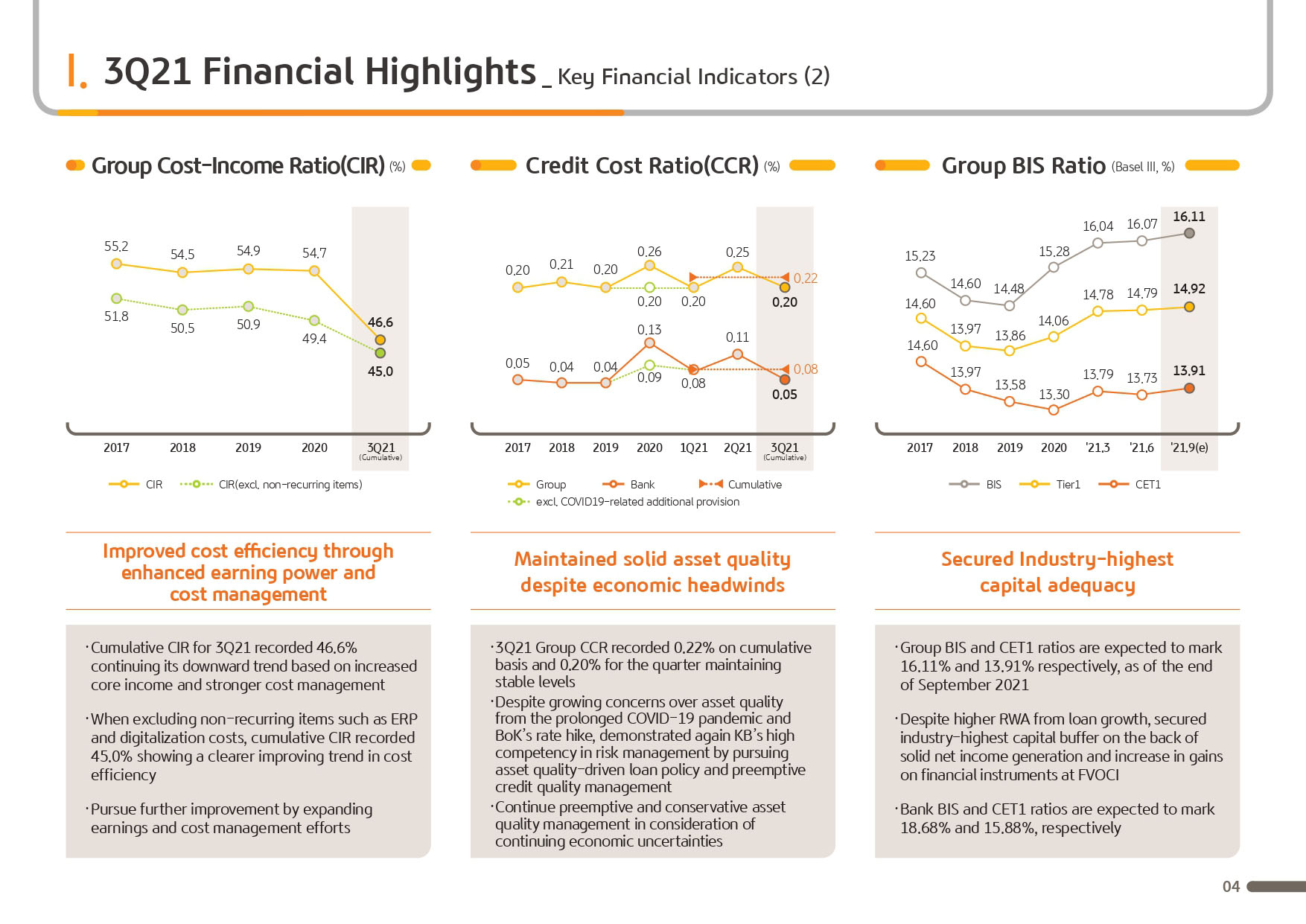

(4p) 2021 Third Quarter Financial Highlights-Key Financial Indicators Let's go to the next page. I would like to cover the group's CIR, cost income ratio. 2021 third quarter cumulative group CIR posted 46.6%, continuing its stable downward trend on the back of solid core income growth and cost management efforts. Excluding items such as ERP costs, recurring CIR posted at 45% level, further highlighting clear improvements in cost efficiency.

Next is on the credit cost ratio, CCR. 2021 third quarter group and bank credit cost each posted 0.20% and 0.05%, respectively. On a cumulative basis, they remained at stable levels recording 0.22% and 0.08%, respectively. Even when excluding KRW 23 billion of reversal in provisioning following the end of the walk-out process related to Hanjin Heavy Industries, the group credit cost maintained a low level of 0.23%. KB continues to prove its high competency in asset quality management even under the difficult conditions presented by COVID-19.

With the prolongation of various COVID-19-related financial support programs and the possibility of additional BOK rate hike, concerns over asset quality seem to increasing. However, because we have made pre-emptive preparations and continue to strengthen the management process of potentially vulnerable exposures, we expect to maintain asset quality at stable levels in the future.

Next, I would like to cover group's capital ratio. As of the end of September 2021, group BIS ratio posted 16.11% and CET1 ratio recorded 13.91% increasing by 4 bps and 18 bps QoQ, respectively. Our capital buffer continues to remain among the highest levels in the financial industry. Despite the higher level of risk-weighted assets from loan growth, capital ratios improved based on strong core income generation and valuation gains on securities.

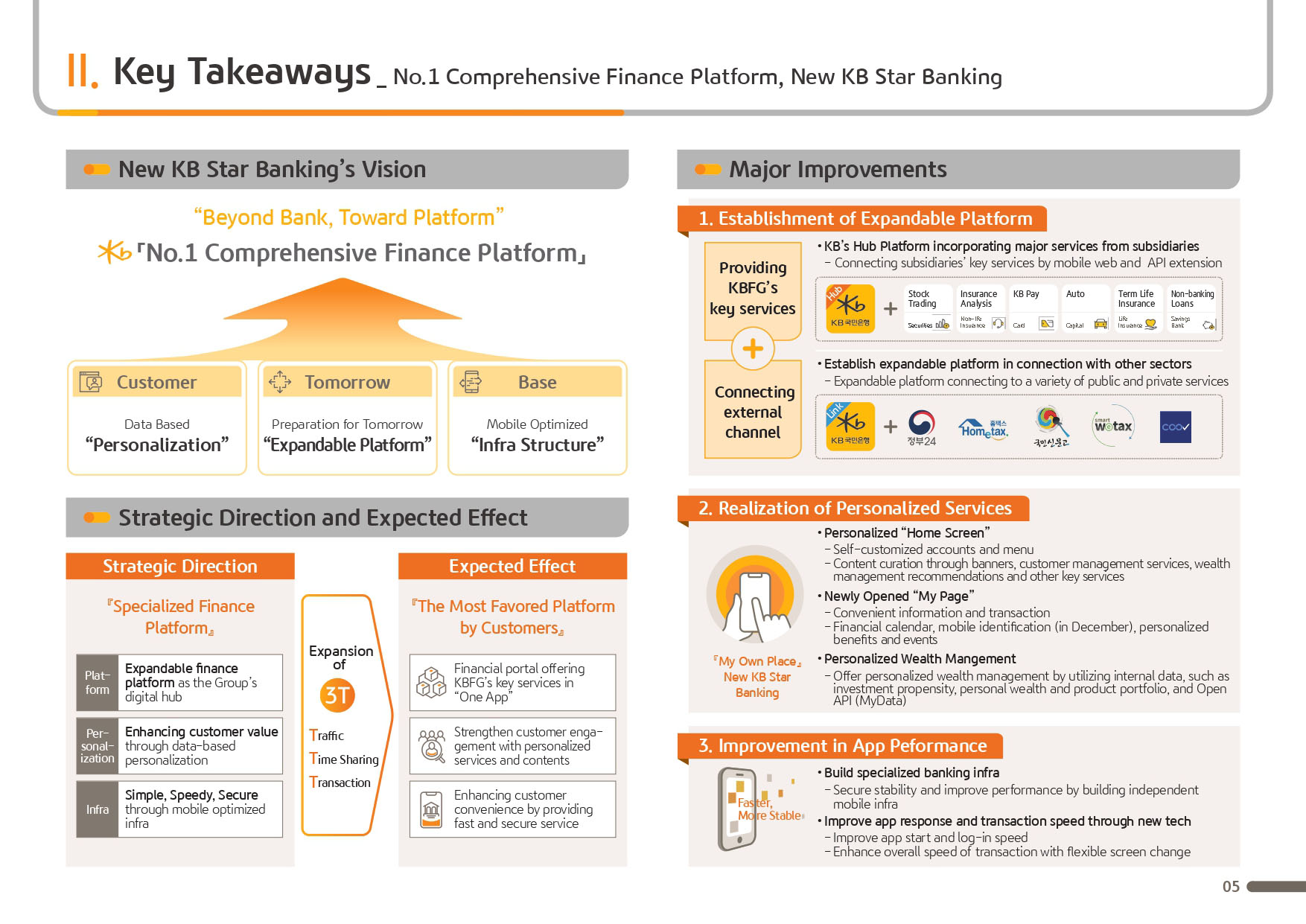

(5p) 2021 Third Quarter Key Takeaways – No.1 Comprehensive Financial Platform, New KB Star Banking

Let's now go to the next page. From this page, I would like to introduce our most representative digital platform, KB Star Banking, that will be newly launched in the coming days towards the end of this month. Digitalization is becoming more pronounced as an important competency factor in the financial industry with the acceleration of digitalization in financial transactions due to COVID-19 and new competition in the industry from the IPO of Kakao Bank and Toss Bank recently starting its operations.

KB Financial Group, which has been preparing for these changes well in advance, has made many improvements in the digital platform from the perspective of customer needs and pain points and will continue to drive a comprehensive digital transformation encompassing platform, contents and marketing in order to solidify our top-tier status in the digital financial market.

As a part of these efforts, starting with the new KB Star Banking, KB seeks to strengthen its platform capabilities and become the number one financial platform most favored by customers through bold integration and reorganization of the group’s key services.

As you are well aware, the success of a platform is defined by the three “T”s, the ability to acquire Traffic, Time sharing and Transactions. The key for a successful platform is to develop and deliver killer content that entices customers to visit often and stay for a long time.

The new KB Star Banking is an expandable comprehensive financial platform, also serving as the group’s “Hub” platform, that incorporates and provide key services from major subsidiaries in one application. We expect that the new Star Banking can become a powerful platform realizing all three “T”s by improving customer experience through stronger customer engagement and personalized service based on data and strengthening customer convenience through implementation of mobile infrastructure that provides fast and secure services.

To explain in more detail, first, we aim to establish an expandable platform basis that connects not only KB’s subsidiaries but also diverse services outside the group channels by utilizing “KB Mobile Certificate” and “In-App Browser.” In going beyond simple inquiry functions, Star Banking internalizes key services from major subsidiaries such as stock trading, insurance coverage analysis and digital payment so that it creates an ecosystem that fully utilizes major services without the inconvenience of installing separate apps or leaving the platform. Star Banking also connects with other services in the outside channels, including major public services such as government inquiries and tax services. We will continue to enhance customer convenience in Star Banking by providing a flexible platform that seamlessly connects with the daily activities of customers and expanding our partnership with public and private institutions.

Second, the new Star Banking will provide highly personalized wealth management services through sophisticated homescreen curation and “MyPage” services and developing customized contents by utilizing data analysis based on AI and machine learning, as well as MyData and open-banking services.

Lastly, the new Star Banking has great significance in that it has achieved an expandable structure that can maintain high level of speed and security even when expansion of new channels and services continue. By implementing SPA (Single Page Application), we not only expect great improvements in screen transitions and speed of transactions, but also in the overall security level based on the establishment of a mobile-optimized infrastructure system that can continue to carry out important functions even under system errors. In addition, we seek to complete KB’s own unique platform competitiveness that can connect financial services to the daily customer activities by expanding its connection to non-financial platforms such KB Real Estate, KB ChaChaCha and KB Healthcare, in order to obtain our goal of becoming lifetime financial partner most favored by customers.

From the next page, we have the details regarding the results that I have aforementioned. With this, we will conclude KB Financial Group's 2021 Third Quarter Earnings Presentation. Thank you for listening.