Governance Overview

KB Financial Group is committed to highest standard of corporate governance to enhance corporate value and contribute to sound and transparent financial market.

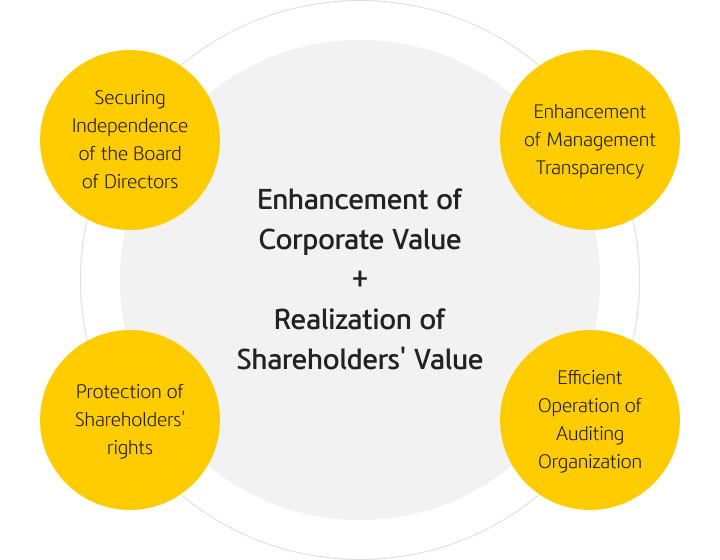

KB Financial Group is making efforts to enhance corporate value by continuous improvement of corporate governance and create sound and transparent management environment and doing its best to protect and improve the rights and interests of all the interest parties by operating independent board of directors and auditing organization with responsible management system.

-

-

KB Financial Group provides the matters related to corporate governance, corporate information and IR via Internet web site in real time and makes public through Financial Supervisory Service and Korea Exchange to disclose major information on corporate management in a transparent manner.

-

-

-

KB Financial Group has six board committees such as audit committee, risk management committee, evaluation and compensation committee, non-executive director nominating committee, audit committee member nominating committee, corporate governance committee, and non-executive directors play an effective of checks & balances on the management by expressing their opinions on the agenda at the committees. We are adopting a system to evaluate non-executive directors’ performance to improve transparency in governance. We also offer education to non-executive directors to enhance their understanding of business so as to strengthen board oversight on the business management and advisory function on the business management.

-

-

-

KB Financial Group provides the webcasts of general shareholders meeting at our website to protect the shareholders' rights. KB Financial Group strives to reflect minor shareholders opinions through the voting system in writing based on cumulative voting system.

-

-

-

KB Financial Group discloses its policy on appointment of audit committee members and adopts whistleblower program to ensure effective functioning of audit.

-

KB Financial Group prioritizes expertise and capabilities when nominating candidates for non-executive directors and appointing new non-executive directors, but strives to strengthen the diversity of its board of directors to protect the interests of various stakeholders and enhance corporate value

Expertise

KB Financial Group has collective consistency by composing the board of directors with diverse expertise and extensive hands-on experience as non-executive directors of financial companies, including Finance, Management, Finance/Risk management/Economy, Accounting, Legal/Regulation, Digital/IT, ESG/Consumer protection to blend maximum convergence of expertise among members and sufficient make up for deficiencies.

Diversity

KB Financial Group does not impose restrictions on gender, age, and nationality on non-executive director candidates, but seeks diversity in the composition of its board of directors so that the opinions of various stakeholders, including shareholders and financial consumers, can be broadly reflected in management decision making.

- Nomination of candidates for non-executive directors

Diversify the nomination route to make rational decisions from the perspective of various stakeholders, such as shareholders and customers - Gender

Maintain at least two female non-executive directors to ensure that all directors of the board are not made up of a particular gender - Age

Consider various age groups so that various perspectives and experiences can be harmonized to enhance the efficiency of the board of directors - Social background and Experience

Compose of the board of directors from diverse social backgrounds with rich experience and competence - Compose of the board of directors from a diversity and inclusive perspective of nationality, race, religion, etc

KB Financial Group (the “Company”) is making and developing a system to secure independence of non-executive directors so that the board of directors can establish a transparent governance structure based on the principles of checks and balances. Our non-executive directors meet the independence requirements as set forth in the Commercial Act and the Act on the Corporate Governance of Financial Companies. A non-executive director of the Company is independent by meeting all of the following criteria listed below

- The non-executive director must not have been employed by the Company or its subsidiaries in an executive capacity within the last five years.

- The non-executive director must not have accepted any payments, or have a family member who has accepted any payments from the Company or its subsidiaries in excess of $60,000 during the current fiscal year, except in certain cases as permitted by SEC Rule 4200 Definitions.

- The non-executive director must not be a family member of an individual who has been employed by the Company or its subsidiaries as an executive officer.

- The non-executive director must not be an adviser or consultant to the Company or a member of the Company’s senior management.

- The non-executive director must not be an employee of a company that has signed a major advisory agreement or a technology partnership agreement with the Company.

- The non-executive director must not be an employee of a company that has concluded a single contract with the Company for an amount that exceeds 10% of the Company’s consolidated gross revenues in the current fiscal year.

- The non-executive director must not be an employee of a company that has had transactions with the Company in the amount exceeding 10% of the Company’s consolidated total assets or operating revenue in the past three fiscal years.

- The non-executive director must not have any other conflict of interest on the agenda determined by the board of directors.