-

Please adjust the volume.

2021 Business Results

Greetings and Summary

I am Peter Kweon, the Head of IR at KBFG. We will now begin the 2021 early business results presentation. I would like to express my deepest gratitude to everyone for participating today.

We have here with us our Group CFO and Senior Managing Director, Scott Seo, as well as other members from our Group management. We will first hear the 2021 major financial highlights from our CFO and Senior Management Director, Scott Seo, and then have a Q&A session. I would like to invite our Senior Managing Director and CFO, to deliver our 2021 earnings results.

Good afternoon. I am Scott Seo, CFO at KB Financial Group. Thank you all for joining KBFG's Q4 and Full Year 2021 Earnings Release Presentation.

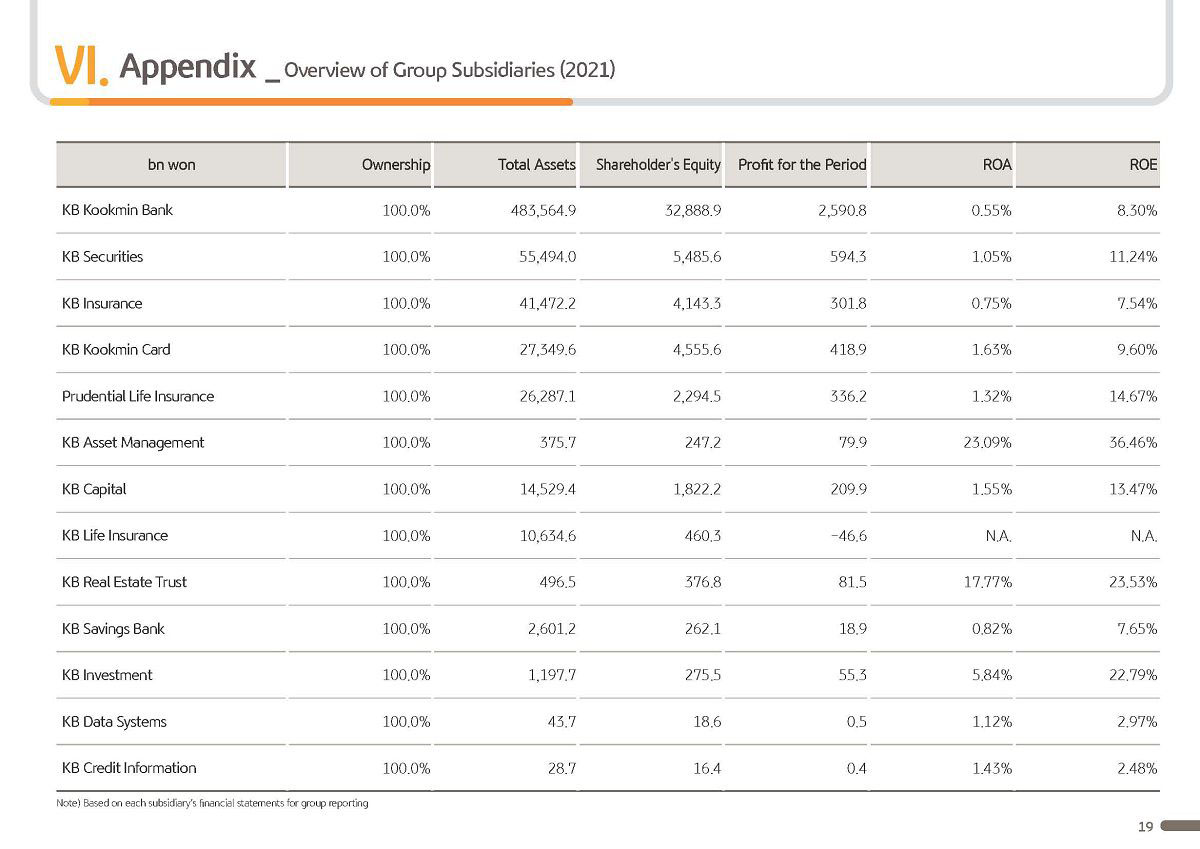

Before presenting on the 2021 business performance, allow me to first run through key highlights. First, 2021 net profit on a controlling share basis was up 28% on year KRW 4.41 trillion, meeting the market consensus. Diluted EPS was KRW 10,891, up 25%. ROE was 10.2% up 1.4 percentage points year-over-year, which is a testament to notched up earnings capacity.

In the middle of the COVID pandemic, Korean economy posted a record high export growth last year on the back of global recovery, achieving 4.0% economic growth rate showing a clear sign of recovery. Driven by solid loan growth, interest rate hikes, booming stock market, core income, including interest income and commissions posted a growth-driving earnings improvement. This earnings improvement, however, is not merely driven by interest income, but an outcome of stronger competitiveness gained from WM and IB as well as better insurance market backdrop and M&A impact of Prudential Life and acquisitions in Cambodia and Indonesia. Also, nonbank contribution to net profit, which used to be 30% has risen to 43% level in 2021.

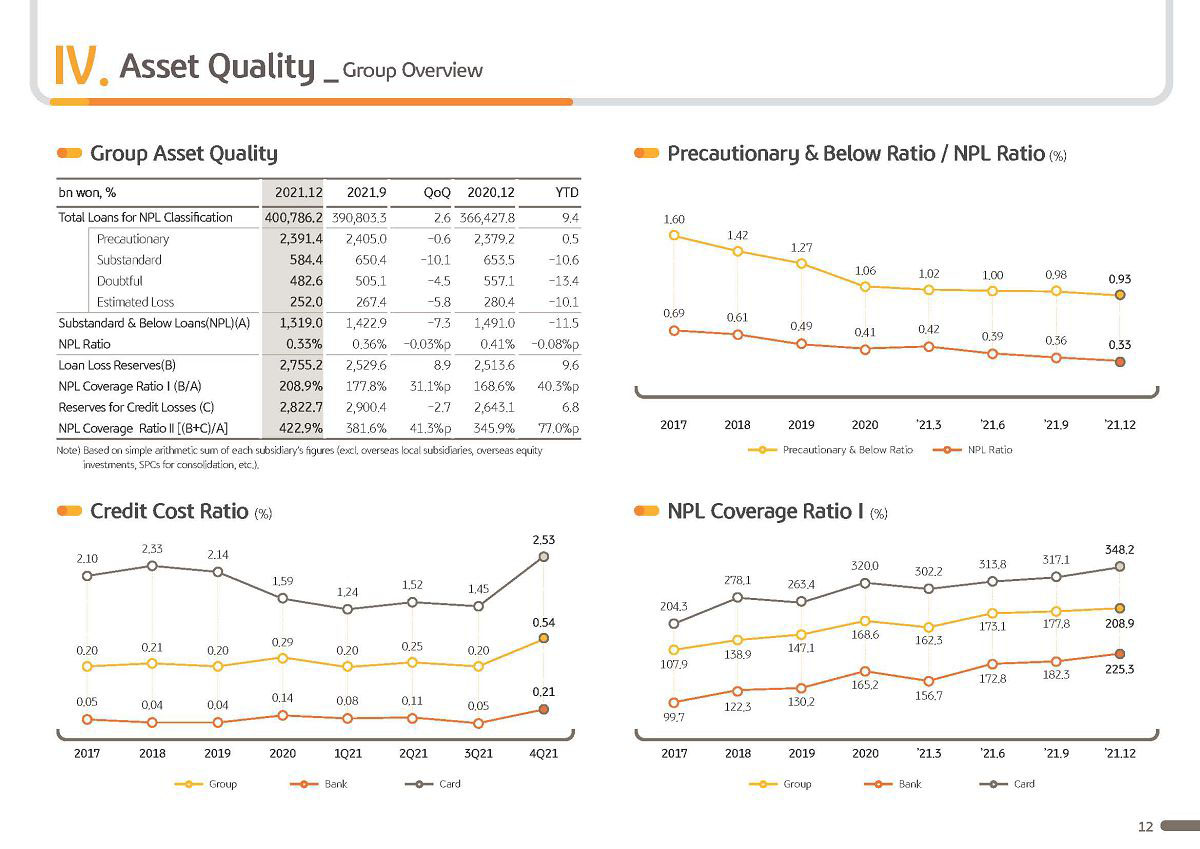

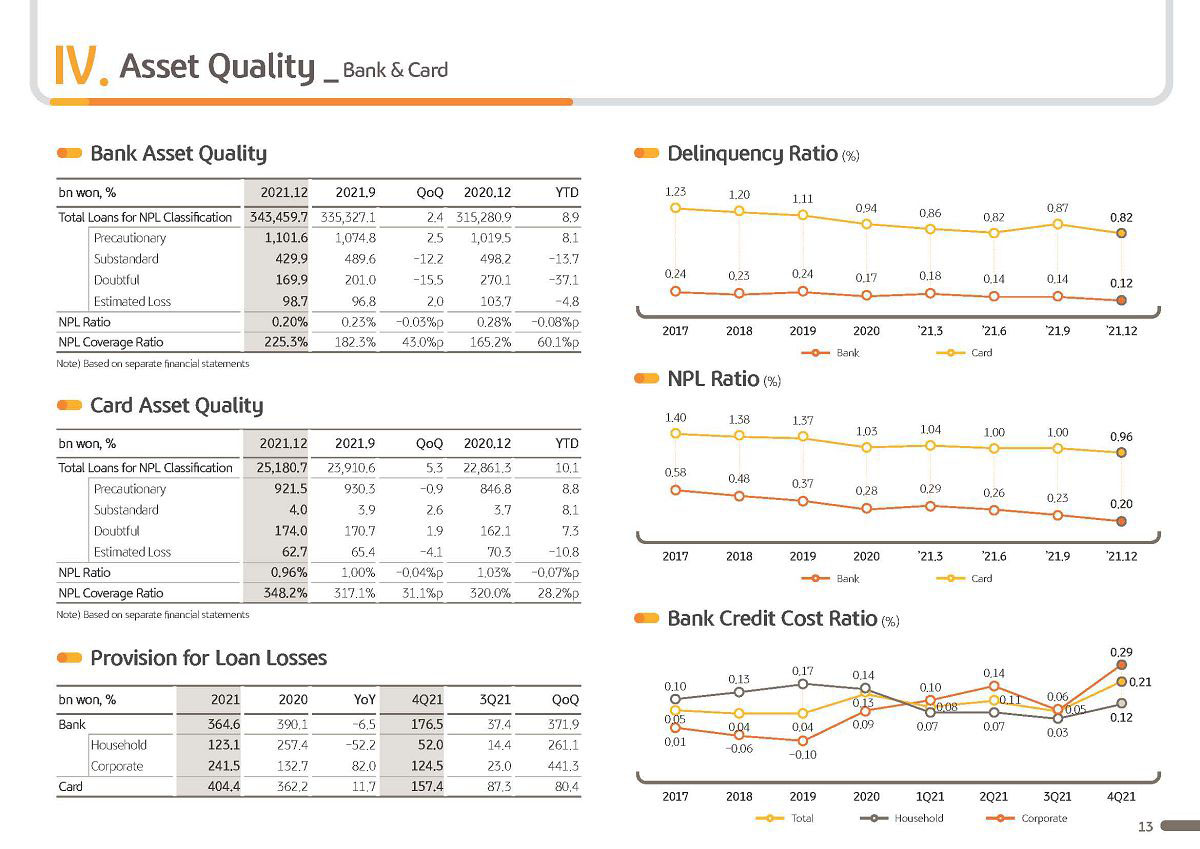

Second point to note is that net profit growth and double-digit ROE were achieved even under the Group's conservative provisioning stance, which it took voluntarily. 2021 Group's credit cost was around 30 basis points, 1.5 times the pre-COVID average of the preceding 3 years. Also, 2021 NPL coverage ratio was 209%, up 62 percentage points versus pre-COVID level. All this is an outcome of preemptive provisioning for 2021 in the midst of softening of the asset market experienced in the equities, fixed income and real estate market on the back of lower liquidity and interest rate hikes, as well as concerns from the market on asset quality. Regarding household debt levels and government-led COVID-19 forbearance support.

Third, during today's BOD, FY 2021 payout ratio was set at 26%, and we were able to bring back payout ratio to the pre-COVID levels after the temporary decline to 20% since the pandemic.

In terms of the DPS for full year 2021, including interim dividend of KRW 750 per share paid out in August amounts to KRW 294 supported by normalization of payout policy and higher net profit DPS was up 66% year-over-year. There was also a derivative solution to cancel KRW 150 billion worth of treasury shares. This is equivalent to 3.4% of '21 net profit. This decision was point of our commitment to enhance shareholder value in the midst of difficult backdrop brought on by COVID-19 pandemic. We will continue to explore wide-ranging options for a more advanced shareholder return policy And do what we must to raise it up to the global standard.

Lastly, let me provide an update on our digitalization efforts. Over the course of 2021, to redefine ourselves as a #1 financial platform company, we undertook bold strategies. Last year, we launched the new KB Star Banking, a super app and the Group's hub platform that connects core subsidiaries, including the bank through which we were able to level up platform competitiveness as a comprehensive financial group.

In the same vein, we also launched Liiv Next, which is a financial platform for Gen Z’s to ensure potential customers for the future. This year, MyData service will fully initiate triggering a fiercer competition between financial versus nonfinancial and big tech versus financial incumbents. Nonetheless, underpinned by valuable information of KBFG's 36 million customers, we will utilize data analytics capabilities, critical content of affiliates and expert asset management know-how to rise as a #1 financial platform in 2022. I will now run through our Q4 and full year 2021 business results in more detail.

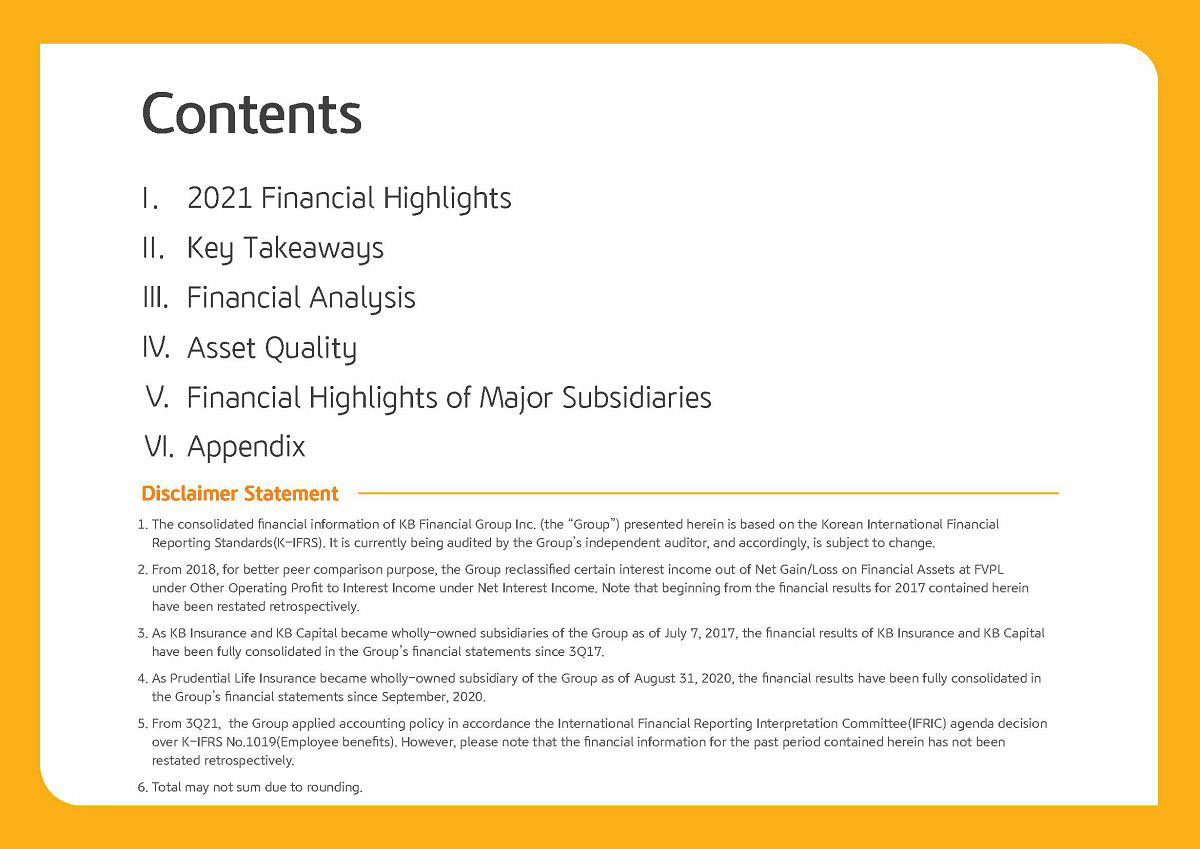

Page 2.

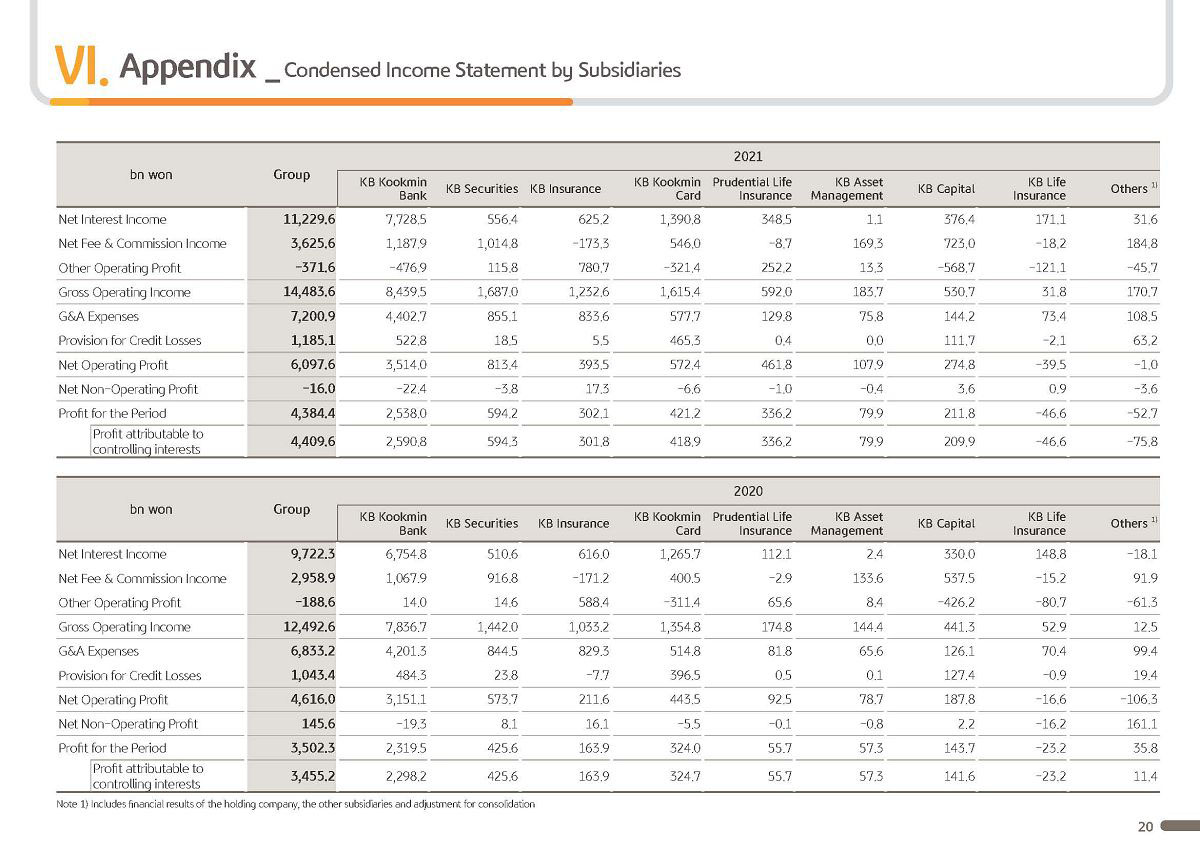

KBFG's 2021 net profit was KRW 4,409.6 billion on the back of interest income and net fees and commissions income, which are solid core profit growth and through inorganic growth via M&As, there was sizable year-over-year growth of 27.6% attesting to enhanced earnings capacity of the Group. Meanwhile, Q4 net profit was KRW 637.2 billion, a large decline Q-on-Q due to ERP expense this quarter, preemptive provisioning, one-off items and seasonality. But recurring basis net profit was around KRW 1.1 trillion, sustaining a robust earnings capacity.

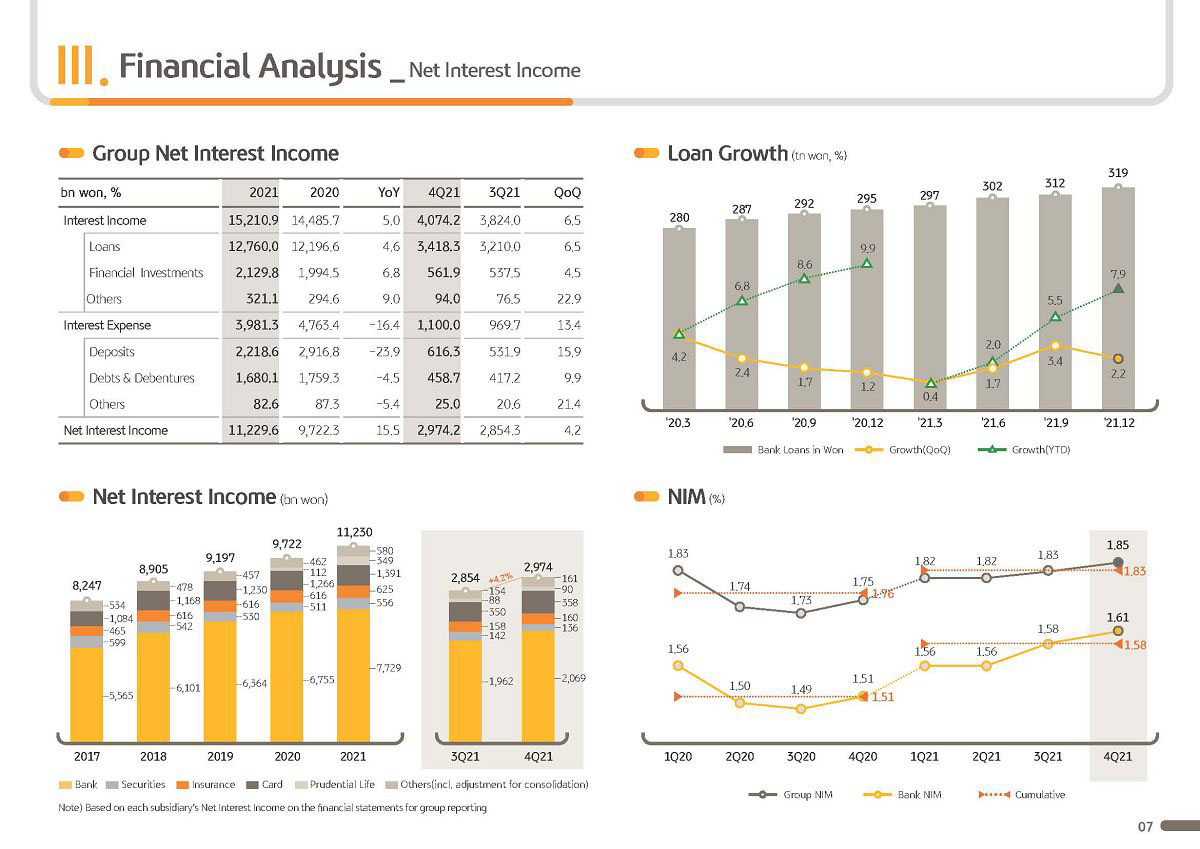

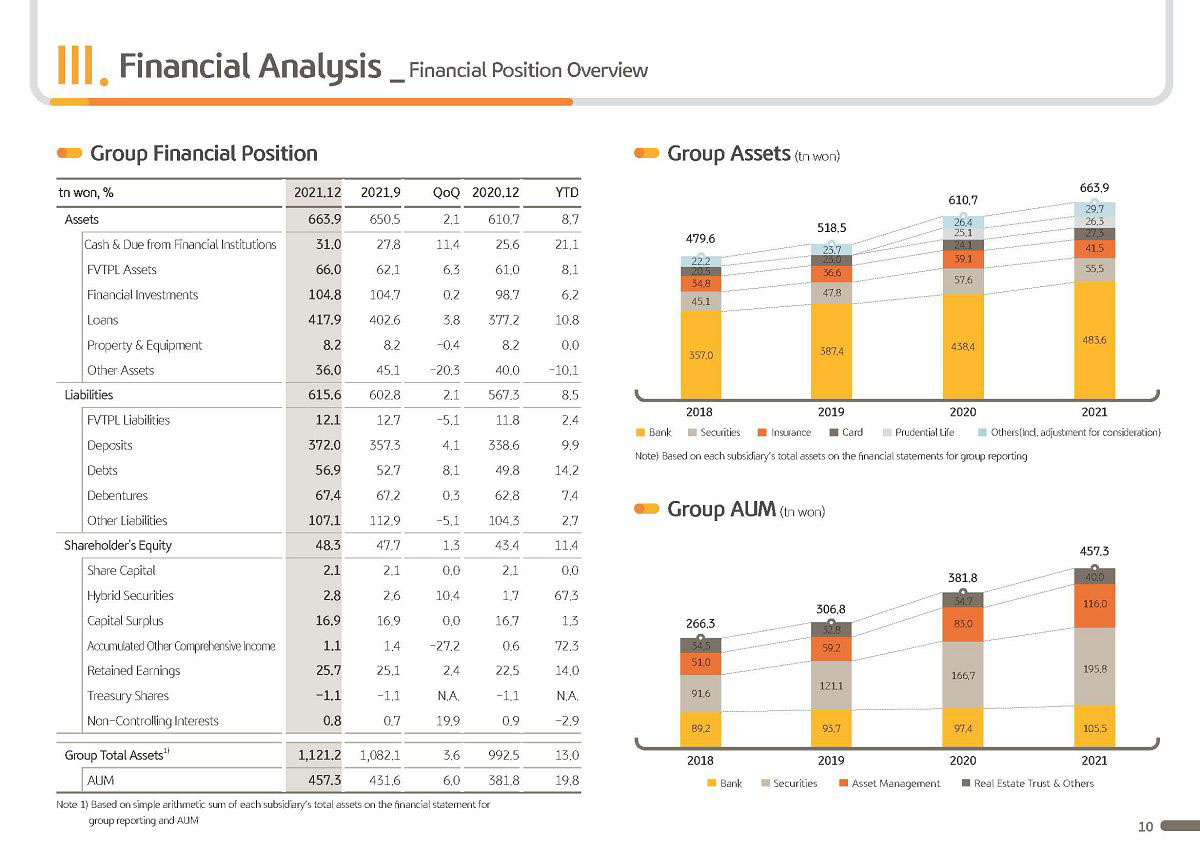

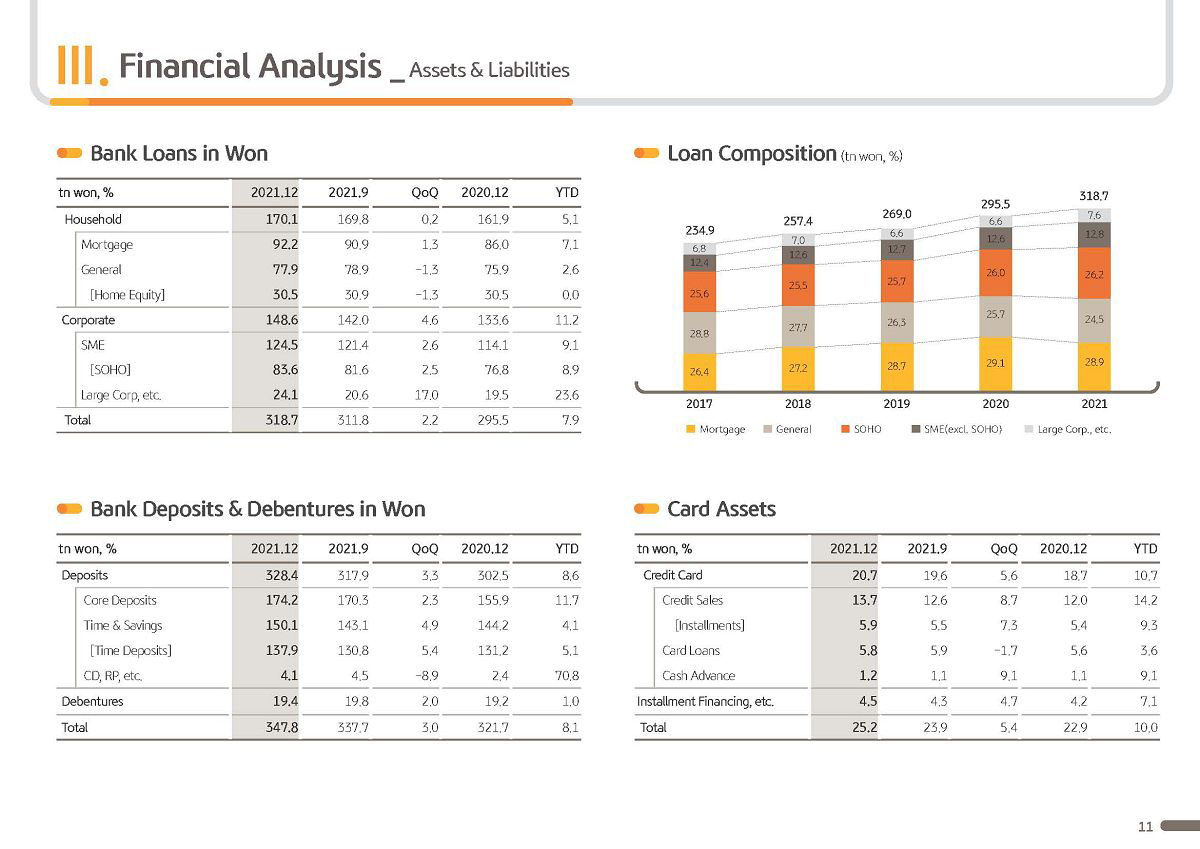

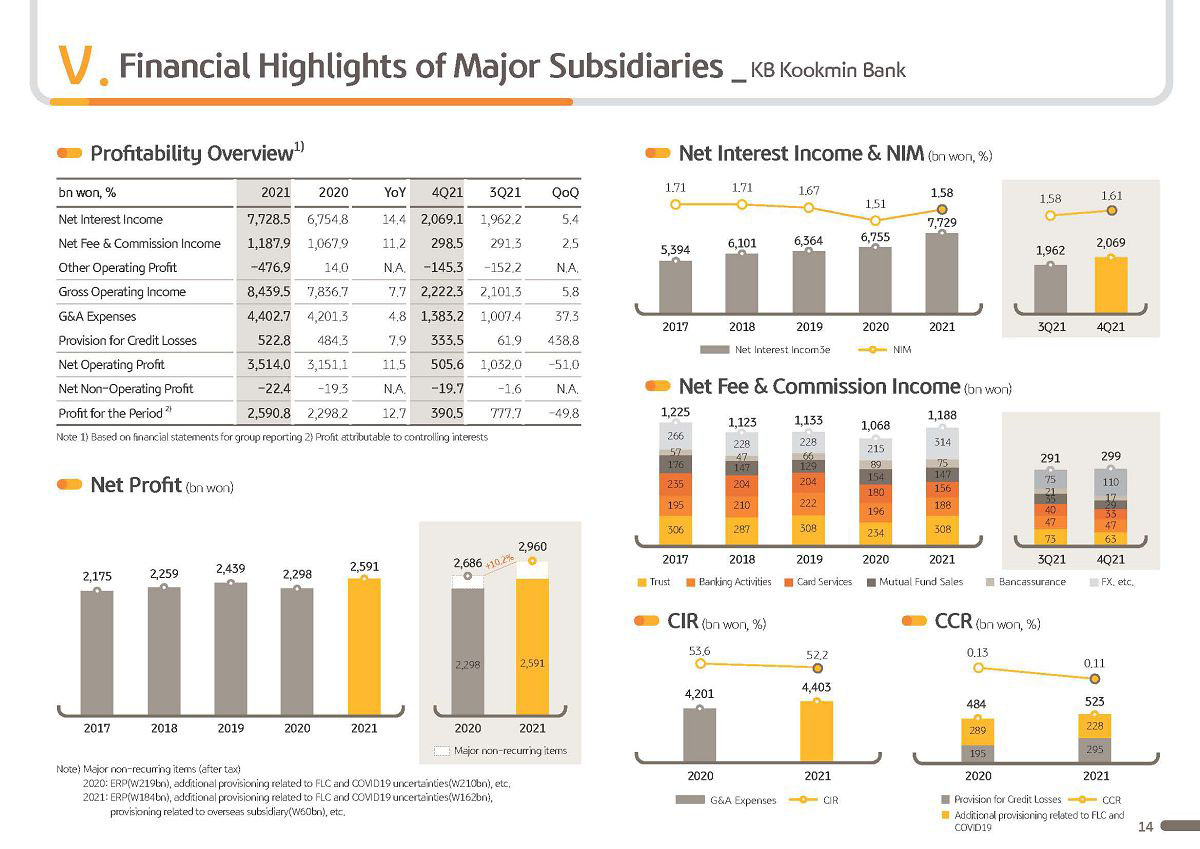

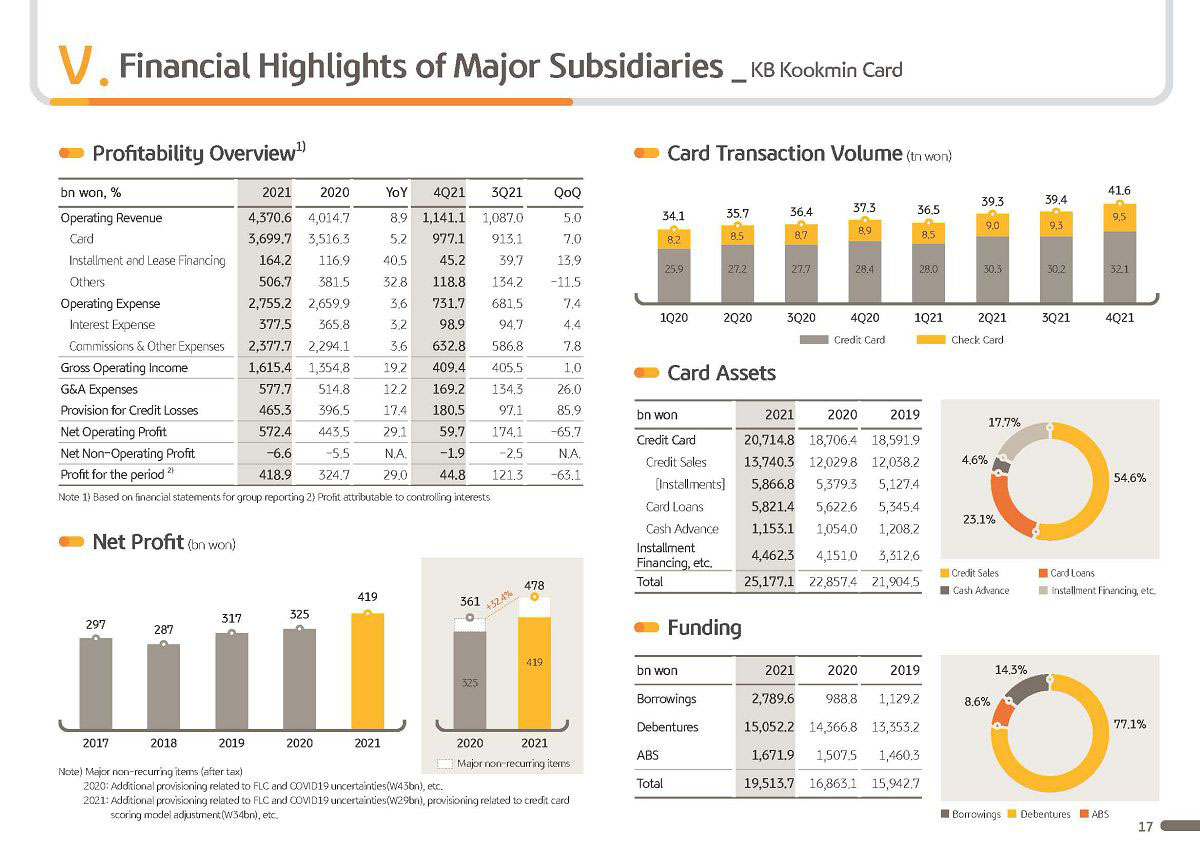

As can be seen from the bottom right graph, through continuous efforts to improve business competitiveness of our subsidiaries, bank, securities, insurance and credit card have all seen meaningful performance improvements. Nonbank contribution to Group's net profit, hence, expanded to 42.6%. I will now dive into the details of each item. 2021 Group net interest income was KRW 11,229.6 billion, up 15.5% year-over-year or around KRW 1.5 trillion, a sizable increase, which drove Group performance improvement. This result is driven by the Bank's solid loan growth and NIM improving,driving interest income,up 11%, while impact of Prudential Life and Cambodian PRASAC M&A further drove around KRW 500 billion of rise in interest income. Q4 net interest income was KRW 2,974.2 billion, up 4.2% Q-on-Q. The bank of the Bank's loan in won going up 2.2% versus September and continuing the uptrend as well as NIM improvement of 3 basis points Q-on-Q.

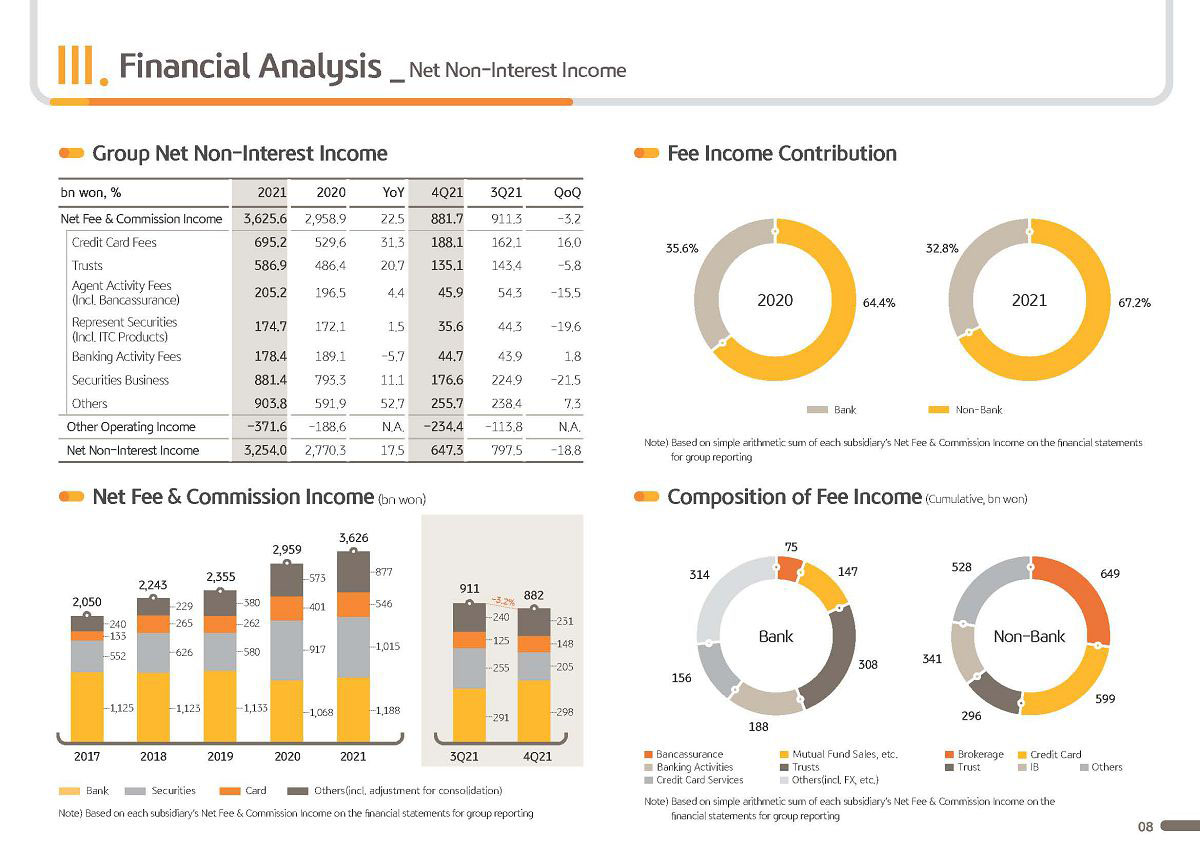

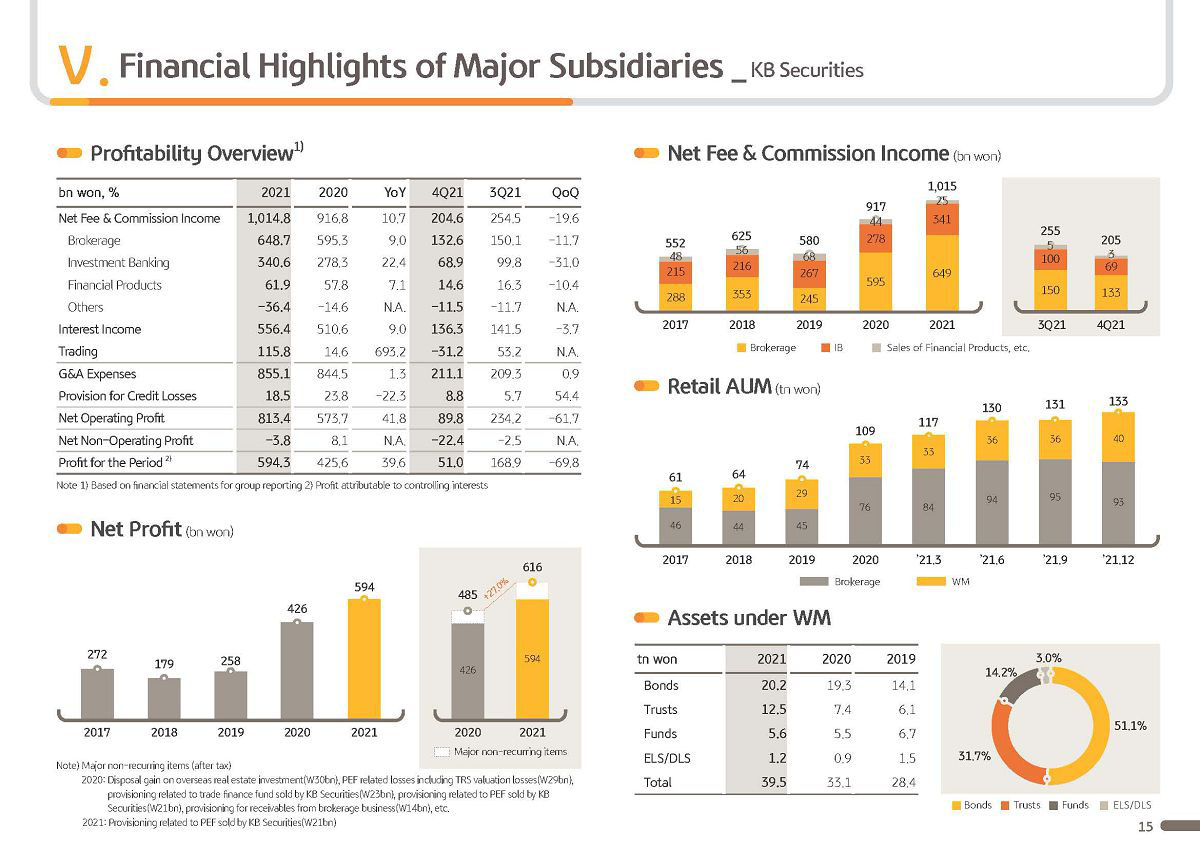

Next, 2021 Group's net fees and commissions income was KRW 3,625.6 billion, up 22.5% or KRW 667 billion year-over-year. This improvement to increases in credit card fee income riding on the recovery and consumption and Bank's trust product sales recovery, which led to better trust income as well as strong equities market and IB competitiveness driving a growth in fee income from securities business. On the other hand, Q4 net fees and commissions income came in at KRW 881.7 billion, a marginal Q-on-Q decline on the back of seasonal squeeze on fee income from securities business, mainly around brokerage and IB. But compared to KRW 2 trillion of annual Group fee commission income,in 2021, we notched up that level to mid KRW 3 trillion level endorses Group's improved capacity in generating such income.

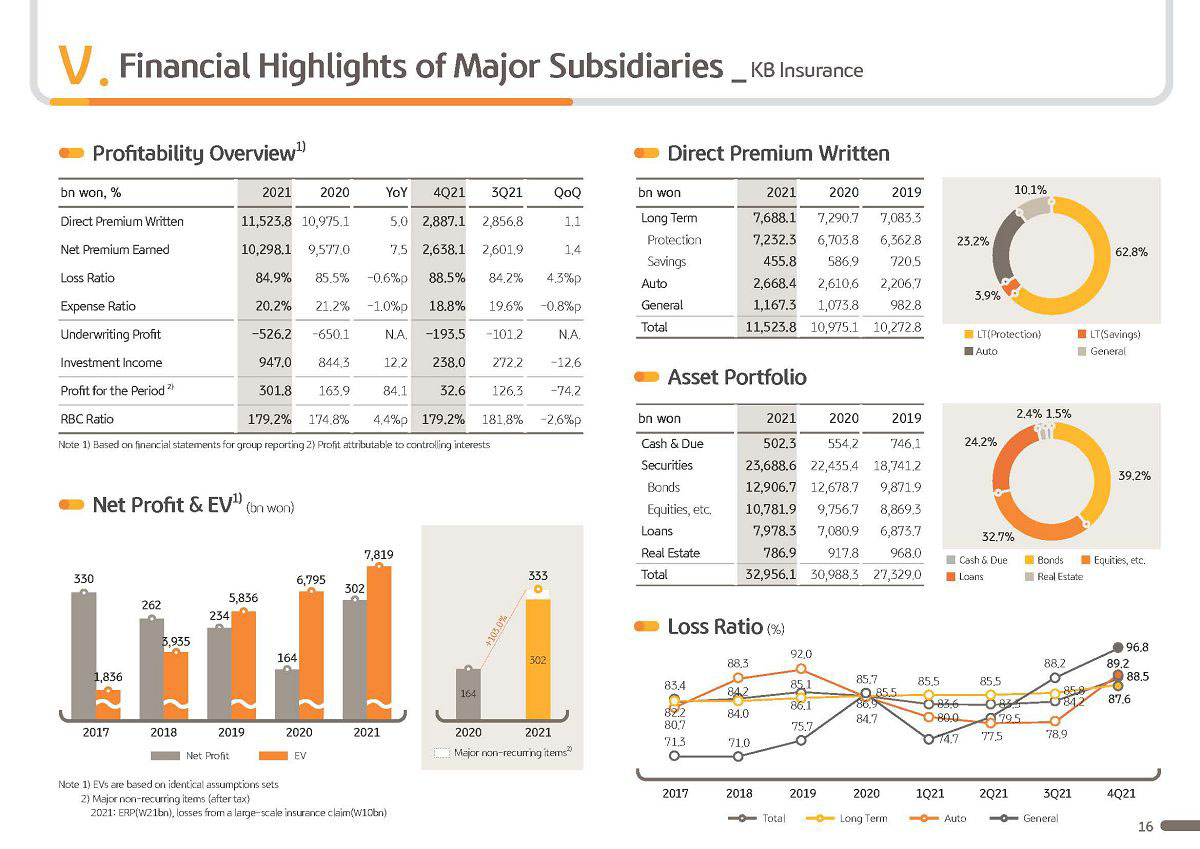

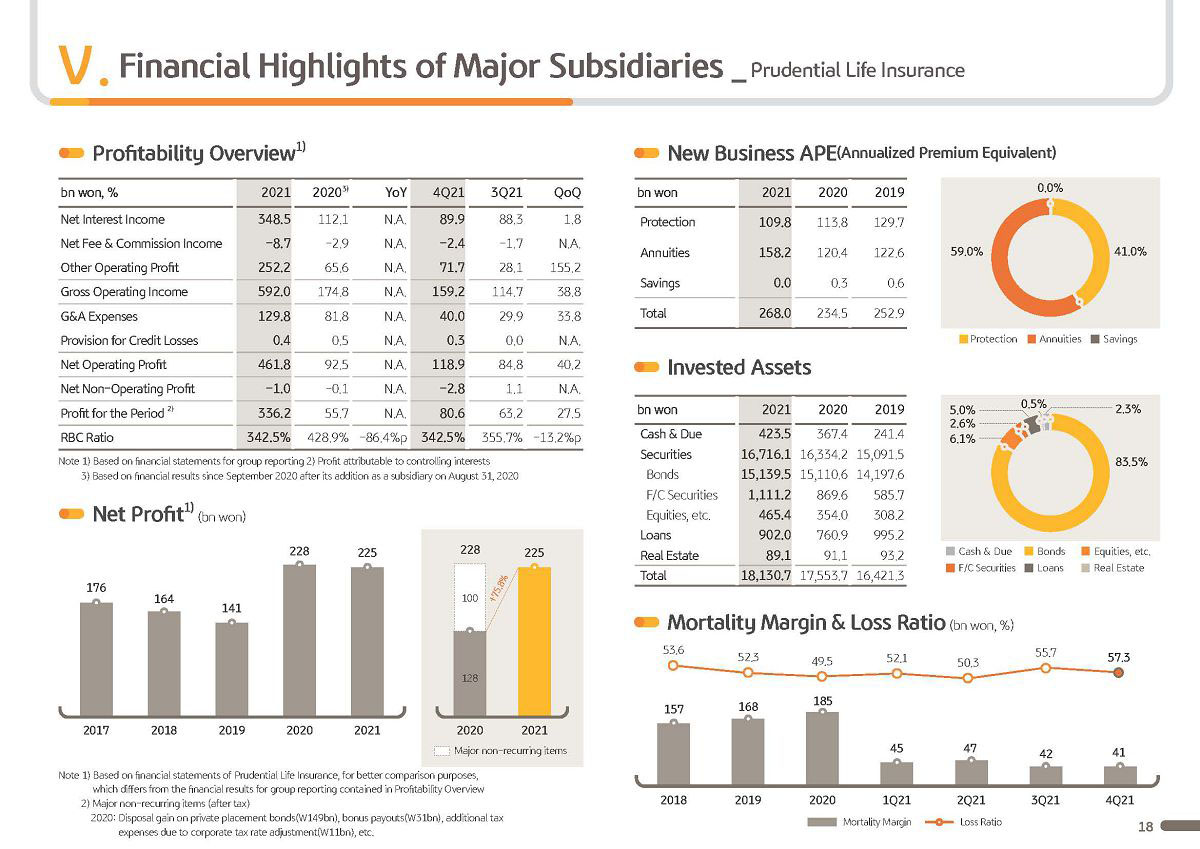

Next is on other operating profit. Group's '21 other operating profit was impacted by a rise in market rate and won-dollar exchange rate, which squeezed earnings related to securities, derivatives and FX driving other operating balance down KRW 183 billion year-over-year. But for the insurance business, with gradual earnings improvement from KB Insurance and acquisition of Prudential Life making its mark, there was KRW 256.7 billion improvement year-over-year. Q4 other operating profit was impacted by higher financial market volatilities in terms of interest rate and equities index, which led to erosion of securities trading performance also seasonal factors like cold wave and heavy snowfall and high-value accidents drove up loss ratio, constraining insurance underwriting income, all leading to a lower Q-on-Q result.

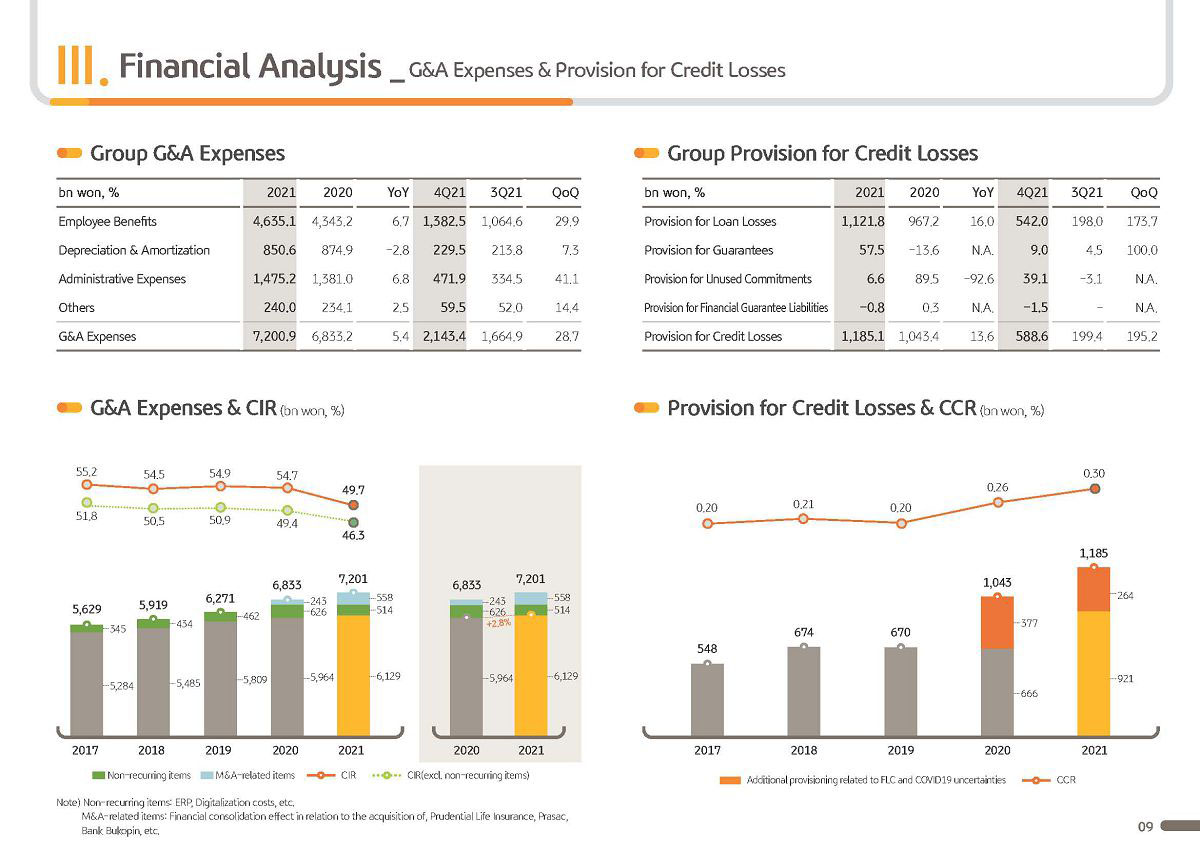

Next is on Group's G&A. Q4 Group G&A was KRW 7,200.9 billion, 5.4% or KRW 368 billion year- over-year, mainly due to the acquisition of Prudential Life, Indonesia's Bukopin Bank and Cambodia's PRASAC which added approximately KRW 300 billion of expenses. Apart from such M&A impact, G&A was up only 0.8% on year, which we believe is the tangible outcome of corporate-wide effort on cost management and headcount efficiencies. Q4 G&A was KRW 2,143.4 billion on the back of KRW 262 billion of ERP expenses and higher ad and promotion expense and other seasonal factors reporting a significant increase.

Next is on provision for credit losses. Q4 '21 Group PCL was KRW 588.6 billion. As part of preemptive risk management, large additional provisioning amounting to 3 times usual quarterly size took place up to Q3 of 2021. And due to such one-off impact, there was KRW 389.2 billion rise Q-on-Q. To fully prepare for COVID-19 related uncertainties during the fourth quarter, we used conservative economic forecast scenarios reclassifying certain loans related to COVID-19, which led to around KRW 264 billion of additional provisioning.

As you know, on top of KRW 377 billion of preemptive provisioning made last year, we've set aside yet additional provisions which we believe has given us ample buffer against the COVID-19 uncertainties. For the credit card business, in compliance with Basel III revisions, new PD, probability of default model was applied. And accordingly, in line with the required upgrade of the retail credit scoring model, there was additional provisioning of KRW 34 billion in Q4. 2021 PCL reported for the full year, KRW 1,185.1 billion. Credit cost was 30 basis points, following KRW 1,043.4 billion of FY '20 provisioning and credit cost of 26 basis points, we decided to take a conservative approach to meaningfully provision above the 20 basis point level for 2 consecutive years. Next is on key financial indicators.

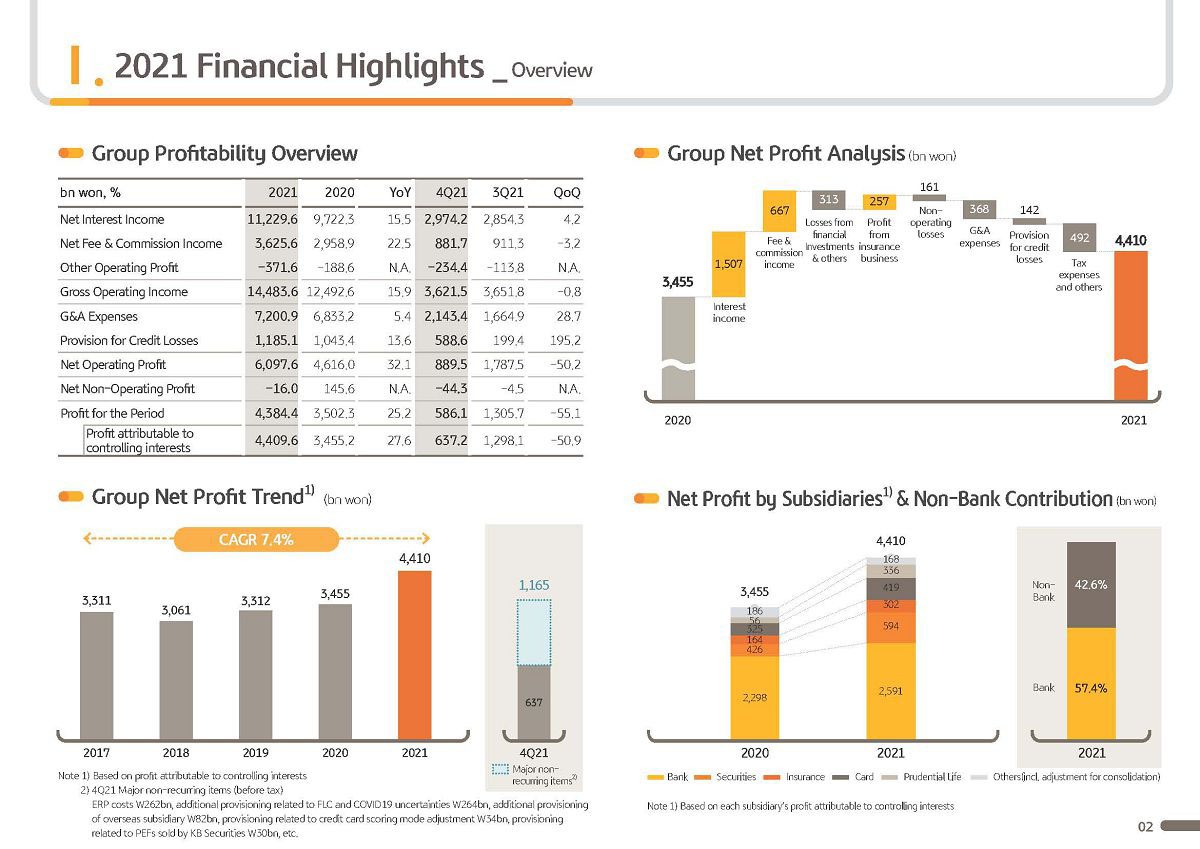

Page 3.

First is on Group's profitability. KBFG's 2021 ROE was 10.22%. On solid growth in core earnings and diversified revenue sources, Group's earnings fundamentals notched up with recurring basis, ROE sustaining a steady 10% quarterly level since the beginning of the year.

Next is growth in won denominated loans. Bank's loan in won as of end of '21 is KRW 319 trillion, up 7.9% year-to-date and 2.2% versus September end. Household loans reported KRW 170 trillion, and driven by Jeonse loans pinned by actual demand, there was a fair level of growth of 5.1% year-to-date.

However, that growth slowed down in Q4 due to the regulatory impact on household loans. Corporate loan reported KRW 149 trillion on a YTD basis. SME loan continued steady uptrend at around 3% quarterly basis and large corporate saw recovery in demand and stronger CIB business, leading to a solid growth in acquisition financing driving 11.2% growth. On a Q-over-Q basis, as corporate bond market was constrained on rate hikes, there was a rise in demand for loans on top of acquisition financing, which drove around 4 trillion of large corporate lending, leading to a Q-on-Q growth of 2.6%

Next, I will elaborate on the NIM. 2021, Q4 Group and Bank NIM each posted 1.85% and 1.61%, respectively, and continued an expansionary trend for 2 consecutive quarters. In particular, Bank NIM reflected the interest rate hike and while the loan asset repricing taking place, as a result of our continuous efforts to improve managed asset profitability and selective loan policies centering on profitability, it improved 3 basis points Q-o-Q.

On the other hand, in case of the Group and Bank's 2021 annualized NIM, the spread widened on the back of profitability-centered portfolio management. And with the effect of lighter funding burden following the core deposit growth, it improved by 7 basis points Y-o-Y and led the Group's interest income expansion. We will not only thoroughly manage funding costs taking into consideration, the loan pricing advancement and market circumstances going forward, but also improved profitability through securities, management portfolio advancements and managed the NIM thoroughly. From Q1 of this year, we are expecting the NIM to additionally expand with the full-fledge reduction of the effect from the BOK interest rate hike.

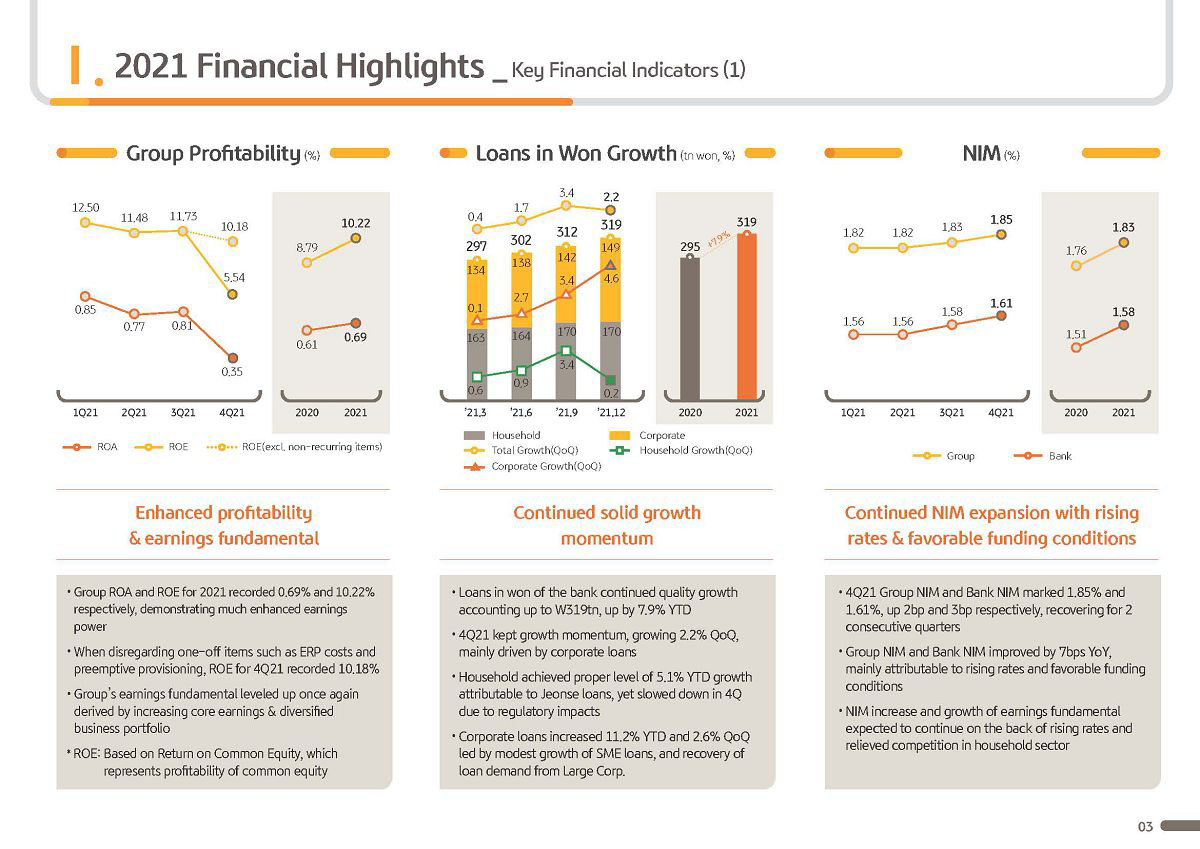

Let's go to the next page, Page 4.

First, I want to cover the Group cost efficiency. 2021, Group cost income ratio posted 49.7% and greatly improved Y-o-Y. And on the back of solid increase of core earnings and improvement of headcount structure, the cost efficiency improvement trend is truly taking place. In particular, when we exclude one-offs, including ERP and digitalization costs, CIR posted 46.3%, a record low. Going forward, through strengthening profit generation capacity and Group-wide cost management, we plan to manage the CIR so that the CIR, which was at a standstill at a mid-50% level in the past can approach it early to mid-40% level in the mid- to long term.

Next is the credit cost ratio. 2021 Group credit cost posted 30 basis points. And due to the aforementioned sizable preemptive provisioning effect, it increased slightly Y-o-Y but the credit costs, excluding nonrecurring items posted 21 bps and has been stably maintaining a 20 bps level for the last 5 years and has been proving industry-leading risk management competency. Although there are increasing concerns about asset quality, with the interest rate upcycle and impending COVID- 19 forbearance program termination, since we are securing sufficient buffer by accumulating additional provisioning, we believe that the credit cost will be stably managed going forward.

Next, I will cover the capital ratio of the Group. 2021 year-end Group BIS ratio posted 15.78%. Tier 1 ratio recorded 14.55% and CET1 ratio posted 13.46%, all increasing Y-o-Y. Despite the increase of RWA following loan growth and increase of dividends, on the back of strategic capital management, including solid profit generation capacity and hybrid bond issuance, we are still maintaining the highest level of capital adequacy in the industry.

Let's go to the next page. It is Page 5.

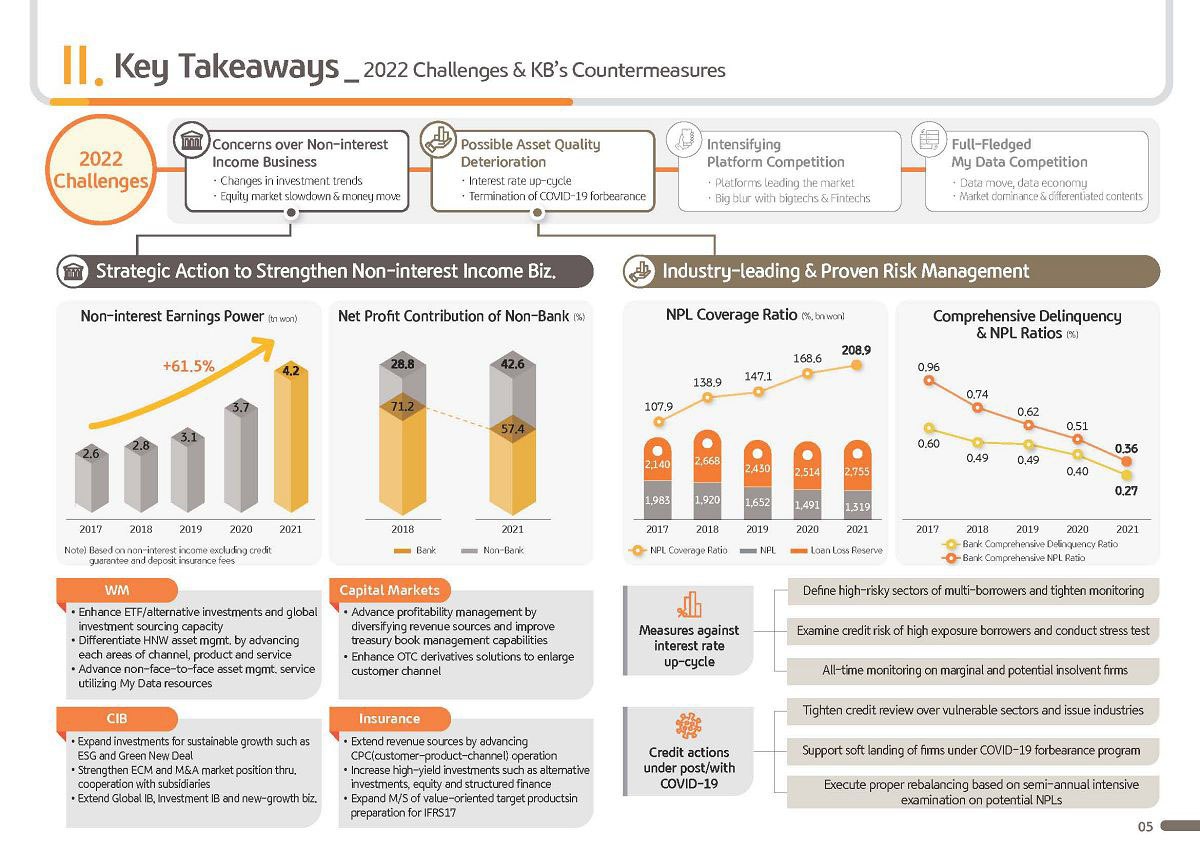

From this page, among the many challenges that the financial industry is facing this year in 2022, I would like to cover those that the market is very concerned about and interested in the 2022 challenging factors and then elaborate on KB Financial Group's countermeasures.

This year, there are concerns that the non interest income, which performed positively last year in a favorable sales environment, including the strong equities market will weaken due to many reasons, including equity market slowdown, interest rate hike and credit card merchant fee cuts. There are also concerns that with the reflection of the possibility that the asset quality can also worsen with a key interest rate hike in termination of the COVID-19 forbearance program, the earnings improvement momentum might slow down.

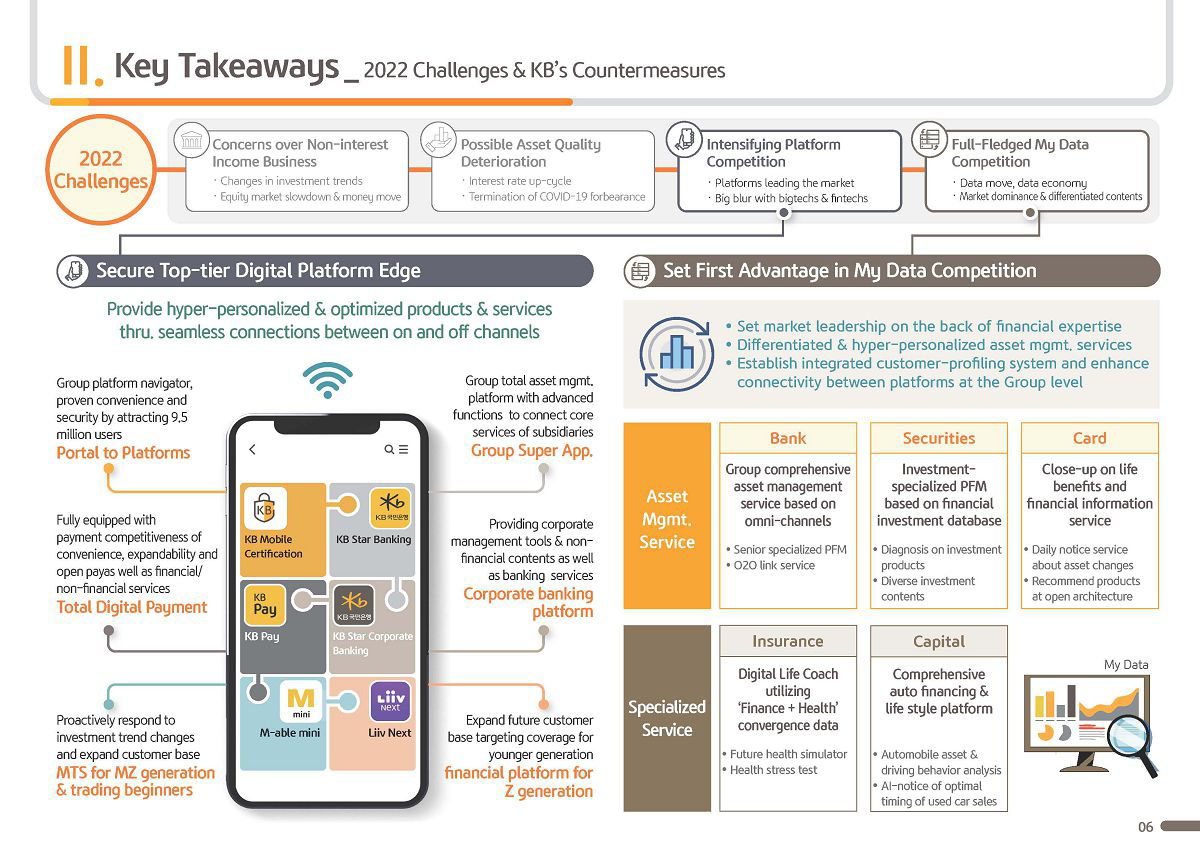

In addition with the lowering boundaries between financial and nonfinance and not only that platform competition between fintech and big tech is intensifying but also with the complete rollout of MyData service with full-fledged competition to secure data initiative and early market dominance this year will be a very important time for financial companies to find ways to secure platform competitiveness, market dominance and to secure them as soon as possible.

To this end, we broke down the 2022 challenge factors into four: first, concerns about noninterest business deterioration; second, possibility of asset quality worsening; third, intensifying platform competition; and fourth full-fledged MyData competition and are coming up with strategies to respond to these 4.

First of all, regarding concerns about weakening noninterest income, I would like to elaborate on KB's countermeasures. 2021 was a year when the performance of nonbanking business was prominent in the overall financial industry. In particular, KB Finance was evaluated to have improved our level of noninterest earnings power based on the most diversified business portfolio in the industry. We also expect that we will be able to continue our additional growth momentum this year as well by reaping visible results in the group's 4 major growth businesses, including WM, CIB capital markets and insurance.

In the WM area, basically, we will expand product sourcing, including ETF, alternative investment and overseas investments. In asset management service, we will advance channels, products and services for customer subsegments and provide differentiated asset management service for ultra-high asset customers. And in non-face-to-face asset management, we will link MyData and band market share. In the CIB and capital market, we will expand the Group CIB coverage and expand revenue sources through new investment in equal friendly and future-oriented business, Investment IB and Global IB business, diversified capital market magic portfolio and strengthen our treasury book management capabilities to thoroughly manage profitability. In insurance, we will advance CPC, customer-product-channel operating system and expand revenue sources and increased investment in high-yield assets, including alternative investment in structured products so that we can improve our managed asset profitability.

Next, I would like to cover our countermeasure to the second challenge, which is related to the possibility of asset quality deterioration. KB Financial Group has been proving the highest level of risk management capability until now. 2021 and the Bank's comprehensive delinquency rate and comprehensive NPL ratio is posted 0.36% and 0.27%, respectively, and is being managed stably at the lowest level in the industry, and the Group's NPL coverage ratio posted 208.9% and is being evaluated to a faithfully secured loss absorption capacity.

Despite this, this is a year when credit risk can rise with the interest rate hike in COVID-19 forbearance program termination, we will do our best to more strengthen our asset quality management system. To respond to the interest rate upcycle, we have defined high-risk sectors of multiple borrowers and are monitoring them and strengthening stress tests for high exposure borrowers and to respond to post and with COVID, we are tightening credit review of vulnerable sectors and issue industries and executing proper rebalancing based on semiannual intensive examination on potential NPLs and we plan to support soft landing of firms after the termination of the COVID-19 forbearance program through stage support.

Let's go to the next page.

Third is the intensifying platform competition, KB Financial Group is focusing on our group's capacity and support so that we can secure a top-tier level digital platform competitiveness. Through KB Star Banking, the Group's super app, which strengthen the connectivity of core services and representative comprehensive asset management platform and comprehensive digital KB Pay, we established the basic banking app and, of course, a financial platform, which will lead to asset management and the settlement market, and we have to enable Mini, which targets the MZ generation investment in stock market offices and Liiv Next, the financial platform customize with the Z generation, we are now expanding our coverage of our customers.

Moreover, with KB Star Corporate Banking, we plan to lead the platform market in the corporate finance sector. With this platform competitiveness, if we can secure seamless connectivity with the offline channel and provide the most optimal products and high-quality services from the customer's perspective, we believe that we can secure top-tier competitiveness. Lastly, I would like to cover our countermeasure to MyData, which is the most talked about topic in the financial industry.

With the full rollout of MyData in January of this year, the data economy era opened up. KB Financial Group strategy is to provide not only KB's unique differentiated content based on our financial expertise and also link business specialized services to our Group's platform, but also provide hyperpersonalized asset management services that will reflect the daily activities of our customers.

Going into more detail in the area of asset management service, in the case of the bank, it will provide comprehensive asset management service based on on-off line omnichannel securities and card, each will provide investment specialized and lifestyle-based asset management services, respectively, business specialized service, not our insurance will provide health management service, which converges health care and finance. Capital will provide auto finance and auto-related lifestyle platform service and thus, customized lifestyle financial contents will be provided for different businesses.

If we can secure KB's unique content competitiveness through this method, we believe that we can have early dominance in the MyData market and contribute to accelerating our Group's top-tier platform competitiveness. In 2022, this year, KB Financial Group will respond to these challenges through seamless innovation, focusing on our customers, secure sustainable growth and leap forward once again as a leading financial group.

From the next page, there are details regarding the earnings results that I have aforementioned. So please refer to them as needed. With this, I will conclude KB Financial Group's 2021 earnings release presentation. Thank you for listening.