-

Please adjust the volume.

3Q25 Business Results

Greetings.

I am Peter Kwon, Head of KB Financial Group IR Division.

We will now begin the 2025 Q3 business results presentation.

Thank you very much for participating in today's earnings release.

We have here with us executives from the group, including our Group CFO, Sang-Rok Na.

We will have our CFO cover 2025 Q3 major business results, and then we will have a Q&A session.

I will now invite our group CFO to walk us through 2025 Q3 business results.

Good afternoon. I'm Na, Sang-Rok, CFO of KB Financial Group.

Thank you for joining the third quarter 2025 earnings presentation by KBFG.

Before running through the third quarter performance, let me first talk about our approach to profitability against changing business environment.

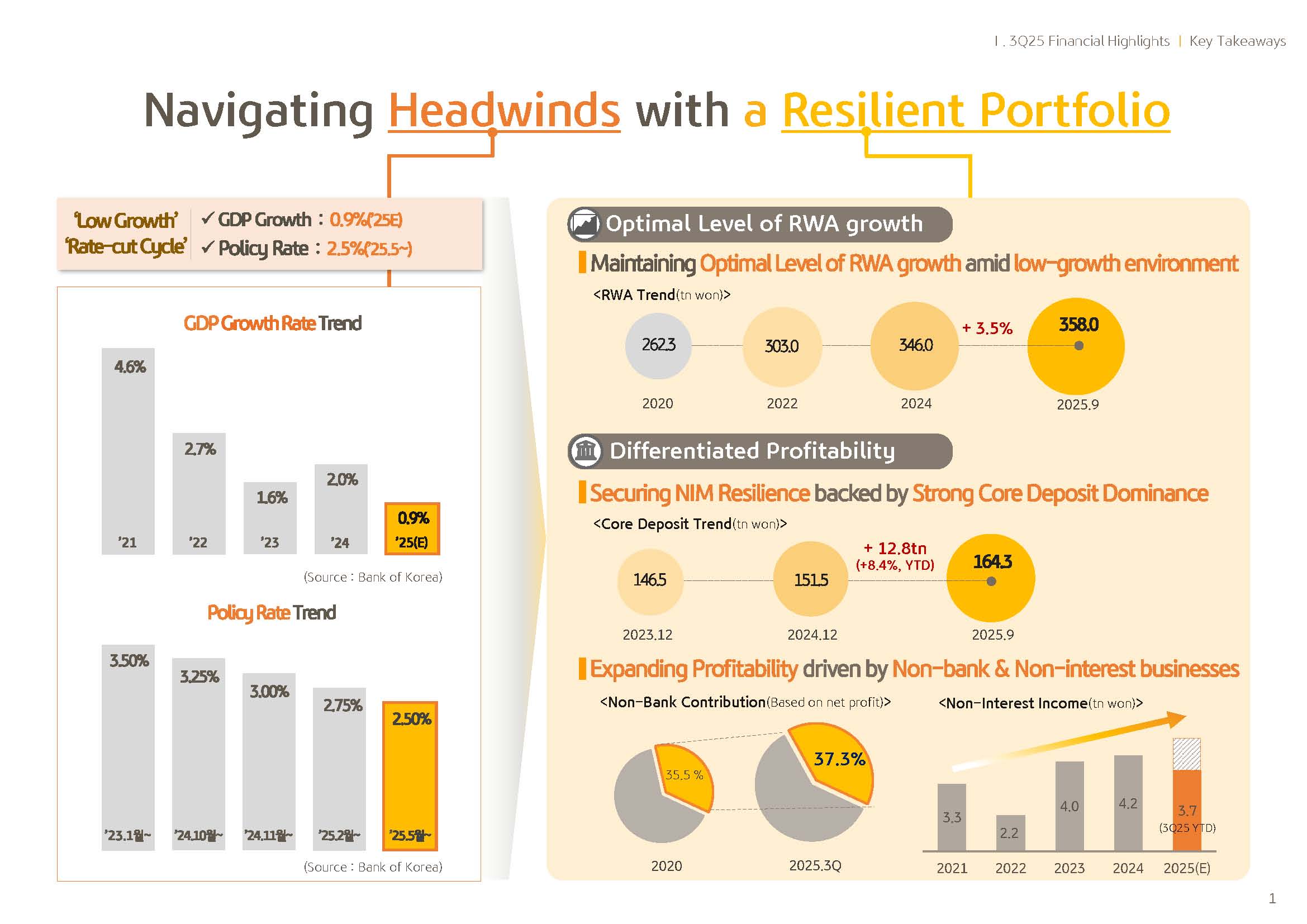

Amid continuing slow growth trend, we face wide-ranging factors, including interest rate and FX volatility, government housing market stabilization measures and policies to revitalize the capital market.

Navigating this environment and underpinned by robust fundamentals, KBFG mitigated the impact of external uncertainties as it continuously ensures stable earnings capacity.

On strong growth of core deposit base, we defended the group's NIM resilience offsetting external volatilities, while through nonbank subsidiaries portfolio, we are building a well-balanced earnings structure in this new wave of change.

We are also maintaining appropriate RWA growth, absorbing the impact arising from multiple variables, which we believe forms a steady foundation for the group's overall profitability.

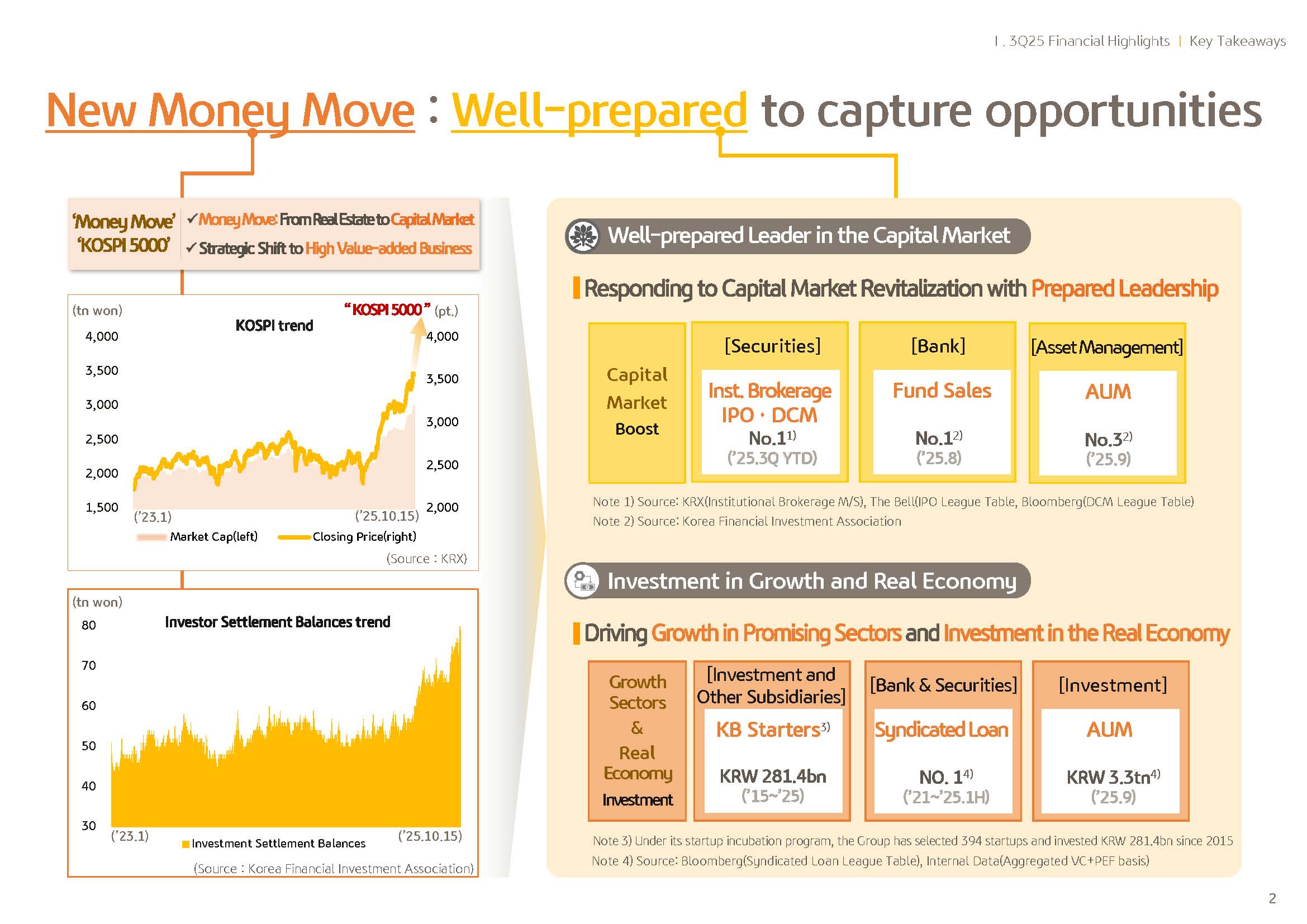

Under the government's target of KOSPI reaching 5,000, Korean economy is at an inflection point where the pivot of the economy is moving from real estate to capital market.

In line with such change, KBFG will leverage this opportunity and turn the tide of change to one that can strengthen our profit-making capacity in order to broaden the basis of group's future growth.

Upon the bank and KB Securities WM channel, we will expand brokerage, credit and sale of investment products to broaden the basis of earnings while supporting financial asset growth of the Korean people.

Leveraging our accumulated expertise and influence in the capital markets, we aim to lead the market tide characterized by expansion of productive finance and venture capital and capture emerging and new business opportunities.

And I believe our experience in investing into venture and innovative companies and the success cases we were able to draw from them will provide greater boost for our market leadership as we make investments into growth sectors.

Thus, supported by well-prepared leadership, KBFG will proactively respond to change, driving quality improvement in earnings structure. Before moving on to financial performance, first on Q3 cash dividend.

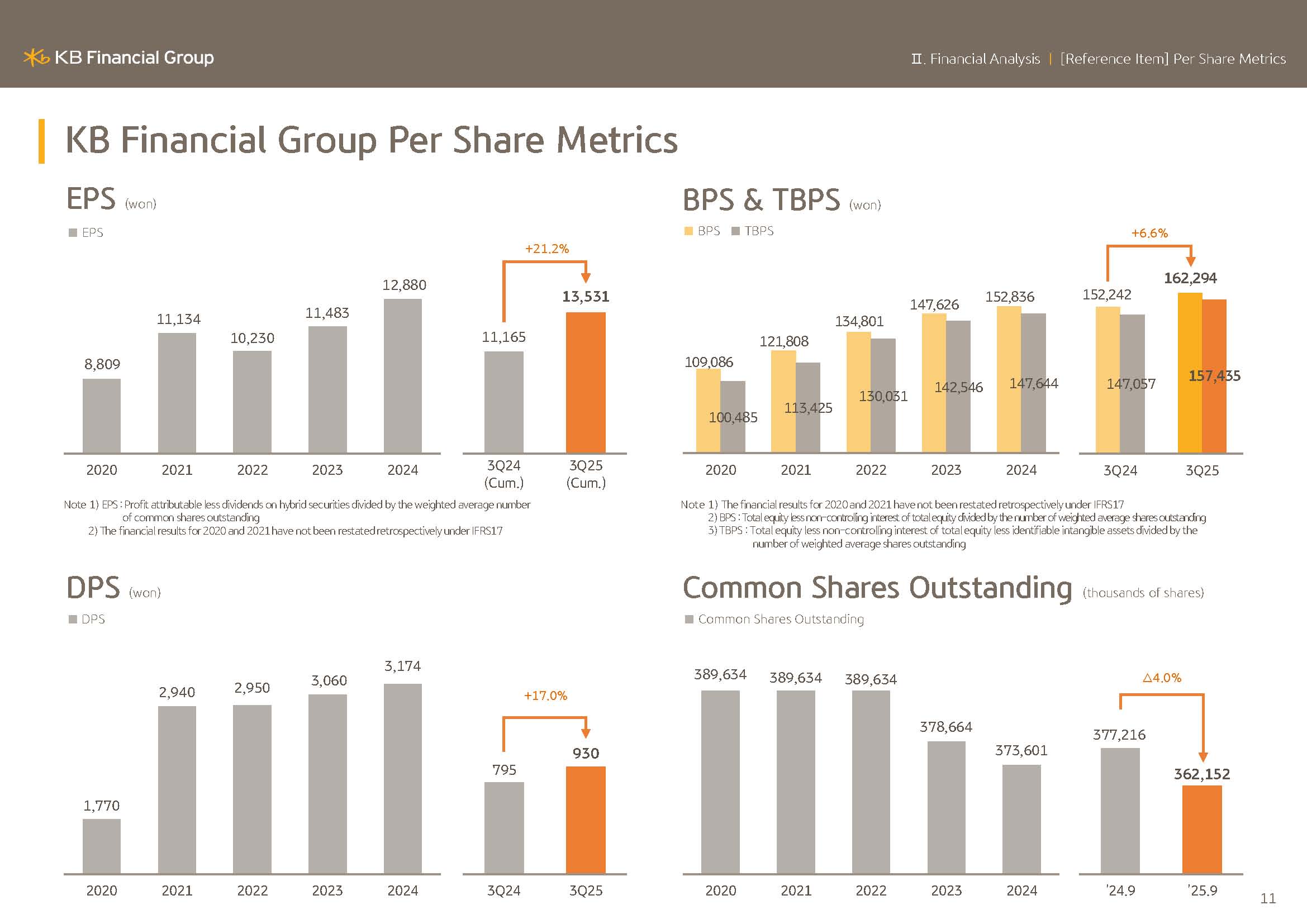

Today, Board of Directors approved KRW930 DPS with total cash dividend amounting to KRW335.7 billion.

Q3 cash dividend per share increased KRW135 year-over-year on the back of increase in total dividend sum beginning of the year and the impact of share buyback.

Next, moving on to financial performance of KBFG.

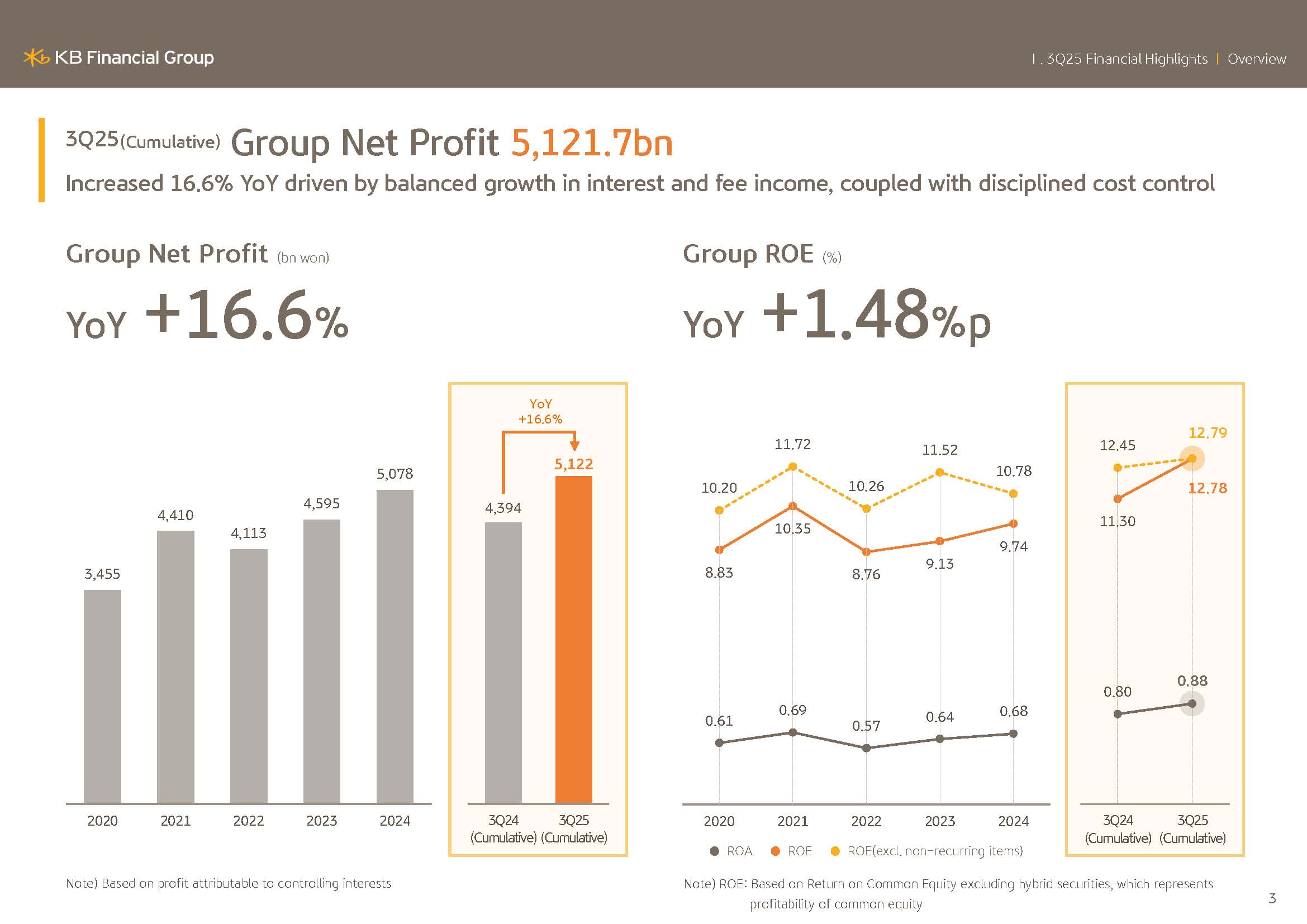

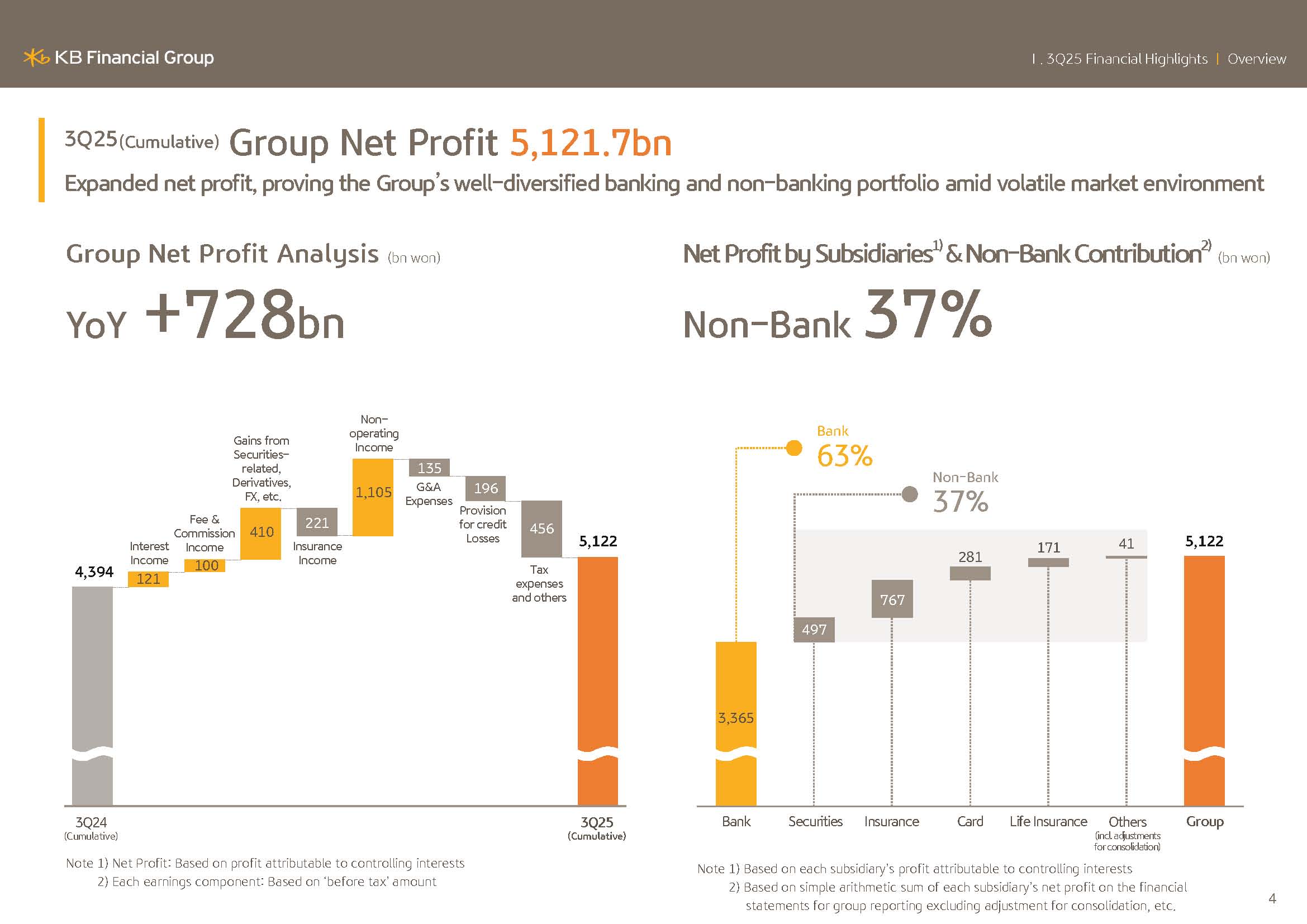

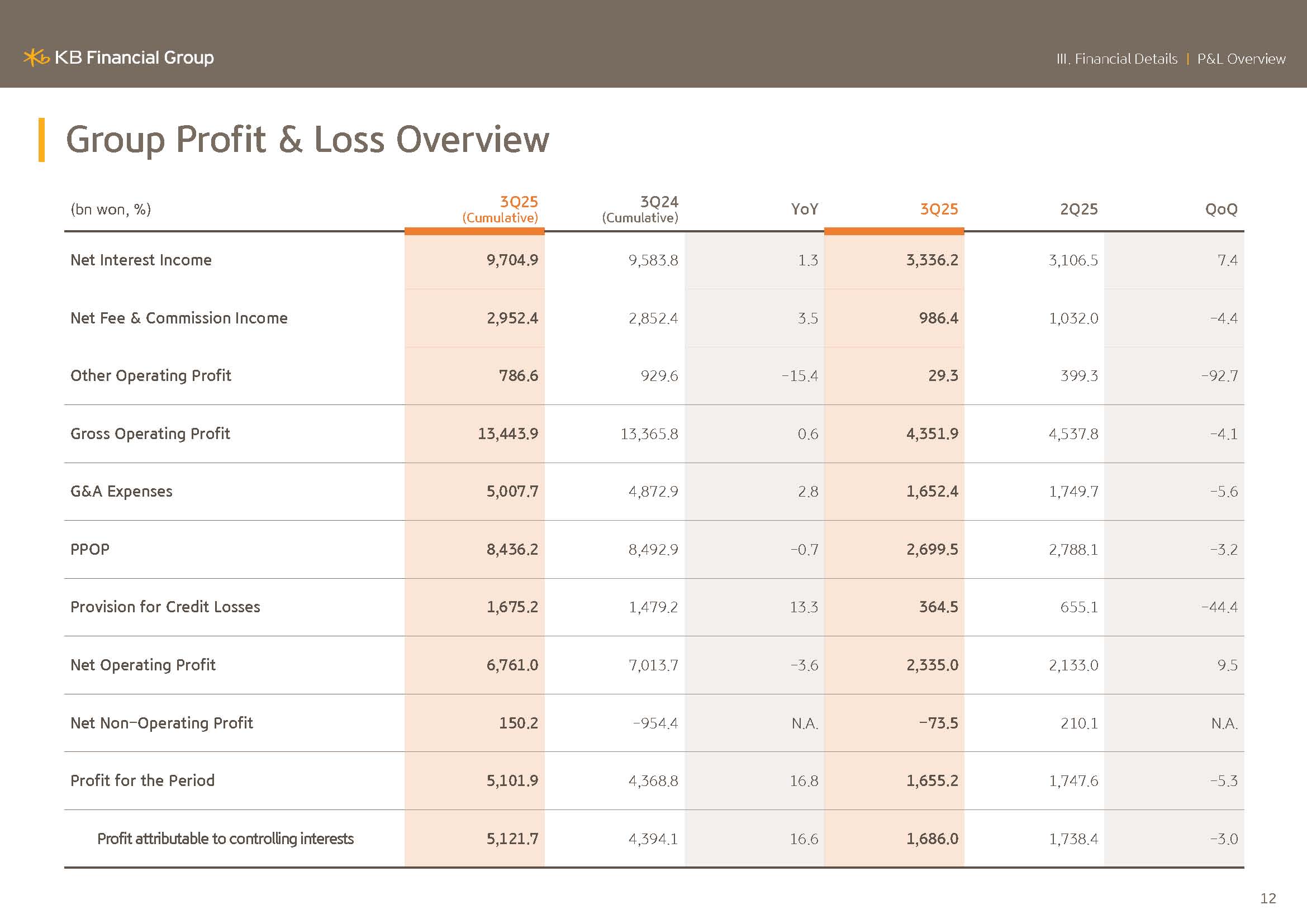

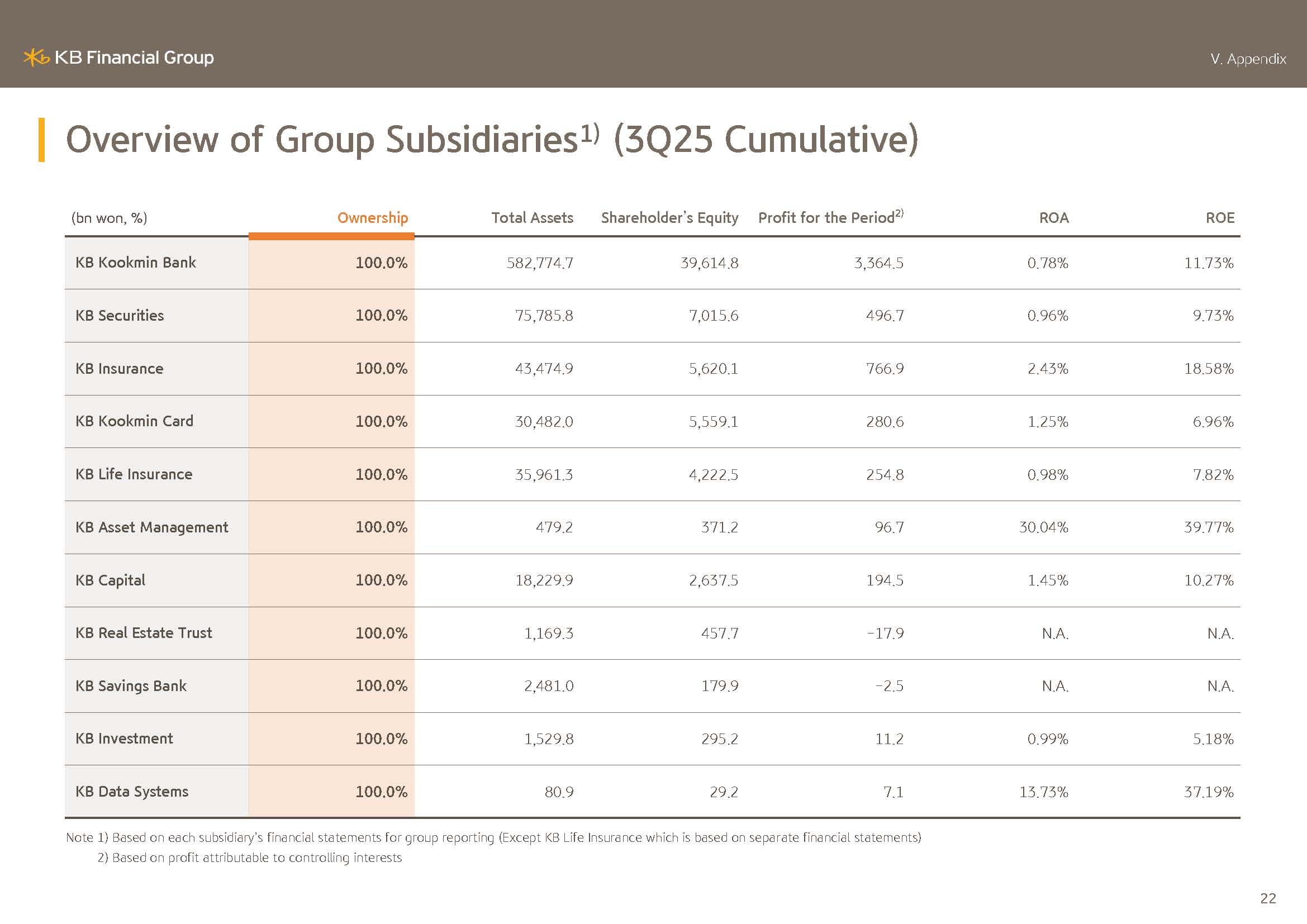

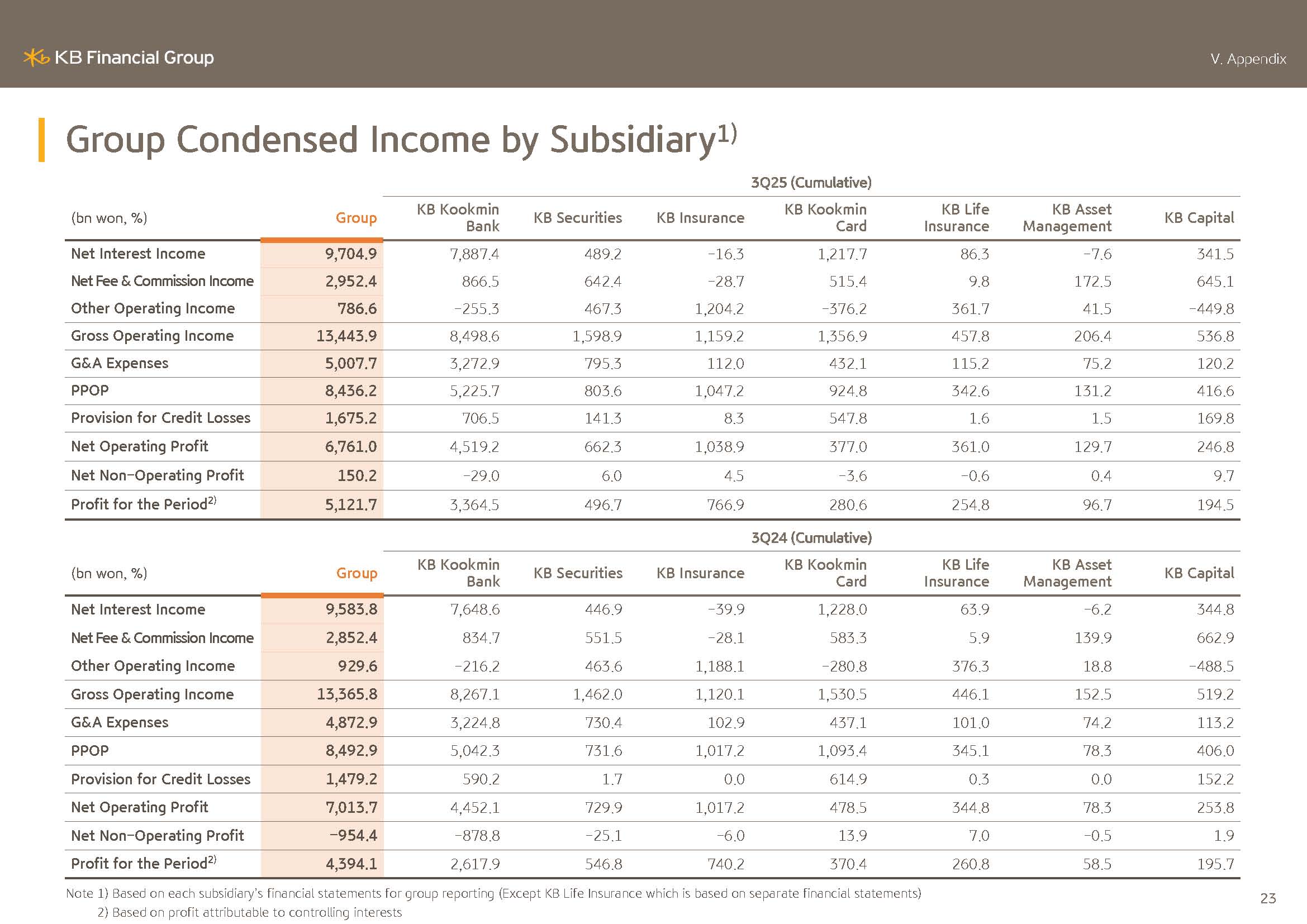

Group's net profit for the quarter reported KRW1.686 trillion, while on a cumulative basis as of Q3 reaching KRW5,121.7 billion.

Cumulative group ROE in Q3 was 12.78%, an improvement by a large margin versus last year. This was driven by solid core earnings and with the absence of ELS reserving impact and gains from sales of holdings in our consolidated funds in Q2, there was sizable recovery on the nonoperating accounts.

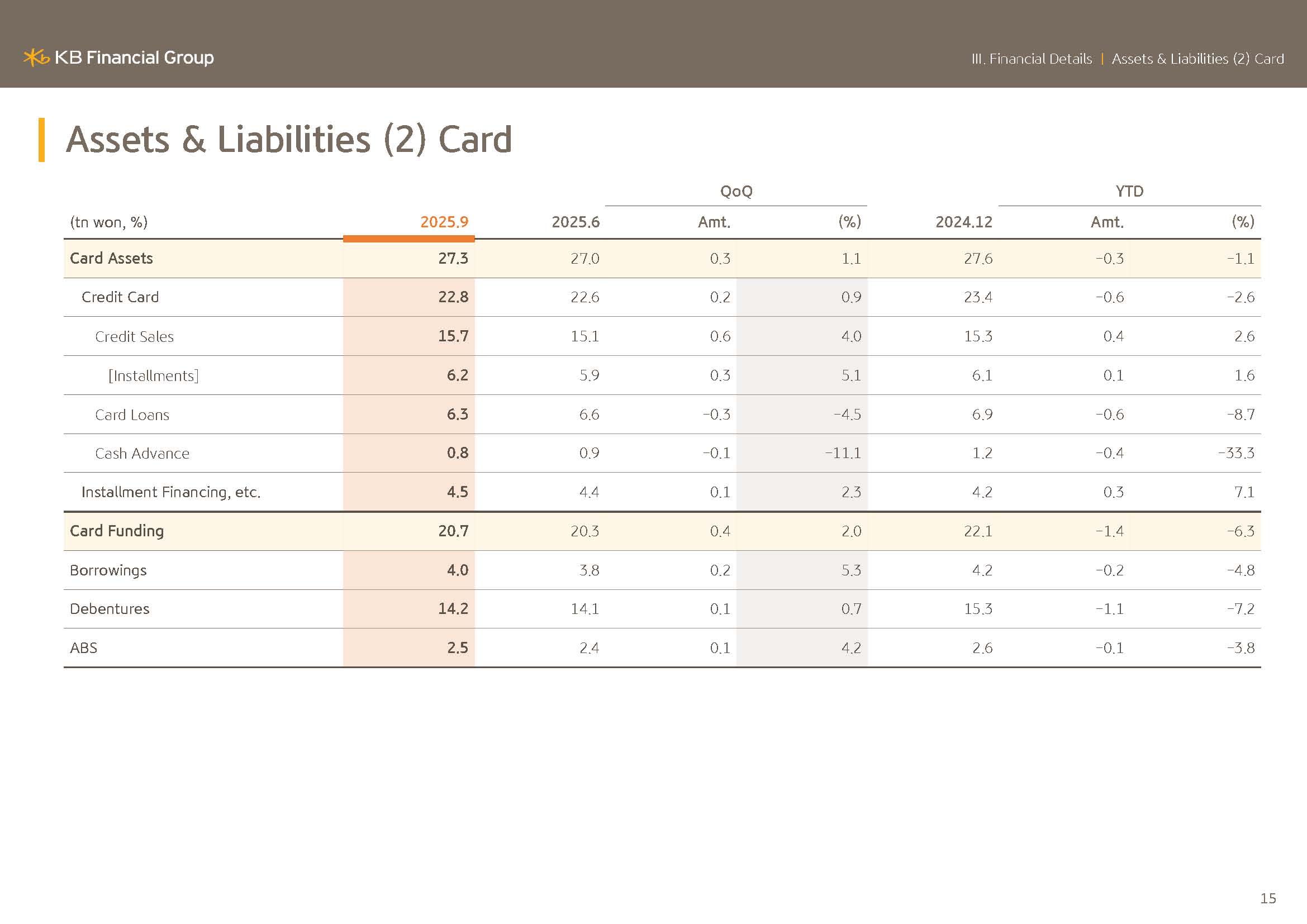

On top of this, rigorous cost control efforts were compounded, driving and attesting to group's solid fundamentals. Meanwhile, nonbank business accounts for 37% of cumulative Q3 net profit as we maintained diversified earnings portfolio.

Next, I will move on to detailed breakdown of earnings results.

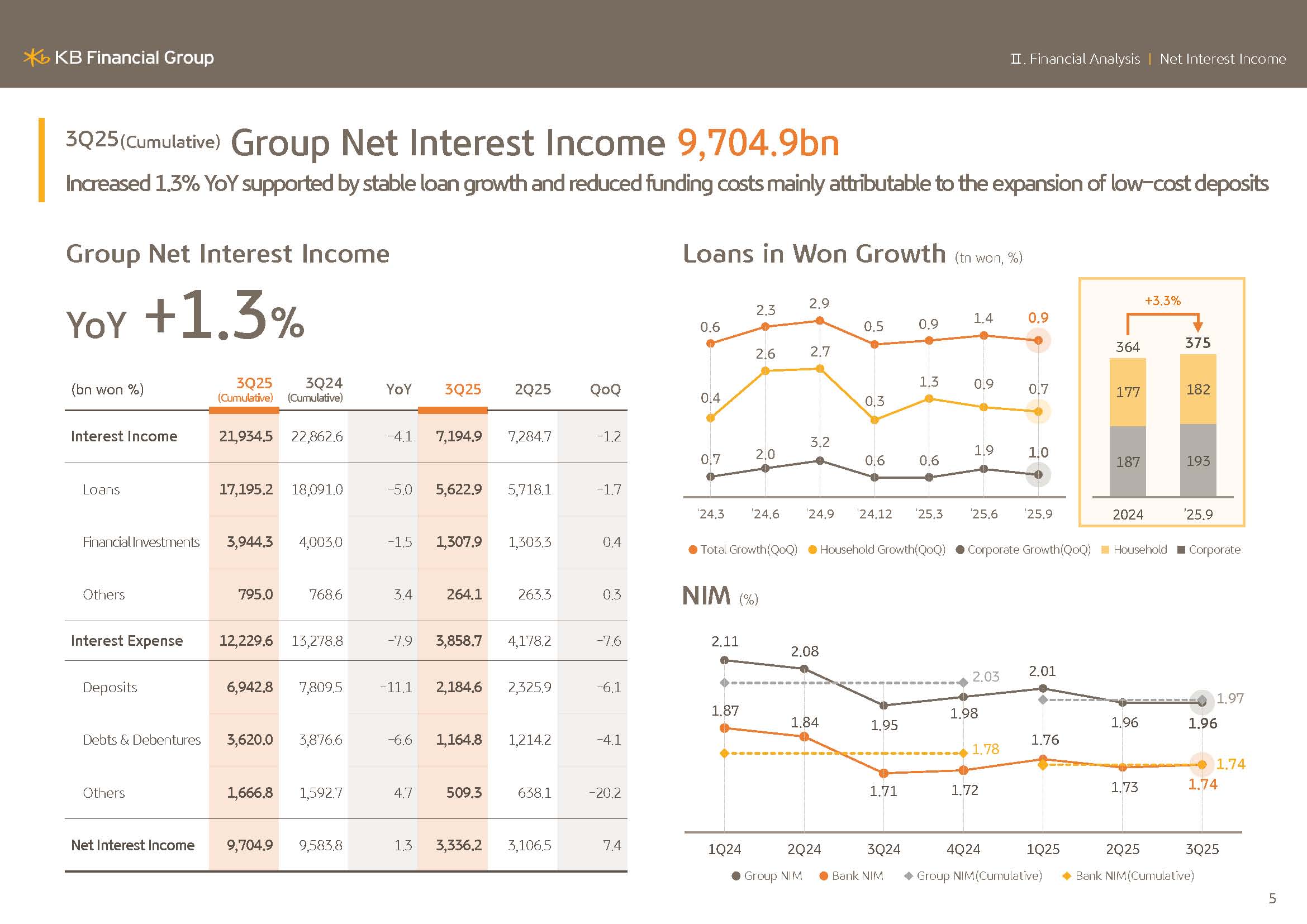

Group's third quarter cumulative net interest income was KRW9,704.9 billion, flat year-over-year.

In Q3 '25, group's net interest income was KRW3,336.2 billion, but removing the base effect of costs related to liquidation of fund being recognized as interest expense, NII was flat Q-on-Q.

Next, I will elaborate on bank loans in Won growth.

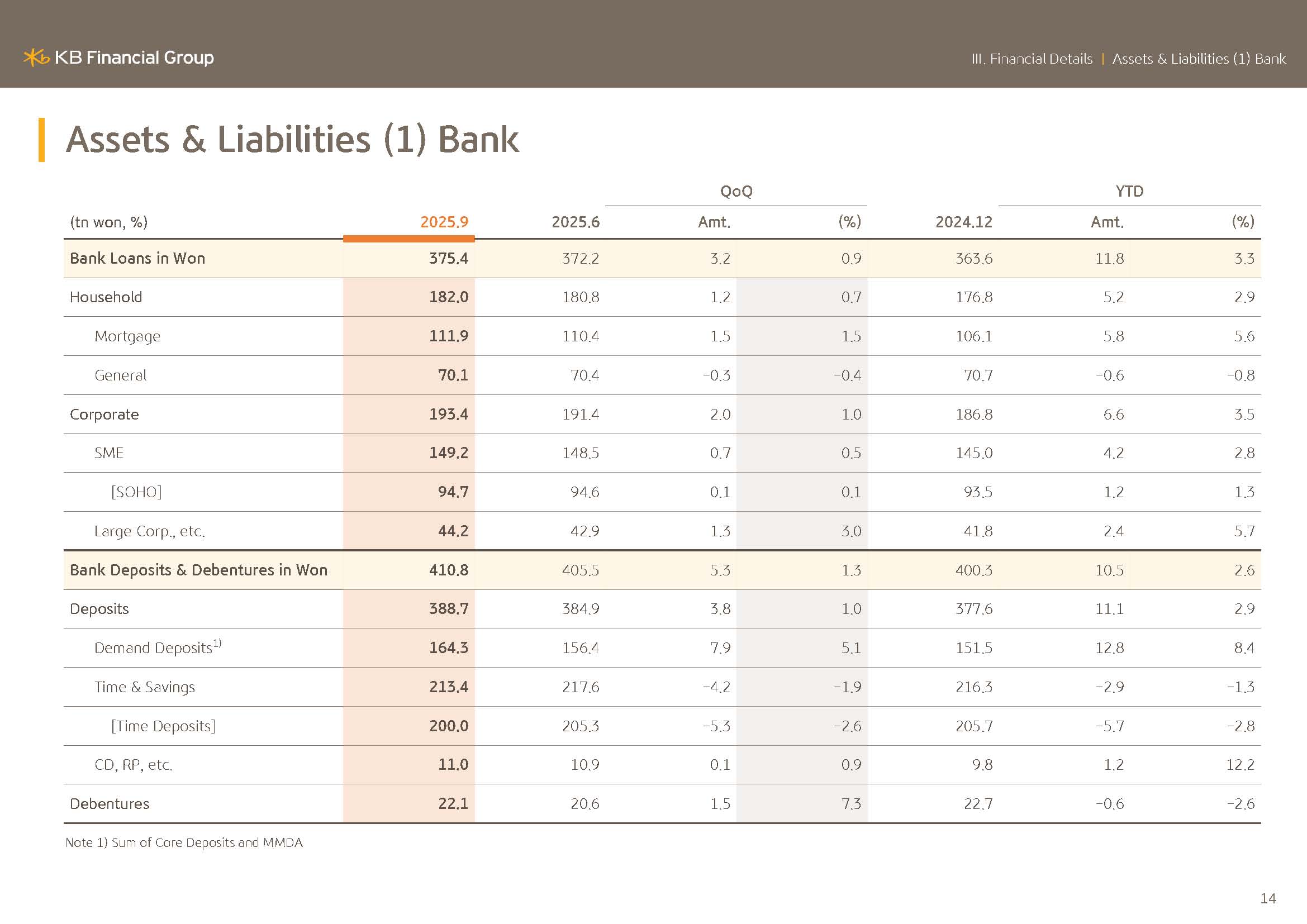

As of end September 2025, bank loans in Won stood at KRW375 trillion, a 3.3% growth compared to last year and a 0.9% growth Q-o-Q. Household loans recorded KRW182 trillion, a 0.7% growth Q-o-Q and corporate loans centering on large corps and robust SME loans grew 1.0% Q-o-Q.

Taking into consideration the government stance of strengthening household debt management and housing market stabilization measures, we expect household loans to show limited growth for the time being.

However, we plan to rebalance household loan portfolio from a profitability perspective and pursue a loan growth strategy focusing on robust SMEs to secure our interest income basis.

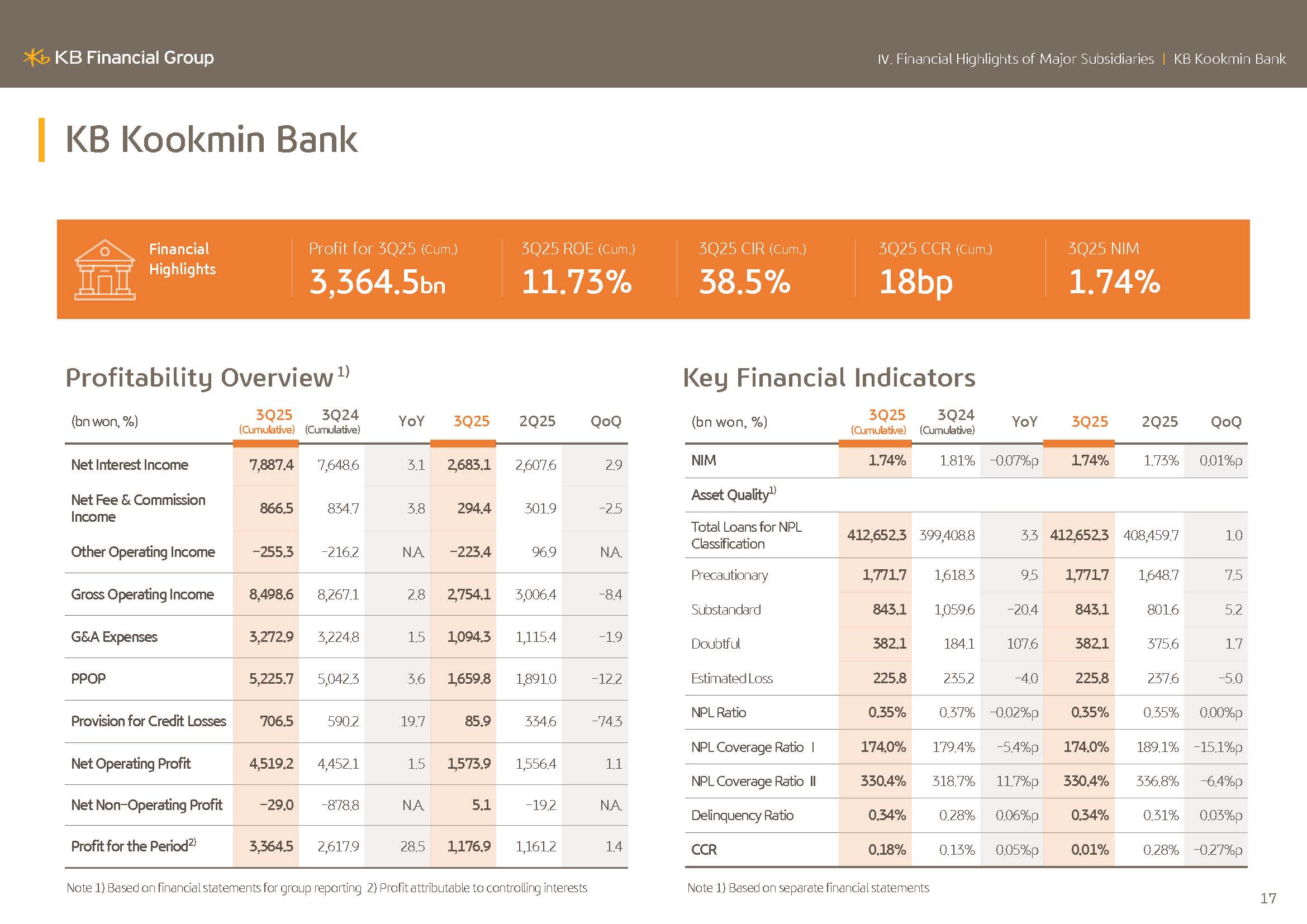

Next is NIM on the bottom right of the page. Q3 bank NIM stood at 1.74% on the back of funding cost management efforts and group NIM posted 1.96%, maintaining a similar level to the previous quarter.

In particular, despite the contract in loan yields this quarter, the bank's NIM remained stable at around KRW7.9 trillion growth in core deposits alleviated funding pressure, enabling a steady defense of our margin.

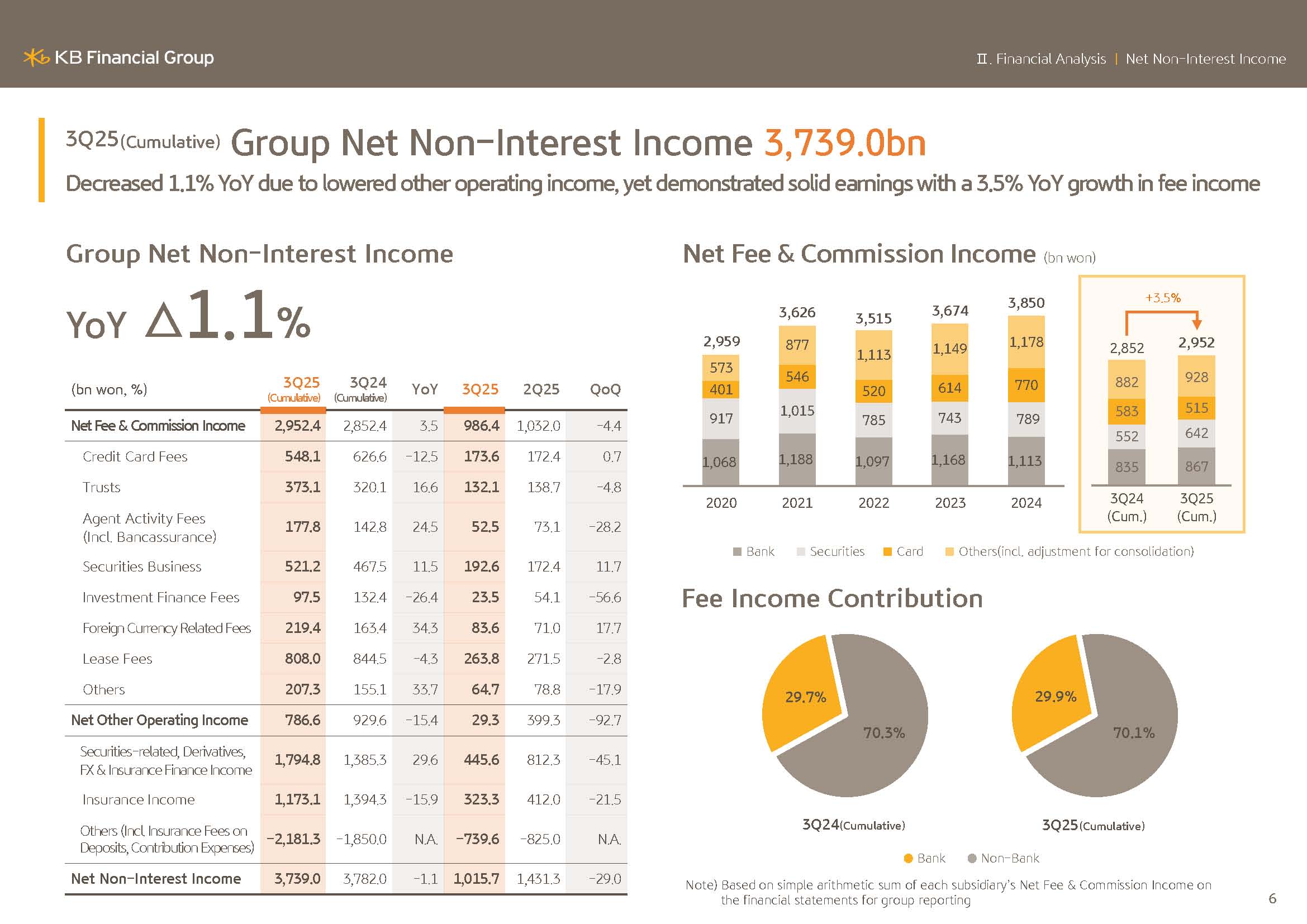

Next, I will cover noninterest income.

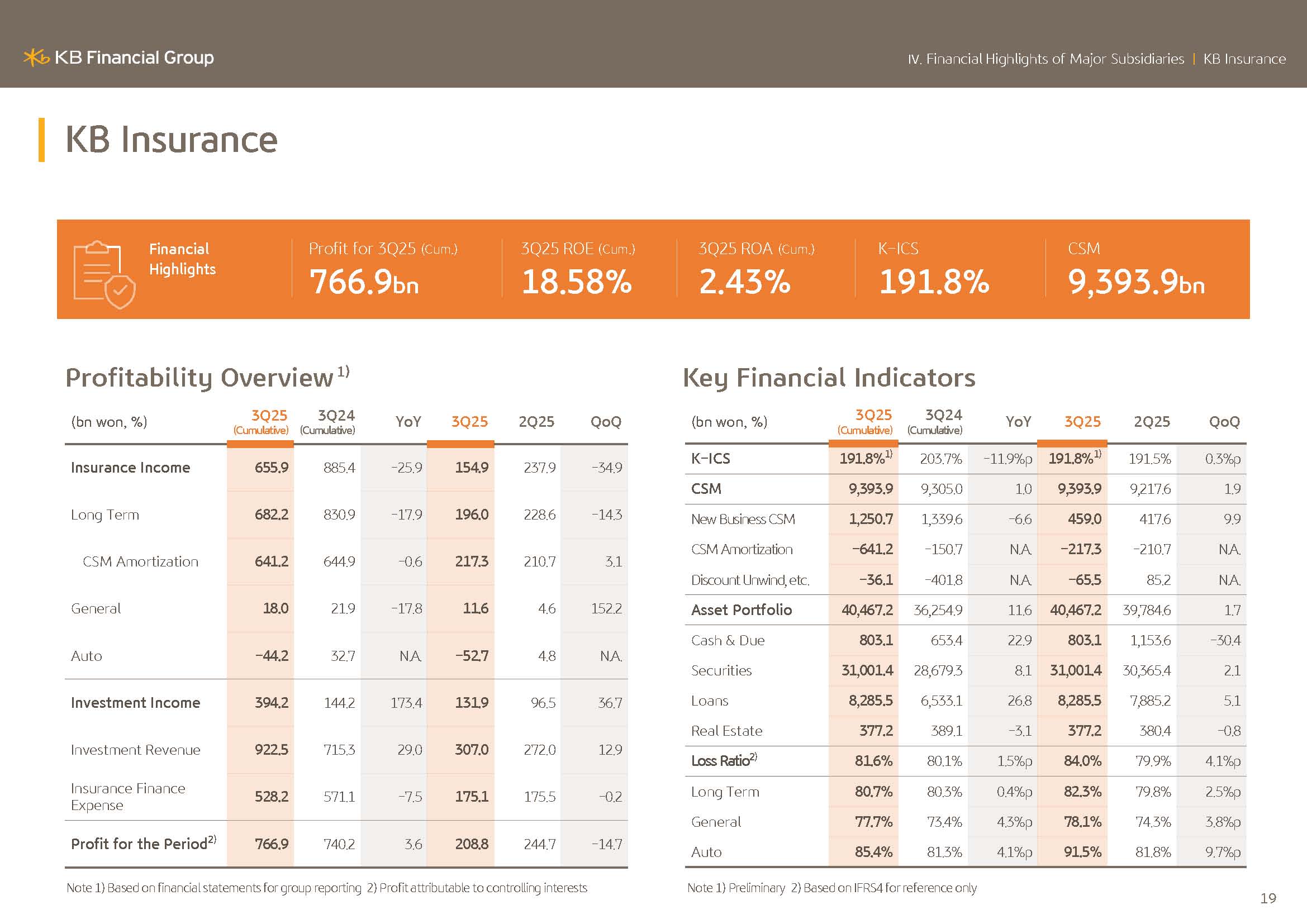

Q3 cumulative group noninterest income posted KRW 3,739 billion, a 1.1% decrease Y-o-Y. Q3 cumulative other operating income posted KRW 786.6 billion, a 15.4% decrease Y-o-Y, and it was primarily attributable to the base effect from the reversal of KRW 123 billion in KB Insurance, IBNR reserves in the previous year.

On the other hand, Q3 cumulative net fee income posted KRW 2,952.4 billion, a 3.5% growth Y-o-Y.

Along with the increase in stock market trading volume, brokerage commission income grew significantly, while strong bancassurance sales and the expansion of trust-related earnings also contributed to improved performance.

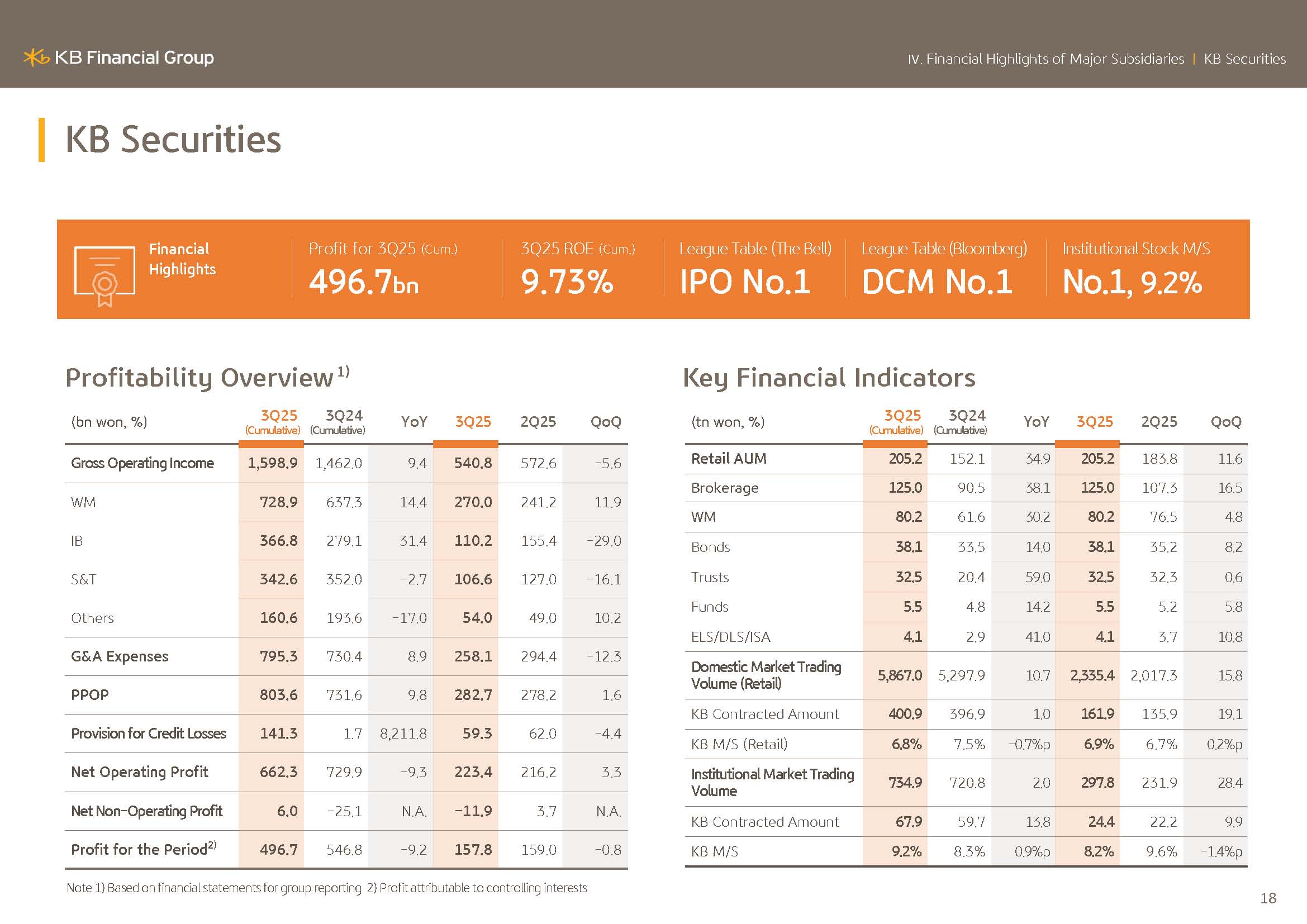

In particular, in case of our subsidiaries, KB Securities showed 16.5% net fee income growth and KB Asset Management showed 23.3% of net fee income growth, respectively, and drove group's fee income expansion.

We believe that this increase in fee income from the capital market, in line with the ongoing momentum of capital market revitalization, has ample potential for further expansion going forward.

Since around 70% of the group fee income is generated by nonbanking subsidiaries centering on the capital market, we plan to strengthen nonbanking competitiveness to further expand our fee income basis.

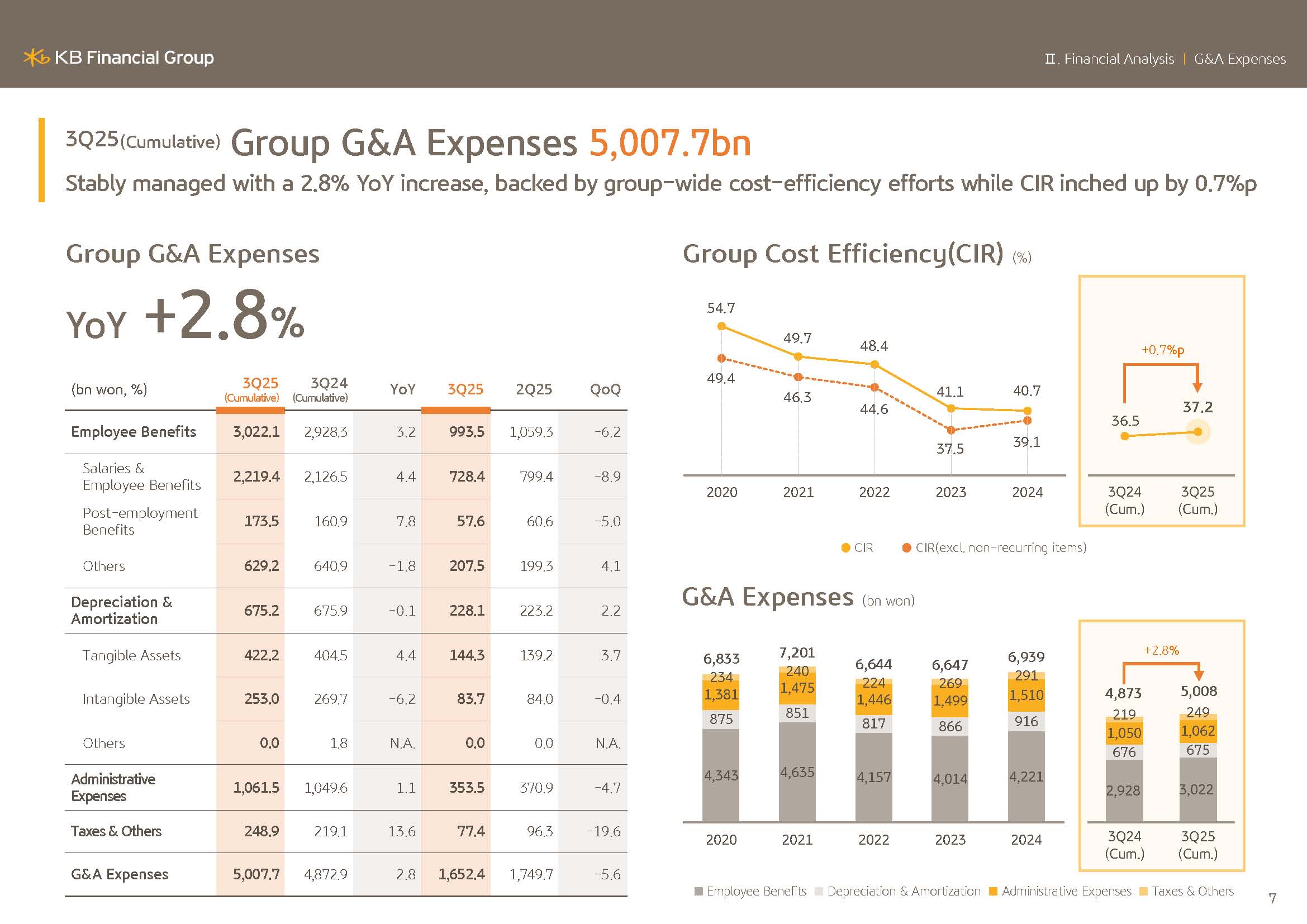

Next, I will cover general G&A. Q3 cumulative general G&A posted KRW5,007.7 billion. And on the back of continuous cost efficiency efforts, it stopped at a 2.8% increase Y-o-Y.

Q3 cumulative group CIR recorded 37.2% and is being stably managed within our target range.

We have been exerting efforts to save recurring expenses and at the same time, maintaining an appropriate level of investment in essential areas, including IT, disaster prevention and strengthening information security.

We are strategically expanding investment in growth areas, including AI. And going forward, we will heighten our cost structure efficiency through selective cost implementation.

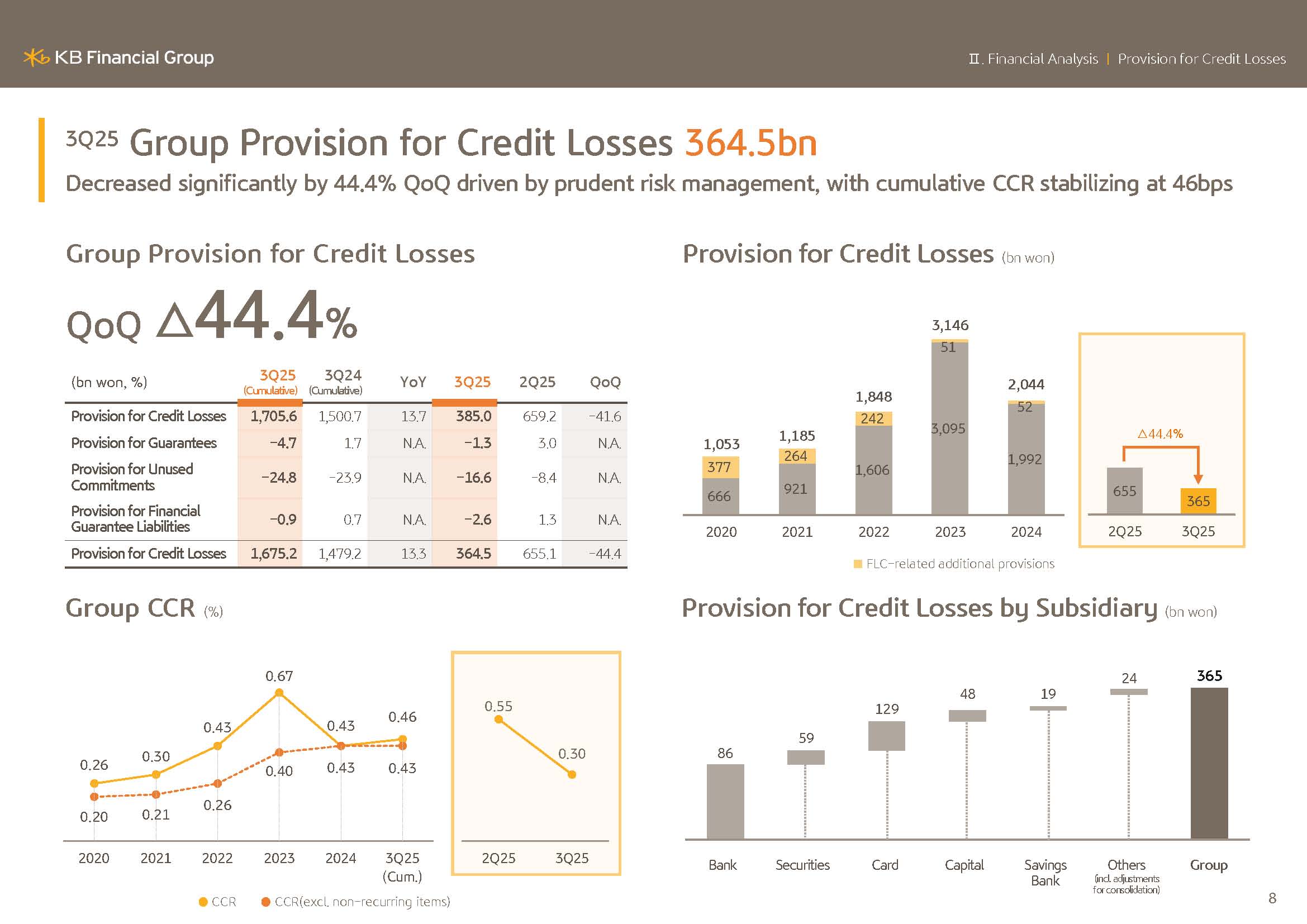

Next is Page 8, group provision for credit losses.

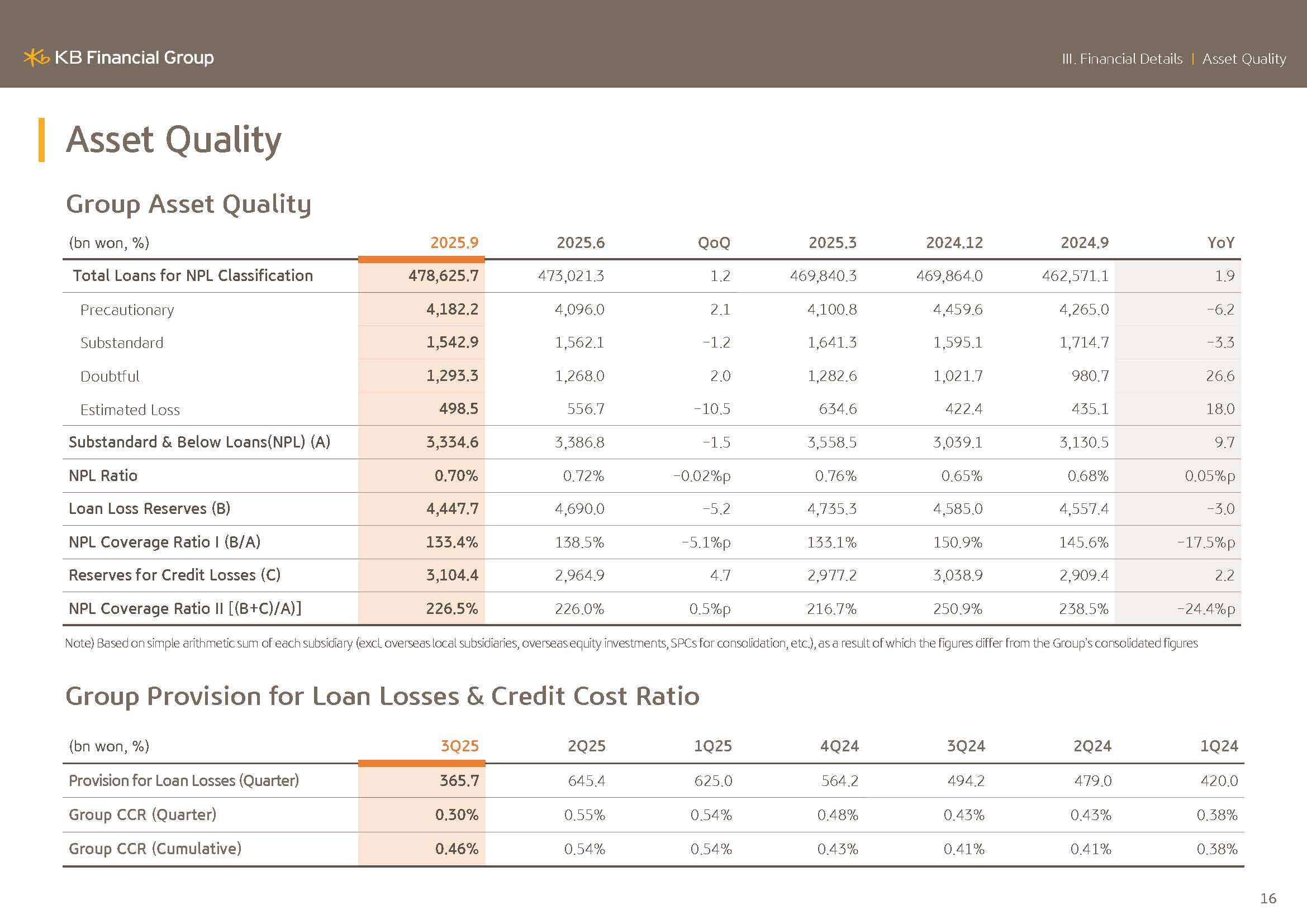

Q3 provision for credit losses posted KRW364.5 billion, a 44.4% decrease Q-o-Q. Q3 group credit cost went down 25 bps Q-o-Q, posting 30 bps and on a cumulative basis, recorded 46 bps and transitioned to a lower stabilization trend.

To give more color about the main reason why this quarter's provisioning decreased around KRW290.6 billion Q-o-Q, it was on the back of the conservative additional provisioning stance we had until now as well as slightly alleviated burden on provisioning accumulation through the portfolio improvement efforts, which took place from the second half of last year as well as the bank retail credit assessment model advancement.

In addition, there was a partial provisioning reversal due to NPL recovery in Q3. So overall provisioning size decreased significantly.

We believe that our efforts to strengthen risk management until now have been gradually showing results. And considering this trend of improved soundness, we believe that this year's group -- this year, group's credit cost will be managed around the mid-40bp range.

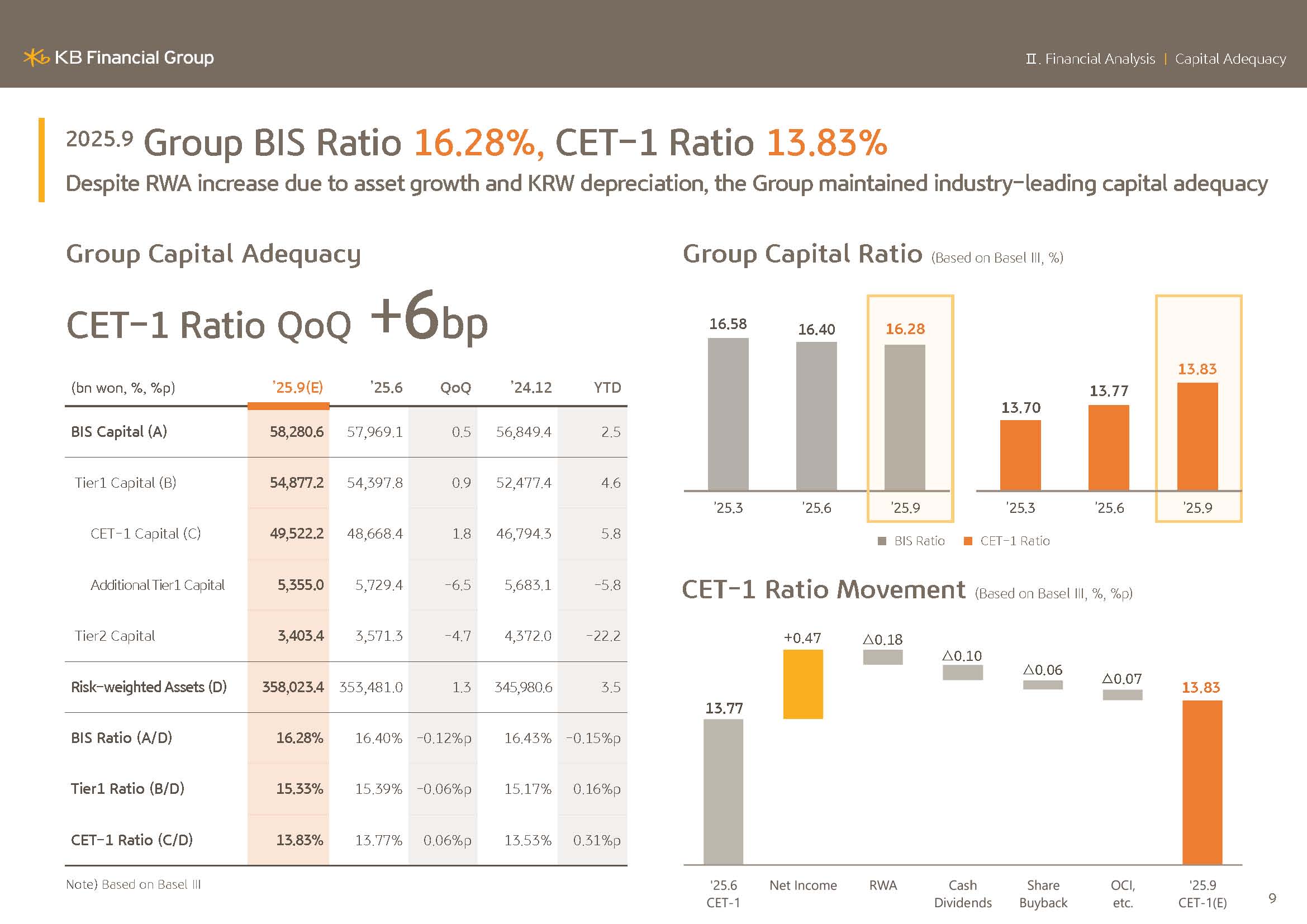

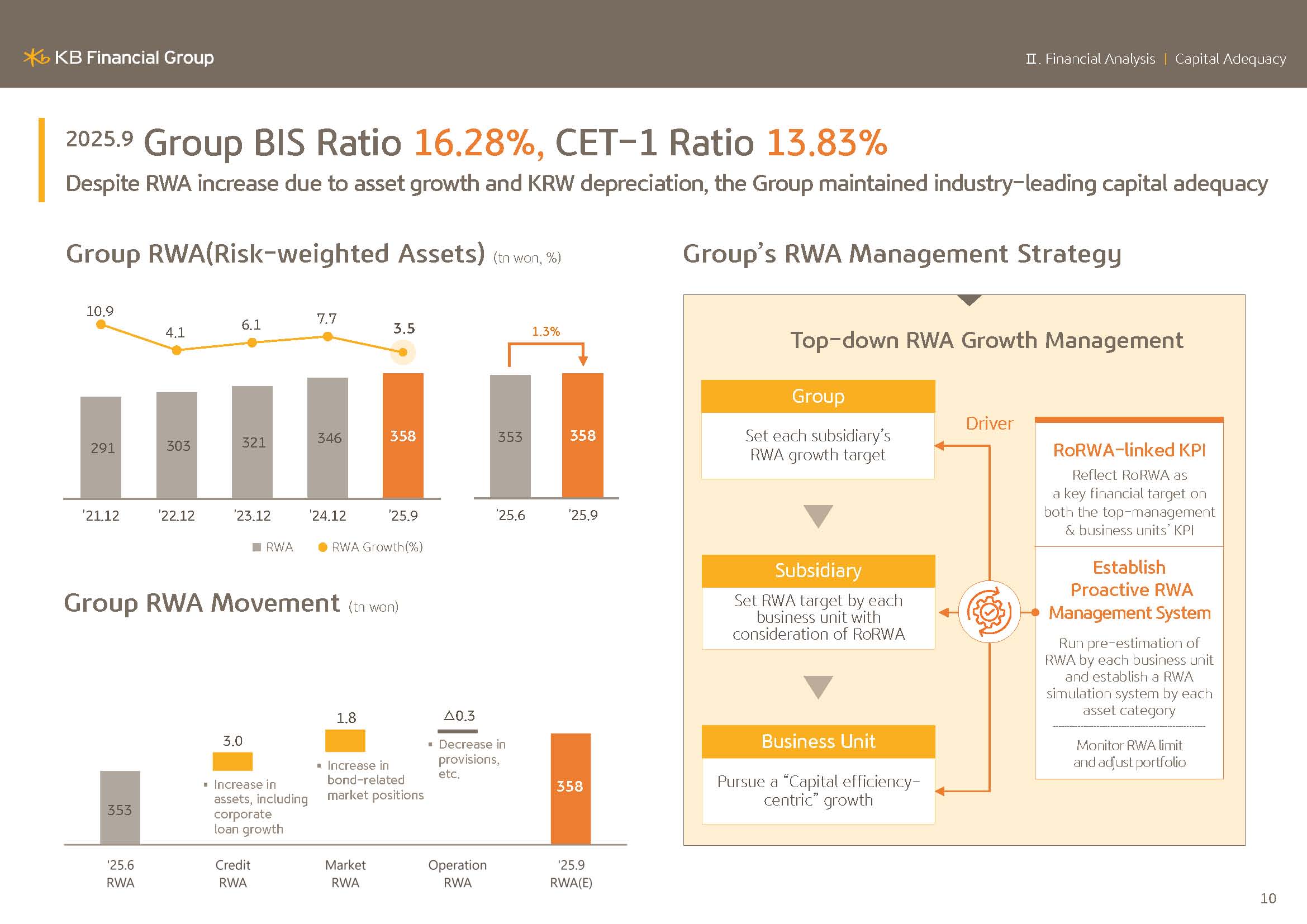

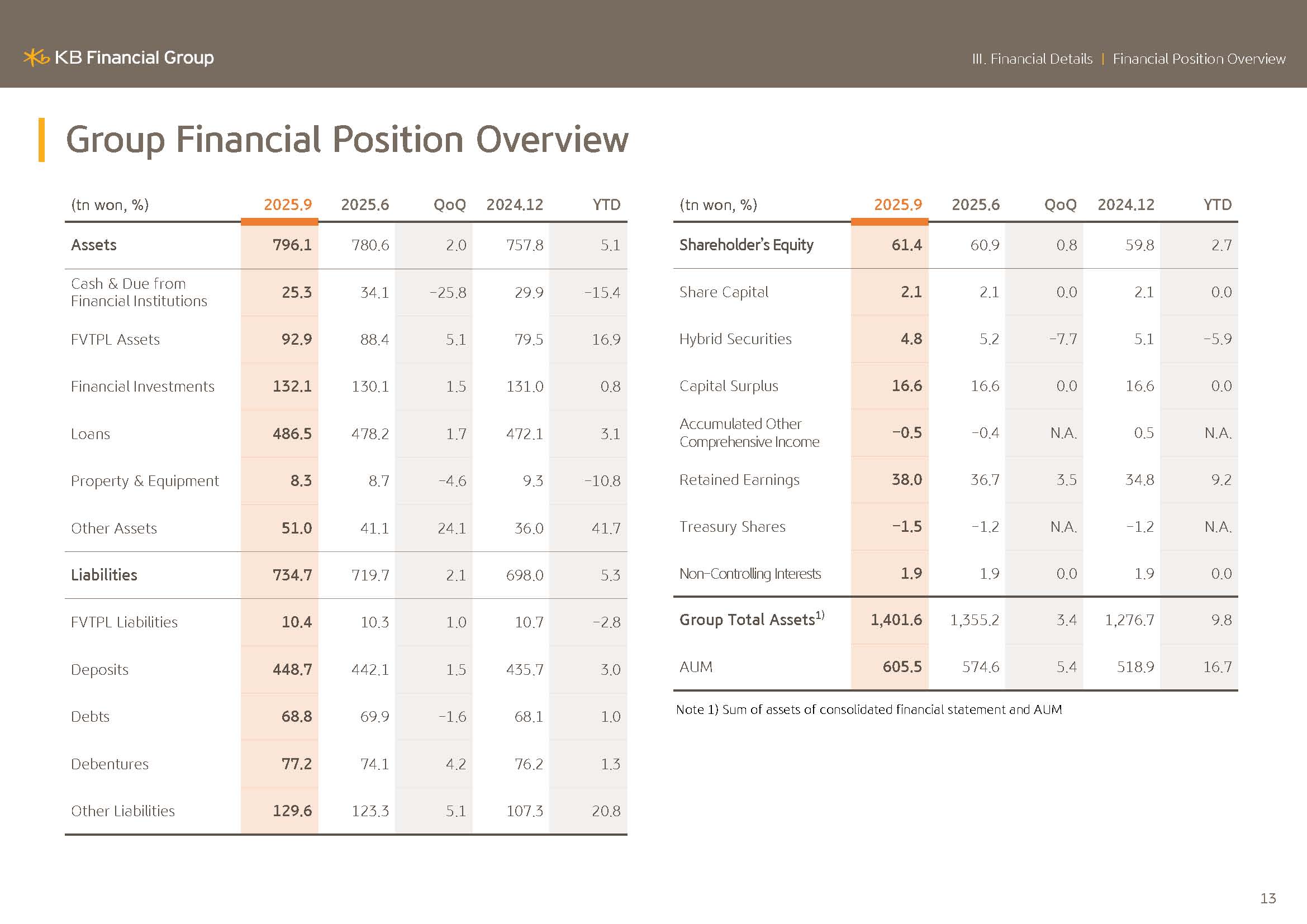

I will now cover group's capital ratio. At the end of September 2025, estimated group BIS ratio posted 16.28% and CET1 ratio recorded 13.83%, respectively, securing one of the highest levels of capital adequacy in the industry.

2025 September end group risk-weighted asset posted KRW358 trillion and increased 3.5% compared to the end of the previous year.

In Q3, the KRW48 depreciation of the Korean Won against the US dollar acted as a driver of RWA growth, but through RWA monitoring and portfolio adjustment, the FX effect was absorbed, and we adequately manage RWA growth at an appropriate level.

From the next page, please refer to the detailed materials regarding the performance results I have just covered.

With this, I will conclude KBFG's Q3 business results presentation.

Thank you for your attention.