-

Please adjust the volume.

1H25 Business Results

Greetings.

I am Peter Kwon, Head of the KBFG IR division.

We will now begin the 2025 first-half business results presentation.

Thank you very much for participating in today's earnings release.

We have here with us executives from the group, including CFO, Nah Sang Rok, and other executives from the group.

First, our Group CFO will cover 2025 first-half major performance highlights.

After that, we will have a Q&A session.

Like in the previous quarter, please note that after our real-time Q&A session, we have set aside additional time for management team to answer questions that were previously submitted by our shareholders.

I will now invite our Group CFO to walk us through the first-half business results of 2025.

Good afternoon.

I am Nah Sang Rok, CFO of KB Financial Group.

Thank you all for joining the first-half 2025 earnings release presentation.

Today, I will walk through key results of the first half and update you on the shareholder value and return, then move on to the details of our earnings.

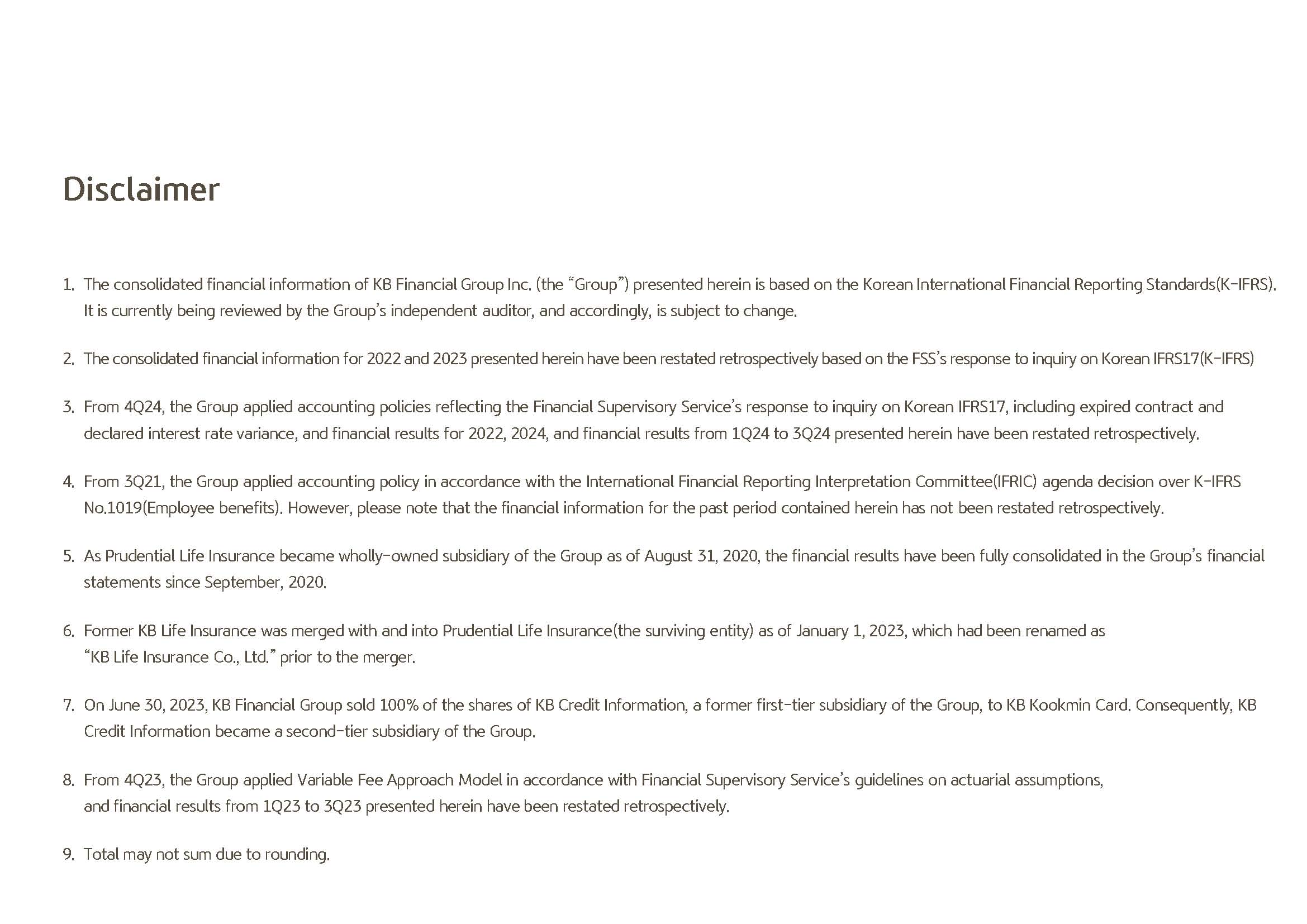

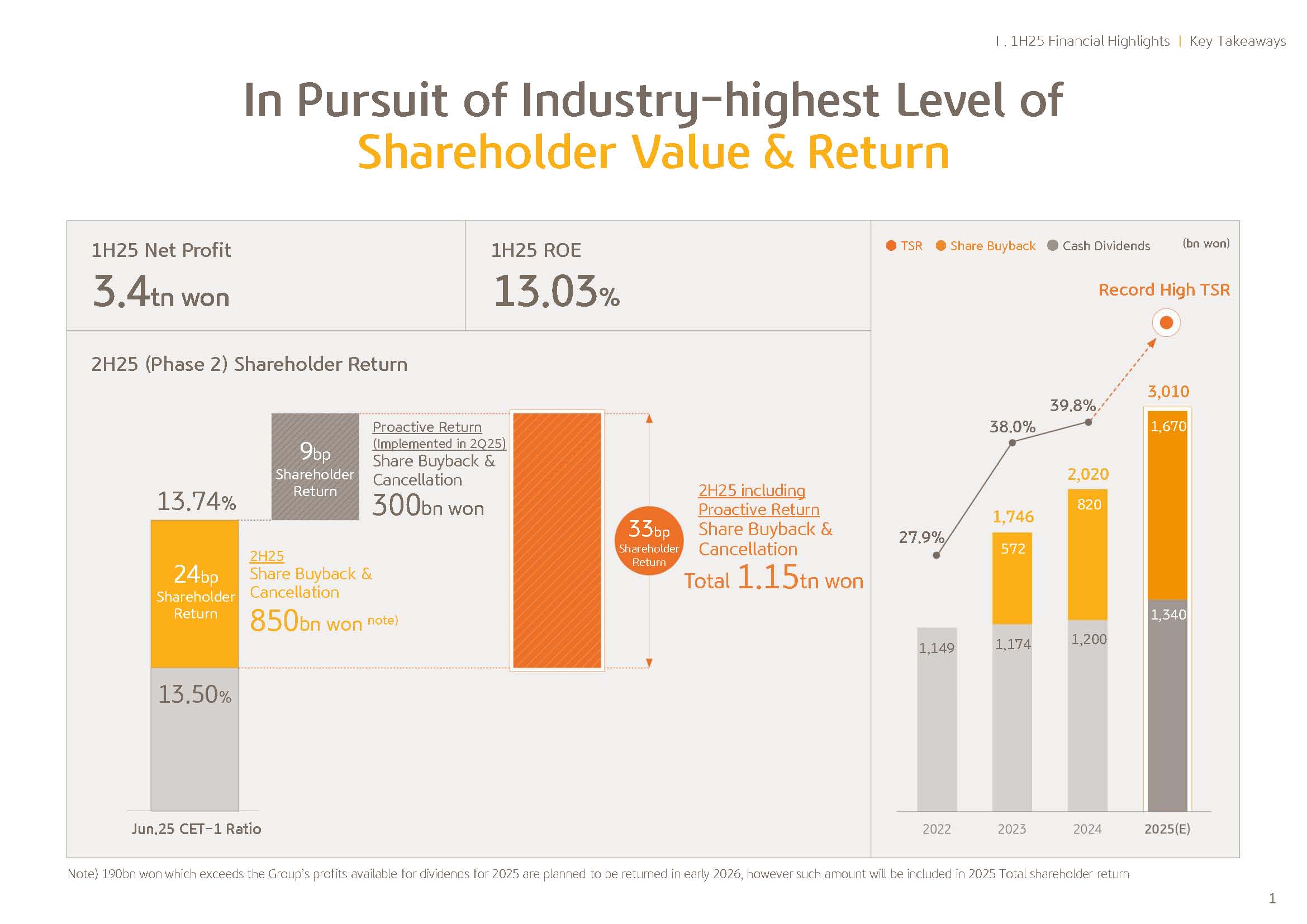

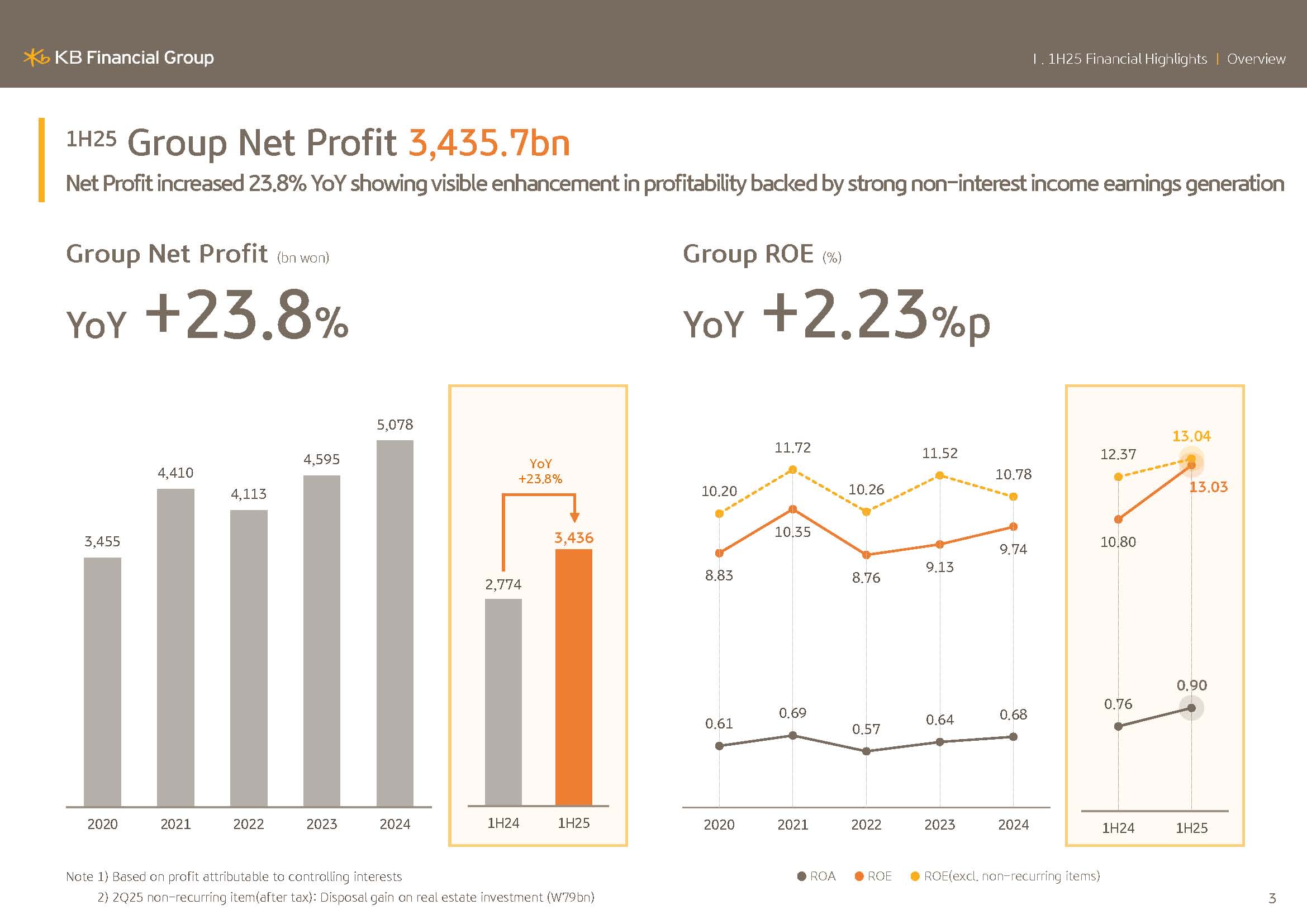

First, page 1, Q2 net profit reported KRW1,738.4 billion with first-half cumulative profit reporting KRW3,435.7 billion and ROE of 13.03%.

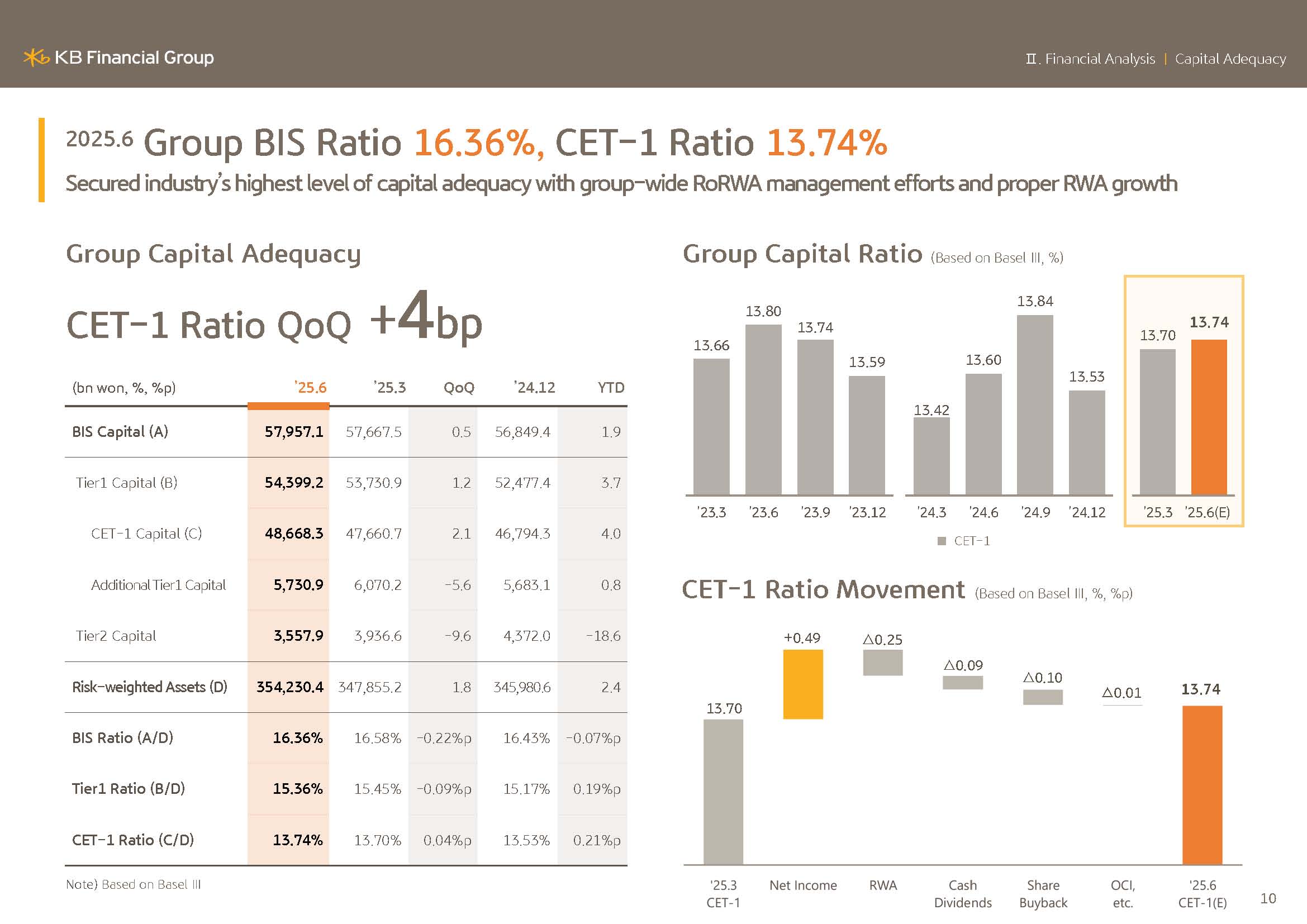

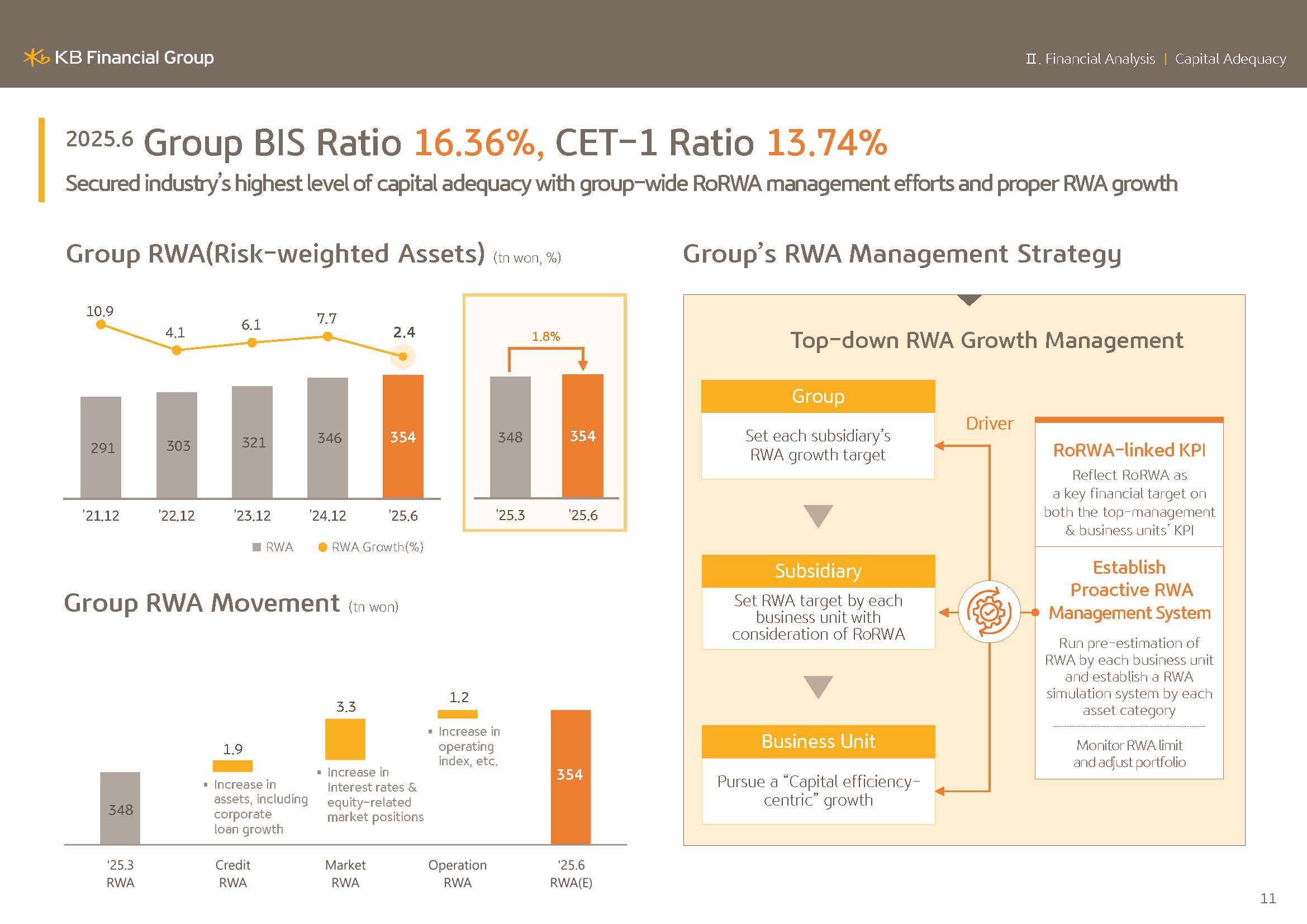

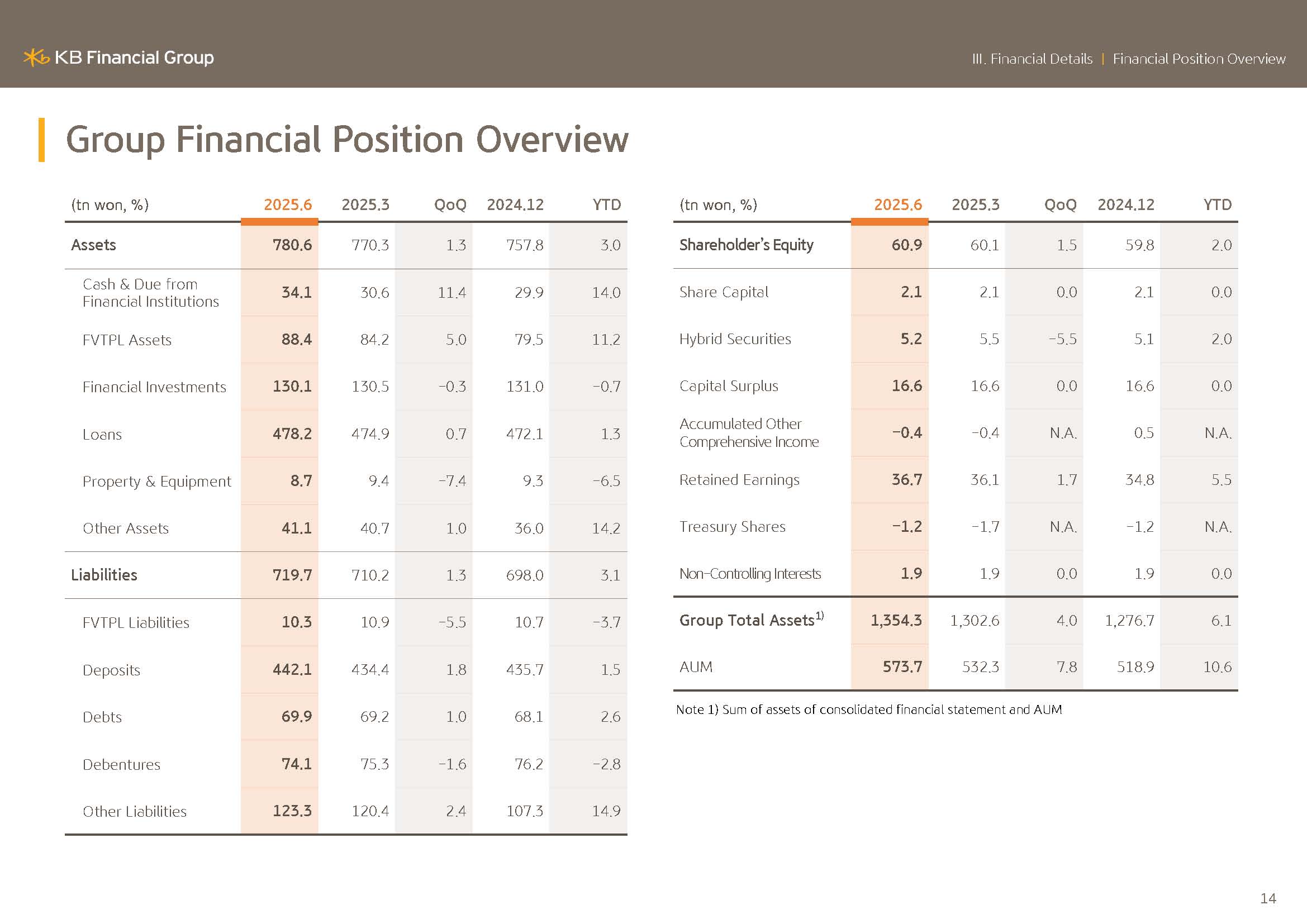

Increase in RWA for the first half on a cumulative basis was managed at around 2.4%, whilst CET1 ratio as of June end came in at 13.74%.

All in all, we maintained the balance between resilient earnings power and stable capital management. And under KB's shareholders' return framework, we will be using what is above CET1 ratio of 13.5%, which is KRW850 billion in total as funds for shareholder return in the second half.

When accounting for KRW300 billion of proactive buyback done in the second quarter, second round of shareholder return upcoming in the second half will amount to around KRW1.150 trillion.

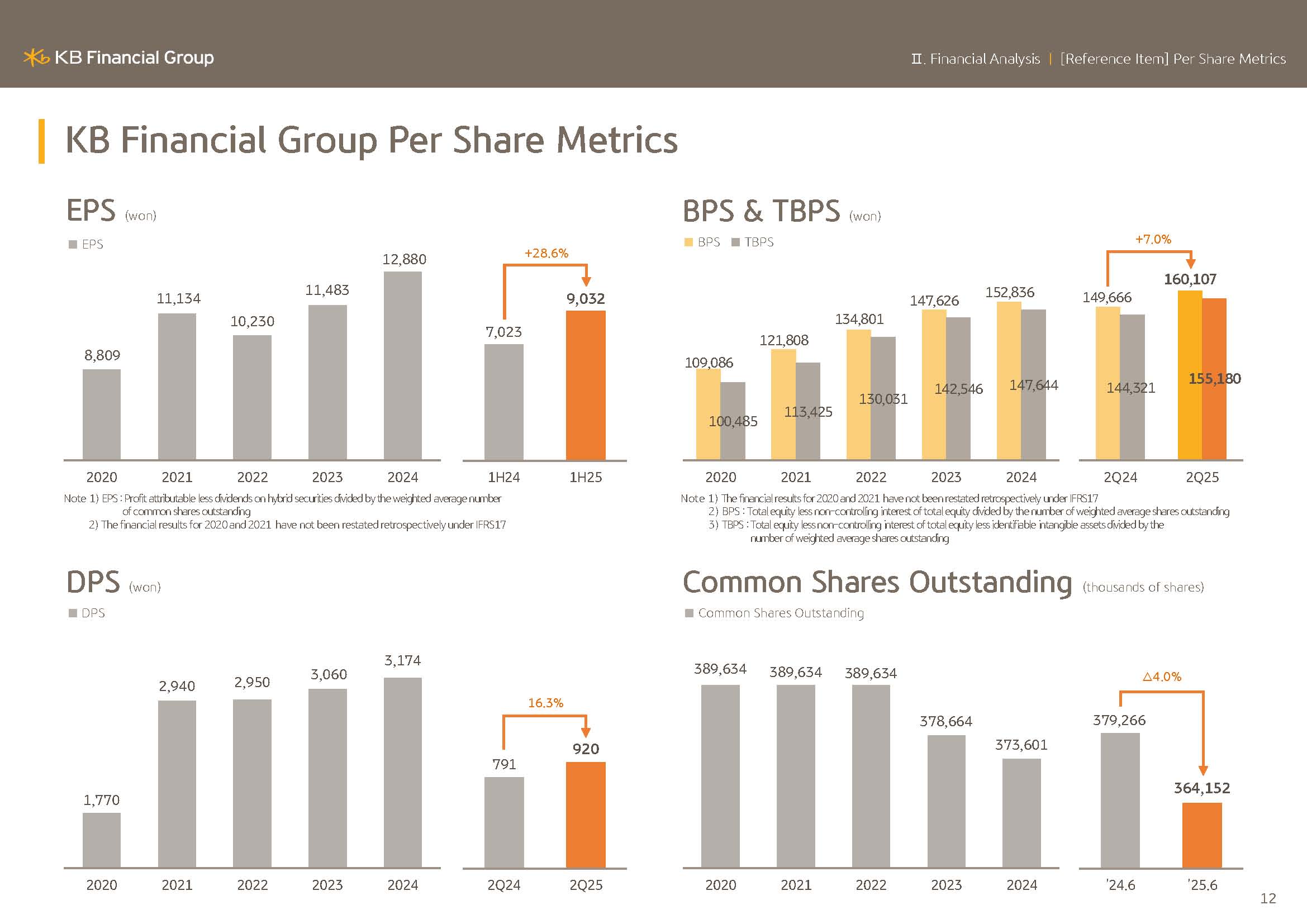

Out of the total annual cash dividend of KRW1.34 trillion for 2025, today's BOD resolution decided on KRW335 billion of equally portioned dividend for second quarter and DPS of KRW920.

Also, we decided to first buyback and cancellation KRW660 billion of treasury shares within the scope of distributable profit.

Out of KRW850 billion, the KRW190 billion, which is excess capital, would be used as fund for shareholder return at book closing of 2025 accounts following the BOD resolution. And this amount will be classified and attributed to shareholder return for 2025.

It's inevitable that portions of the second round of shareholder return for 2025 will be pre-paid in Q2, while the rest will be returned by early next year, which is due to the progressive expansion of shareholder return at KBFG versus the past practices as we exceeded the profit available for dividend payout.

I want to reiterate that KB's firm commitment to shareholder return and its promise stays unchanged.

In particular, total shareholder return for 2025 is KRW3.010 trillion, which is a significant increase year over year.

And although TSR may slightly fluctuate depending on the size of annual net income, we expect record-high TSR for the year.

Also, we plan to have interim dividend payout from the subsidiaries in the second half to secure ample amount of distributable income for the upcoming year.

Next is page 2.

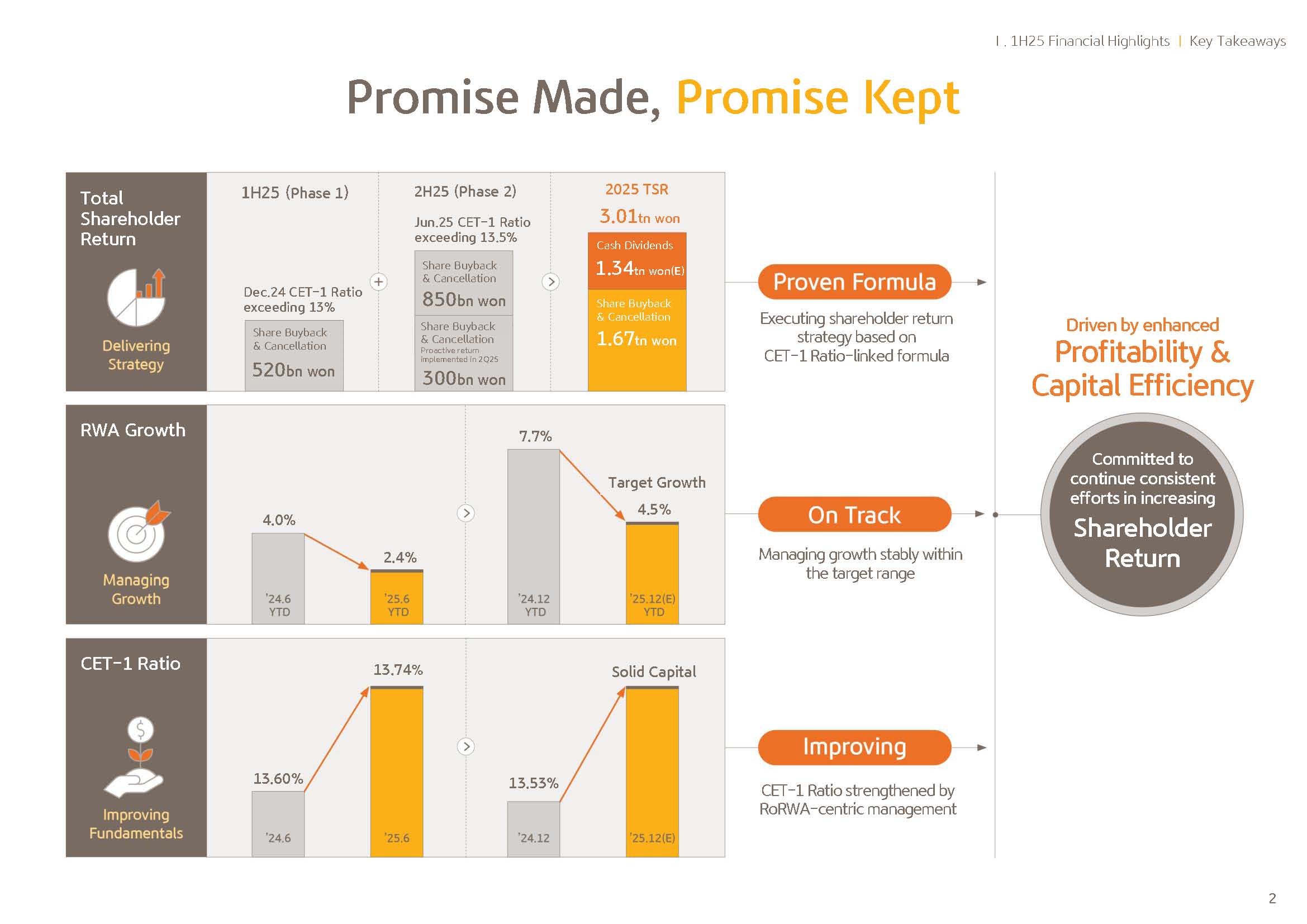

We shared our shareholder return plan for both first half and second half of 2025 with the market for the benefit of transparency and are faithfully implementing the plan.

In the second half, we plan to focus on three key directions in terms of capital discipline.

First, promise to the market. We know the gravity of this commitment and will hence implement the announced shareholder return framework with consistency.

Based on our execution capabilities, we will further solidify trust from the market.

Second, we will manage risk-weighted assets with greater precision.

RWA growth will be controlled at an appropriate level, but rather than just managing the rate of RWA growth, we will change the fundamentals to one that guarantees our bottom line.

Third, under such capital discipline, to ensure the shareholder return expansion is not one-off event. We will continue to balance between ROE and capital ratio as done so in the first half of the year.

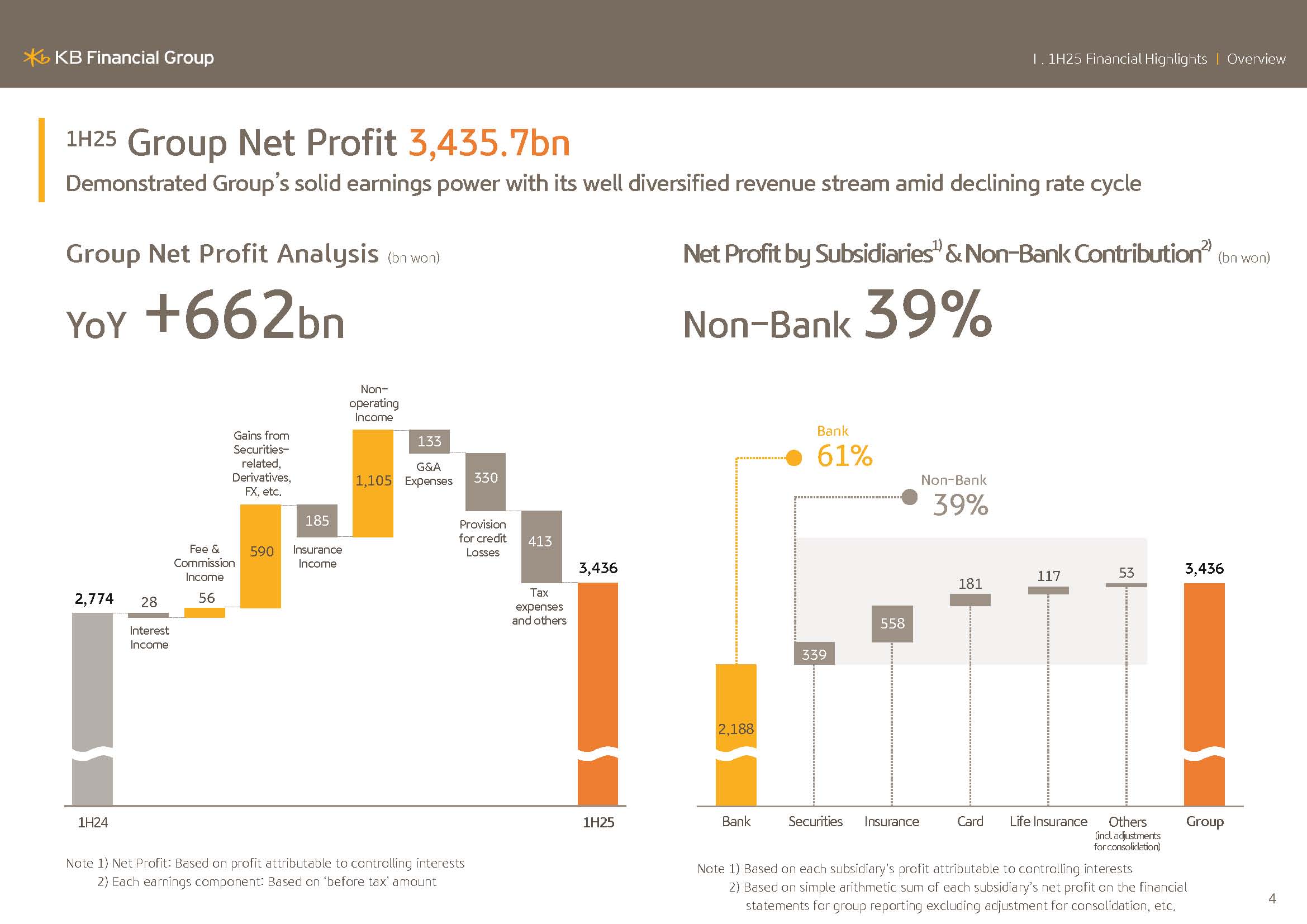

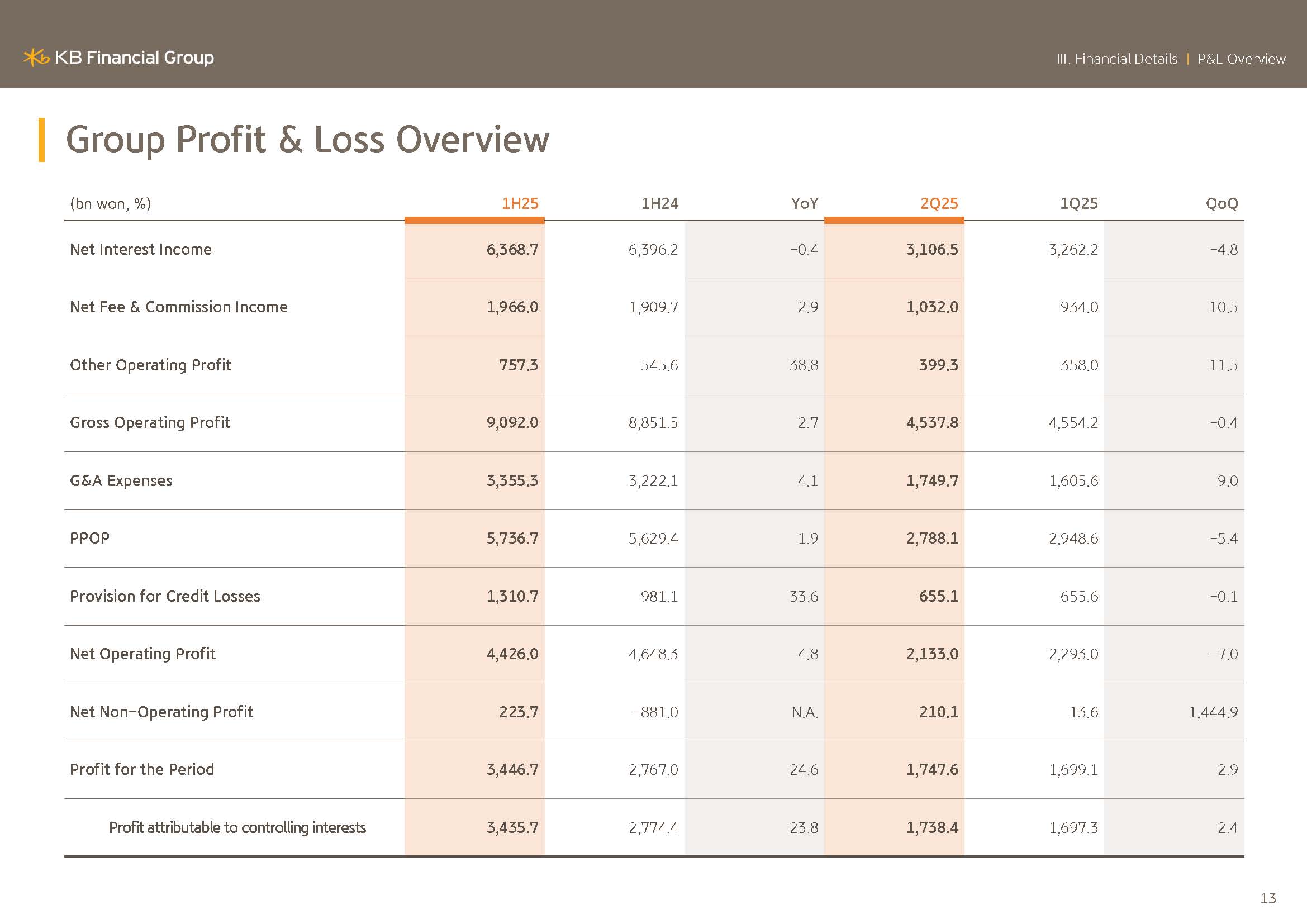

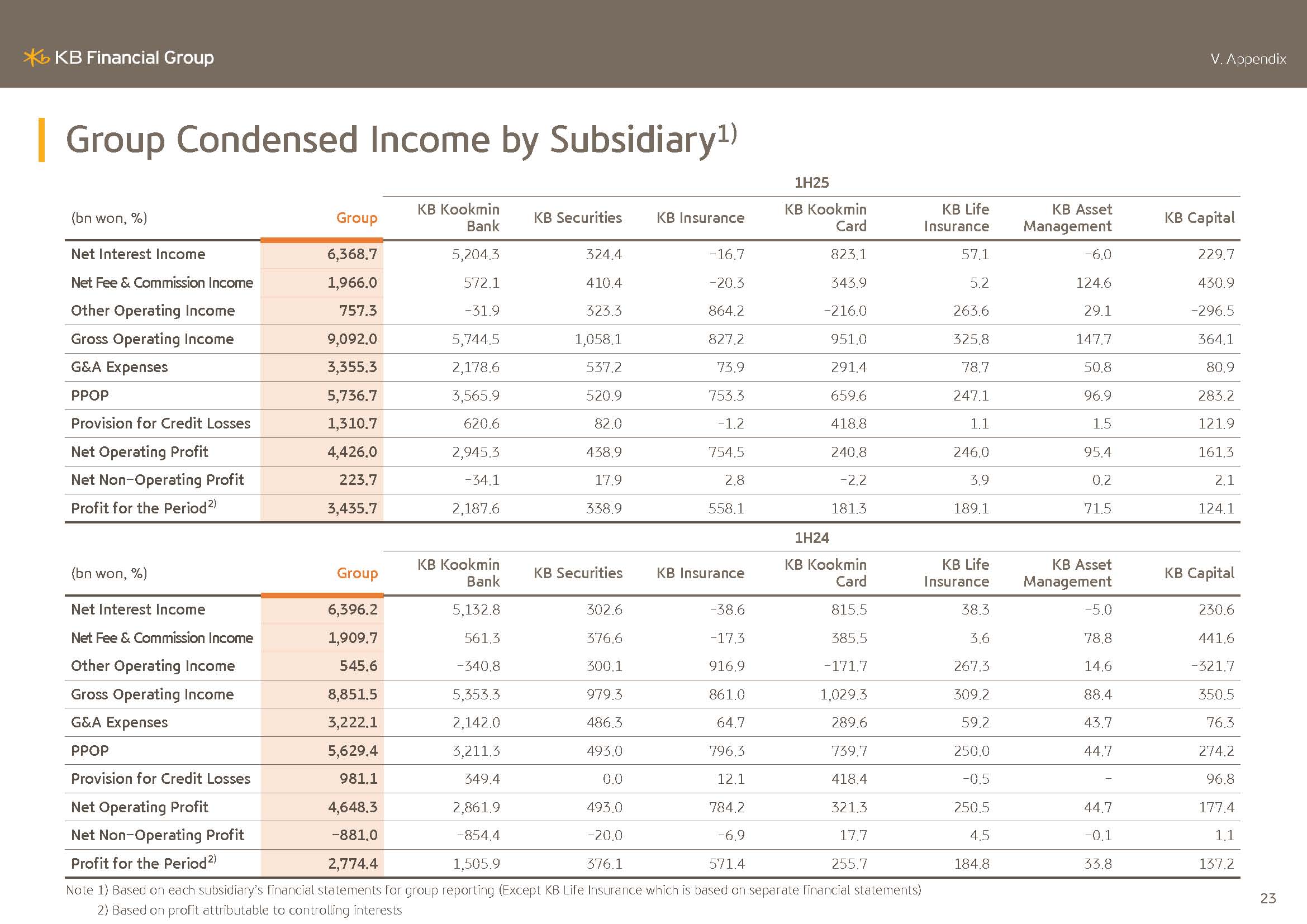

Now, moving on to KBFG's business performance, group's net profit for Q2 was KRW1,738.4 billion. And on a first-half basis, it was up 23.8% year over year, reporting KRW3,435.7 billion.

Such result was driven by higher non-interest income and the recovery from non-operating profit, which drove the group's net profit.

Non-interest income was up 10.9% year over year. And due to the absence of ELS provisioning seen last year and gains from disposition of assets under consolidated funds, non-operating income increased by KRW1,104.7 billion year over year.

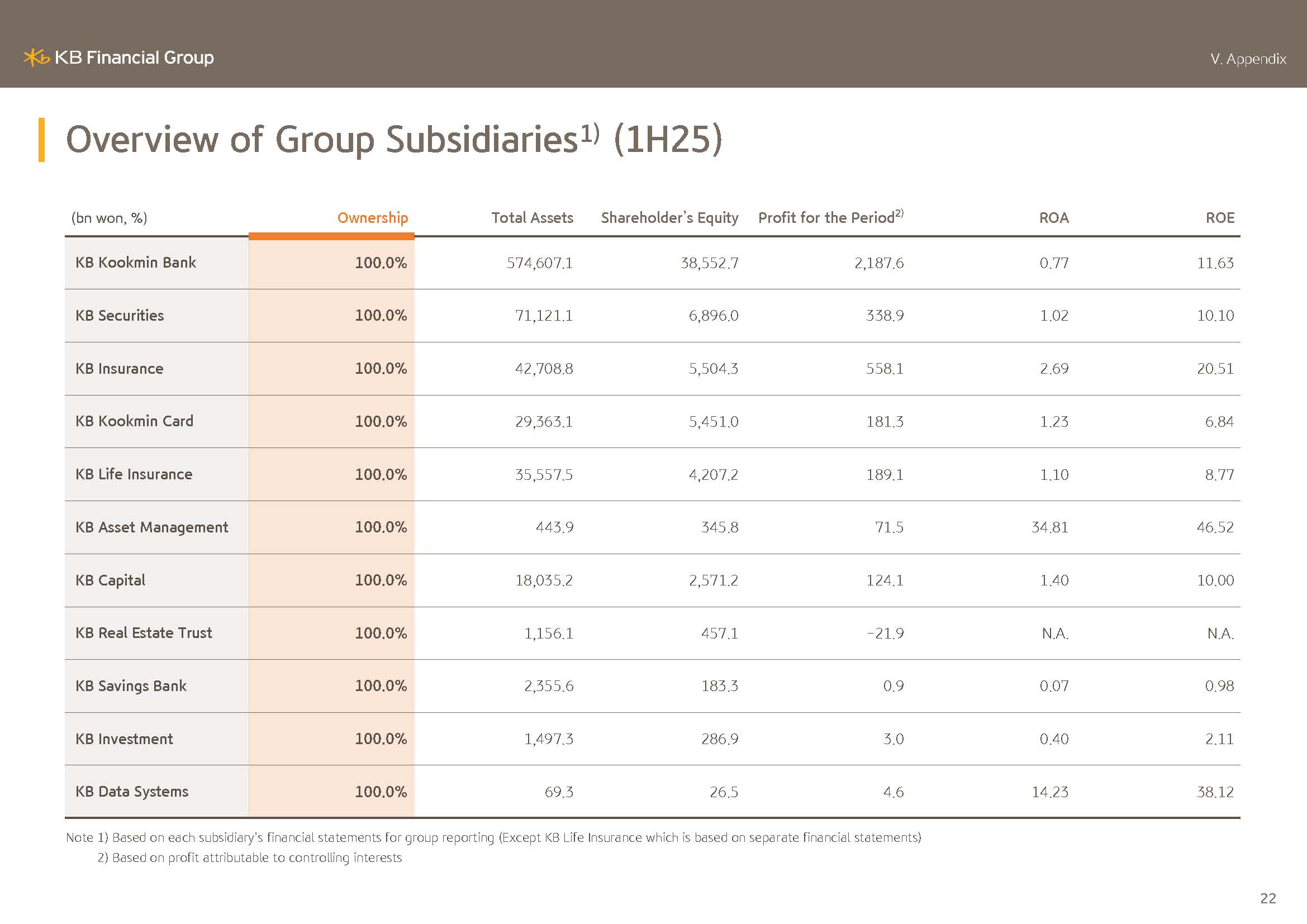

Also, non-bank accounted for 39% of the group's first-half net profit. Diversified business portfolio of the group is expected to play a critical role in securing earnings stability in times of interest rate decline and boom in the stock market trading.

With that said, I will now move on to the breakdown of the earnings results.

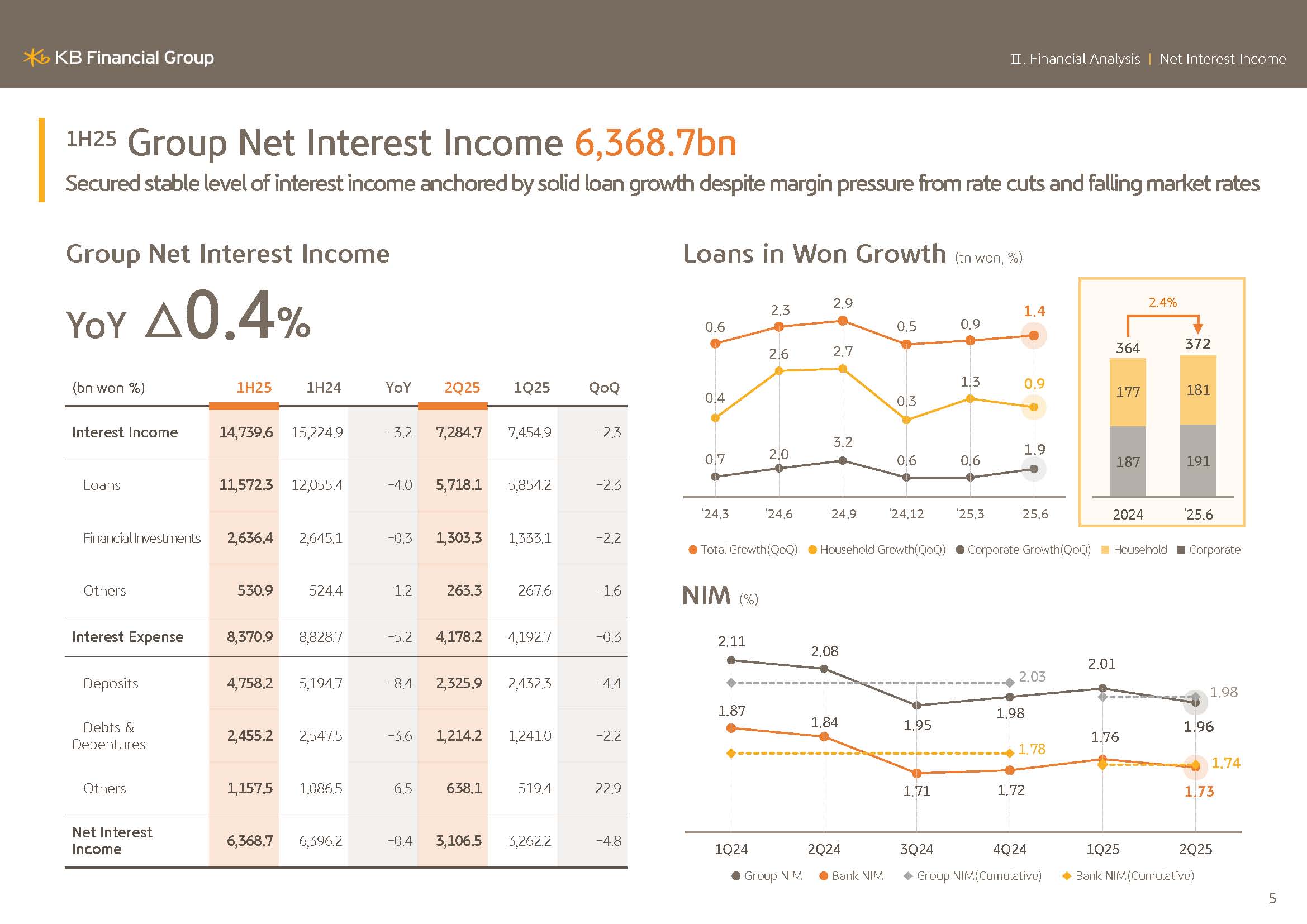

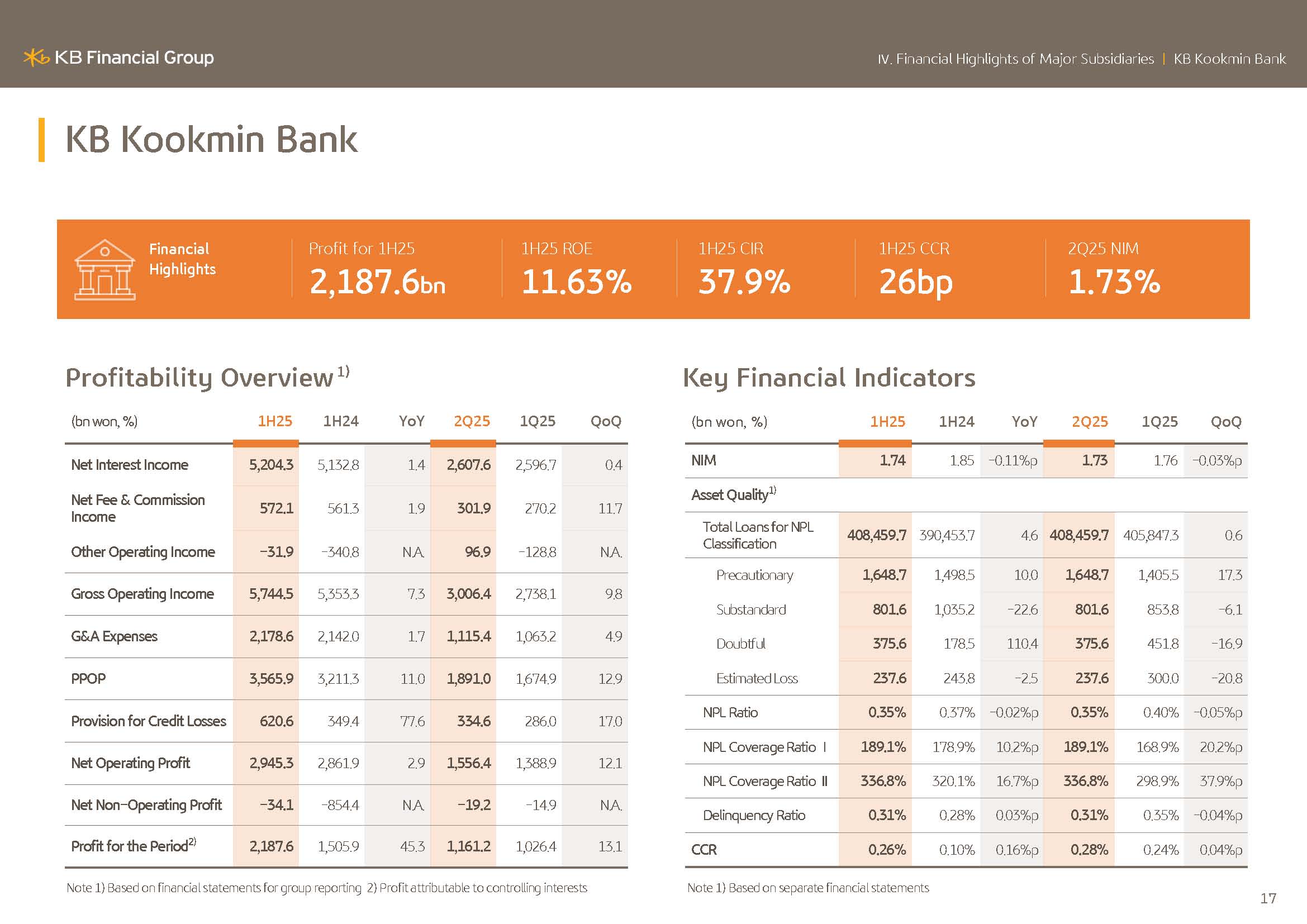

2025 first-half group net interest income posted KRW6,368.7 billion. And despite the net interest margin contraction following the rate cut through stable loan growth, we achieved results similar to the same period last year.

However, it decreased 4.8%. Not QoQ, because around KRW159.1 billion of the expenses from the liquidation of consolidated funds in Q2 was temporarily reflected on interest expenses. And excluding this on a recurring level, we are maintaining the level of the previous quarter.

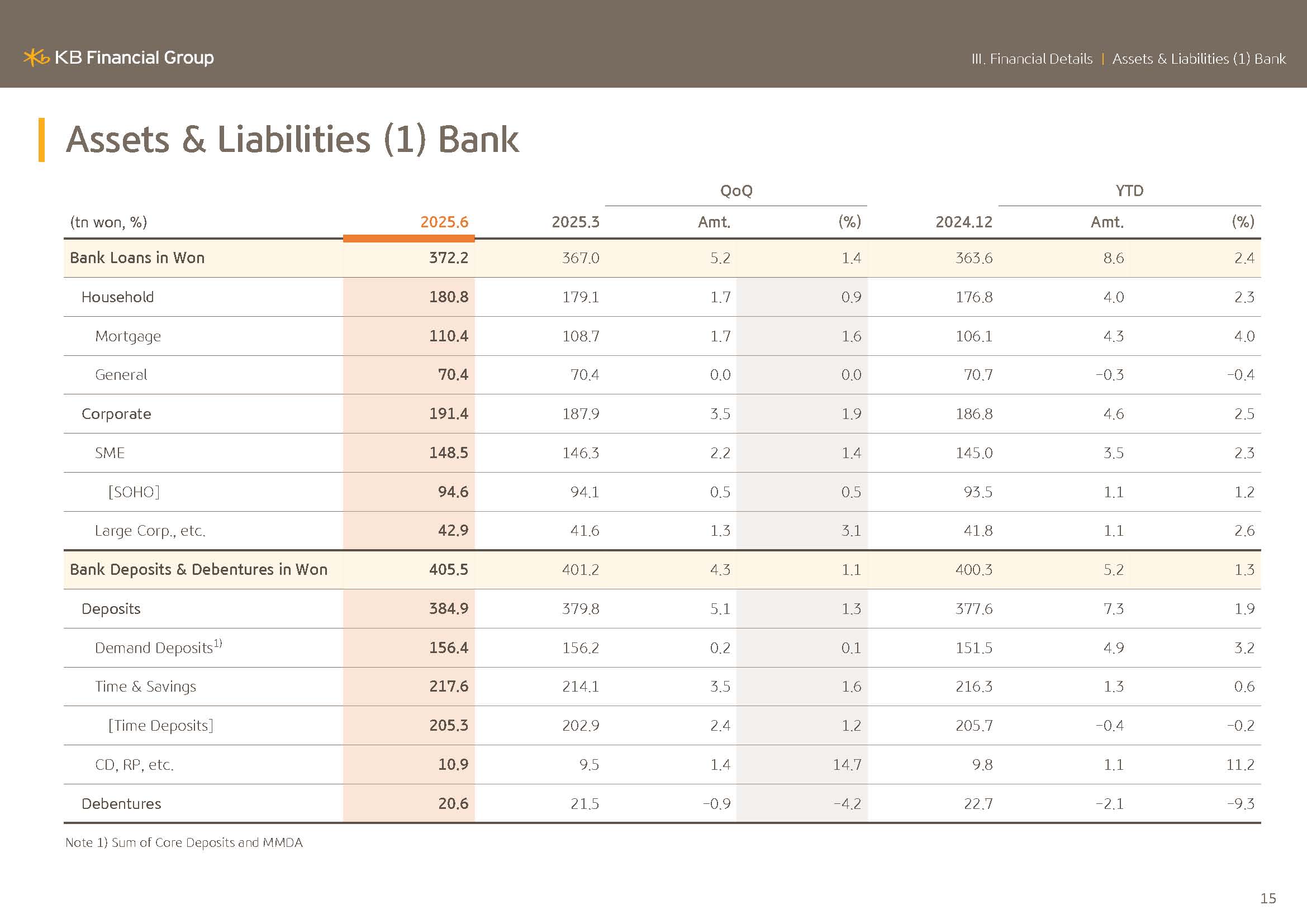

Next, I will cover bank loans in won growth. As of end June 2025, bank loans in won posted KRW372 trillion and grew 2.4% YTD and 1.4% QoQ.

Household loans posted KRW181 trillion and mortgage loans and unsecured loans grew evenly and grew 0.9% QoQ.

Corporate loans posted KRW191 trillion and centering on large corporates and prime SMEs grew 1.9% QoQ. We plan to operate our loan policy from a comprehensive profitability perspective in the second half as well and stably secure our interest income base.

Next is net interest margin that you can see on the bottom-right side.

Q2 bank NIM posted 1.73% despite efforts to cut funding costs, including increasing core deposits.

And with the loan yield contraction following the market rate cut, it went down 3 bp QoQ.

Meanwhile, group NIM posted 1.96%, and the impact to the bank NIM decline was further compounded by the decline in credit card receivables yield and went down 5 bps QoQ.

In the second half as well, since we expect the interest rate decline trend to continue through core deposit growth and profitability-based loan portfolio management, we plan to minimize the contraction of NIM as much as possible.

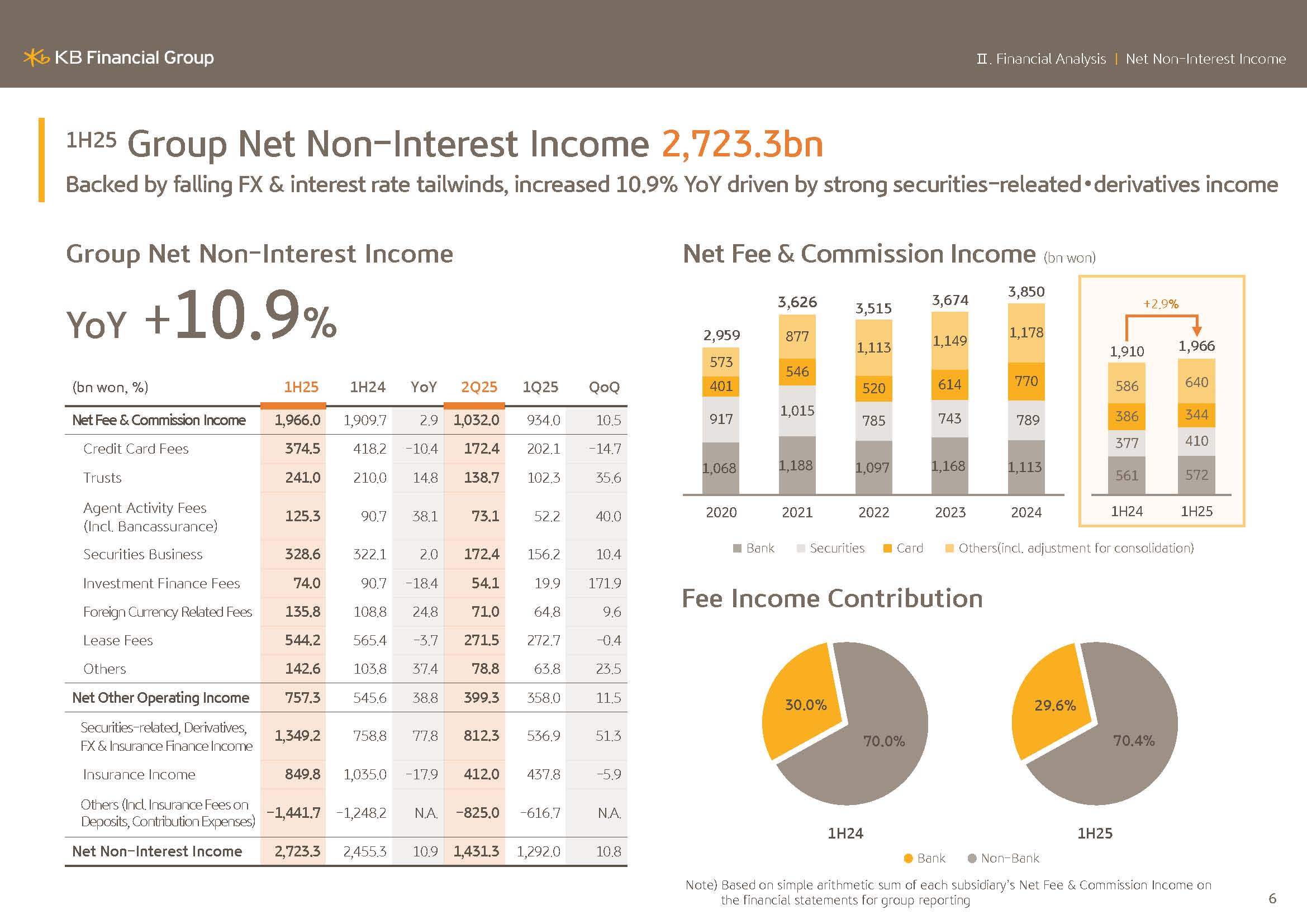

Next, I will cover non-interest income.

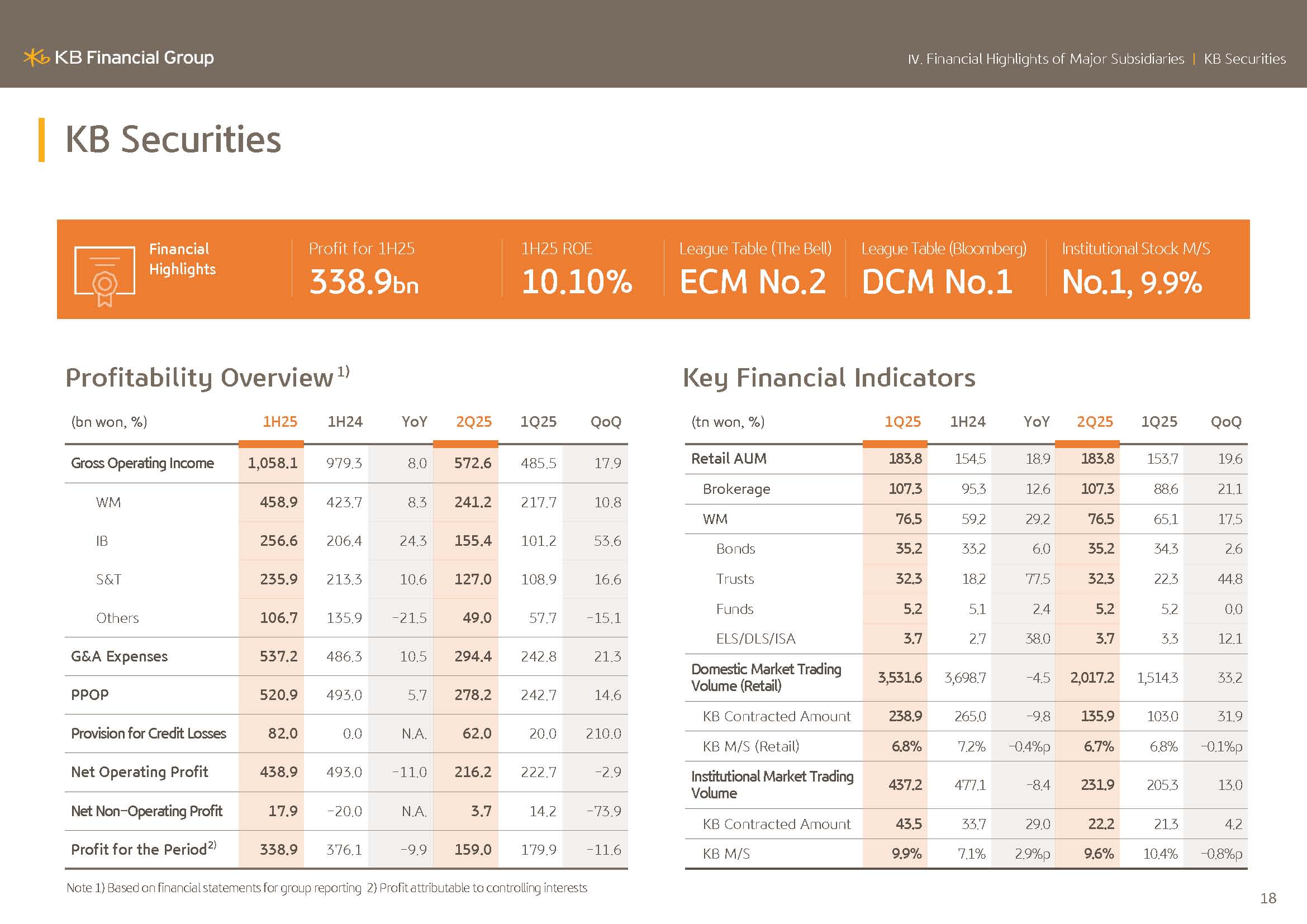

First-half group non-interest income posted KRW2,723.3 billion and improved 10.9% YoY.

Due to the decline in exchange rates and the rise in stock market index performance related to securities and derivatives significantly improved, leading to an increase of KRW211.7 billion of other operating income compared to the same period last year.

On the other hand, first-half group net fee income posted KRW1.966 trillion, a 2.9% increase YoY.

And with the increase in bancassurance sales commissions and securities brokerage fees, combined with higher fee income from the disposal of assets under management, achieved results, which was a KRW56.3 billion increase compared to the same period last year.

In particular, Q2 group net fee income posted KRW1.032 billion, a 10.5% increase QoQ and surpassed for the first time on a quarterly basis KRW1 trillion.

I believe these results were a fruit of our consistent efforts to expand fee income that does not accompany RWA growth and our growth in non-interest income by our subsidiaries.

Going forward, based on diversified group portfolio, we will gradually achieve qualitative improvement of our profit structure.

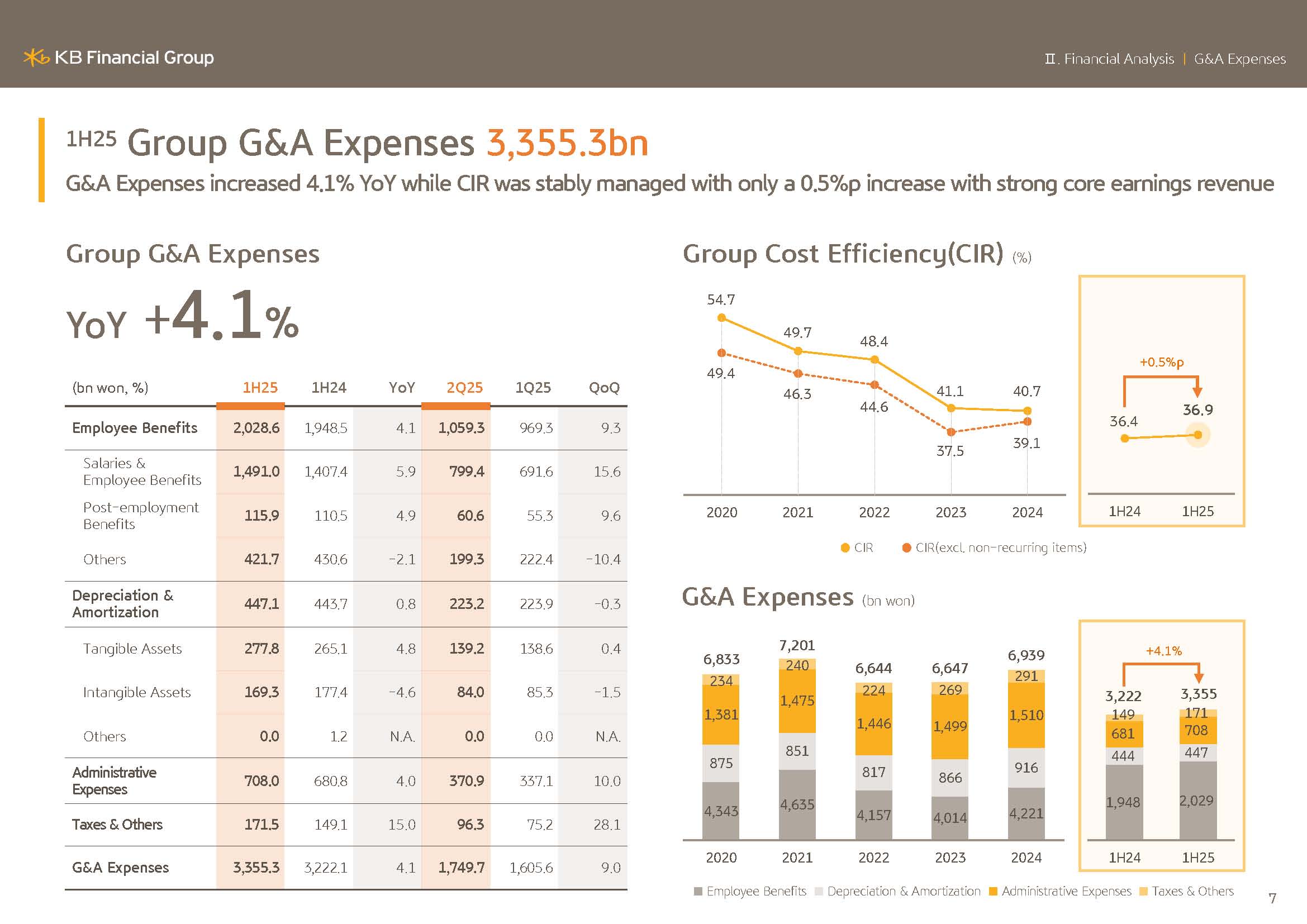

Next, I will walk you through our G&A expenses.

First-half G&A expenses posted KRW3,355.3 billion, a 4.1% growth YoY. First-half group CIR is being maintained at a stable level of 36.9%.

Going forward, we will actively expand investments to secure future growth drivers, including exploring new businesses and enhancing productivity through AI and also strive to rationalize costs, focusing primarily on rationalizing recurring expenses and continue our group's CIR downward stabilization trend.

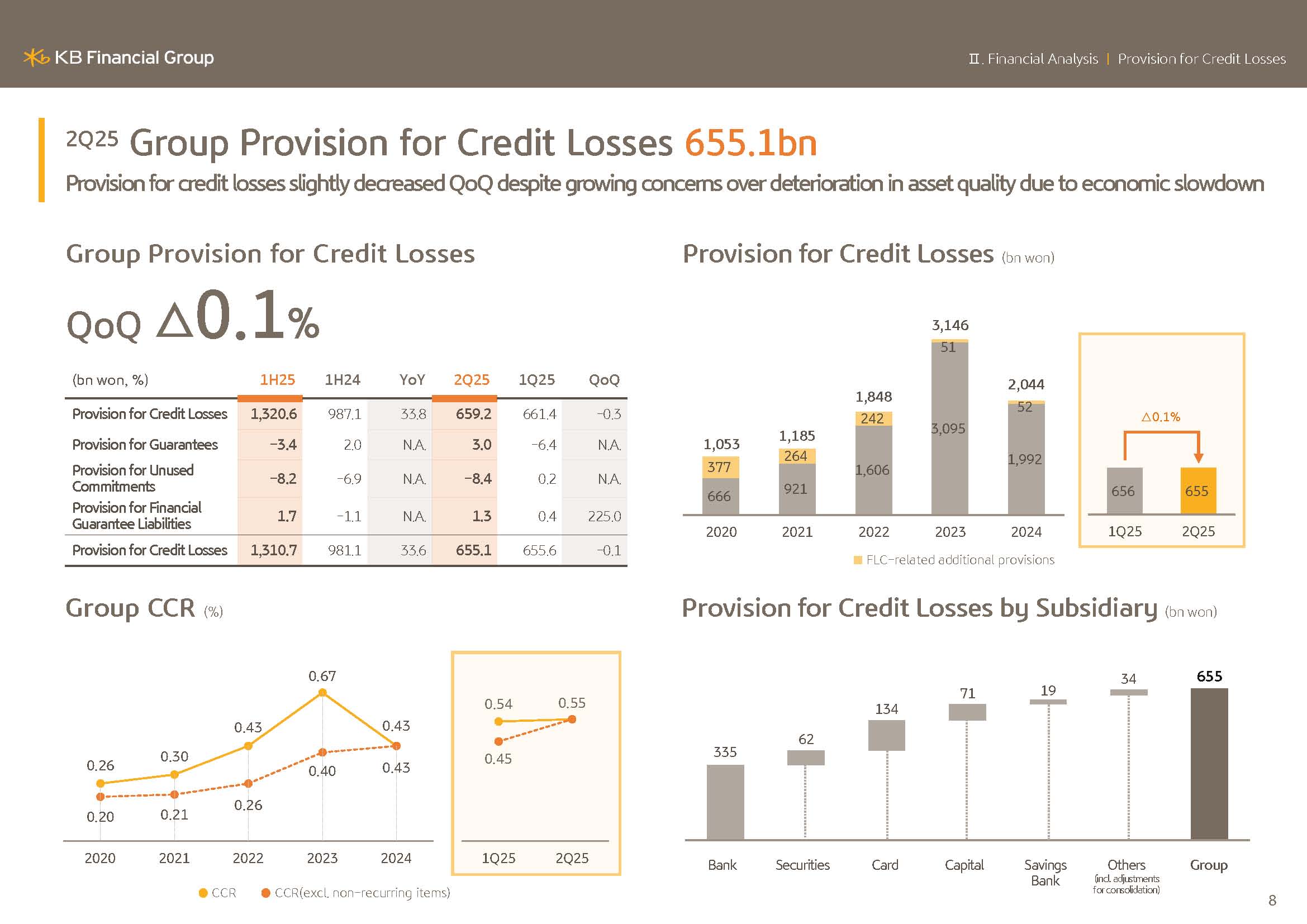

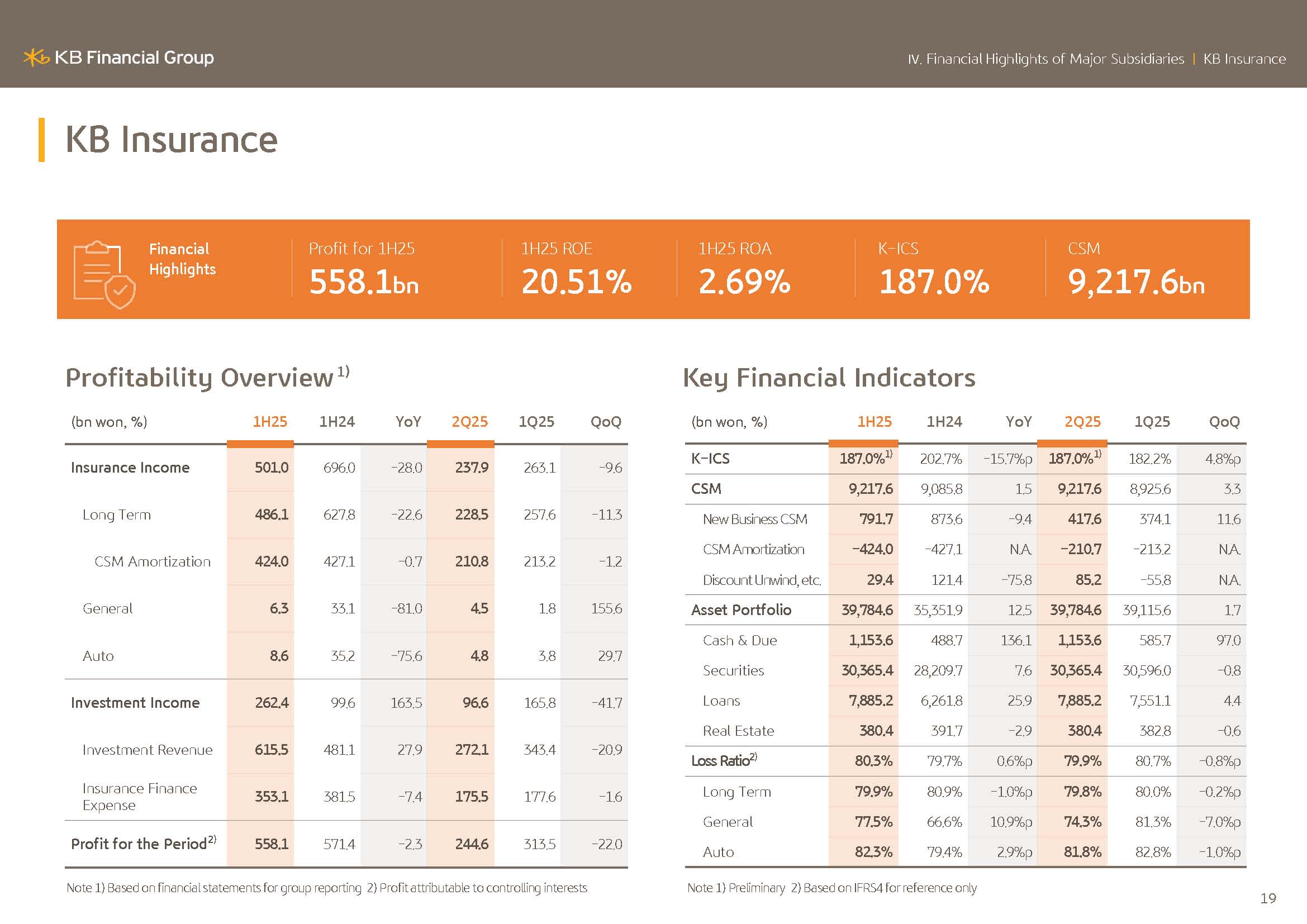

Next is page 8, group's provision for credit losses.

Q2 provision for credit losses posted KRW655.1 billion and group credit cost posted 55 bp and maintained a similar level to the previous quarter.

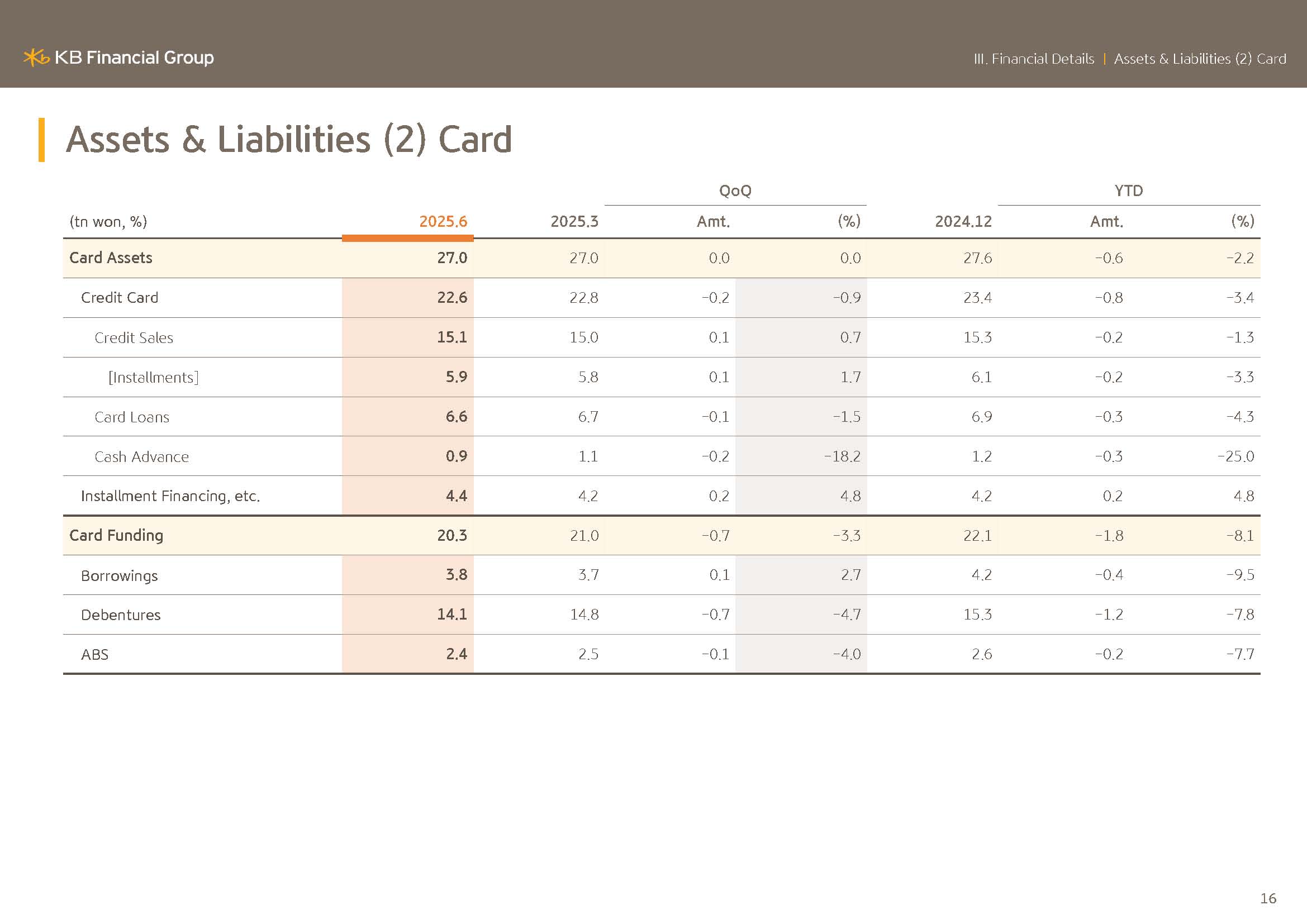

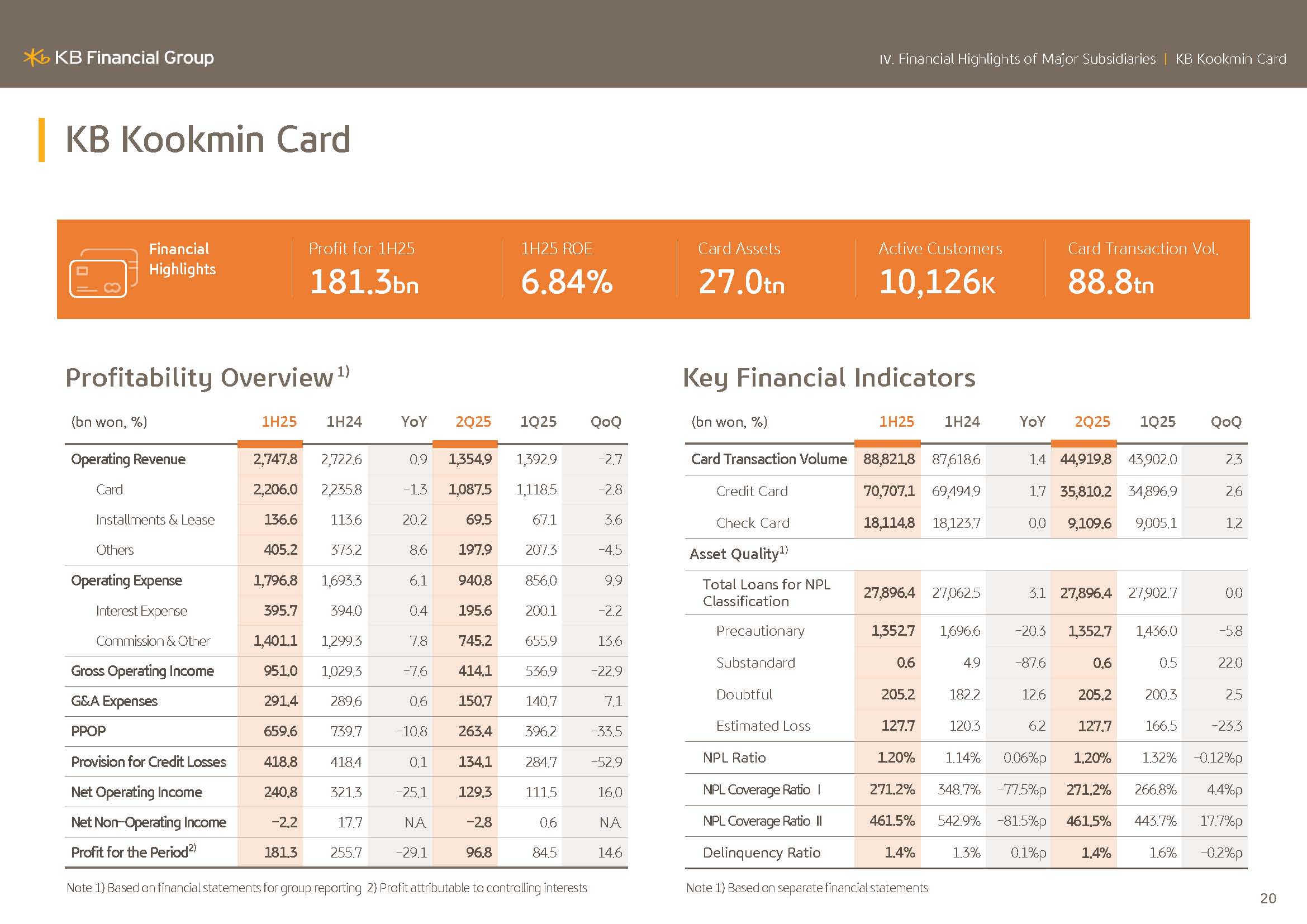

In the previous quarter, in the Card division, which the market was concerned about as a result of implementing focused measures to improve asset quality, including sale of non-performing loans and reinforcement of short-term delinquency recovery teams, the scale of provisioning was significantly reduced compared to the previous quarter.

However, while maintaining a conservative provisioning stance, bank and securities additionally provisioned around KRW100 billion for real estate PF sites and guaranteed completion real estate trust projects, leading to Q2 credit loss provisioning level.

And CCR is being maintained at a similar level to the previous quarter. And the NPL coverage ratio slightly improved QoQ.

Meanwhile, in the second half of the year, along with key rate cuts, driven by the government's economic stimulus efforts such as supplementary budget and support for vulnerable borrowers through the establishment of a bad bank, we expect that the asset quality management conditions will improve favorably, and we believe that the credit cost has passed its cyclical peak and is entering into a downward phase.

In the second half, we will do our best to achieve meaningful improvements in asset quality by actively promoting the rebalancing of nonperforming assets and reducing high-risk asset limits.

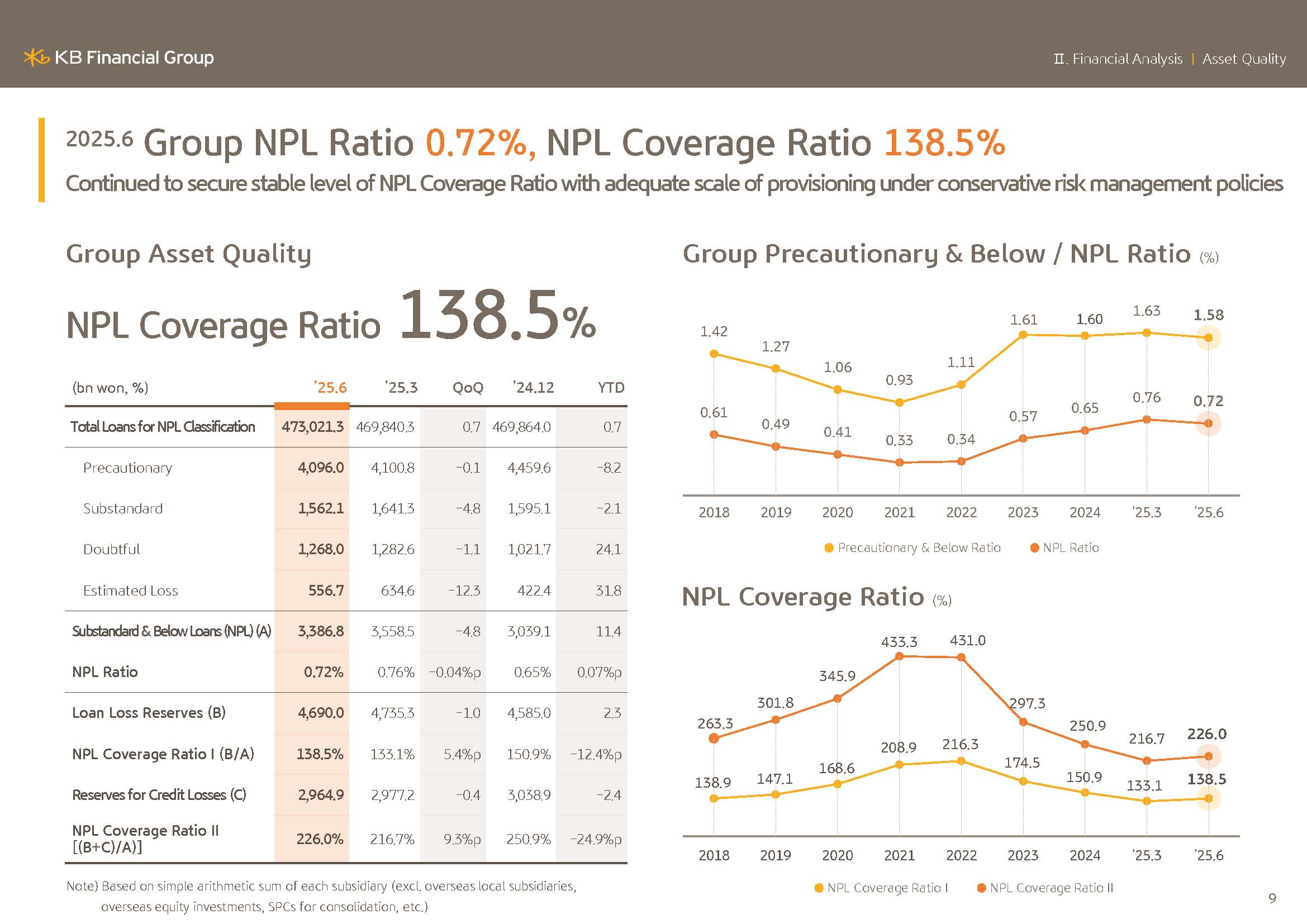

Let's go to the next page.

Q2 group NPL ratio posted 0.72% and improved 0.04 percentage points QoQ. Group's NPL coverage ratio improved 5.4 percentage points QoQ and recorded 138.5% and has sufficient loss absorption capacity to prepare for potential non-performing assets.

Lastly, I will cover group's capital ratio.

As I explained previously, group's BIS ratio at the end of June 2025 on a preliminary basis posted 16.36% and the CET1 ratio recorded 13.74% and secured the industry's highest level of capital adequacy.

As of end June '25, group's risk-weighted assets posted KRW354 trillion and grew 2.4% YTD, and considering our annual RWA growth target, is being maintained at and managed at appropriate and controlled pace of growth.

The following pages contain details on the performance we have just presented, so please refer to it if needed.

This concludes KB Financial Group's 2025 first-half business performance report.

Thank you for your attention.